What if the popular millennial trading app added index funds?

One product idea that I have been thinking a lot about is the idea of updating index funds. Index funds have had a massive impact on how people invest their money today. But they?ve largely gone unchanged since they were created in the 1970s. So I?ve been trying to think what Index Funds 2.0 might look like.

Taking the idea of tapping into the Wisdom of the Crowds like Kaggle has done with machine learning and data science, I thought it might be interesting to do this with index funds. Could the crowds generate better results than existing institutional index funds? And what might those funds look like? This where the concept of custom index funds comes from.

Given how Robinhood ? the popular commission-free trading app ? has already up-ended the traditional investing model, I thought their platform might be a natural fit for this new type of financial product. If any existing company is going to do something like this, it?d likely be Robinhood.

This may seem like an oxymoron to have a passive investing vehicle on an active trading platform, but with a bit of creativity, I think there?s a potential way to do it that would excite users and create a whole new way of thinking about a traditional financial product. Something that?s at the core of Robinhood?s mission.

Below is a hypothetical product spec that I put together that goes into the details of how this new product might work and integrate with the existing Robinhood platform.

Overview

Robinhood changed the investing world by offering commission-free trading for stocks, ETFs, options, and cryptocurrencies. However, there is one area of investing that Robinhood has yet to disrupt, the index fund.

There?s no question how successful index funds are today. In the last three years alone, investors have invested over $800 billion dollars, just in Vanguard funds. Yet, despite their recent popularity with investors they remain largely unchanged since Jack Bogle introduced them to the market in 1974.

Millennial investors are demanding new ways to invest ? mobile-first, friendly UIs, easy to understand, etc ? and Robinhood has been the company to match these new demands. Investing in index funds is no different. Young investors are concerned about their money being blindly invested into companies that they don?t agree with ? like gun manufacturers or oil companies ? just because they are a part of an index fund. They are questioning why it has to be this way. Instead of blindly investing into companies that have been chosen because they meet some old standard, why can?t investors create their own index funds to invest in?

That?s where Robinhood Index Funds come in. Just like how Robinhood changed the game by offering commission-free trading, they will once again change the way investing is done with the introduction of user-created index funds.

Robinhood Index Funds is a service within the Robinhood app that allows anyone to create their own index fund, invest in it, and share it with others.

This document is intended to be an idea exploration for the Robinhood Index Funds product. It is intended to explore the product from the point of view of the end user and not meant as a technical specification document.

Potential Customers

Below are some imagined customers of the service.

Customer 1: Jill Shakespeare

Jill is in her early thirties and works as a computer software engineer at TheHottestStartup. In her spare time she likes to invest in the stock market. Over the years she?s done pretty well for herself. Being up to date with the latest financial portfolio theories, Jill knows that investing in index funds will likely do better than investing her money with active managers.

The problem for Jill used to be that the choices of index funds available weren?t very flexible. There are options at the various financial institutions that do differ and offer a decent selection of companies but they have higher fees and don?t have the exact composition of stocks that Jill desires to invest in.

However, now that Robinhood has added their index funds product, Jill has been really putting her investment skills to the test. Using its simple and intuitive UI, Jill has created not one but five(!) different index funds. Now Jill can compare her funds performance versus the market and active managers. This is something that?s particularly appealing to someone as competitive as Jill.

Another feature Jill also enjoys is the ability to share the index fund she created with others. She gets a kick out of how many people are using her index funds. Her unique funds have generated some pretty good returns for people. Hey, maybe she should quit her day job?

Customer 2: Jack McBeth

Jack is a 20-somethings social media manager at FlixBook. Like many of his friends and colleagues, Jack uses his phone for everything. Whether that?s getting a Lyft to go cross-town to the latest Broadway play or scheduling his annual checkup with his doctor, Jack pulls out his handy iPhone.

Jack also has had a mixed relationship with investing. He assumed it just wasn?t for him. His parents tell him that it?s important to save but he finds that pretty hard to do living in Manhattan as a social media manager. His employer automatically puts some of his salary into a 401k, which is the lamest sounding investment ever. Outside of his 401k, Jack used to have all of his money in Vanguard invested in their S&P 500 Index Fund because he read on one of those early retirement blogs once that it?s the smartest thing to do. This was fine but the website was hard to use and the service seems catered to 70-year-olds, not millennials like Jack.

Being an informed citizen of the world, Jack listens to the NPR One podcast. One day Jack listened to a story about how bad some companies behave yet they still end up doing well in the market because of how many billions of dollars are invested in index funds. This frustrated Jack because the stories pointed out that even if you don?t like the behavior of a particular company, you?re still likely supporting them with your money because they?re in the S&P 500. Jack doesn?t want to invest in companies he doesn?t agree with but finding index funds without these companies is quite challenging to do, even for experienced investors.

That?s why Jack?s been going around telling all his friends about the Robinhood app and its new product called Robinhood Index Funds. Before they released their index funds product, Jack was intimidated by the app because investing in individual stocks was too daunting and risky in his eyes. But now that they offer the ability to invest in index funds ? and ones he can create himself(!) ? he?s moved all of his investments from Vanguard into Robinhood.

He particularly likes the feature that helps him find index funds created by others on the Robinhood app that have companies he can feel good about investing in. Even though he doesn?t feel as though he?d be able to craft his own index fund using the app, he does like how easy the app makes it if he ever changed his mind. He also loves the fact he can sleep soundly at night knowing he isn?t funding companies that conflict with his ideals.

