The Dorm Room Fund community at All DRF 2018

The Dorm Room Fund community at All DRF 2018

How SAFEs Work

SAFE stands for Simple Agreement for Future Equity. It was created by the team at Y Combinator and has been a popular method for investing at the earlier stage of a company.

At the early stage of a startup, it can be difficult to accurately assign a value to the company because there is usually very little data. That?s where a SAFE comes in to play ? it?s a form of convertible security that allows you to postpone the valuation part until later on. A SAFE is neither debt nor equity, and there is no interest accruing or maturity date.

What if the company fails?

If the company fails, whatever money they have left will be returned to investors. If you?re the founder, this doesn?t mean you need to pay the money back if the company fails. The liability is on the company, not on the founder individually.

What if the company grows?

For a growing startup, the company will likely raise more money. As a startup investor, I?m not interested in just getting paid back. The risk associated with a startup is high, so I?m hoping that with high risk comes the potential for high upside. Because of this, I want my SAFE to ?convert? into equity at a later stage. Basically, once someone decides to invest in the company in a ?priced round,? my SAFE will turn into shares in the company.

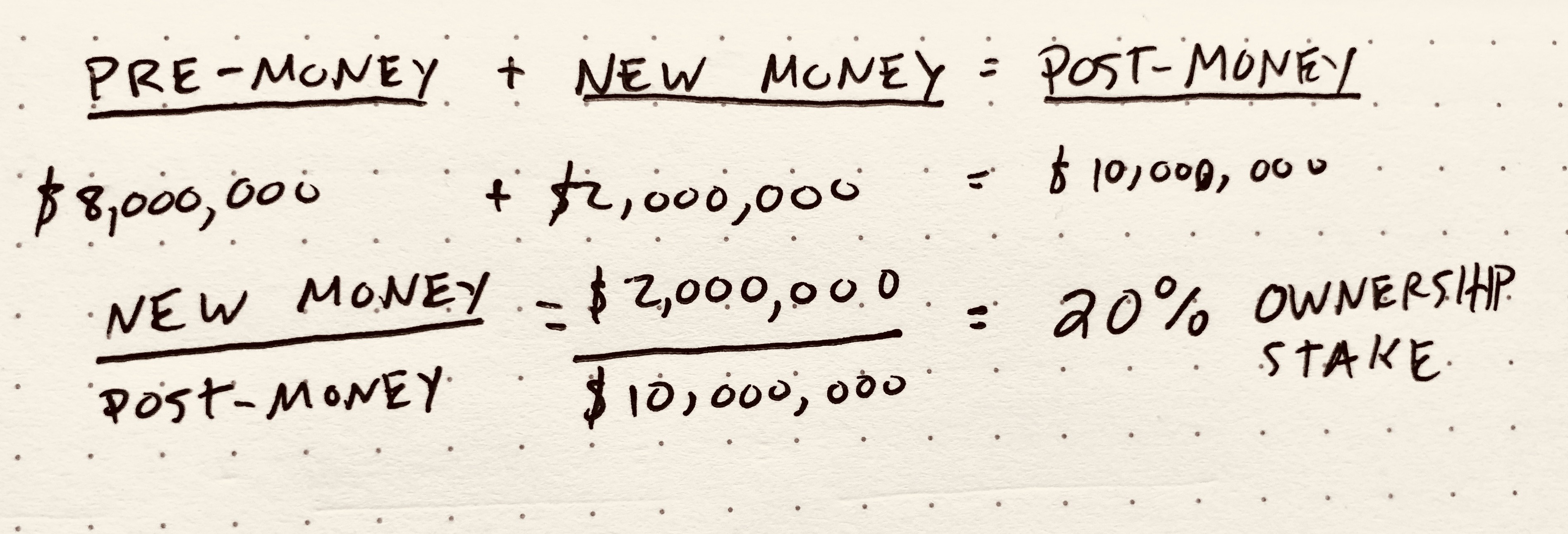

If I invest $20,000 through a SAFE, the company will then use that money to build the business. But $20K doesn?t go that far. So once they make some progress, they may want to raise more money. Let?s say they find an investor that wants to buy 20% of the company for $2M. If 20% of the company is worth two million dollars after they invest, that means the post-money valuation is ten million dollars.

So if we assume for simplicity that your company had 8,000,000 shares before the $2,000,000 financing, we can calculate the new price per share.

