Google Cloud Platform vs AWS: what?s the deal? A while back, we also asked the same question about Azure vs AWS. After the release of the latest earnings reports a few weeks ago from AWS, Azure, and GCP, it?s clear that Microsoft is continuing to see growth, Amazon is maintaining a steady lead, and Google is stepping in. Now that Google Cloud Platform has solidly secured a spot among the ?big three? cloud providers, we think it?s time to take a closer look and see how the underdog matches up to the rest of the competition.

Is Google Cloud catching up to AWS?

As they?ve been known to do, Amazon, Google, and Microsoft all released their recent quarterly earnings around the same time the same day. At first glance, the headlines tell it all:

- Google Cloud is generating $8 billion in revenue a year and plans to triple sales force

- Partly cloudy: As AWS growth slows to 37%, Google Cloud hits $8B run rate

- Amazon?s cloud business reports 35% growth in the third quarter, trailing estimates

- Amazon takes a nosedive after reporting a less profitable quarter than expected.

- Microsoft beats on revenue and earnings; stock is little changed

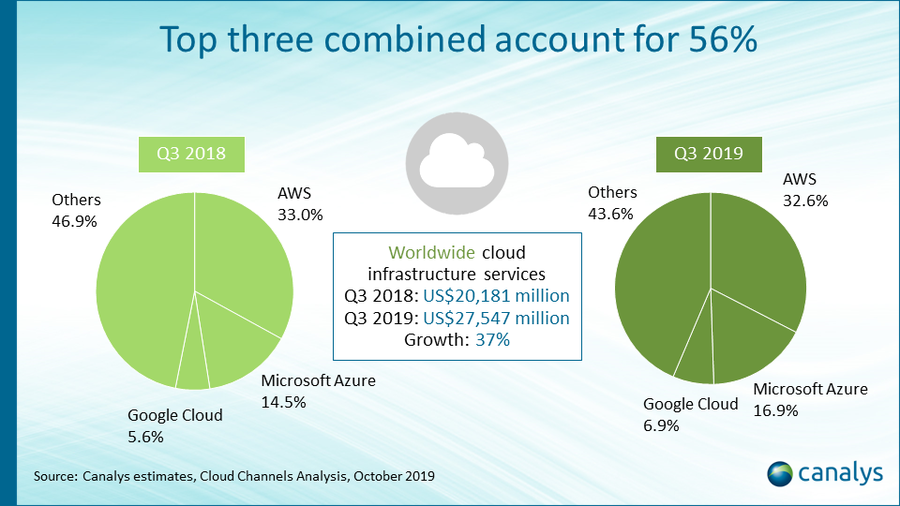

The obvious conclusion is that AWS continues to dominate in the cloud war. With all major cloud providers reporting earnings around the same time, we have an ideal opportunity to examine the numbers and determine if there?s more to the story. Here?s what the quarterly earning reports tell us:

- AWS had the slowest growth they have ever since they began separating their cloud reportings ? up just 37% from last year.

- Microsoft Azure reported a revenue growth rate of 59%.

- Microsoft doesn?t break out specific revenue amounts for Azure, but Microsoft did report that its ?Intelligent Cloud? business revenue increased 27% to $10.8 billion, with revenue from server products and cloud services increasing 30%

- Google?s revenue has cloud sales lumped together with hardware and revenue from the Google Play app store, summing up to a total of $6.43 billion for the last quarter.

- To compare, last year during Q3 their revenue was at $4.64 billion.

- During their second-quarter conference call in July, Google said their cloud is on an $8 billion revenue run rate ? meaning cloud sales have doubled in less than 18 months.

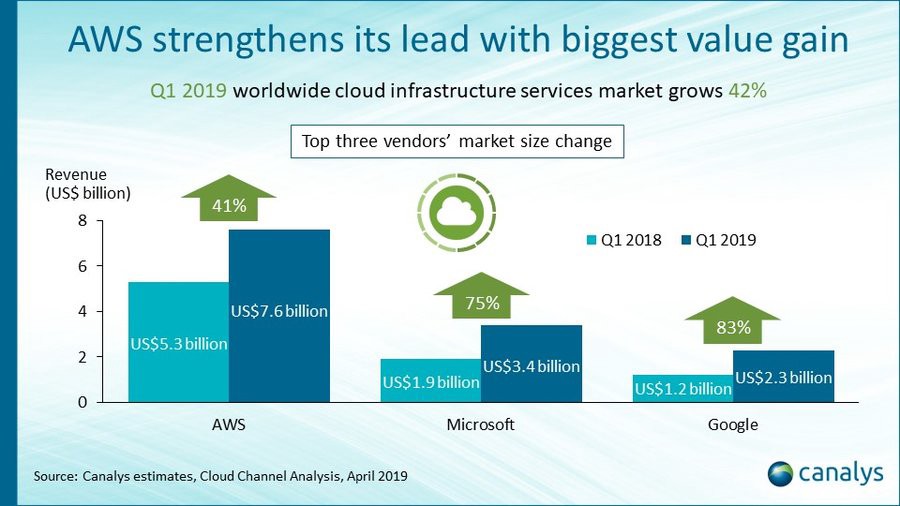

You can see here that while Google is the smallest out of the ?big three? providers, they have shown the most growth ? from Q1 2018 to Q1 2019, Google Cloud has seen growth of 83%. While they still have a ways to go before surpassing AWS and Microsoft, they are moving quickly in the right direction as Canalys reported they were the fasted growing cloud-infrastructure vendor in the last year.