Features Not Supported

This version will not support the following features:

- Creator compensation: creators of index funds will not be compensated monetarily for the index funds they create, their index funds will be shared freely to all other users; this ensures fees for user-generated funds can be extremely low and eliminates any complications compensation might add

- Joint creation: users will not be able to create and collaborate on custom index funds in this version. This makes it easier for users to understand how to use the new product and avoids any complex issues around ownership

Screen by Screen Implementation

The Robinhood Index Funds product consists of a few different screens. The details below describe each screen?s functionality but does not intend to layout its exact design. Instead, the below should be treated as an exploration into how the product might work and integrate into the existing app.

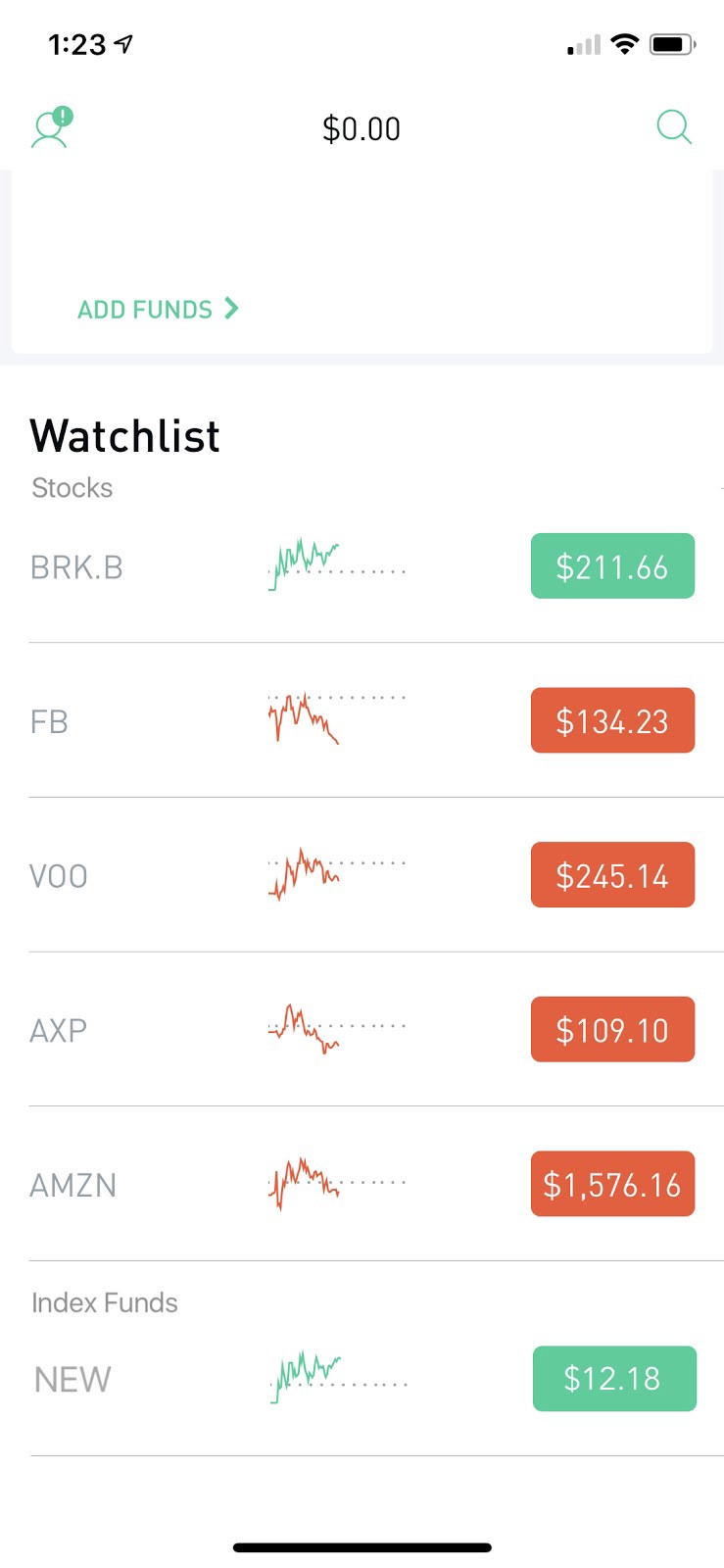

Home Screen

The Home Screen is the main view of the Robinhood app. On this screen, users can see their overall performance over different time intervals, the current value of their investments on Robinhood, their individual investments, and their watchlist. Users can also reach the main navigation menu and search from this view.

The Robinhood Index Funds product will integrate into this view just like the other investment products ? stocks, options, ETFs? offered by Robinhood. Whenever a user is invested in an index fund on Robinhood, that index fund will appear in the appropriate list. For example, the index fund could be added to the Watchlist if the user wants to track its performance without having to invest in it. Or, if the user has invested in an index fund, it will appear on the Home Screen under their current investments. In either case, Index Funds will be separated from other investments, just like how Stocks and Crypto investments are separated today.

The only other addition to the Home Screen that will be made to support Robinhood Index Funds is the addition of a new list called Created Index Funds. This list will appear below the Watchlist and will consist of index funds the user has created. This list is necessary because it is possible the user has created index funds that they haven?t also invested in.

