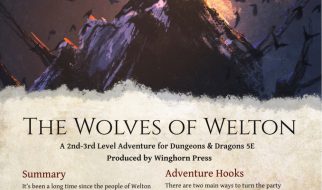

Housing prices in the US have seen large increases in recent decades? particularly in areas like California and Manhattan. Home prices have soared to easily eclipse their high?s before the 2007 crash. The median home now sells for over $325,000, and there are around 200 cities across the country where a median home runs you $1 Million or more.

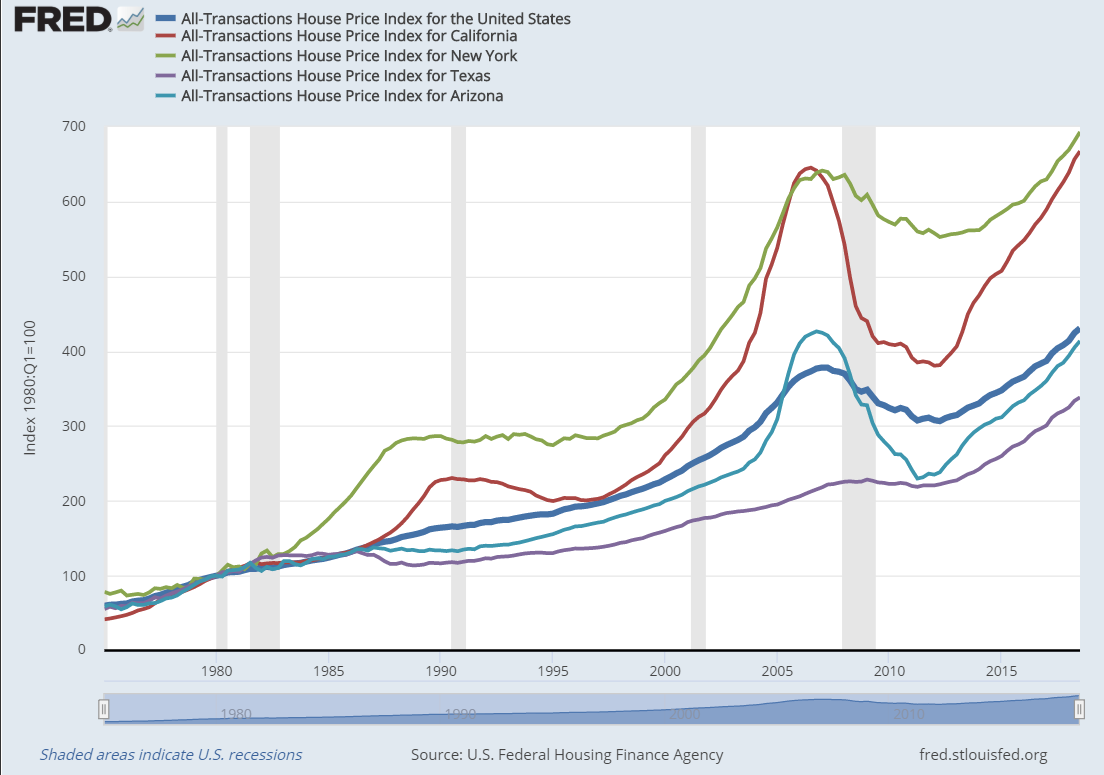

Here we can see the fast rising US home prices:

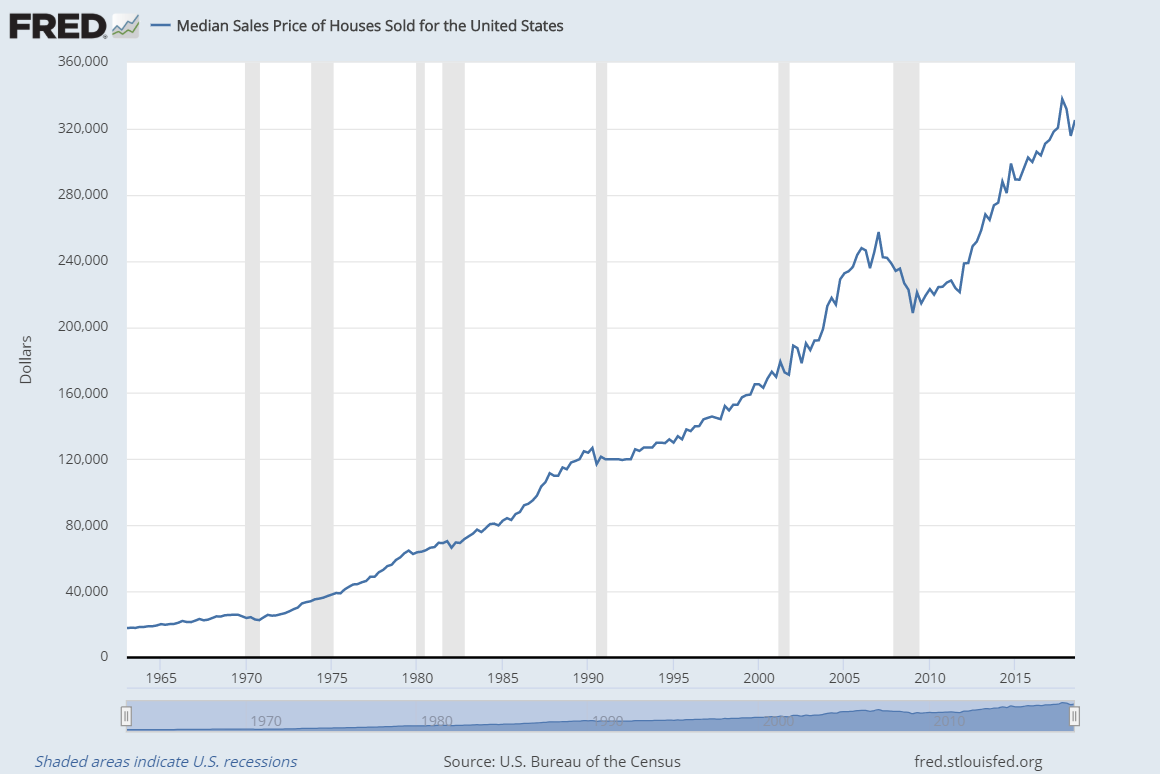

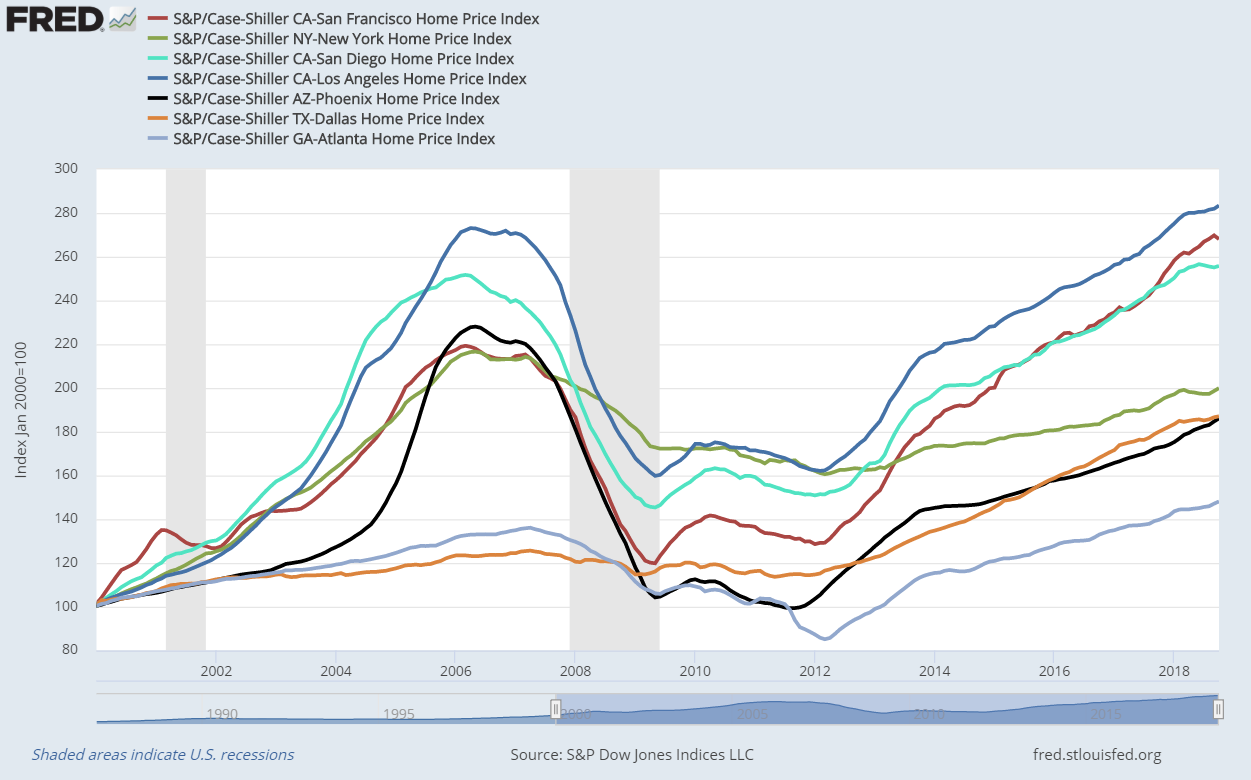

Another way we can look at home prices is the Case-Shiller Index ? developed by economists Karl Case and Robert Shiller (winner of the 2013 Nobel Prize in Economics). The index looks at the values the same homes sold over a period of time, and is generally considered to be a more accurate picture of changes in home prices.

After adjusting for inflation, home prices are still a bit below their 2006 peak. However, we can also see home prices have still risen nearly 40% since 2000.

So what gives?

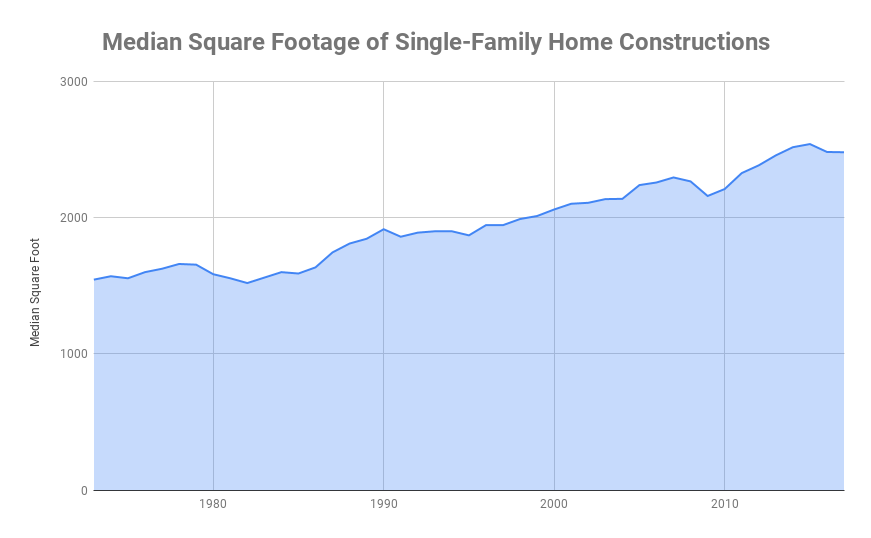

