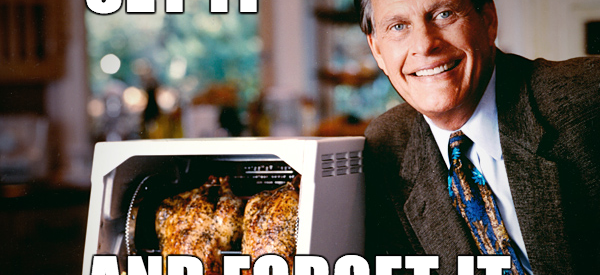

Those annoying infomercials that clog up the late-night airwaves as they hawk everything from perfect abs to greaseless grills? Well, you can thank Ron Popeil for those.

Popeil was the pitchman for Ronco, the company that brought the world such life-changing gadgetry as the Pocket Fisherman, Chop-O-Matic hand food processor, GLH (Good Looking Hair) Spray, and of course, the Showtime Rotisserie Oven. Popeil was the first to use quick-hitting infomercials to hawk those products, and he also coined the phrase ?Set it and Forget it? for his best-selling rotisserie oven ? all you had to do to cook a perfect rotisserie chicken was just set it and forget it. The bird would come out all juicy perfection when done.

Since then, the term ?Set it and Forget it? has become ubiquitous for 401(k) investment plans that use target-date funds as their primary investment vehicle.

Target-date funds usually include a mix of stocks and bonds that automatically transition away from stocks to more conservative asset allocations as the targeted retirement date draws near. That ?Set it and Forget it? approach is the main reason why target-date funds have grown so much in popularity ? these funds provide unseasoned retirement investors with a simple investment solution. All they have to do is make regular contributions and forget about their money; it grows on its own, it re-allocates automatically, and the account is all juicy perfection upon retirement.

?Set it and Forget it? is excellent for cooking chicken using Ronco?s rotisserie oven, but it?s hardly the best investment strategy to grow your hard-earned retirement money. Rocket Dollar account holders can leverage the power of Self-Directed retirement accounts for a much more proactive ? and personal ? retirement investment strategy.

Don?t Let Your Chicken Or Nest Egg Burn

One of the reasons why target-date funds have grown so much over the past decade is due to reforms enacted through the Pension Protection Act of 2006. While the act had many elements, a first reform was that it allowed employers to automatically enroll workers in defined contribution plans if they did not select their investment options when they enrolled in their company?s 401(k) plan.

There are several flaws with target-date funds, however. First, target-date funds are a blind investment. You put in your money, and hopefully, when you retire at age 65, your modest contributions have grown into a retirement nest egg. For me, that?s putting too much trust in having someone else determine how you invest your money. There?s no room for diversification or alternate investment strategies ? you are bound to follow the investment philosophy of the fund provider and aren?t allowed to make tactical shifts in investments based on changing market dynamics.

Before starting Rocket Dollar, I worked as a traditional retirement plan consultant for 14 years, and I can assure you that ?Set it and Forget it? is not the best strategy to grow a 401(k) or IRA. Simply put, you can?t just sit back and hope things will work out OK when you look at your account statements. You can?t neglect a 401(k) for decades on end and think the result at retirement will be the best possible outcome.

Vanguard, Fidelity and T. Rowe Price are the leading providers of target-date funds, and they?ve reaped millions in fees from these accounts since target-date funds typically have pretty high fees. It?s the crown jewel for these companies to win a target-date option from employers ? they usually constitute 70 percent of overall retirement account investments.

Target-date funds have generally served people well when the stock market goes up, but it?s not a sustainable investment strategy for a bear market. Retirement investors should strive for true 21st-century diversification in their retirement portfolio by including a wide range of alternative investments and asset classes that are not affected by the performance of the market. These assets provide a hedge against the inevitable market downturns and corrections that can shave tens of thousands of dollars off the net worth of retirement portfolios ? or even reduce them to rubble.

The Proactive And Intentional Way To Invest Retirement Funds

Rocket Dollar allows investors to harness the power of the Self-Directed Solo 401(k) or Self-Directed IRA by investing in assets not related to stocks and bonds, such as real estate, private equity, peer-to-peer loans, cryptocurrencies, and many others.

Furthermore, retirement investors can allocate funds to things that truly matter to them, such as business loans to local entrepreneurs or rental income properties that provide homes for families in their neighborhoods. These investments have personal attachments that can?t be found in target-date funds or other standard financial instruments. While these tax-deferred investments often provide above-market returns, their real strength lies in their ability to empower community investment that?s intertwined with investor beliefs and personal connections. Rocket Dollar enables retirement investors to go further with their money and pursue many different tax-deferred investment options that have deep personal relationships.