Why Big Tech sitting on piles of cash in the middle of a recession will power the coming M&A boom

Photo: Chesnot/Getty Images

Photo: Chesnot/Getty Images

In the middle of the Great Depression, Mars candy titan Forrest Mars Sr. decided he was going to buy a dog food company. For the head of one of the world?s most iconic candymakers, it wasn?t the most natural of acquisitions.

?He was always prepared to consider outlandish ideas,? a colleague later noted. At the time, purchasing Chappel Brothers, a small U.K.-based purveyor of pet food ? itself a category that had only just emerged ? was a wild notion. But Forrest?s mind was made up, and in 1934, he brought ?Chappie? into the company known for producing Snickers, Mars, and 3 Musketeers bars.

It turned out to be a stroke of genius. With virtually no competition, Chappie became a bestseller in Europe, dominating the region, and setting the groundwork for Mars? pet-focused empire. Over the years that followed, the company would go on to launch Pedigree and 38 other pet brands, in addition to purchasing a large chain of veterinary clinics. Today, the company synonymous with M&Ms and other sweets earns the majority of its revenue serving animals.

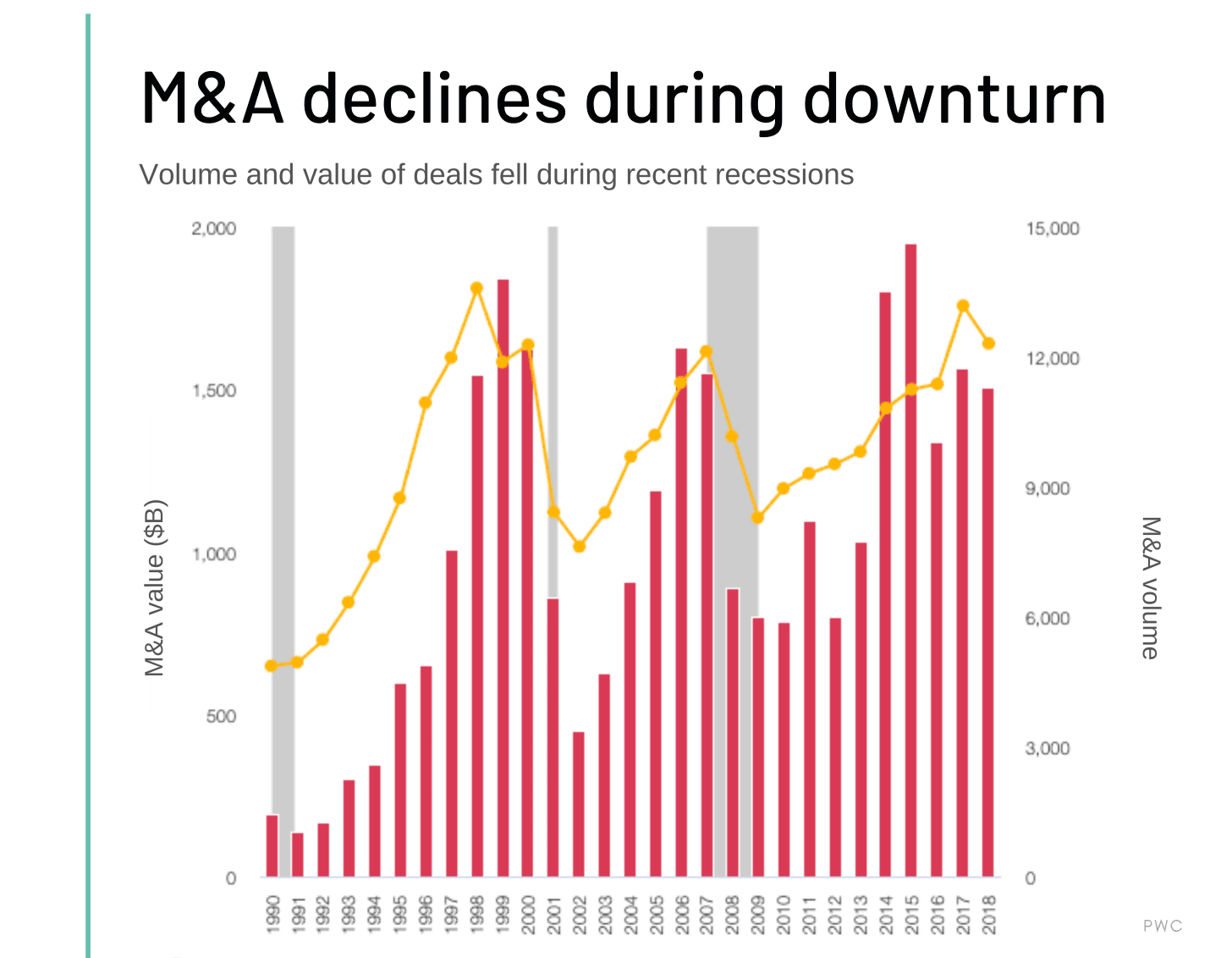

The current recession may present similarly transformative merger and acquisitions (M&A) opportunities for tech?s titans. While buying activity typically declines in a downturn, the rules may not apply for Google, Amazon, and others like them. For one thing, circumstances are favorable for buyers. Corporate balance sheets are fatter than they?ve been in decades, and interest rates are low, making it easier to borrow the money to make a deal happen. A study by Gartner found that 71 U.S. companies have at least $5 billion on hand, excluding those with high debt. Of those 71 businesses, 57 are involved with IT and internet services, collectively controlling $1.1 trillion in cash reserves, or so-called dry powder, that they could use to buy up other businesses.

