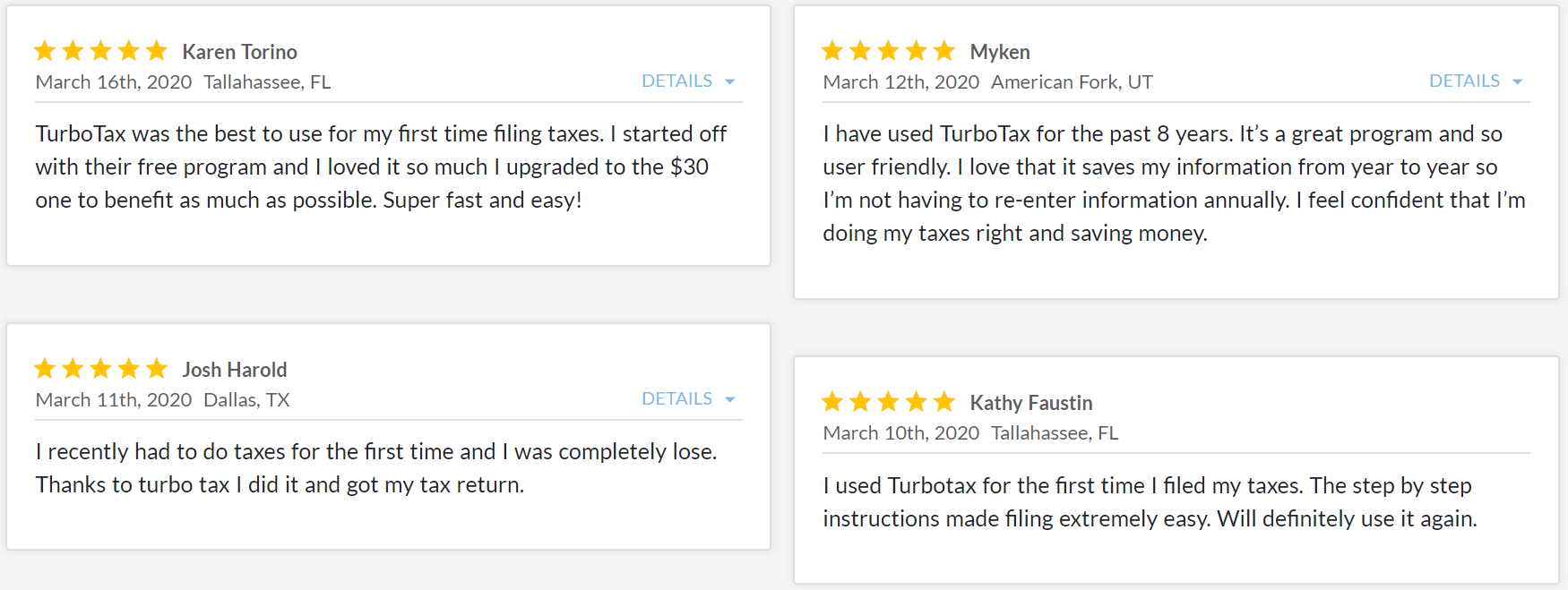

You?re not sure if you should get TurboTax Deluxe VS Premier. It is arguably the most favorably reviewed program out there ? but now that you have narrowed it down to TurboTax, there is an decision that must be made: which subscription should you take?

If you don?t have the time to read the whole article, here?s a quick answer: TurboTax Deluxe is what you need.

While the Premier version could be a better choice for people who invest more, the Deluxe version wins from an overall perspective.

Considering the price, simplicity, convenience, and user experience, any taxpayer would be more pleased to have the cheaper but equally efficient Deluxe.

