Imagine the 2020 presidential election. Trump is against federal cannabis legalization, and every Democratic candidate (minus Biden) is for it. You may not be qualified to predict the results of the election, but one might imagine cannabis stock is going to swing.

People typically bet on whether a stock will go up or down. Options allow you to speculate on whether a stock?s value will move or stay the same.

You don?t have to guess whether marijuana is going up or down; you just have to guess movement will happen.

This trading strategy is called a straddle, and it?s a great time to tell you that this is not financial advice. I am not a financial adviser, and options trading is risky business.

There are similar warnings when you enable options under Account -> Settings -> Options Trading. Getting approved for options trading took one weekend in my case.

Since options sell in contracts of 100 shares, you can limit your risk by practicing these strategies on low-value stocks. Of course, penny stocks have a terrible reputation. However, since options losses can be magnified by 100, small accounts can avoid going bankrupt by dealing in low-value assets.

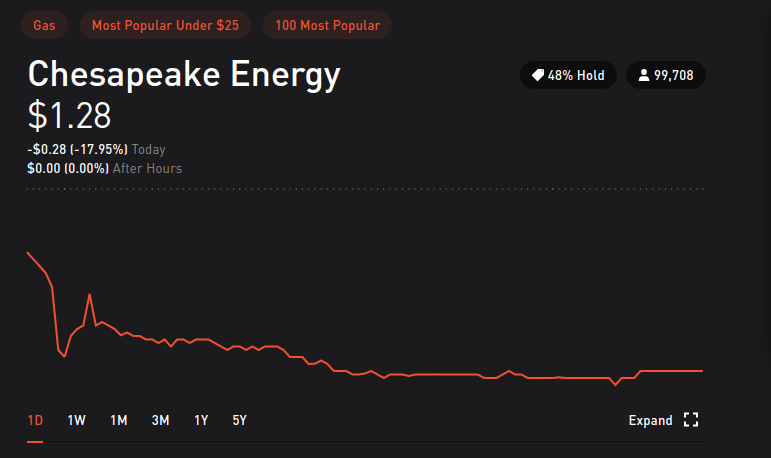

For example, I used Chesapeake Energy (CHK) as a practice stock for testing options strategies:

You might be able to tell by the line above, but earlier in the day, CHK was trading for $1.50. I speculated the price would swing heavily because the company was deeply in debt and releasing its quarterly earnings the night before.

I figured this report would:

a. Reveal that Chesapeake?s oil gambits had been profitable, renewing hope, and shooting the price up, or?

b. Show the company was still not making progress, destroying faith, and plummeting the price.

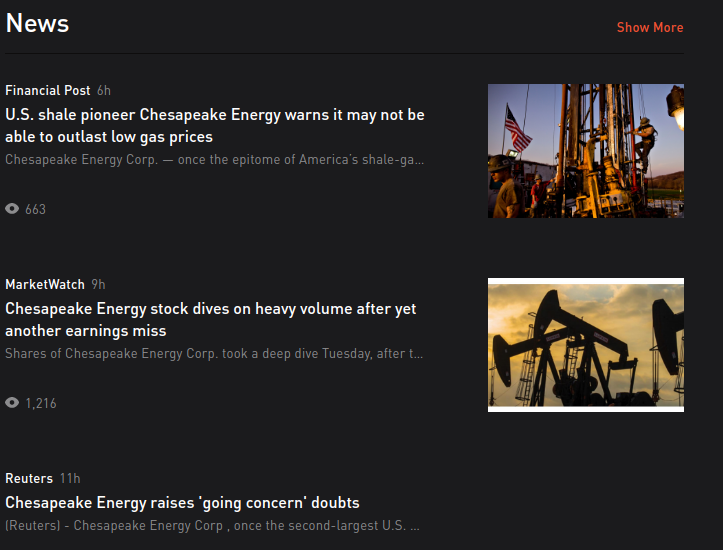

The second occurred, look at these headlines:

The beauty is, I was covered either way. As long as the stock?s value didn?t stay the same.