Source: PWC

Source: PWC

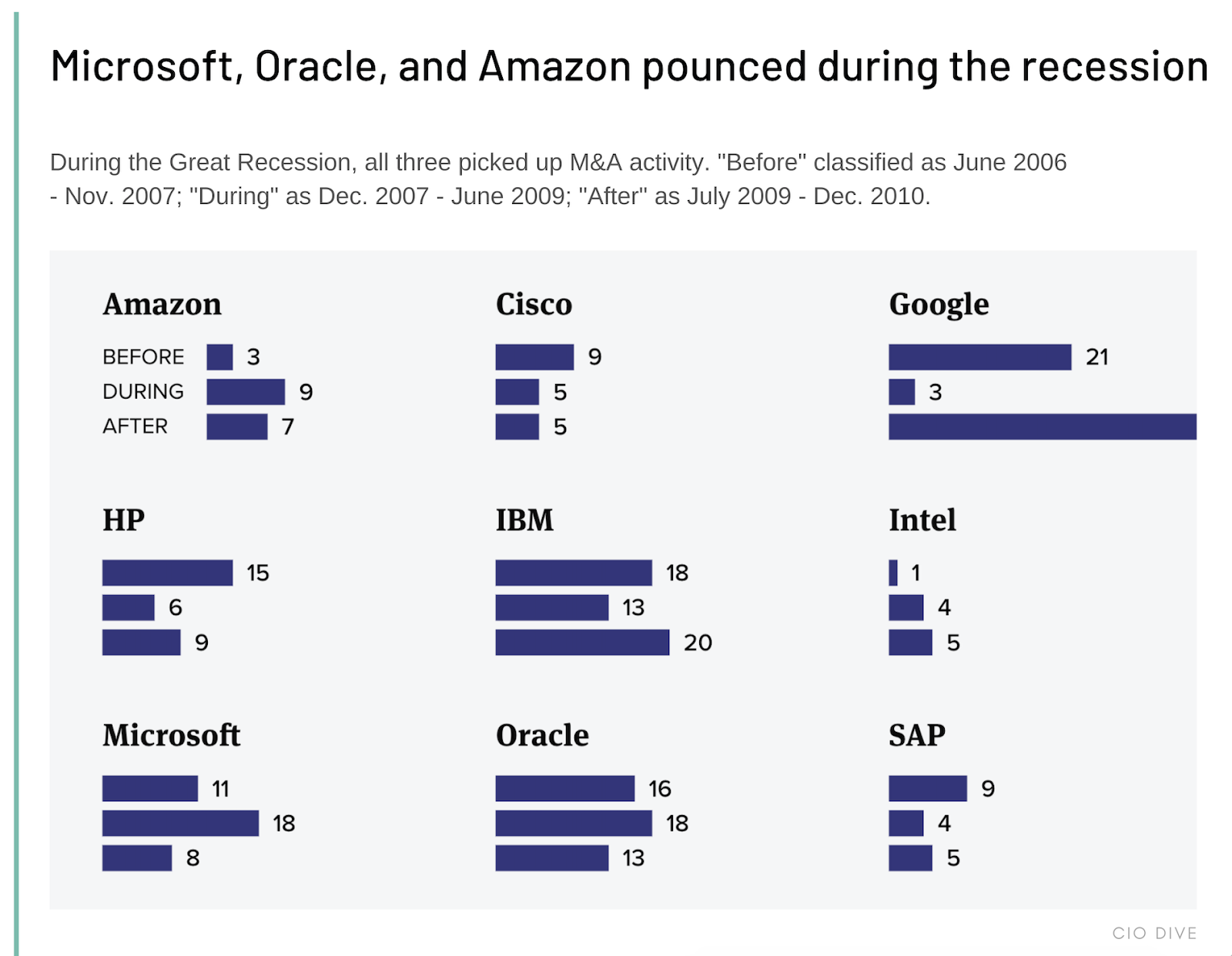

There are also clear benefits to buying during a recession. A study by Bain indicated that acquisitions completed during and immediately after a recession produced nearly triple the excess returns compared to those bought in boom times. That may be part of the reason that Microsoft, Amazon, and Oracle all completed more acquisitions during the Great Recession than either before or afterward.

Source: CIO Dive

Source: CIO Dive

With that in mind, here are some acquisitions that could make sense for some of America?s largest tech firms during this period. As a disclaimer, I have no inside knowledge of any companies discussed.

Amazon

While movie theater chain AMC?s stock surged 30% after rumors surfaced that Bezos had discussed a buyout, there are several more interesting places Amazon could invest, particularly in health care, staffing, and education.

- Health care. The acquisition of PillPack in 2018 gave Amazon a foothold in the space ? now could be the time to add at-home diagnostic testing to the equation. Companies like EverlyWell and LetsGetChecked could set the stage for testing for the coronavirus in 2021, and serve as another puzzle piece in the company?s mission to be ?the new Red Cross.?

- Staffing. If Amazon is successful in building out a Covid-free supply chain, offering in-home services may be a natural next step. If you could be certain that a plumber booked through Amazon was virus-free, why book anywhere else? Thumbtack has recently laid off nearly a third of its employees and would offer immediate supply as demand for home-services begins to reemerge. In the digital realm, layoffs may push many into freelancing. Fiverr ? a former employer of mine via an acquisition ? often claimed to be building the ?Amazon of services.? A recent 17% increase in active marketplace buyers in Fiverr may be enough to attract Amazon?s attention.

