You might be asking yourself, why or how to overdraft your bank account on purpose. There are various features offered by financial institutions where you can actually have a balance under zero for checking accounts.

Sometimes you might not be able to see the big picture: your bank account only has $30 in it, and you make a purchase worth $60. This transaction will be processed, but now you?re overdrawn on your account. Typically this would be terrible, but there are opt-in features that allow you to be covered by your financial institution (and overdraft apps that are not related to your bank), and you won?t be paying as much as you would if you were charged an insufficient funds fee or an overdraft fee.

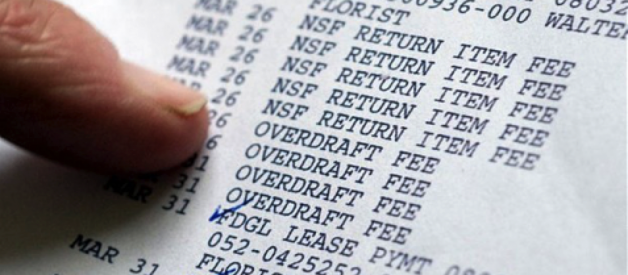

Overdrafting your checking account ? easy and expensive

Overdrafting your checking account ? easy and expensive

We all know how checks work with no overdraft protection, and not having a ton of money in your account ? your check will bounce, and the receiver won?t get the funds. Your bank will charge you a insufficient fee, and the retailer or person you wrote the check to may also be charged a fee for this check. Not only is this bad for both the giver and the receiver, but if it was money for a balance like rent, you may be charged a late fee, and the extra money will accrue, leaving you high and dry when you get paid again.

The more you write checks, the more susceptible you are to experience this; however, if you use your debit card, and you don?t have enough in your account, you may see that your transaction is rejected, and you won?t be charged anything ? not even a fee. If you do have overdraw protection on, you?ll be hit with a fee. Because of the types of purchases people make, some opt-in for paying an extra fee, as long as the money gets to the recipient. It can be convenient for those that don?t abuse the system.

What?s Overdraft Protection?

In short, overdraft protection is a safety net for those that that need to make a certain transaction, and don?t have enough in their account. The financial institution in which they have overdraft protection set in place for will cover the rest of the balance, but will hit the account with hefty overdraft fees. When you?re able to overdraft your bank account on purpose, you can get your bills paid in on time, or make an emergency transaction without being denied for not having that much in your account. As long as you go back to positive soon, you?ll be able to continue using this service reliably.

Over Drafting on Purpose

If you?re someone that?s in a tough financial situation, we opt for going to your bank or financial institution and turning on overdraft protection or some form of ?line of credit?. In doing so, you?ll be able to make these emergency transactions when you need to, and have your bank back you up. However, having an overdrawn bank account can be expensive and dangerous if it stays in negative for too long.

Alternative Solutions

It?s worth noting that there are overdraft protection apps available that act as cheaper overdraft protections, making it less expensive to have that line of credit.