It?s also important to note that Google is just getting started. Also making headlines was an increase in new hires, adding 6,450 in the last quarter, and most of them going to positions in their cloud sector. Google?s headcount now stands at over 114,000 employees in total.

The Obvious: Google is not surpassing AWS

When it comes to Google Cloud Platform vs AWS, we have a clear winner. Amazon continues to have the advantage as the biggest and most successful cloud provider in the market. While AWS is growing at a smaller rate now than both Google Cloud and Azure, Amazon still holds the largest market share of all three. AWS is the clear competitor to beat as they are the first and most successful cloud provider to date, with the widest range of services, and a strong familiarity among developers.

The Less Obvious: Google is actually gaining more ground

While it?s easy to write off Google Cloud Platform, AWS is not untouchable. AWS has already solidified itself in the cloud market, but with the new features and partnerships, Google Cloud is proving to be a force to be reckoned with.

Where is Google actually gaining ground?

We know that AWS is at the forefront of cloud providers today, but that doesn?t mean Google Cloud is very far behind. AWS is now just one of the three major cloud providers ? with two more (IBM and Alibaba) gaining more popularity as well. Google Cloud Platform has more in store for its cloud business in 2020.

A big step for google was announced earlier this year at Google Cloud?s conference ? Google Cloud Next ? the CEO of Google Cloud announced that they would be coming out with a retail platform to directly compete with Amazon, called Google Cloud for Retail. What ?s different about their product? For starters, they are partnering with companies such as Kohl?s, Target, Bed Bath & Beyond, Shopify, etc. ? these retailers are known for being direct competition with Amazon. In addition to that, this will be the first time that Google Cloud has had an AI product that is designed to address a business process for a specific vertical. Google doesn?t appear to be stopping at just retail ? Thomas Kurian said they are planning to build capabilities to assist companies in specialized industries, ex: healthcare, manufacturing, media, and more.

Google?s stock continues to rise. With nearly 6,450 new hires added to the headcount, a vast majority of them being cloud-related jobs, it?s clear that Google is serious about expanding its role in the cloud market. In April of this year, Google reported that 103,459 now work there. Google CFO Ruth Porat said, ?Cloud has continued to be the primary driver of headcount.?

Google Cloud?s new CEO, Thomas Kurian, understands that Google is lagging behind the other two cloud giants, and plans to close that gap in the next two years by growing sales headcount.

Deals have been made with major retailer Kohl?s department store, and payments processor giant, PayPal. Google CEO Sundar Pichai lists the cloud platform as one of the top three priorities for the company, confirming that they will continue expanding their cloud sales headcount.

In the past few months, Pichai added his thoughts on why he believes the Google Cloud Platform is on a set path for strong growth. He credits their success to customer confidence in Google?s impressive technology and a leader in machine learning, naming the company?s open-source software TensorFlow as a prime example. Another key component to growth is strategic partnerships, such as the deal with Cisco that is driving co-innovation in the cloud with both products benefiting from each other?s features, as well as teaming up with VMware and Pivotal.

Driving Google?s growth is also the fact that the cloud market itself is growing so rapidly. The move to the cloud has prompted large enterprises to use multiple cloud providers in building their applications. Companies such as Home Depot Inc. and Target Corp. rely on different cloud vendors to manage their multi-cloud environments.

Home Depot, in particular, uses both Azure and Google Cloud Platform, and a spokesman for the home improvement retailer explains why that was intentional: ?Our philosophy here is to be cloud-agnostic, as much as we can.? this philosophy goes to show that as long as there is more than one major cloud provider in the mix, enterprises will continue trying, comparing, and adopting more than one cloud at a time ? making way for Google Cloud to gain more ground.

Multi-cloud environments have become increasingly popular due because companies enjoy the advantage of the cloud?s global reach, scalability, and flexibility. Google Cloud has been the most avid supporter of multi-cloud out of the three major providers. Earlier this year at Google Cloud Next, they announced the launch of Anthos, a new managed service offering for hybrid and multi-cloud environments to give enterprises operational consistency. They do this by running quickly on any existing hardware, leverage open APIs and give developers the freedom to modernize. There?s also Google Cloud Composer, which is a fully managed workflow orchestration service built on Apache Airflow that allows users to monitor, schedule and manage workflows across hybrid and multi-cloud environments.

Google Cloud Platform vs. AWS ? Why Does It Matter?

Google Cloud Platform vs AWS is only one of the battles to consider in the ongoing cloud war. The truth is, market performance is only one factor in choosing the best cloud provider. As we always say, the specific needs of your business are what will ultimately drive your decision.

What we do know: the public cloud market is not just growing ? it?s booming. Referring back to our Azure vs AWS comparison ? the basic questions still remain the same when it comes to choosing the best cloud provider:

- Are the public cloud offerings to new customers easily comprehensible?

- What is the pricing structure and how much do the products cost?

- Are there adequate customer support and growth options?

- Are there useful management tools?

- Will our DevOps processes translate to these offerings?

- Can the PaaS offerings speed time-to-value and simplify things sufficiently, to drive stickiness?

Right now AWS is certainly in the lead among major cloud providers, but for how long? We will continue to track and compare cloud providers as earnings are reported, offers are increased, and price options grow and change. To be continued in 2020?

Originally published at www.parkmycloud.com on December 5, 2019.