Home Have Gotten Much Nicer

In recent years, we?ve seen an increasing trend of homes becoming bigger, safer, and more luxurious. For example, we?ve seen the median home built expand by nearly 1000 feet since 1973:

Source: US Census Bureau

Source: US Census Bureau

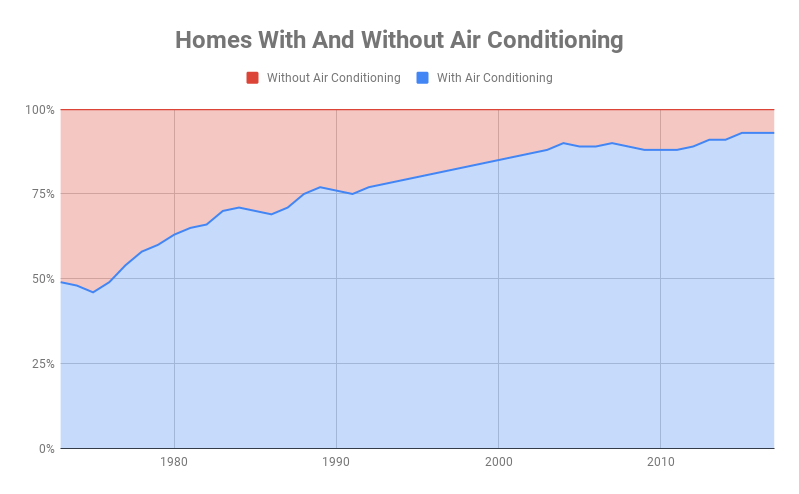

We can also see that a feature such as air conditioning has went from a relative luxury to almost standard in a home today:

Source: US Census Bureau

Source: US Census Bureau

This is just one example of homes becoming more luxurious, there are of course many others. However, that isn?t the only reason housing prices have increased.

