Learn how to stay diversified but keep things manageable.

Photo by William Iven on Unsplash

Photo by William Iven on Unsplash

One of the most exciting moments in your early career is when you finally earn enough money to invest.

Maybe it?s from a salary raise, or an annual bonus, or a growing side hustle ? but you finally have a chunk of cash you want ?put to work? in the markets.

One of the first questions new investors often wonder is, ?How many stocks should I buy??

The truth is, there?s no ?one size fits all? answer. The right number of stocks to own is different for every investor.

Most investors aim to own somewhere between 10?30 stocks in their portfolio.

In my experience, owning fewer than 10 stocks is too little diversity and too much risk concentrated on just a few positions. And owning more than 30 stocks is almost too diversified (starting to look like an index fund) and too much work for the average investor to research and monitor over time.

So I recommend holding somewhere between 10?30 stocks in your portfolio. And, for most investors, owning 10?20 stocks works just fine.

Of course, there are exceptions. Here are two that come to mind:

- If you?re just starting out as a beginner investor and don?t have much money to invest, it?s fine to start by buying just a handful of stocks. I?d encourage you to add more positions over time and strive to own 10+ stocks as you add more savings to your account.

- Some investors who have a lot of money in the market may want to buy more than 30 stocks to be fully diversified.

Similarly, you may choose to create different types of portfolios in different accounts.

For example, an investor might buy 15 blue-chip value stocks in her main investment account, but experiment with 20 high-growth small cap stocks in her Roth IRA retirement account (a total of 35 positions).

If you?re pursuing multiple different strategies in different accounts, it can be fine to own more than 30 positions in total.

But, keep in mind you?ll need to do some type of research and monitoring on everything you buy. I?d discourage taking a ?set it and forget it? approach to your stock investments.

Now that we?ve laid out a general guideline that you should own somewhere between 10?30 positions, let?s look at some supporting research and tips to consider.

How Many Stocks Provide Adequate Diversification?

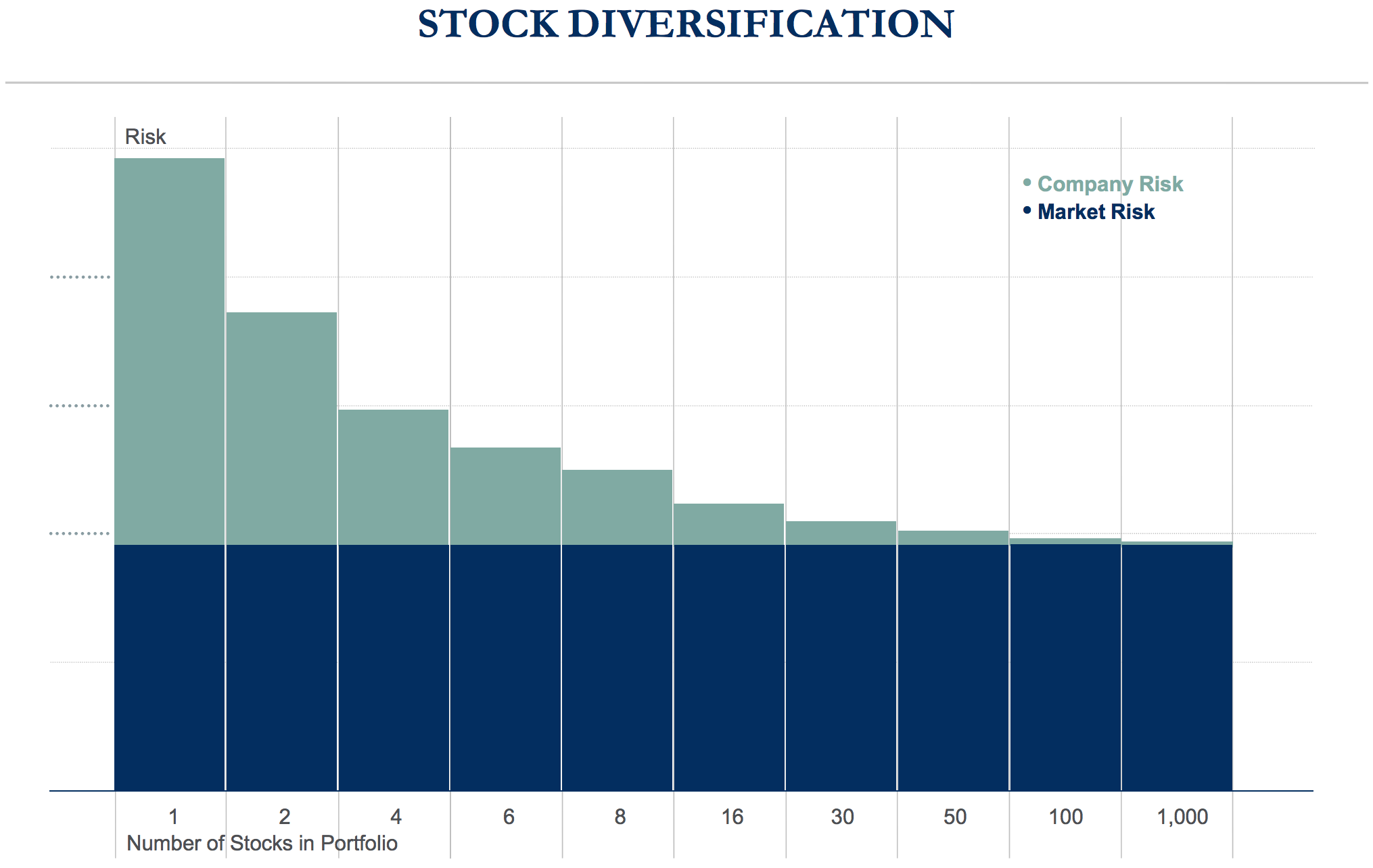

This chart from Raymond James shows that as the number of stocks in your portfolio gets larger your company risk gets smaller while your market risk stays the same.