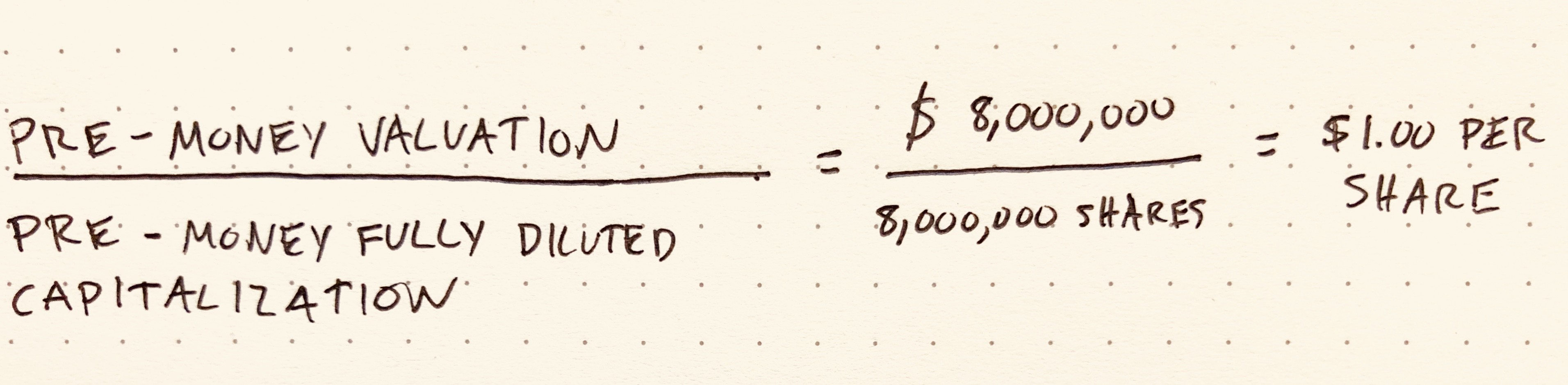

Now that we have a $1.00 price per share, we can now do the conversion of the $20K SAFE. Assuming there was no cap or discount (we?ll explain those in a minute), my $20K SAFE will turn into 20,000 shares in the company.

Terms of a SAFE

SAFEs have a few common terms that can change how they convert to shares in the company. The main four terms I?ll go over are discounts, valuation caps, most favored nation provisions, and pro rata rights

At Dorm Room Fund, we invest using uncapped SAFEs with no discount, but with a MFN clause. This means that when the SAFE converts to equity, the founders end up with more of the company than they would if there was a cap or discount. If the new investors are buying shares at $1.00, so is Dorm Room Fund.