Not All Home Prices Have Soared

It?s important to note that upon a closer look at the data, different areas of the country experienced home prices that changed at dramatically different rates. Here we can see that for some select states:

These differences are very large. Both California and New York experienced nearly a 700% increase in prices since 1980. During this same period, national home prices increased a more modest 431%. Then, we can see states such as Texas (338% increase) and Arizona (413% increase) performed even better. This means homes in New York or California have increased in price substantially faster.

If we move back to the Case-Shiller Index, we can view a similar change among select metropolitan areas since 2000:

Since 2000, California cities like San Deigo, Los Angeles, and San Francisco experienced far larger price increases than cities such as Phoenix, Dallas, or Atlanta.

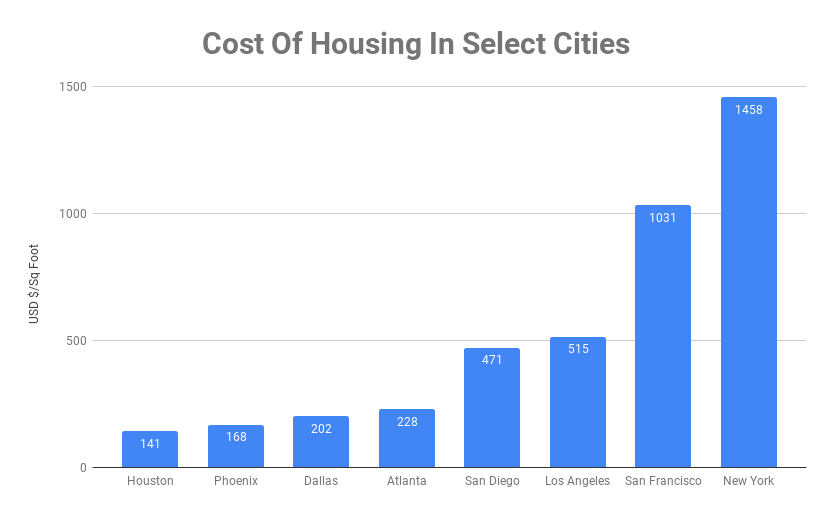

As a result of this, cost of living now varies very substantially by city:

Source: Zillow / Trulia

Source: Zillow / Trulia

So Why Did Some Areas See Massive Price Increases While Others Didn?t?

This large variance in results has not gone unnoticed by researchers on this topic. One such expert is Harvard economist Edward Glaeser, a leading researcher on urban economics. Glaeser?s research lead to some important conclusions as to why housing prices soared in some areas while remaining much more modest in many others.

This paper argues that in much of America the price of housing is quite close to the marginal, physical costs of new construction. The price of housing is significantly higher than construction costs only in a limited number of areas, such as California and some eastern cities? Instead, our evidence suggests that zoning and other land use controls, play the dominant role in making housing expensive.

Glaeser?s research (with University of Pennsylvania urban economist Joseph Gyourko) suggests excessive regulation has caused major supply constraints in parts of the country ? resulting in skyrocketing prices. In a properly functioning housing market, a spike in demand results in construction of new housing units to accommodate for the increased demand. Housing prices may increase some, but these increases will be considerably more modest as they will follow the costs to build additional units.

However, in a market where strict regulations prevent supply from responding, increased demand simply bids up prices of existing units higher and higher. This explains why housing prices in places like San Francisco the median home price now sits at over $1.6 Million while in many other locations have kept relatively affordable housing even through strong growth.

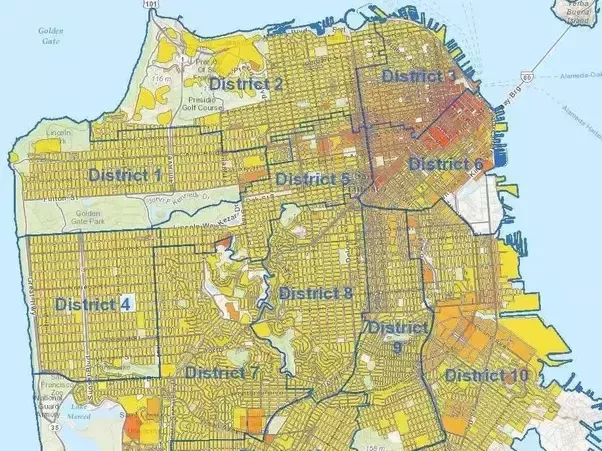

San Francisco, CA ? Yellow areas have a 40 foot height restriction

San Francisco, CA ? Yellow areas have a 40 foot height restriction

In another paper that examined the Manhattan housing market, Glaeser estimated housing costs had risen to over double the construction costs ? meaning regulation was effectively adding on a 100%+ tax onto housing costs. Estimates also indicated cities such as San Francisco, Los Angeles, San Jose, Washington, and Oakland faced high ?regulatory taxes? as well.