- Education. As students balk at the cost of a higher education experience provisioned digitally, many may turn to lower-cost options. With a partnership between AWS and Udacity already in place, Amazon could capitalize by bringing the company in-house and expanding the e-learning platform?s ?nanodegree? offerings. In the process, Amazon would secure a pipeline of technical talent, deepen consumer trust, and begin the process of disrupting education, one of the few markets large enough to be worthwhile. Prying Flatiron from WeWork?s withering grip or winning over Lambda School are other plausible alternatives, though their focus on live classes would add a layer of complexity.

Apple

The accountants in Cupertino have been plenty busy lately; DarkSky, Voysis, and NextVR have all been acquired by Apple in recent months. With iPhone sales projected to drop 36% next quarter, Apple may look to expand services revenue and add hardware products that relate to health ? consumers? highest priority ? or enhance the home.

- Digital health. Apple is reportedly spinning up a workout app internally called ?Project Seymour.? That could be bolstered by adding a catalog of classes, and bringing key talent on board. Aaptiv might be a good place to start (something of a snag given the company took funding from both Disney and Amazon), while breakout stars like Megan Roup and her company, Sculpt Society, could give the new service a face. If Tim Cook is set on building a physical health app from scratch, then perhaps Calm and its guided meditation might represent a canny parallel purchase. The mental health business was valued at $1 billion just over a year ago.