Here?s how:

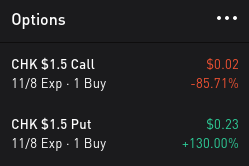

I manually implemented a long straddled by buying one call of CHK at $1.50 and one put at $1.50. Basically, if the stock went up to say $1.75, I could use my call to buy it at the cheaper $1.50. If the stock went down to say $1.25, I could use my put to sell shares at $1.50.

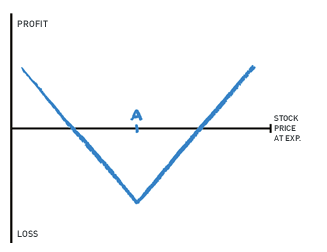

Ally Investing?s Options Playbook has a great explanation of the straddle strategy:

From Ally Investing for education purposes.

From Ally Investing for education purposes.

Why doesn?t everyone do this? First, there is the risk that without proper spread tools, only one of your options orders will be filled (i.e. someone will sell you a put but not a call). You need advanced spread features from Robinhood to get these guarantees, which I?ll explain in the next section.

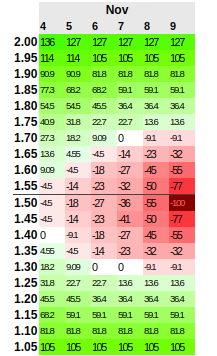

Second, these options cost money. Specifically, my call option cost $13, and the put was $9. So to make a profit, the stock needed to make a large swing. I calculated exactly how much the ticker needed to move at optionsprofitcalculator.com:

Running options strategies through this website is a great way to better understand risks. Notice how you lose opportunities to make money as time passes? That?s because option contracts have ?theta,? the daily value the option loses as it approaches expiration. Theoretically, an option that expires the next day should be worth less than one you can hold onto for a month.

Therefore, if your desired price swing occurs, it may be best to sell your options before expiration.

So how can you get the options spread feature on Robinhood to guarantee both your straddle?s call and put will be bought at the same time?

Robinhood initially denied my application for the feature under Account -> Settings -> Options Trading. According to this author, when the algorithm asks for more options trading experience, it looks for roughly 10 filled calls or puts.

Here?s where I provide yet another warning: buying and selling pure calls and puts is risky. Notably, selling introduces the risk you?re assigned an order. If someone exercises the call contract you sold them, you have to provide 100 shares of the underlying stock. Similarly, selling puts means you may have to buy 100 shares of the underlying stock at whatever price it?s currently trading.

GOOG is currently at $1300. If you sell a put of GOOG, and it gets exercised, your account may be in the red $130,000 to purchase 100 shares. Robinhood brokers may sell off the GOOG shares and liquidate your account?s other assets to help pay the cost.

In addition to the straddle, you may find other advanced options strategies online. Any that contain selling calls/puts expose you to early exercise. This risk is not highlighted in most articles.

Even optionsprofitcalculator.com neglects to tell you an iron condor can land you in trouble if one of the sold options is exercised early.

That is why I focus on the straddle. The strategy only contains buys.

Frankly, the fastest way to complete ten trades and reach the ?advanced? level is to buy a cheap call/put and then sell it at the same price.

