Last week, Rob Booker and Markay Latimer launched their new services ?Profit Accelerator.?

In this article, I will review Rob Booker and Markay Latimer?s service:

- Who is Markay Latimer?

- What is her ?Retirement Pattern??

- Is there anything unique about this pattern?

- What?s included in this service?

- Is the service worth the investment

- Final verdict: Thumbs up or thumbs down?

- Let?s get started?

In order to review Rob Booker?s new service, let?s break it down into 5 parts:

1. Who is Markay Latimer?

Rob is launching his new service ?Profit Accelerator? together with another trader: Markay Latimer.

So who is she?

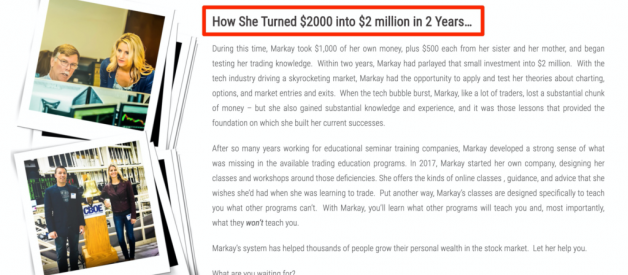

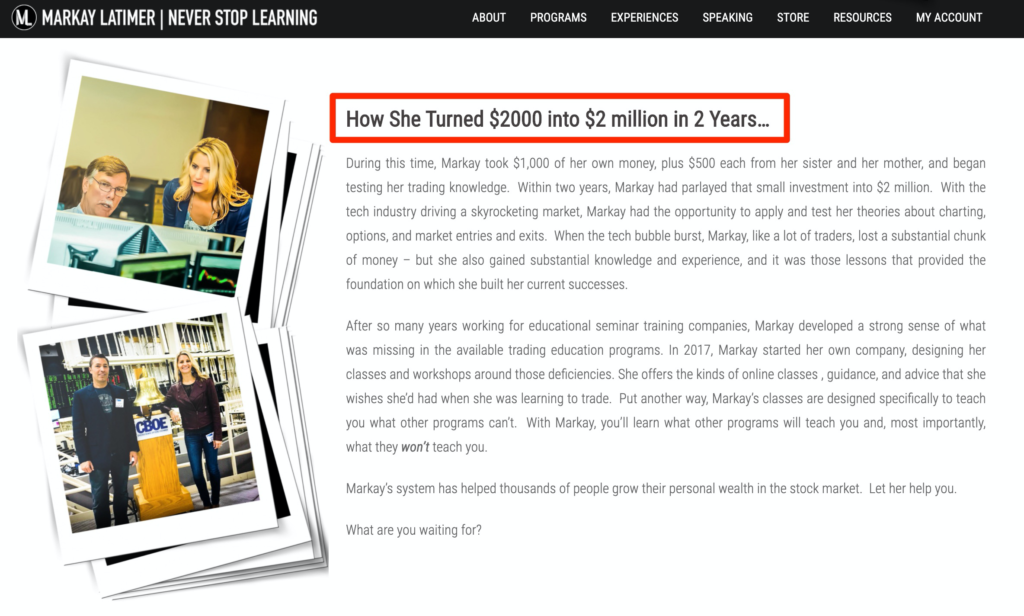

According to her website, Markay turned $2,000 into $2,000,000 in 2 years.

A quick Google search shows that she?s also an instructor for Better Trades, a company that teaches how to trade stocks and options:

According to her website, she founded her own education company in 2017.If you check Google for reviews of Markay, there are no negative reviews.

So let?s give her the benefit of the doubt and say she really did turn $2,000 into $2,000,000 in 2 years. That?s very impressive!

Now the question is:

How exactly did she do that? So let?s take a look at the next element?

2. What is Markay?s ?Retirement Pattern??

I watched a 90-minute webinar with Rob Booker and Markay in which Markay showed her chart setup.

She is using 3 exponential moving averages (EMA)

- 10-Day EMA

- 20-Day EMA

- 50-Day EMA

The ?Retirement Pattern? that Markay and Rob are talking about, is a retracement to the 10-Day EMA.

At this point, Markay is looking for a breakout ? both to the upside or the downside ? to get a trade.

Now that you know the pattern that Markay is using for her trades, let?s talk about the next element:

3. Is There Anything Unique About This Pattern?

At first glance, it seems that the mysterious ?retirement pattern? is just a retracement to the 10-Day Exponential Moving Average.

So is this just a marketing gimmick, or is there more to this pattern?

In the webinar, Rob and Markay explain that there are actually 5 elements to that pattern:

- The retracement to the 10-Day EMA

- A unique candlestick pattern (I haven?t found out yet what that is)

- A volume pattern: Markay is looking at the 5-day moving average of volume.

- Rob?s and Markay?s trading experience.

- Fundamental analysis of the sector and the stock.

The last two are tricky, because how do you quantify this?

Think about it this way:

I love the beach! And the kids and I love ?riding the waves.?

No, we are not wave surfers. We just wait for a ?good? wave and then we try to swim with the wave as far as possible.

Here?s the problem: Some waves ?look? great when they are forming. But when we try to ride it, it turns out to be an ?ok? wave.

Maybe that?s why the real surfers let so many waves go by until they find the perfect one?