Note: One feature that is still to be determined is whether or not to give the ability for users to save ?drafts? of their index funds. The benefit of having the ability to save a draft is that it gives users the opportunity to play around with the product. The downside of having drafts is that it adds complexity and clutter to the app.

Just like the other investment products, tapping on any of the index funds in any list will open the View Index Details modal. Finally, at the top of this list ? whether a user has created an index or not yet ? there will be a button that says ?Create Index?. Tapping this button will take a user to the Create Index view.

How the Index Funds product might fit into the Home Screen

How the Index Funds product might fit into the Home Screen

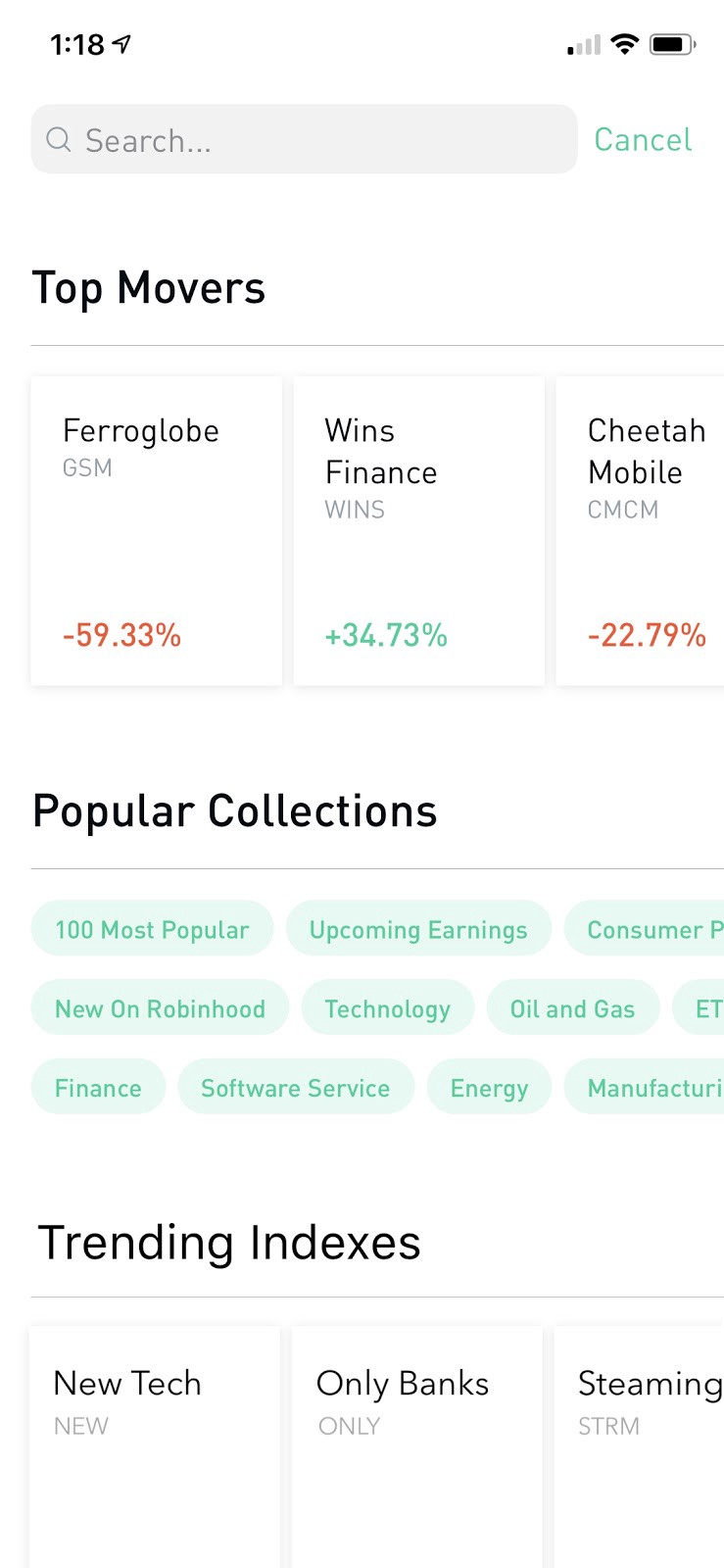

Search View

The Search View is a crucial part of the Robinhood app. It?s the screen that unlocks many of the other elements of the app. One of the great features of the Search View is that before a user types a query into the search box, the app presents some useful information to help the user find what they might be looking for ? like Top Movers, Popular Collections, and Recent News.

One way Robinhood Index Funds would integrate into the Search View is by adding a new section in the initial view called Trending Indexes. This section would list the most popular index funds ? as measured by new investors ? created by Robinhood users over the past week.