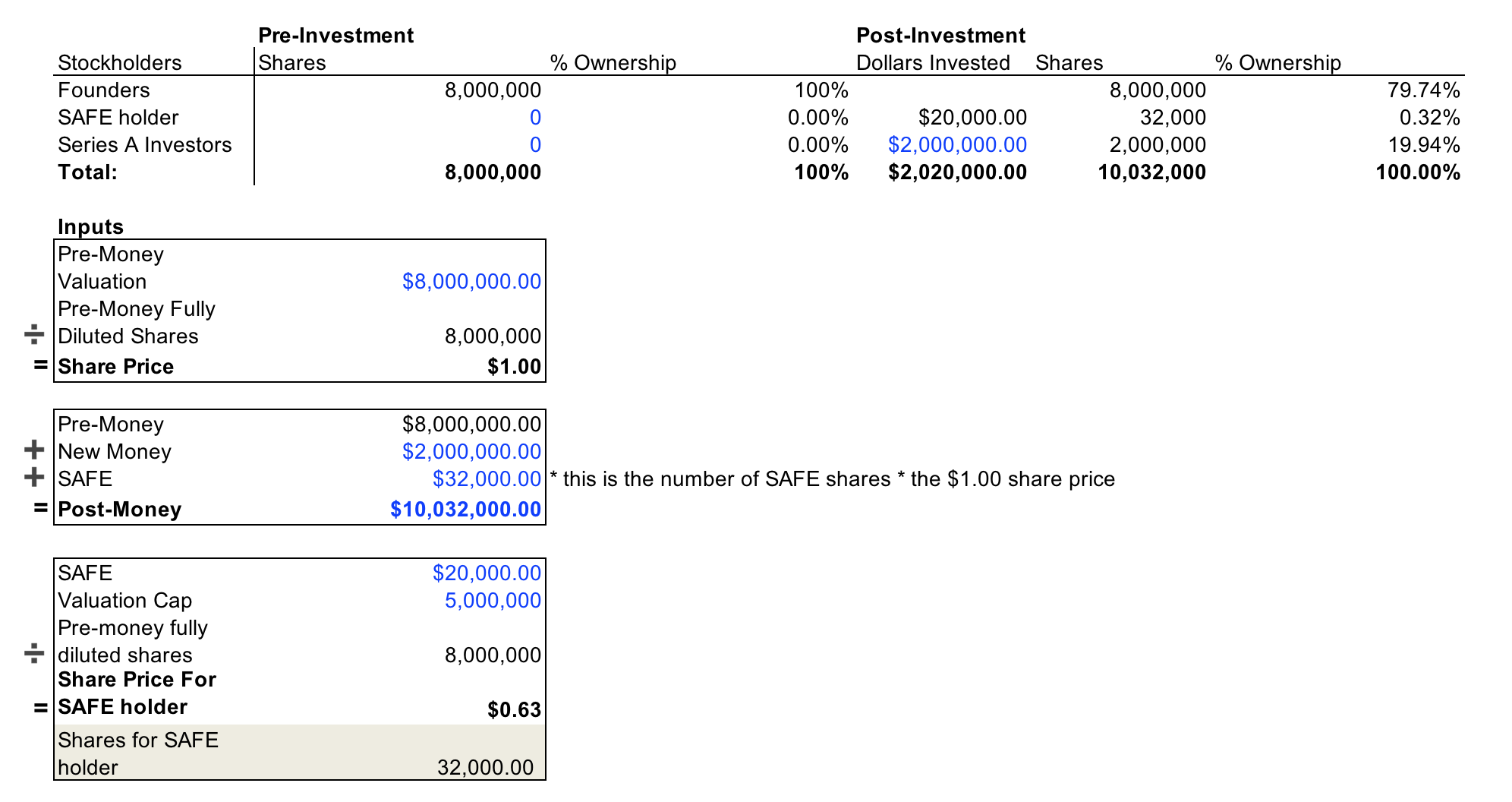

Using the hypothetical scenario from above, your cap table will look like this after a VC invests $2M, and you have a $20K SAFE from Dorm Room Fund that has no discount and no valuation cap.

The ?SAFE holder? which here is Dorm Room Fund, ends up with 0.2% of the company. My calculations are based on the more common pre-money method where the new investor and existing stockholders share the dilution caused by the SAFE. You could also hold the Series A investor?s ownership percentage fixed and force existing stockholders to take all of the dilution.

The ?SAFE holder? which here is Dorm Room Fund, ends up with 0.2% of the company. My calculations are based on the more common pre-money method where the new investor and existing stockholders share the dilution caused by the SAFE. You could also hold the Series A investor?s ownership percentage fixed and force existing stockholders to take all of the dilution.

What is a discount?