And that?s where Rob?s and Markay?s trading experience come in.

According to the webinar I watched, there are 200 stocks every day that meet the technical pattern, i.e. retracement to the 10-Day EMA, the candlestick pattern and the volume pattern.

And now Rob and Markay are filtering out the best 2?3 using their trading experience and some fundamental analysis of the stock and the sector.

This brings us to the next element:

4. What exactly is included in this service?

For me, the most valuable part of their service is the signal service.

This means that you received an email or a text message whenever Rob and Markay are identifying a new stock to trade.

Both Rob and Markay like to trade options on that stock, which is perfect for small accounts.

Here?s a trade alert that I received on March 30, 2020:

IMPORTANT: Do yourself a favor and do NOT judge the service based on ONE trade!!!! I?m just using this as an example so that you know what you can expect when you sign up for this service as part of this Rob Booker review)

Here?s what I really like about this trade alert:

- It?s super specific: They tell you WHAT to buy and the maximum price you should pay.

- It includes a stop loss! That?s important, because as we all know: losses are part of our business as traders. So you need to know when to bail if the trade doesn?t work out.

- It includes a profit target! You need to know when to take profits because most traders exit too early or too late and leave money on the table

- The profit target is larger than the stop loss. In this example, they recommend risking $1.50 trying to make $8. That?s more than a 1:5 risk reward ratio, which is great: This way you can still make money even if half of your trades are losing trades.

- They include a detailed explanation of the trade. This is great because I am more confident in a trade when I know WHY somebody is recommending it.

If I remember correctly, you?re getting 1?2 of these trade alerts per week for 2 years. That?s 100?200 trade alerts, which is pretty good.

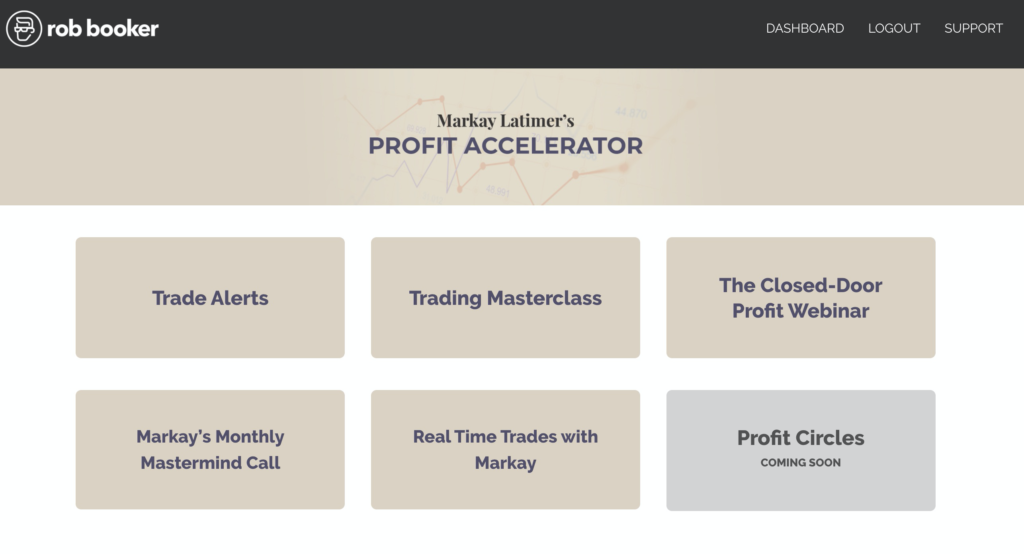

In addition to these trade alerts, there?s a bunch of stuff in the member?s area:

I personally like the Trade Alerts the best.

But if you?re new to trading, then you will find a bunch of videos in the member?s area that can help you to take your trading to the next level and get a much better understanding of what?s going on in the markets.

5. Is The Service Worth The Investment?

Let?s do the math.

If I remember correctly, you get 2 trade alerts per week. The program goes for 1 year.

But I think they gave everybody who signed up when the opened the program 2 years of service.

But let?s just go with 1 year for now.

So that?s 104 trades.

In the trade alert for Disney (DIS) that I got, they suggested to risk $150 to make $800.

Let?s say they are only right 1 out of 3 trades. That?s very conservative, but let?s use this for our math. That?s 35 trades and they expect $800 per trade. 35 * $800? that?s $28,000 on your winning trades.

Now you have 70 losing trades, and you lose $150 per trade. So that?s 70 * 150 = $10,500 on your losing trades.

So you make $28,000 on your winning trades and lose $10,500 on your losing trades.

This means that after 100 trades you are looking at around $17,500. That?s not bad at all, don?t you think? I believe the investment in the program is $997.

Investing $997 with the potential to make $17,500? Seems like it?s a worthy investment.

Final Verdict: Thumbs Up Or Thumbs Down?

The key question: Is this program for you?

It is for you if?

- ? you want somebody to spoon-feed trades. Because you get the trades as text alert and email so you can?t miss it.

- ? you like specifics like the entry point, stop loss and profit target.

- ? you are happy with 1?2 trades per week. If you need more action, you can always use this as an add-on.

- ? you like the overall idea of the ?retirement pattern? that I?ve shown you above.

Anyhow? hope this helps.