- Entertainment. If Netflix and Disney+ are in an all-out streaming slugfest, Apple is the sidelined friend just begging for a piece of the action. Even Starz has more subscribers than Apple TV+. Now might be time to take one of those two off the table. There have been discussions about Apple buying either Netflix or Disney in the past, with Netflix the more logical choice given the baggage (think: theme parks, resorts) that comes with joining up with Disney during a pandemic. With little opportunity to make new original content over the next year or so, a purchase may be Apple?s only way to go on the offensive.

- Connected hardware. Peloton would kill two birds with one stone, expanding services revenue, and deepening Apple?s connection to health. Same with Mirror or Tonal. Oura, a much-beloved sleep-tracking ring, would be another option, though it wouldn?t add services revenue and might conflict with Apple Watch?s own slumber-metrics. Finally, Sonos could represent a value-pick at under $1 billion. The stock has been in freefall over the last three months, dropping from $14 to just above $9. Once the dust settles, consumers may look at the speaker manufacturer as a way to make staying-in more fun.

With its recent Giphy acquisition and investment in Indian telecom company Jio, Facebook has already been busy. While Zuckerberg is unlikely to bring Zoom into the fold, he may still have targets in mind. He could do worse than turning his attention to creator tools and gaming.

- Creator tools. As artists struggle to earn revenue in physical spaces, many are turning to platforms like Patreon. Over 70,000 have joined since mid-March, while the firm has been forced to lay off 13% of staff. A Patreon purchase would give influencers more ways to monetize and manage fan relationships without needing to leave Instagram. Patrons, meanwhile, would have more reason to spend time on platform should they be given the option to access gated content in-app. The business was last valued at $450 million.

- Games. Facebook?s VR headset Oculus was supposed to usher in a new era of socializing, with ?Facebook Spaces? the metaverse in which we were expected to live. The coronavirus has laid bare just how far behind Facebook is when it comes to the next generation of fraternization ? social gaming, not VR, is the new frontier. To catch up, Facebook could snap up Epic, owner of Fortnite, adding Roblox to their tab to capture a younger demographic. Both are fundamentally social games, built for interaction. Assuming a 100% markup from Epic?s last round, and a generous 50% premium on Roblox?s more recent funding, the deal might cost in the region of $36 billion.

Other possibilities

- Uber could buy Convoy. Even though their potential acquisition of Grubhub fell through, Uber can still remake itself before our eyes. Rather than ferrying people, the company?s future may be as a deliverer of things. With trucking brokerages forced to make cutbacks, now might be an opportune moment to take share. Micro-fulfillment solutions like Flexe could also be worth investigating.

- Google could buy Lyft. Uber may have the latitude to pivot; Lyft doesn?t. With well-established ties between the companies, Google CEO Sundar Pichai could swoop in, locking up Waymo?s distribution strategy for the future.

- Dropbox could buy Figma. Despite the company?s 2017 redesign, aptly described as a ?fantastic midlife crisis,? Dropbox has failed in its attempts to move beyond file-sharing and into collaboration. Design software Figma (valued at $2 billion) would correct that perception, giving the company a jewel to showcase that fits the platform?s core competencies. Though more of a conflict with existing product Dropbox Paper, Notion would solve a similar problem.

- Slack could buy Front. With $862.5 million in fresh cash via convertible note, Slack is in a strong position to buy. Front, a shared inbox product, might be an interesting target, giving Slack a way to manage external communications. Front, a French company, raised $59 million at an undisclosed valuation. Meanwhile, picking up Asana, valued at $1.5 billion, would give Slack a bundled communication and collaboration suite, allowing them to compete more directly with Microsoft Teams? more comprehensive platform.

- Netflix could buy Caffeine. Twitch-competitor Caffeine could give Netflix an interesting property in livestreaming and provide an avenue to expand beyond recorded video. Caffeine has raised $146 million and is valued at $500 million.

With a single acquisition, right in the heart of a depression, Forrest Mars set his family?s business on an entirely different trajectory. In the years to come, we may return to this period and find similar tales of metamorphosis. For Big Tech, there may be few better opportunities for reinvention and expansion.