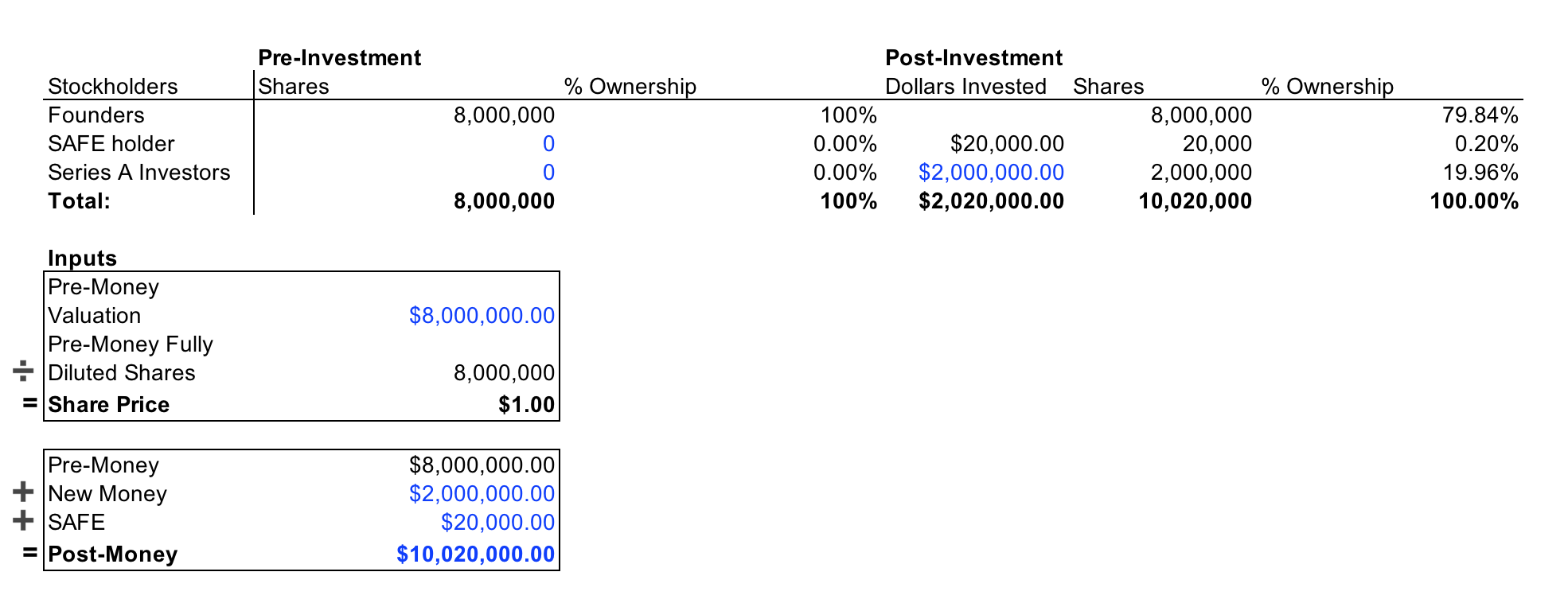

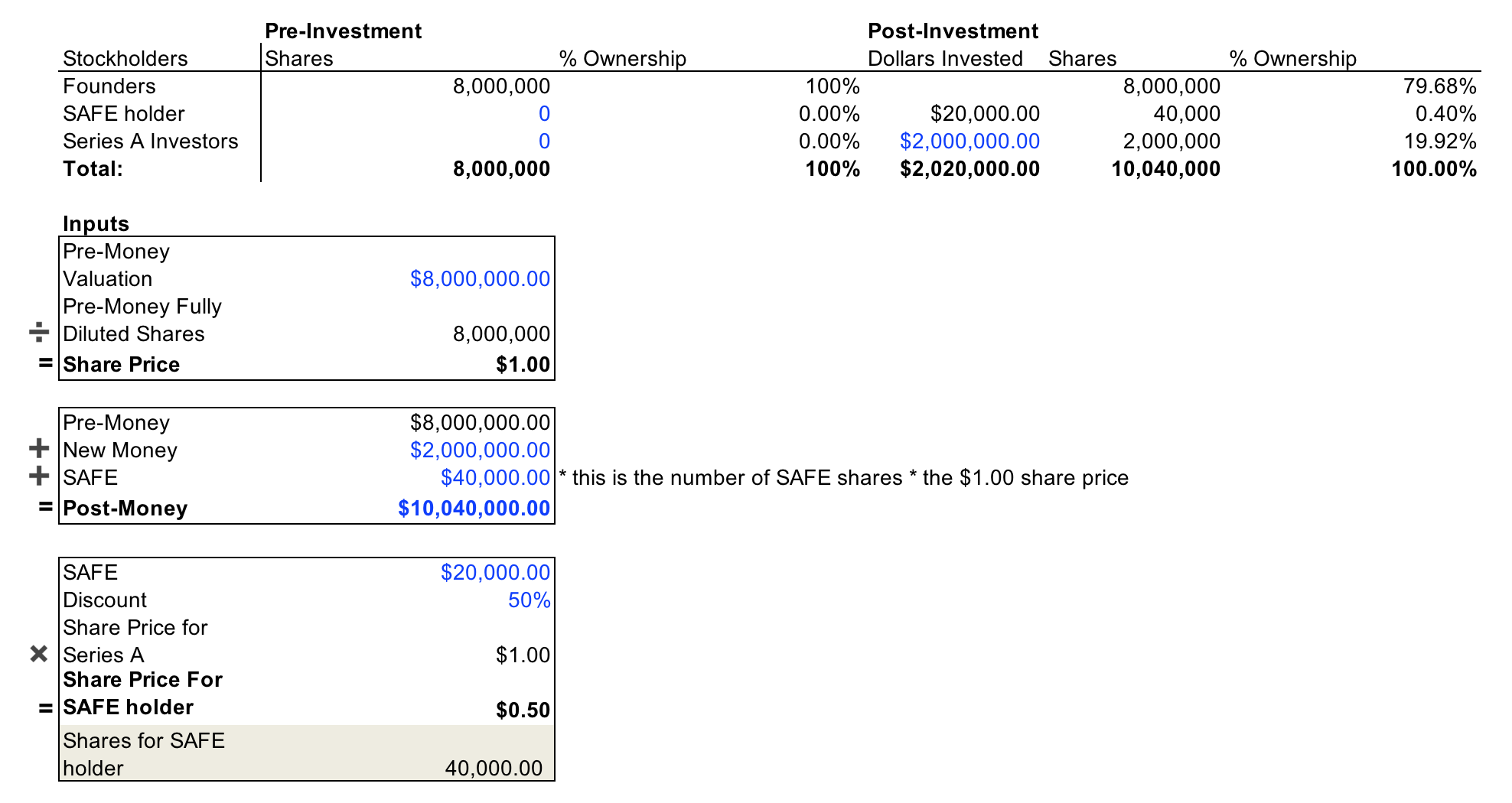

To complicate things a little bit, sometimes a SAFE will have a discount. Because the SAFE comes before any investor later on, the SAFE investor might want the SAFE to convert to equity at a discount to the later round of financing. Discounts typically range from 10?30%. For illustrative purposes, I?ve modeled what at 50% discount will look like. Instead of buying shares at $1.00, the SAFE holder gets to buy shares at $0.50. Here is an example:

Here, the ?SAFE holder? get 0.4% of the company when they convert, instead of before when they only got 0.2%.

Here, the ?SAFE holder? get 0.4% of the company when they convert, instead of before when they only got 0.2%.

What is a Valuation Cap?

Another term that can come with a SAFE is called a Valuation Cap. This is another way for the SAFE investor to get a better price per share than a later investor. If your company ends up raising money at a valuation above the ?cap,? then the SAFE investor gets to convert at a share price equivalent to the cap. Below, I?ve modeled what a valuation cap of $5M dollars would look like. In this case, instead of getting shares at $1.00, the SAFE investor gets shares at $0.63.

The ?SAFE holder? gets 0.32% of the company, instead of 0.20% ? nearly a third more than without the cap.

The ?SAFE holder? gets 0.32% of the company, instead of 0.20% ? nearly a third more than without the cap.

Sometimes, a SAFE will have both a cap and a discount. In this scenario, the SAFE holder will pick either the cap or the discount to use. If there was a 50% discount and $5M cap like in the scenarios above, the SAFE holder would pick the discount, because it would give them a lower price per share.

What is a Most Favored Nation (MFN) Provision?

Let?s assume SAFE ?A? has a MFN Provision. If another SAFE is issued, let?s call it SAFE ?B,? the company has to tell SAFE ?A? about it. If the terms of SAFE ?B? are better for the investor than SAFE ?A,? then SAFE ?A? can ask for the same terms as SAFE ?B.?

What are Pro Rata Rights?

With pro rata, or participation rights, investors can invest additional funds to maintain their ownership percentage during equity financings subsequent to the financing where the SAFE initially converted to equity. If exercising pro rata rights, the investor pays the new price of the round rather than the price they paid when the SAFE initially converted.

These are the basics of how a SAFE works. For more information, you can check out Y Combinator?s Startup Documents, which includes a primer on SAFEs, as well as examples of the documents with various provisions. Be aware that there are many different flavors and conditions that can be added or changed from the documents listed on the YC website.

If you have any questions, or would like to discuss this further, feel free to reach out on twitter or via email. You can apply for DRF funding here.

If you?re ever considering raising money through a SAFE or any other investment instrument, you should consult a lawyer directly.

Dorm Room Fund is dedicated to supporting student founders across the country and helping them reach new heights ? Check out our 5 year report to learn more about what students are capable of building.