In subsequent research, Glaeser has further looked to identify the prevalence of this phenomena. He estimates that about 26.4% of US housing has risen more than 25% above the minimum profitable production cost ? suggesting regulation is imposing a substantial premium on houses there. These include most of the markets where housing prices have risen to $1 Million+ levels.

What Does A Healthy Housing Market Look Like?

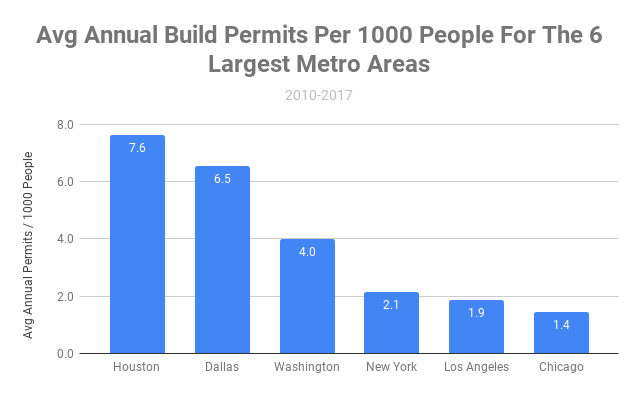

On the opposite end of the spectrum, what does a market that is functioning properly look like? An excellent example is the Houston metropolitan area, for a few different reasons. Houston has a booming economy, and has experienced strong population growth. Between 1990 and 2000, Houston?s population grew at nearly twice the rate of the United States as a whole and it has historically been one of the fastest growing metropolitan areas in the US. More importantly, Houston is the largest market in the US that has no regulations on land usage. As a result of this, Houston built units at a rate higher than most other metropolitan areas.

Source: US Census Bureau

Source: US Census Bureau

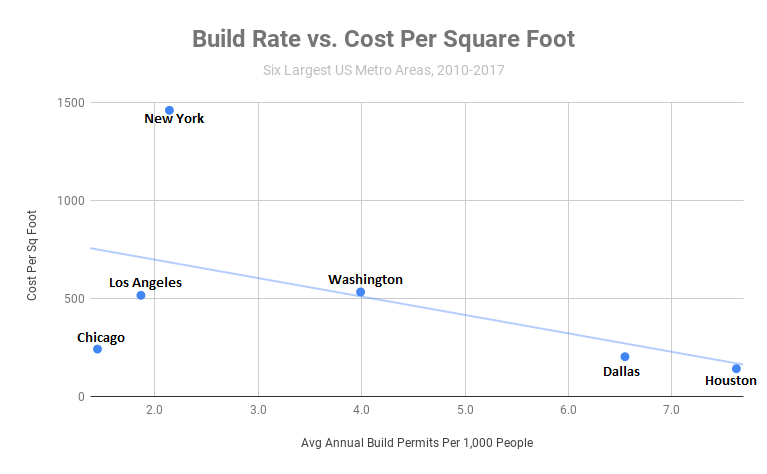

Houston builds new housing units at the highest rate among the six largest metro areas in the US. Houston also builds new units at a rate almost 4x than Los Angeles. As a result, cities like Houston and Dallas have some of the more affordable housing in the country:

Source: US Census Bureau & Zillow

Source: US Census Bureau & Zillow

As a side note, you may be wondering how Chicago achieved relatively low housing costs with such a low build rate. Remember, there can be two reasons for a low build rate:

- The market is supply-constrained (such as New York and Los Angeles)

- The market has low demand for new housing (as is the case with Chicago)

In a market like Houston ? which has seen strong growth ? we can see that housing has stayed surprisingly affordable. Despite being in one of the fastest growing housing markets in the country, an average Houston home is valued at only about $184,000.

Now, that doesn?t mean that a typical San Francisco home will be valued at under $200,000 if they are able to fix their regulatory issues. The marginal costs of construction are much higher in San Francisco or Manhattan than they are in Houston. However, if the places facing skyrocketing prices can reform their regulatory and bureaucratic barriers to construction, then the market forces of supply can begin to work properly again, and we could reasonably expect prices considerably lower than they are today.