There are endless posts on Reddit regarding the inability to gift friends and family Oculus Quest and Rift games over the holidays. It seems like a horrible omission on Oculus? part and even the use of ?Visa Gift Cards? doesn?t seem to always work either. But take heart ? there is a way to make this work.

Note: This article sounds like a paid advertisement for Privacy.com. I assure you there are no referral links nor am I being compensated by the company. I?m a happy customer that has found a way to use their services with my VR hobby.

Right now, your options for ?gifting? games to an Oculus Quest owner are:

- Give them cash. They need to put that cash into the account (bank or PayPal) that is attached to their Oculus.com account.

- Give them a compatible gift ?credit card? ? and HOPE it works (most don?t, based on the posts on r/OculusQuest regarding their use).

- Send cash to their PayPal account. IF they are using a PayPal connected to their Oculus account; but many aren?t and there could be fees involved with this if you?re not careful.

None of these are good options.

This article is two-fold; helping you give the gift of Oculus games for the Quest-owner in your life ? but also to use this platform to discuss the importance of protecting yourself financially while conducting business online.

Protect Yourself (With Features)

Let?s start off this by saying if you?re not already using a service like Privacy.com ? you should be; and it has nothing to do with gifting your friends and family games on the Oculus Quest. It has to do with protecting yourself in the incredibly devious and scummy world of internet purchasing. Whether you?re paying bills online, purchasing goods or services ? your financial information is more likely to be stolen than it is likely to stay safe. Data breaches aren?t an ?if? scenario anymore ? it is only a matter of ?when?.

Right, we all know that using your financial information online is a terrible risk and yet most people still offer up high risk data like their main bank account debit card and high-limit credit card numbers on a daily basis.

You shouldn?t give out primary financial payment information? and you don?t have to.

Some people use services like PayPal or Amazon Pay to put in some layer of security between themselves and retailers. Those are fine; but not everywhere online takes these methods of payment and there are usually fees involved with these sorts of transactions; either on the side of the storefront or the purchaser (which is why storefronts don?t like to accept it).

These services don?t help you gift things like Oculus games, either.

What every purveyor of goods and services accept are credit cards; Visa and Mastercard. Your debit card can act like a Visa or Mastercard so it can be accepted everywhere (wasn?t always like that, folks) which makes it very attractive as a means of making payments online.

That debit card is often tied directly to your bank account; your livelihood ? your reason for living. While most banks offer some form of protection against fraud, those proceedings can take days or weeks to pan out and if a hacker cleaned out your bank account that offers very little respite to the fact that you?re out a lot of money until the bank compensates you.

Privacy.com (like other virtual credit cards) is a service that acts as a layer between your bank and online merchants. Instead of requiring the merchant to support some ?other? means of payment (like Paypal or Amazon) ? they let you generate ?burner cards? on the fly during a purchase; credit cards that are fully disposable and instantly closable. Fixed total purchases, per-purchase limits and even ?single use? cards are possible. They each have their own numbers, expiration dates and are tied to your funding source under your name.

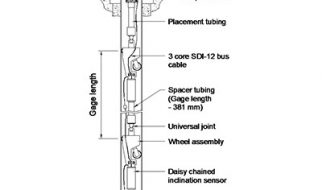

Here is a card that has a $30 TOTAL limit ? proven to work with Oculus.com

Here is a card that has a $30 TOTAL limit ? proven to work with Oculus.com

Some banks offer this service (Wells Fargo does not) to its customers directly through the bank?s website.

Burner cards are a fantastic way of protecting yourself while shopping online.

Unfortunately a lot of people don?t know about them and even those that do? They don?t feel that a data breach could happen to them because they ?watch their bank account everyday? and they would ?know? if someone was stealing from them.

This isn?t The Matrix; ignorance is not bliss. Just because $300 didn?t disappear from your account ? you might not notice someone bleeding you slowly for $10 here and $5 there; those charges could look pretty legit.

Burner Cards Are Great For Gifting On Oculus.com

Let?s assume your bank (like mine) doesn?t support burner credit cards (Bank of America, Capital One and Citibank offer these services).

You can use a service like Privacy.com (again I?m not a compensated endorser; I?m an early adopter whose life was changed by having access to those services) to give you ?virtual card? or burner card access.

Why does this work when Visa ?gift? cards do not? Why does this make sense for people to embrace a service like this?

As we discussed above, you should be using a virtual card system already to protect yourself. This is a good time to make that leap ? and you get to gift some Oculus love at the same time.

Not all ?gift? cards are created equal. There are difference between pre-paid credit cards, reloadable gift cards, gift CREDIT cards, gift DEBIT cards and a few other types. Here is a great article explaining the differences. These gift cards usually have activation fees; some have monthly fees (no kidding) that are debited every month the bearer doesn?t use the funds.

Many ?gift? credit cards won?t work on Oculus? online store.