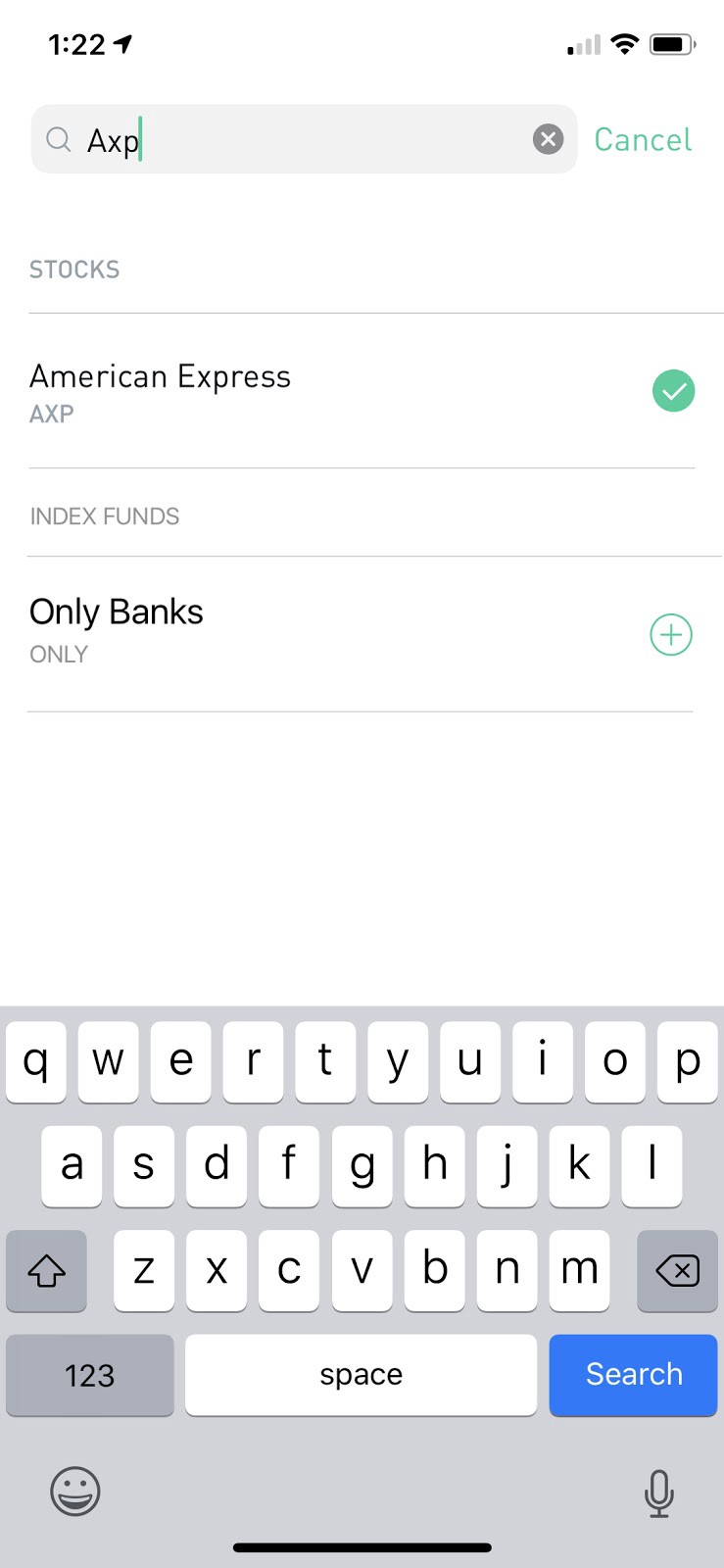

Another way that the Robinhood Index Funds would be incorporated into the Search View is to show index funds as search results whenever a user searches for a particular stock symbol or company name that is apart of an index fund. For example, if a user enters the search query ?AXP?, all index funds that incorporate the American Express Company will show in the search results, separated by the words Index Funds to distinguish between index funds and other investment types in search results. Tapping on any of the search results for an index fund will show the View Index Details modal.

How Trending Indexes might look

How Trending Indexes might look How the search autocomplete might look with Index Funds

How the search autocomplete might look with Index Funds

Create Index

The Create Index screen will be where users can create their own customized index fund. On this screen, users will be able to name their index, add stocks to the index, and decide how to weight each stock within the index.

Naming the index will just be a normal text field input. To add stocks, the user will tap on a ?+? icon and the be presented with a search field. In this search field, the user can start typing to search for stocks, either by their symbol or company name. As they type, the list below the search field will populate with stocks based on their query. Tapping on a stock will show the View Stock Details view. On this screen there will be a ?Add to Index? button. If the user taps this button, then this stock will be added to the index and they will be brought back to the Create Index view. Before typing a search query, the user will be presented with some stock suggestions. These suggestions will be based off of prior searches and other information gathered on the user.

Note: What other information about a user should be used to make better stock suggestions is a matter to take seriously. It?s possible that this information may change the company?s privacy policy and terms of service. Final implementation of this feature will need to check with the legal team.

Finally, once all stocks are selected for a index fund, the user has the ability to adjust their weights however they desire. Initially, all stock weights will be based off their market cap. In future versions of the product, the user may have the option to change this.

Note: Because of the complexity around how to weight stocks in an index, the initial rollout of this product should aim for the simplest method possible. In this case that is by using companies? market caps. Future versions might add the ability for the user to select between other options like price-weighted, equally-weighted, risk-weighted, and fundamentally-weighted.

Also because indexes require rebalancing, the company should come up with a standard rebalancing practice. For example, the easiest method for rebalancing an index is to do it yearly. This means at the end of every year ? say on Jan. 1st ? Robinhood will automatically rebalance all existing index funds by however the creator chose to weight the stocks in it.

After deciding on a name and the list of stocks that compose an index, a user can create their index. Upon creation, if an exact match already exists, then the app will let the user know and show the View Index Details screen for that index. If the index does not already exist, then the index will be created and its View Index Details screen will be shown.

