As a first-time investor, I?ve found the Robinhood app super-useful for buying stocks. But as a first-time investor, there?s a lot I don?t know. Here are the top 5 mistakes I made in my first months using Robinhood.

#1: Don?t buy in real-time

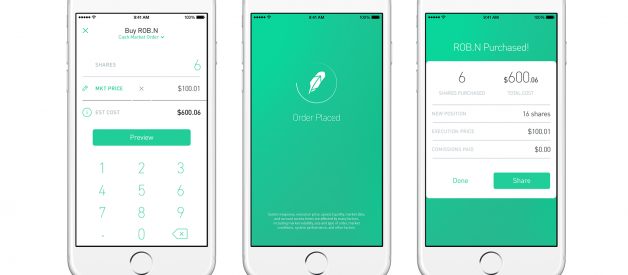

When I first started using Robinhood, it was my first time buying stocks directly, ever. So I didn?t realize that even Robinhood offers different ways to buy stocks. When you buy in real-time, you often don?t get the exact price you want because of delay between when you enter the order and when it processes. But this is not the only way to buy a stock, and definitely not the best.

To access the other ways to buy a stock, you tap on the stock you want, you can then tap ?Buy?, and then ?Order Types? in the upper right-hand corner. The different kinds of ?orders? are: Limit Order, Stop Limit Order, Stop Loss, and Limit Order. For myself, I find the ?Limit Order? most useful. A limit order means that you can tell the app, ?Hey, I want to buy Apple stock, but only if it?s $95 or less.? The app will earmark funds for this, and automatically execute the buy when the stock price reaches $95 or less.

Now, when you do a ?Limit Order?, it means you have less money in the kitty (Robinhood calls this ?Buying Power?) for buying other stocks. Which leads me to my #2 mistake.

#2: Don?t forget to add money well in advance

You may see a great stock you want to buy RIGHT NOW. But darn it, you forgot to add funds, so the opportunity passes you by. Unless you have Robinhood Instant, it?ll take about 3 days for your money to transfer from your bank account to the Robinhood app. So if there?s a stock you have your eye on, don?t even think of buying until you?ve amassed enough ?buying power? (Robinhood?s term for available cash) in your account.

#3: Don?t get impatient

Even though my ?investment strategy? (ha ha) is basically to buy low, hold on, collect dividends, and eventually sell high, I still get impatient. When I see money sitting in my Robinhood account, I want to spend it right away because I don?t want it losing the potential interest it would be gaining if it were in, say, an IRA or other savings vehicle. But I am working on patience. We are in a volatile market right now, and there?s a good chance the stock I want may go even lower before the year?s out. The dip in price may be a reaction to a domestic news event like the presidential election, or to global influences like the state of China?s economy, or just because it?s a rainy Tuesday: who the hell knows.

Although the response to news events has been shown to be minor (and more pronounced in reaction to positive news like stock earnings than to negative news) fluctuations can last as little as 40 seconds, so I will set up something automated to make sure I catch the price I want. Computers now do the majority of trades, cashing in on milliseconds, so being a sausage-fingered human is a major disadvantage.

Ideally, I?d like to set up some kind of simple, tiered queue where, for example: If I have more than $200 in cash AND Apple stock is $99 or less, then it?ll buy as many APPL shares as possible; UNLESS Microsoft is less than $34/share, in which case it?ll buy Microsoft. But as far as I know, that?s not possible in Robinhood yet. So until then, I?ll just set up a number of limit buys and whichever gets to its target price first will be executed first.

#4: Don?t check your stocks every day

Since I?m buying most of my stocks in the view that I?ll hold them for at least a year (here?s why), I try not to look at their value daily. Instead, I track the value of my portfolio monthly in a spreadsheet. The way I look at it, it?s kind of like checking your weight every day: fluctuations are normal, so there?s no reason to get freaked out by small changes.

Also, I know that studies have shown that the ?pain? from a potential loss of money is twice as powerful as the ?high? from a gain. So don?t fall prey to your fears and tap ?sell? the moment your stock starts to fall. You want to look at the big picture over time. Set up some Google news alerts for yourself so you can stay aware of any major information involving the companies you hold stock in. And if you?re really intent of not letting a stock dip below a certain price, you can set up Robinhood to automatically sell it (?stop loss? order) before it gets to that point.

#5: Don?t rely on it for research

Currently I?m using three apps to research stock history and prices: Robinhood, ClosingBell, and WikiWealth. Robinhood only gives 1 year of stock history, which may be enough for some. But I often like to use Yahoo Stocks or another tool to look at prices for 5 years or longer, as well as to research dividend history.

