Photo by Isaac Smith on Unsplash

Photo by Isaac Smith on Unsplash

The world of finance can feel like a black box. The industry is full of complicated-sounding ratios and grandeur terms. However, once you understand the core principles, learn how to calculate the ratios, and how to use ratios it becomes a lot less complicated. In this article, we will cover:

- The definition of liquidity

- Assets and their relative Liquidity

- Why liquidity is important

What is Liquidity?

Generally speaking, liquidity refers to how easily an asset can be converted into cash without affecting the market price. It?s obvious then that cash is the most liquid asset you can have, particularly of a relatively stable currency like USD. In comparison, an asset with lower liquidity would be something less simple to convert cash. An example would be large assets such as plant, property, and equipment. Imagine you?re a minerals company and have a digger worth $5 million, you couldn?t just sell it tomorrow if you needed that money to pay off an outstanding debt. The next section breaks down types of assets and their liquidity further.

What is the Liquidity of Different Assets?

The Most Liquid Assets

As we mentioned before, cash is the most liquid asset you can own. Stocks and bonds are the non-cash assets which can also be most easily converted into cash. The higher the trade volume is for a stock or bond, the more liquid it is. This is because higher trade volume indicates that the asset is easily traded for the market price. In practice what this means is that the bid-offer-spread (the difference between the bid price and ask price) is low.

Investment assets are next on the liquidity scale. This includes restricted or preferred shares which often have restrictions or terms upon which they can be sold. This makes them slower to convert into cash and hence less liquid.

The Least Liquid Assets

Collectable items such as coins, stamps, and art are fairly illiquid (opposite of liquid). Owners of these items could get the true value for the items if they shop around enough for the right buyer. However, if they need the cash quickly they will likely have to sell at a discounted price. Clearly this reduces the liquidity of this type of asset. However, should demand for an item suddenly increase (e.g. a new trend for a particular artist) the liquidity could be reassessed.

Plant, property, and equipment are even further down on the liquidity scale for the reasons mentioned in the introduction. Examples of this are the real estate, machinery or tools, and raw materials.

The very least liquid assets (generally speaking) are businesses that the company owns. These are most difficult to sell because of the high degree of complexity involved in the sale.

Why is Liquidity Important?

When assessing the health of a company, understanding the company?s liquidity is important for gauging how able a firm is to pay its short term debts and current liabilities. Any cash left over can be used to pay dividends to shareholders and grow the firm.

Liquidity is measured using ratios such as cash ratio, current ratio, and more. The next article in this series will go over these in detail. For now, let?s look at an example.

Microsoft Liquidity

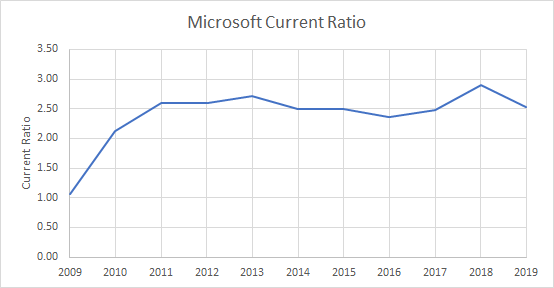

Using Financial Modeling Prep?s free financial statement data we can see how Microsoft?s liquidity has improved since 2009. We will look at Microsoft Corporation (MSFT)the current ratio (Cash and Short Term Investments / Total Current Liabilities).

We can see that there was a dramatic improvement from 2009 to 2011 and then the current ratio has remained around 2.5. This is explained by the global financial crisis that began in 2007. Firms, including Microsoft, were making less revenue and so had to use more cash to pay off debts and liabilities.

Rounding Up

Liquidity is the ability to convert an asset into cash easily and without losing money against the market price. The easier it is for an asset to turn into cash, the more liquid it is. Liquidity is important for learning how easily a company can pay off it?s short term liabilities and debts. We recommend going to Financial Modeling Prep, downloading some of Microsoft balance sheets statements, and seeing how the different companies compare in terms of liquidity. Read the next article, How to calculate Liquidity ratios, to learn how to do this!