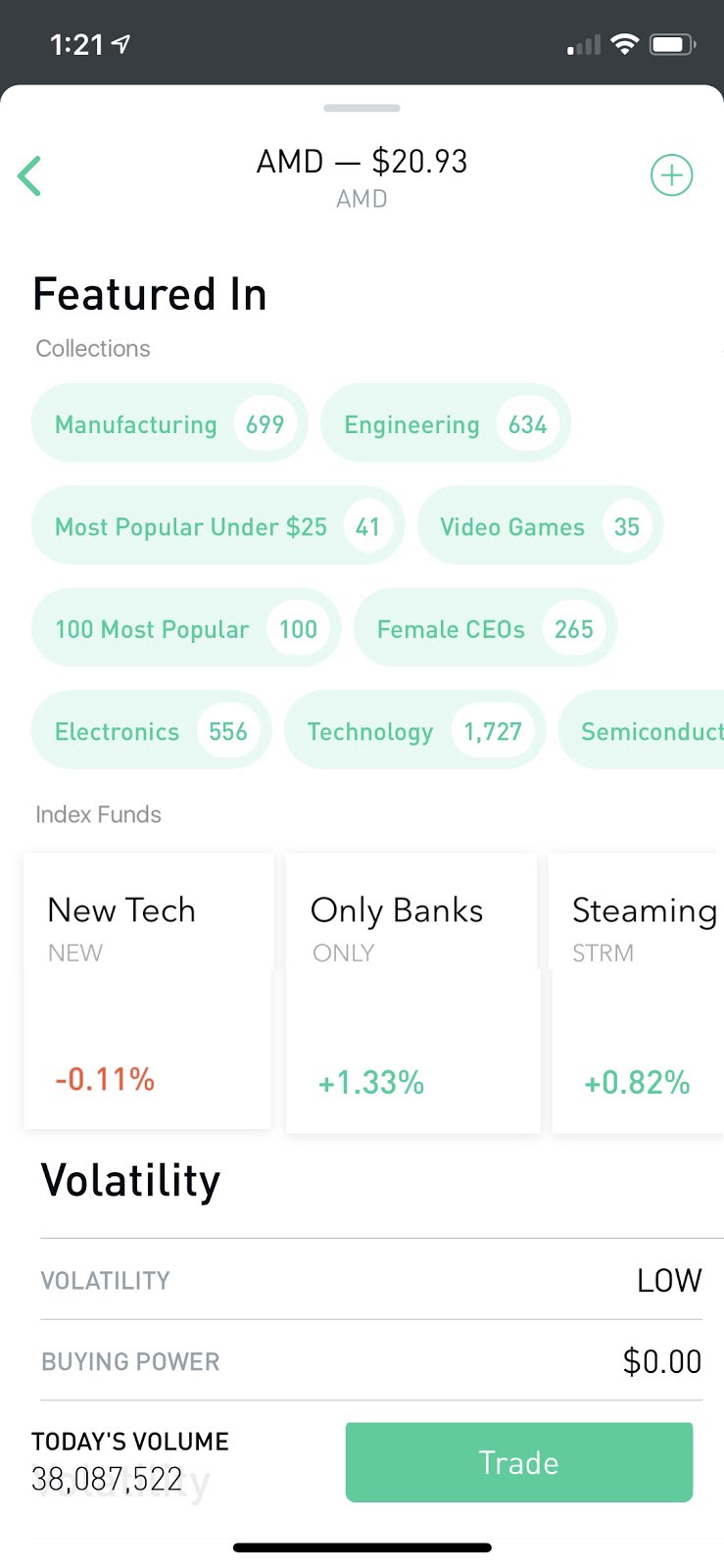

View Stock Details

The View Stock Details modal in the Robinhood app displays information about a particular stock to the user. One section of this view that is relevant to the Robinhood Index Funds product is the Featured In section. Currently, this section displays Collections that the viewed stock is apart of. With the addition of index funds, this section should now also display a list of index funds the stock is apart of. The index funds can be separated from the collections to avoid confusing the user by using titles above the lists ? ?Collections? and ?Index Funds? respectively. Tapping on the name of an index fund in this section would show the View Index Details modal.