The cards created by Privacy.com (and I?m sure plenty of others) actually do work on Oculus.com. Even cards with per-purchase and total limits.

That means these virtual burner cards are just like gift cards; you can put a total gift value on it and send your recipient the card number to add directly to their Oculus account as a funding source.

Share your card via email ? or just send them the card number information

Share your card via email ? or just send them the card number information

When the next holiday comes? When you feel generous? You can ?reload? or add more funds by simply increasing the limit and there is no cost to you or your recipient!

If you feel the card number has been compromised? You don?t have to call the bank or wait on hold; you can kill the card INSTANTLY from your phone or browser.

Sounds fantastic, right?

The best part of this whole thing is that it is free to you and free to the recipient. Privacy.com makes money from the merchant side (like every other credit card company) of the transaction; not from you.

More About Using Burner Cards

I?ve solved your gift-giving issues but I want to talk a little more about how virtual burner cards make sense to use.

Anything that uses re-occurring billing should never have access to your primacy bank account or direct access to your credit cards. This could be gym memberships, Easy Pay for your electric bill, on-line subscriptions; anything that bills you every month for a particular dollar amount.

First, you can protect your burner card with a periodicity. Second, you can set per-transaction and total limits.

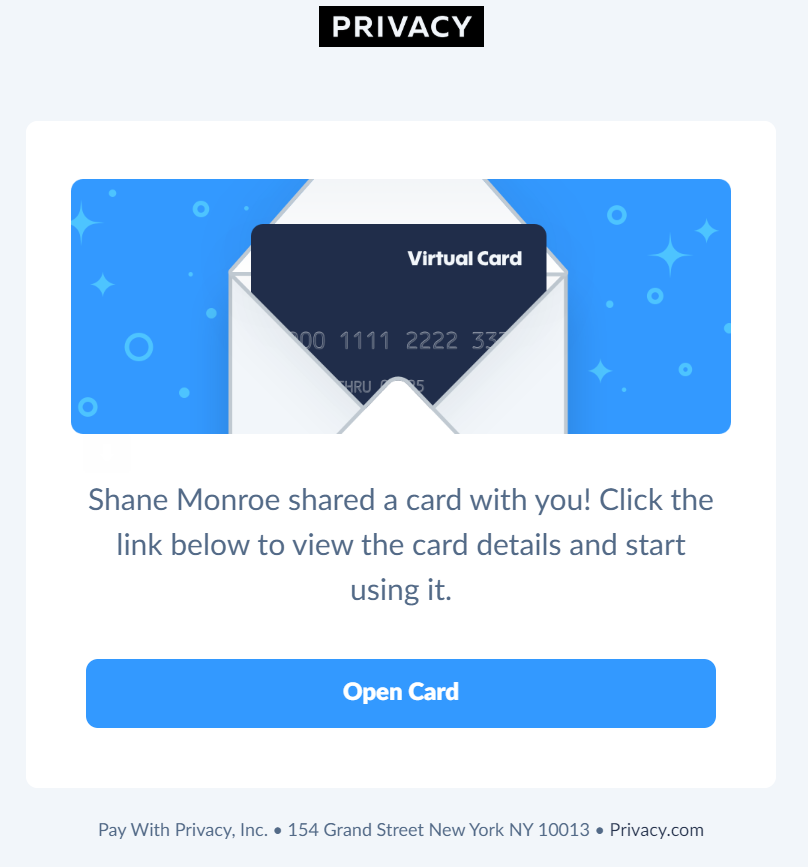

Make sure they bill you on-time and only for the amount you authorize

Make sure they bill you on-time and only for the amount you authorize

My YMCA gym membership tried to bill me five days early one month. No reason, no notification; had they gotten that money from my account early it may have affected other transactions. Thanks to my monthly protection, they were denied and I was notified. I called them and they agreed not to do it again.

Recently, Dropbox.com raised their rates over $30 a year. I was using a Privacy.com burner card for $100 limit per year. The transaction was denied (as it should have been).

Have you ever subscribed for a trial for ? well, anything ? online? Then forgot to cancel? Don?t worry, Disney+ didn?t forget you are on a trial. They will happily bill you immediately after the period is over. By using a burner card set for $1 when you sign up for these ?trial? services, you are in control and even if you forget to cancel, your burner card will not authorize the transaction and you are protected. If you want to keep the service? You already have a card set up. Increase the limit, set a monthly limit and let them re-process.

I?ve heard plenty of horror stories of companies like Microsoft and Sony automatically renewing Xbox Live or Playstation Now accounts without notification or even permission (has happened to me and to a close friend). A burner card used smartly can prevent this from happening.

TL;DR

Virtual credit cards (burner cards) created by Privacy.com and other similar services can be used to quickly and easily gift funds to your favorite Oculus Quest user. These cards can be used to protect you online for all your internet purchasing and even be used to stop trial subscriptions from charging you in case you forget to cancel.