TradeSmith Ideas and TradeStops are a couple of different products developed by investor and mathematician, Doctor Richard Smith. TradeSmith Ideas and TradeStops is intended to help users acquire a profitable stock portfolio. Will TradeSmith Ideas and TradeStops deliver on its claims? Keep reading this post and all will be revealed.

Introducing TradeSmith Ideas and TradeStops

TradeSmith Ideas and TradeStops are two individual but connected products sold by Doctor Richard Smith, an investor and mathematician. Both products are aimed at long term to medium term investors, who wish to acquire and manage a profitable stock portfolio. TradeStops concentrates on risk calculations linked to stocks, depending on their past volatility, and on structuring portfolios in line with these risks. Ideas functions as a supplementary platform and allows traders to build a portfolio, depending on various investment methods and stocks that famous investors have in their personal portfolios.

Options for Pricing

Ideas and TradeStops can be purchased separately, but regrettably, there are no discounts offered on either product. The price for TradeStops is $79 monthly, following an initial thirty day testing period. The price for Ideas is $99 monthly, following an initial thirty day testing period.

The Features of TradeStops

Stock Condition Indicator and Volatility QuotientTradeStops can work out the risk posed by every stock in an investment portfolio. It achieves this with the SQ (stock condition indicator) and VQ (volatility quotient). The VQ allocates a value, in percentage terms, to stock volatility. This is used to gauge how far beneath the existing price trailing stop losses should be set. This prevents them from stopping out too soon, and allows the maximum possible losses on stocks to be identified. A yellow/green/red indicator, known as an SSI, alerts users when stocks are notably volatile, and whether an exit or entry signal has been recently activated.

SSI and VQ are calculated automatically, for each stock in the portfolios tracked by TradeStops. They are the foundation for the platform?s sophisticated risk reduction features.

Calculating the Size of PositionsThe calculator that works out the position size uses trailing stop data, VQ and the investor?s risk profile, to gauge the right quantity of stock to purchase. This calculator asks investors what their maximum liability is for each trade, and provides numerous ways to determine the right position for trailing stops. The results displayed are the maximum amount investible, and the stop loss figure that matches those variables.

In addition, TradeStops explains the calculator?s results in layman?s terms. This makes it simpler to grasp how it reached its conclusions, and how altering the variables will impact the results.

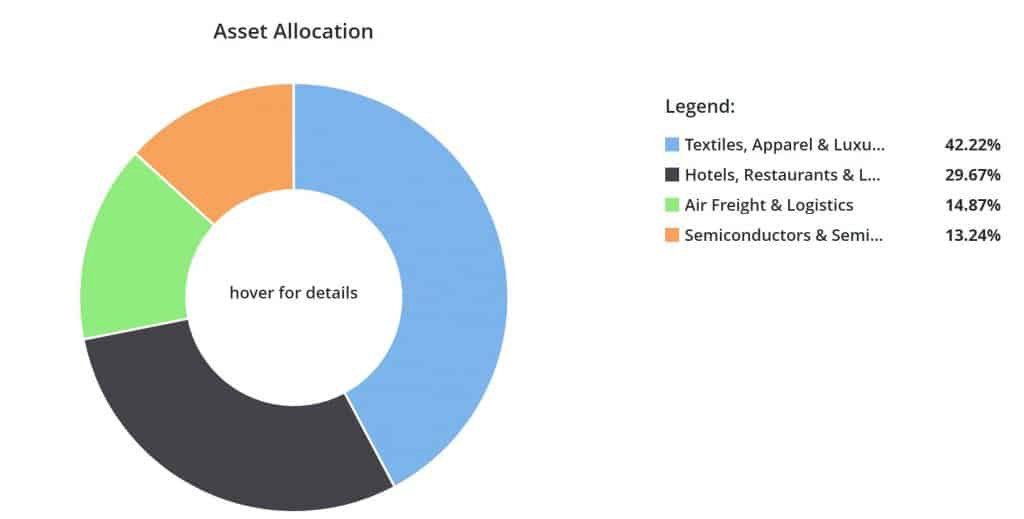

PVQ Analysis and Allocating AssetsThe tool for allocating assets was not invented by TradeStops, however it is useful to have access to it, along with the platform?s other portfolio assessment tools. Basically, the tool for allocating assets enables investors to monitor how their stocks are spread amongst different sectors and industries.

In a similar way, the PVQ assessment tool labels assets. However, it does this based on risk (as determined by VQ), instead of the industry. Using this tool, traders can rapidly gauge whether their portfolios lean towards high, low or medium risk. Be aware that you can apply this tool across several portfolios. This is helpful for traders who have numerous portfolios separated purposefully, based on risk.

Rebalancing RiskThe tool for rebalancing risk uses VQ over one or several portfolios, so that traders can achieve a lower VQ across their holdings on average. This tool just calculates how altering the quantity of shares of current holdings can reduce risk overall. Crucially, the tool enables you to lock certain holdings to preserve their quantities. Furthermore, you can exclude some holdings inside a portfolio from assessment.