What does that mean?

Company risk includes investing risks that stem from the specific companies you buy (for example, their CEO quits or they?re accused of fraud).

Market risk includes investing risks that all stocks in the market are exposed to (for example, the entire economy slows down or a large natural disaster spooks investors).

What this chart shows is that when you own just a few stocks, you have a lot of concentrated risk that something could go wrong with one of your few holdings.

But as you buy more stocks, the company risk from any single position goes down because you own enough stocks that a stumble from any one position won?t impact the rest of your portfolio too much.

As you can see, much of the company risk is gone by the time you own more than eight stocks.

Similarly, Morningstar shared a quote about how many stocks they think you should own in a portfolio:

In their book Investment Analysis and Portfolio Management, Frank Reilly and Keith Brown reported that in one set of studies for randomly selected stocks, ??about 90% of the maximum benefit of diversification was derived from portfolios of 12 to 18 stocks.?

In other words, if you own about 12 to 18 stocks, you have obtained more than 90% of the benefits of diversification, assuming you own an equally weighted portfolio.

Tips on How Many Stocks to Own

In addition to the insights above, here are a few tips to help you decide how many stocks you should buy in your portfolio:

- In general, the more stocks you own the more your returns will look like the overall stock market. The fewer positions you own, the more likely your returns will vary greatly from the market (for better or worse).

- If you?re pursuing a risky investment strategy, you may want to own more stocks to offset some of your risk. For example, if you want to invest in high-growth small cap stocks with strong momentum, you may want to own 20+ positions since that?s a fairly high-risk strategy. However, if you?re buying high-dividend blue-chip stocks, you?re probably fine with 10?15 positions. More positions can help balance out a risky or volatile investment strategy.

- Ask yourself how much volatility you?re comfortable with in your portfolio. If you?d like to reduce your portfolio volatility, you may want to own more positions. If you?re comfortable with lots of volatility, you may be fine holding fewer positions.

- Keep in mind, you can buy a different number of stocks to match different strategies. For example, you could cut your investment account in half and allocate 50% of your money to 10 small cap stocks and the other 50% of your money to 5 dividend stocks. You?d have 15 positions in total with 10 positions allocated towards a higher-volatility strategy (small cap stocks) and 5 positions allocated towards a lower-volatility strategy (dividend stocks).

- As a smart investor, your goal should be to own the best possible stocks in the market. Based on your research, sometimes you will sell a stock and replace it with a new stock. Other times, you may wish to sell but wait on buying something new so your portfolio will temporarily hold fewer stocks. On the other hand, sometimes you may sell a stock and see two stocks with equally strong prospects. It?s fine to buy them both and flex up the number of positions you own. You don?t have to be rigidly tied to owning a set number of positions.

- Don?t buy stocks you haven?t researched or don?t believe in just to make your portfolio reach the 10?30 stocks goal. If you only hold 5 well-researched stocks you think are great investments, you could keep researching until you find 5+ more and put your extra money in an S&P 500 index fund while you wait. Don?t just buy another handful of stocks you don?t fully believe in.

Summary: How Many Stocks Should You Own

The right number of stocks to own in a portfolio is different for every investor. It depends on your investment goals, risk tolerance, preferred investment strategy, time horizon, and more.

To help determine what?s right for you, here are the big takeaways:

- Most investors own between 10?30 stocks in their portfolio.

- Beginner investors can work up to 10+ stocks over time and more experienced investors may hold more than 30 stocks (especially across multiple accounts).

- Research suggests owning at least 12?18 stocks provides enough diversification.

- As you add more stocks to your portfolio, it will start to look and behave more like the overall stock market.

- Buying more stocks can help offset the risk of pursuing a high-risk strategy.

- Owning more stocks will often lessen portfolio volatility whereas owning fewer stocks will increase portfolio volatility (relative to the overall market).

- You may want to allocate more stocks to your high-risk strategies and fewer stocks to your low-risk strategies.

- Always aim to own the best stocks in the market.

- It?s fine for the number of stocks you own to expand and contract over time.

- Don?t buy stocks you haven?t researched or don?t believe in just to reach a goal of a certain portfolio size.

Now that you know how many stocks to buy, the next question is, ?How much money should I invest??

How Much Money Should You Invest in Stocks?

Now, let’s look at the second question – how much of your personal savings you should allocate to the stock market? In?

medium.com

Disclaimer: This article is provided for informational or educational purposes only and is not any form of individualized advice. All information is obtained from sources believed to be reliable but cannot be guaranteed for accuracy or completeness. Use this information at your own risk.