A hypothetical View Stock Details View with Index Funds

A hypothetical View Stock Details View with Index Funds

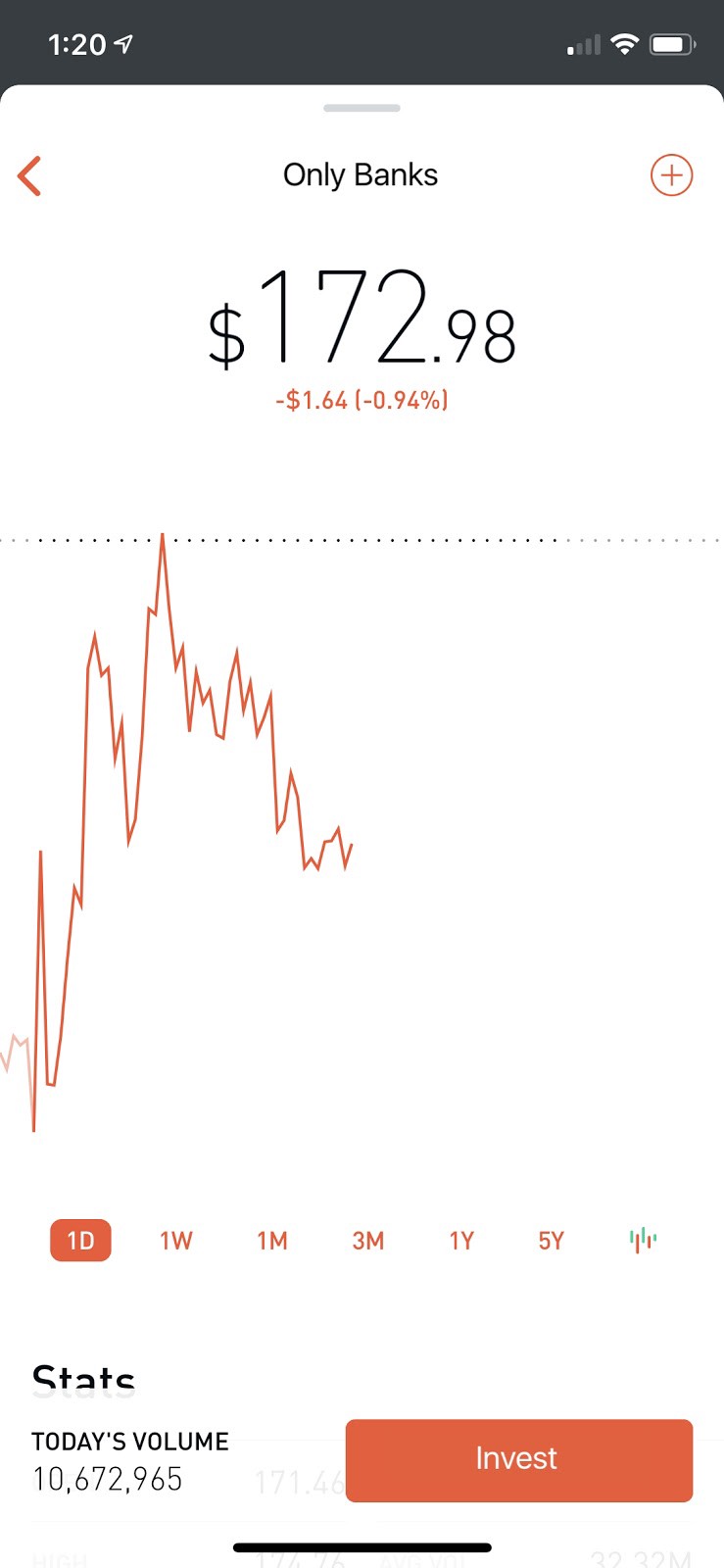

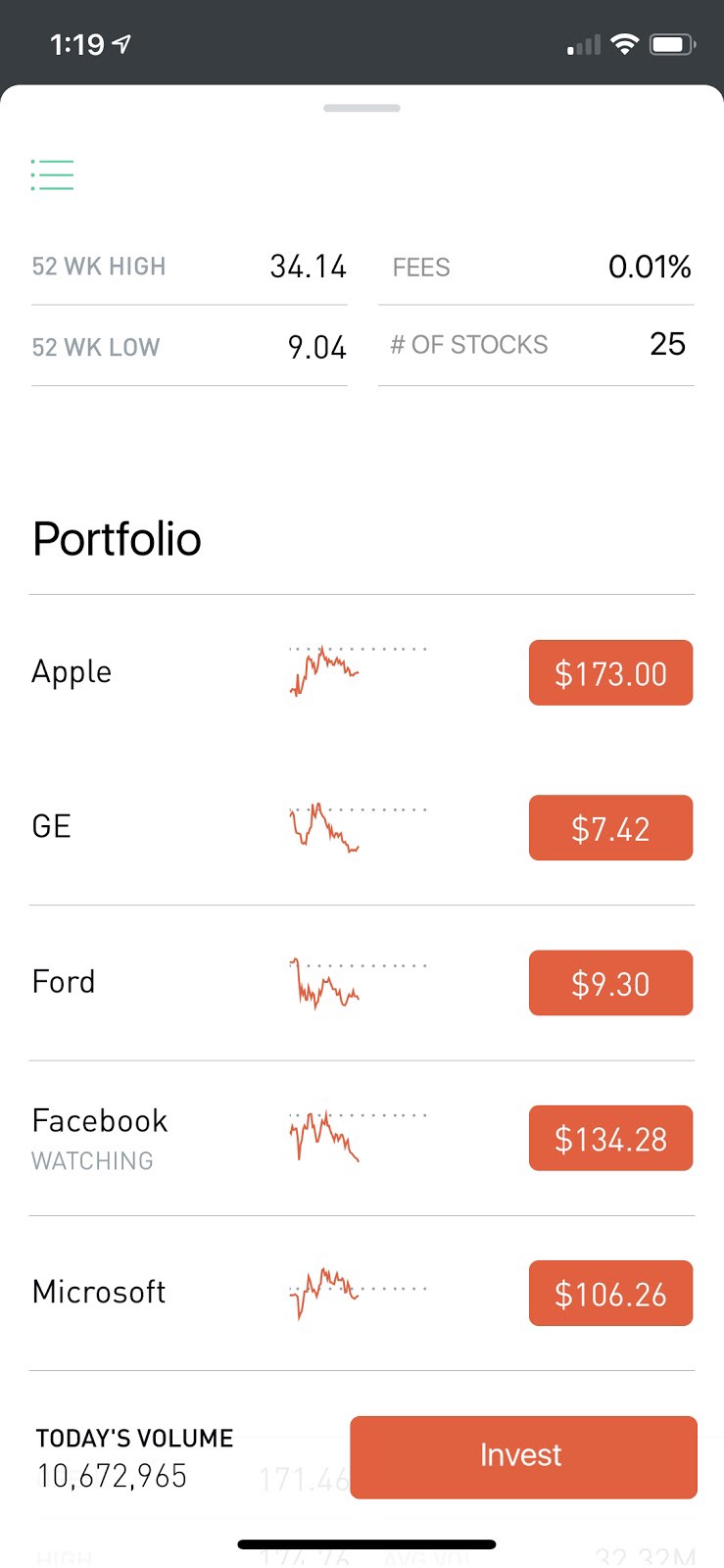

View Index Details

The View Index Details modal shows the details for a given index fund. Its functionality and behavior are very similar to the existing View Stock Details modal in the Robinhood app.

The sections that will be displayed in the View Index Details modal include:

- Overview

- Stats

- Portfolio

- News

- People Also Invested In

- About

- Volatility

Overview

The Overview section of the View Index Details modal displays the name of the index fund, the current price of 1 share of the index fund, and a chart displaying the fund?s performance over time, just like how the View Stock Details modal does for a stock.

Stats

The Stats section of the View Index Details modal displays basic stats for an index fund. The stats about the fund that are shown are:

- Expense Ratio (fees)

- 24 hour Gain/Loss $

- 24 hour gain/loss %

- 52 Week High

- 52 Week Low

- # of stocks in the index

Portfolio

The Portfolio section of the View Index Details modal lists all of the stocks that make up the index and their weights.

News

The News section of the View Index Details modal shows all recent news about any of the stocks that make up the index. It should only display 5 news articles at a time.

People Also Invested In

The People Also Invested In section of the View Index Details modal helps users find other products they might like in the Robinhood app, including stocks, ETFs, and other index funds. This list of other products should show ones that investors of the viewed index fund also invested in.

About