AlarmsOn TradeStops, alarms are an important part of tracking activity inside portfolios. There are several alarm setting options available. You can set them depending on VQ surpassing a specified threshold. Alternatively, you can set them based on a change in percentage, or on a stock?s SSI state. Also, you can set price alarms on TradeStops, so you have lots of scope to set trailing stop alarms.

The Features of Ideas

The Market RisksIdeas are helpful to long term and short term investors, because it offers an informative and accessible snapshot of different stock markets. This platform separates the markets into the main indices, displayed in clear colors. These colors indicate what percentage of the stocks in the indexes are low risk, medium risk and high risk (green, yellow and red respectively). This is calculated using their VQs and allocated exit and entry points. Furthermore, Ideas makes it simple to analyze these indices to note the historical changes to their risk. It allows you to see the standing of these indices, compared to their twelve month lows and highs. In addition, investors can see the risk category of each stock on the Stock Finder interface.

Ideas ventures beyond the main indices and carries out the same risk analysis for commodities and stocks by industry. This is extremely helpful.

Portfolio Concepts

?Doctor Smith?s Lab? is the hub of the Ideas platform. Here, stocks are organized into various investment methods, depending on their SSIs and VQs. This resembles the way Zacks uses its unique metrics to generate stock picks.

The reasoning behind these stock categories is unclear in some cases ? for instance, ?Kinetic VQ? and ?The Best of Billionaires? ? whereas others are more evident ? such as ?Value?, ?Lower Risk Runners? and ?Growth?. Numerous stocks fall under several categories, and the portfolio display indicates this.

Finding StocksThe stock locator tool screens different stocks, and has extra parameters related to SSI, VQ, and the categories of portfolios included in Doctor Smith?s Lab. Inside the stock locator, there are not many technical indicators accessible. The same applies to fundamental filters, so investors have to be dedicated to finding ideas for trades, linked to potential risks and VQ when utilizing the stock locator.

Integrating Ideas and TradeStops

TradeStops and Ideas are intended to be used in combination, although they are sold individually. This is facilitated on the Ideas platform, where it is easy to send stocks to a different portfolio. These transfer to TradeStops automatically, for users with accounts on each platform. To set up a portfolio on Ideas, investors just have to tick boxes adjacent to the stocks they wish to include in their portfolio. These stocks can be in Doctor Smith?s Lab, or in the stock locator results.

The underlying philosophy here is that investors and traders ought to be able to find new trading stocks in Ideas, then discover how they will perform in an existing TradeStops portfolio, or in a brand new portfolio. TradeStops? position size and risk rebalancing tools are really useful in this regard. Investors who want to add new stocks to their portfolios can utilize these tools, to calculate the number of shares to purchase. In addition, they can use these tools to manage the risks on their current portfolios.

Layout, Customization, and Brokerages That are CompatibleIdeas and TradeStops are browser platforms that have no desktop or mobile applications. Although navigation on these platforms is fairly easy, layout customization options are restricted. The majority of settings are concerned with alarms, however you can produce templates of alarm settings for when investors are working with several portfolios, or following different methods. TradeStops can import portfolio information from the main brokerages. Where brokerages can not directly communicate with TradeStops, data can be imported from a CSV or inputted manually. There is no limit to the quantity of portfolios that TradeStops can import.

What Differentiates These Platforms

Together, Ideas and TradeStops form an original portfolio monitoring platform, which identifies and balances risk. Although these tools offer little in the way of technical or fundamental analysis, you can use them together to find new ideas for trades, and integrate these into a wider portfolio. The SSI color coded feature is useful, because it allows traders to see what is happening in the markets, and in their portfolios, with a quick glance.

Ideas and TradeStops include stock selection features that are offered by services such as Gorilla Trades and Motley Fool. Also, they have tools for personal research, which you can find in services like Investors Business Daily and Zacks Premium.

What Kind of Investor are Ideas and TradeStops Most Suitable for?

Ideas and TradeStops are aimed at medium term traders, especially traders who like to manage several portfolios themselves. These platforms are suitable for use with technical and fundamental analysis methods. Nonetheless, they are tightly centered on managing risk, and work better for investors who have a clear grasp of the risks they can shoulder with individual trades, and over their entire portfolio. Be mindful that it is not cheap to use both these platforms for twelve months, so they are rather limited to traders with reasonably big portfolios.

Benefits

- On TradeStops, risk rebalancing across your current portfolio is easy, while you add new stocks

- The calculator for position sizes enables investors to control their losses effectively

- The SSI color codes are a nice visual element that provide data quickly

- Ideas provides a stock screener and ideas for stocks, based on volatility and risk

- The market risk display on Ideas is an excellent way to visualize market performance

Drawbacks

- The subscription cost is fairly high, because no price reduction is offered for purchasing both platforms

- Will not always integrate smoothly with technical based or fundamental trading methods

Final Thoughts

It is always a good idea to research the investments you make, even if you get stock picks from an Internet service. This is why you should test a service, wherever possible, to analyze its? recommended picks. TradeSmith Ideas has enough going for it to make such a test worthwhile. It offers a thirty-day trial period, so you can give it a test run and find out whether it suits your investment style.

If you don?t like TradeStops, you can also check my other trading platform reviews:StocksToTrade ReviewVectorVest REVIEW