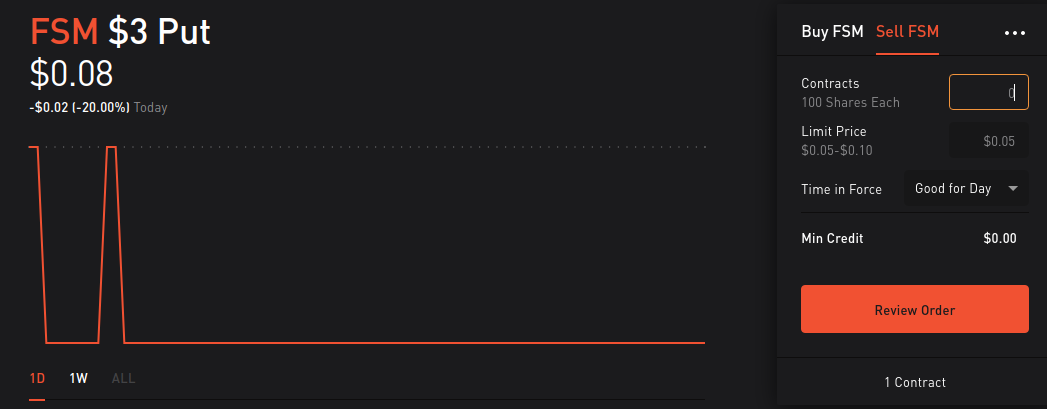

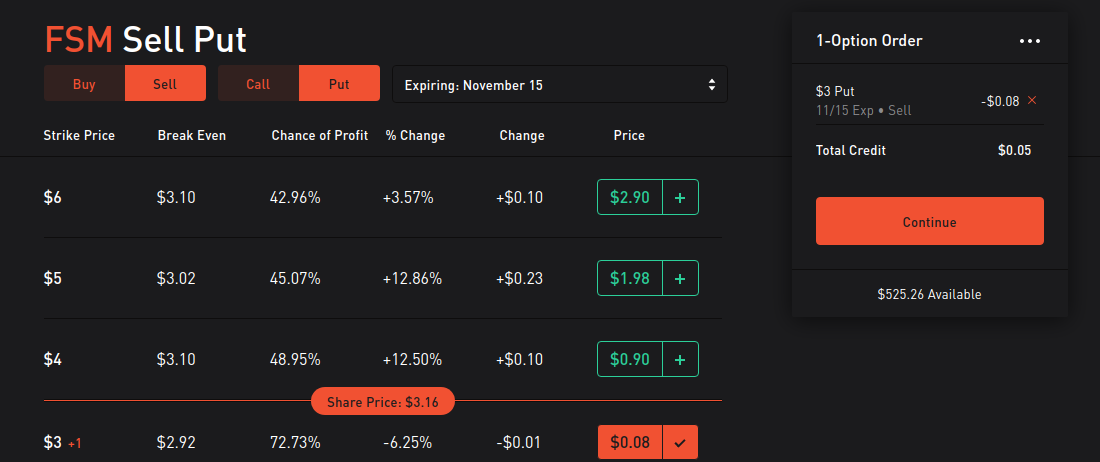

Here?s an example of selling a put contract I just bought. Note the ?1 Contract? in the lower right, signifying I?m selling something I already own:

In contrast to selling a new put contract I?m offering to cover with cash if I get assigned:

This is the only image with a caption because I want to emphasize risk here.

This is the only image with a caption because I want to emphasize risk here.

You can only buy and sell the same asset three times a day before receiving Robinhood?s pattern day trader warning. So, by some combination of manual straddles and buying and selling the same contract, you can unlock option spreads in a few days.

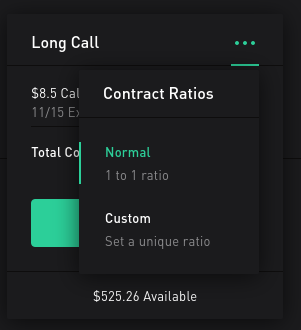

Once you?ve unlocked advanced options trading, here?s an example of using the ?custom? contract ratio:

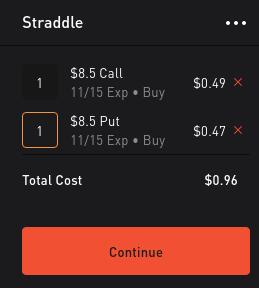

And setting up a straddle:

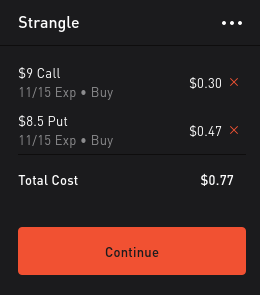

There?s also a ?buy only? strategy called the strangle. The strangle is similar to the straddle but has a lower entry cost than the straddle and requires a larger price swing:

There are more details about the strangle on the Options Playbook site.

You can now take advantage of a new investing paradigm: speculating a stock will swing dramatically in either direction.

If you don?t have a Robinhood account and want to try it, see if one of your friend will give you a referral link. You?ll both get a free stock. But if you want to show extra appreciation for this article, here?s my signup link (you?ll still get a free stock):

Open a new account in the next 24 hours | Robinhood

There?s a free stock waiting for you. Sign up now to find out what free stock you?ll get. It could be a stock like?

join.robinhood.com

Thanks for reading!