The About section of the View Index Details modal gives a little bit more information about the index fund like its creation date, the name of the user who created it, and a general paragraph about index funds and how they work on Robinhood.

Note: A copy writer or someone in marketing should come up with the exact copy of what is said in the paragraph about index funds. In general, this copy should assume the user is not familiar with what index funds are. In addition, the paragraph should explain how index funds work on Robinhood. An example of what this paragraph could say is:

?Index funds are a bundle of multiple stocks. They are a great way for investors to diversify their portfolio in a low-cost way. On Robinhood, index funds are created by users. These index funds are unique collections of stocks that offer investors a way to invest in many companies as a group.?

Volatility

The Volatility section of the View Index Details modal should show the volatility rating of the viewed index fund. This volatility rating should be an automated calculation based on the stocks that are apart of the index as well as their individual weights.

In addition to these sections of the View Index Details modal, this view will also have buttons for two actions: adding the index fund to a user?s Watchlist and investing in the index fund.

The button to add the index fund to a user?s Watchlist is located in the top-right portion of the view, similar to how it is on the View Stock Details modal. The button to invest in the index fund will have the word ?Invest? on it. Tapping this button will show the Invest in Index Fund View.

Mock-up view of what the View Index Fund Details screen might look like

Mock-up view of what the View Index Fund Details screen might look like Mock-up view of what the View Index Fund Details screen might look like