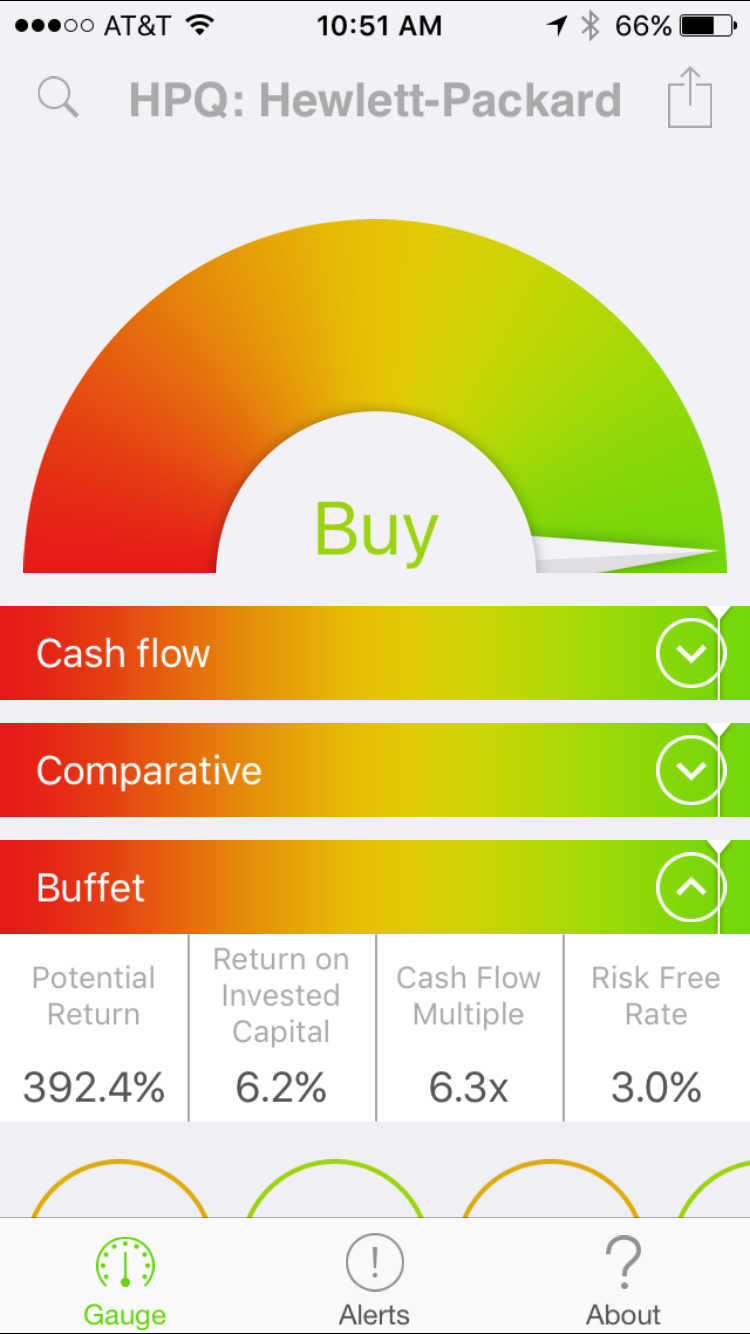

WikiWealth (screenshot to left) is based around Warren Buffet?s stock picks and gives a simple recommendation for stocks. It also shows things like the company?s cash flow margin and potential returns, if you?re interested.

ClosingBell compiles analyst and user ratings and news, but I actually use it more for an alert system. You can tell it to send you a notification when, say, GoPro hits $8 a share. It also has handy lists of things like ?Top Picks in Communication Services? so you can learn more about the top stocks in different sectors, which is great if you?re looking to diversify your portfolio and aren?t sure where to start.

ClosingBell does have a Robinhood integration, but honestly I haven?t used it much.

Okay, that?s the 5 things I?ve learned *not* to do while using Robinhood. I know #1 and #3 are kind of the same thing, but they?re the most important. Since I started using Robinhood, I have been learning a lot about the markets, but of course I still have a lot to learn. I found out, for example, that for tax reasons, I could likely be having a better outcome if I were investing inside of an IRA rather than through Robinhood. But as a newbie, I?ve found Robinhood to be a great way to get my feet wet and sooooo easy since it?s on my iPhone. And hey, in 5 months my $1600 investment has gained almost $300 in value. Not too bad, especially considering the market conditions. Now I just need to learn how to do even better, and more about the tax implications of buying stocks. If you have tips or links to help, please feel free to put them in the comments section. Thanks for reading.

Jan. 2018: I?ve published an update to this post here with more things I?ve learned.