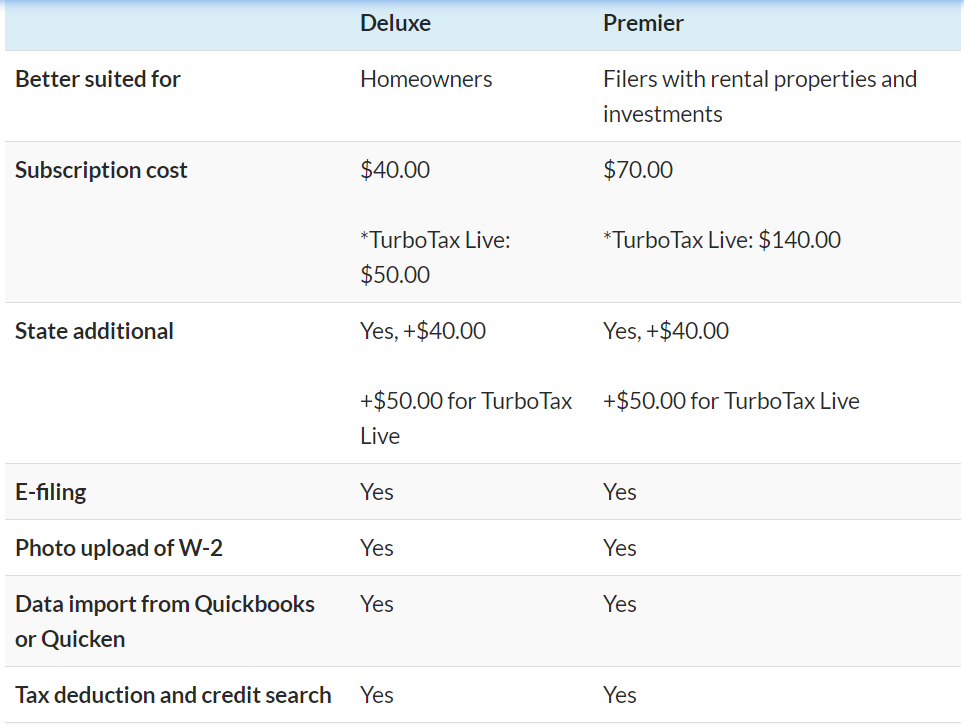

Here?s quick table that will explain you the differences between the two:

There are four main editions for the software, but today we are only comparing the two choices picked the most: Deluxe, and the less popular Premier.

Even though subscriptions for other services often only differ in the number of benefits it can offer a customer, in the case of TurboTax, there is a clear subscriber in mind for each edition. Should you go for the Deluxe, or are you more suited for the Premier?

Premier: The Premier can be accessed online for $79.99 and can likewise be paid upon submission of the tax return.

Payment does not have to be through a credit card as TurboTax gives you the option to pay the costs of the service with the federal tax refund you will receive, although there may be additional fees.

The downloadable software costs $109.99, and like the Deluxe edition, entitles a subscriber to 1 state download and then 5 federal e-files.

Who is it for?

Deluxe: There is a reason TurboTax Deluxe is the more popular choice for the two. Many people simply want to file their returns and have as much deductions and credits as possible.

If you own your home, have bills to mind, or even contribute to charity from time to time, Deluxe will suffice. The Deluxe is also what you?ll need to file the deductions on Schedule A.

Premier: If you have investments and rental properties, Premier will be better suited for your tax filing needs.

This is true if you are involved in stocks, have bonds, mutual funds or have a trust in your name because Premier covers Schedule D. Collecting rent would require you a Schedule E, and that is also included in the Premier.

Are you a recipient of the Schedule K-1? Look no further, Premier is the answer.

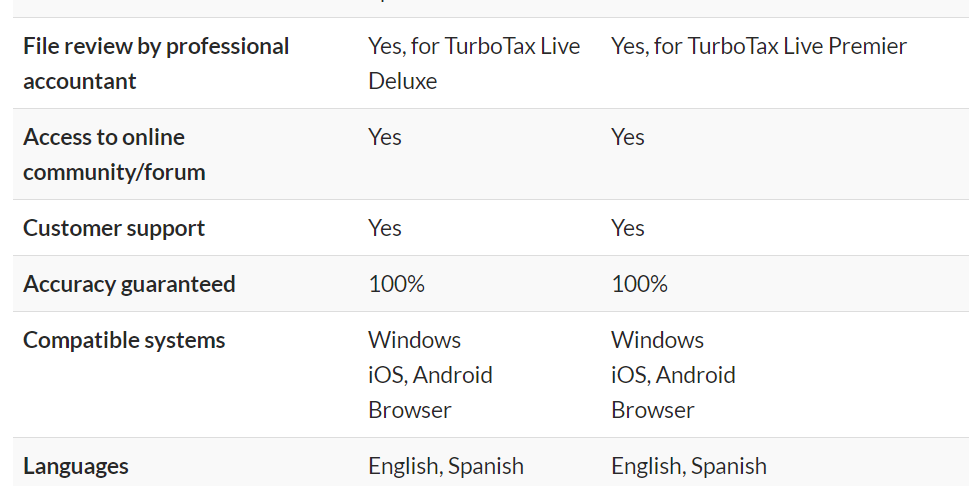

Premier: The support from the Deluxe subscription can be expected on the Premier, but customers can also seek services for tech problems and tax filing through the phone. Certified Public Accountants will address subscribers? inquiries.

System Requirements

Deluxe: The online version should work on most browsers; the most important point here is an Internet connection. For software downloads, TurboTax runs on Windows and Mac environments.

It can be installed on any computer you have. Tax returns for other members of the family can be computed using the software you own.

Premier: There is no difference from the Deluxe edition.

Conclusion

While Deluxe comes out as the overall winner, it should be highlighted that the two editions are marketed to customers with different, or added, needs.

There are more features for the Premier edition, but if you have no investments like the ones that have been mentioned earlier or properties that are being rented out, then there really is very little reason to upgrade from the Deluxe.

A bigger consideration might be going for either the online version or a downloadable software, but otherwise, go with what best fits your situation.

Looking to start LLC? Check out my Zen Business Review.