Mock-up view of what the View Index Fund Details screen might look like

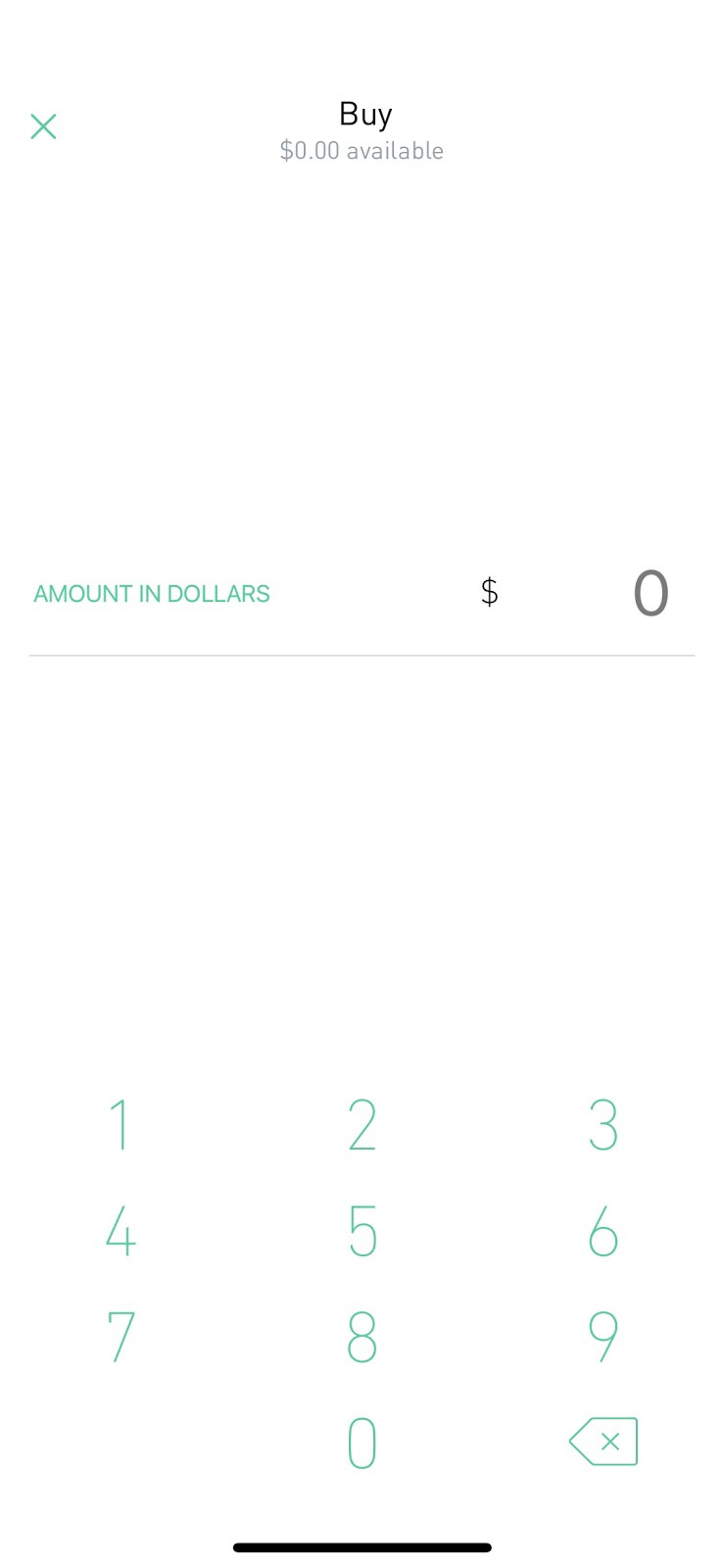

Invest in Index Fund View

The Invest in Index Fund View is a simple screen that is presented to the user when they want to invest in a particular index fund. The view shows the name of the index at the top and the type of transaction that it is. The only input field displayed to the user is for the amount of money they would like to invest in the index fund. If the user has already invested in this index fund, then the existing amount is shown above the input field. If they have not then this information is not displayed.

Once a user has inputted the desired amount they would like to invest in the index, a button with the word ?Review? appears. Tapping this button brings the user to the confirmation page that shows the user the details of their order and gives them the option to cancel their order or confirm it. Confirming their order takes the user to a confirmation page with the details of their transaction. Closing this view returns a user back to the Home Screen.

Hypothetical Invest in Index Fund screen

Hypothetical Invest in Index Fund screen

Other Product Considerations

Since the Robinhood Index Funds product deals with index funds, there are other considerations we need to keep in mind for the end user experience that go beyond the user interface. For example, how an index fund is actually created so that other investors can invest in them is quite complex. Creating an index fund requires knowing how many shares to create, what price to initially set those shares at, and how to rebalance it over time. All of these features are critical to making an index fund work, but they are not something the end user should have to deal with.

That means we need to consider how to handle these scenarios behind the scenes. Because Robinhood Index Funds allow users to create their own funds, there should be a standard or default setup structure for each fund created on Robinhood. Depending on the number of stocks in the index and the initial invested capital, the backend should automatically calculate how many shares outstanding to create and the initial value of each of those shares. The end user should not have to think about this.

In addition, index funds will require some sort of rebalancing mechanism over time. In order for an index fund to maintain the desired weight distribution over time, the fund will need to rebalance itself as the underlying stocks that compose an index change in value. Keeping things simple in this regard is probably best. Therefore, a default rebalancing scheme should be set for all index funds created on Robinhood. For example, the default rebalancing scheme might be to rebalance a fund at the start of each calendar year.

Because this document is meant to be in the point of view of the end user, it will not go into any further details into how these features might be implemented, that?s something the financial team should have more say in. However, it is important to keep in mind how these features are done since they will have a direct impact on the user experience of the end user. At the end of the day, the ideal version of this product is something that is easy to understand, simple to use, and brings joy to the user.

Note: Because of the underlying complexity of this product, it is possible that it may be better to roll it out with only Robinhood generated index funds, rather than user generated index funds. This decision will have to be made based on the complexity required and whether or not it can be overcome in a way that makes it easy and simple to use for the end customer.

One final note to consider is how to market the product. Based on the survey ran in conjunction to this spec, almost 50% of respondents didn?t know what an index fund was. This doesn?t necessarily mean that an index fund product would be a flop. Instead, this may showcase the need to better market index funds to the common investor. Robinhood is in a unique position to do so because of its ability to market complex investment products well to the common investor, like how it does so with Options.

Supplemental Information

In conjunction with this spec, a short survey was run to get a better understanding of how people invest and save. Below is a link to the results.

Note: This survey was done over a general audience and not specific to Robinhood users. The reason this was done was to better understand how people generally think about savings but also to gauge whether or not this additional product may bring more customers onto the platform.

Because the sample size was small (<100 respondents) it is possible that the data suffers from a lack of true representation of the population and it is more likely that the results are due to general randomness. This survey is not meant to be conclusive but rather a preliminary look at how people think about investing. Further surveys of actual customers and large samples should be used to better understand the target market.

Link to survey results: https://www.surveymonkey.com/results/SM-8BLHJ779V/

Enjoy reading this or would like to see a product like this built? Let me know by adding some ? or responding to the post.

More than $1 Trillion are invested in passive funds today: https://en.wikipedia.org/wiki/Index_fund.