Why Should We Support the Idea of an Unconditional Basic Income?1.2K25

Scott Santens

An answer to the response to the answer to the growing question of the 21st century

You can listen to this article in podcast form by clicking the play button above.

By far, the most common concern in regards to my first article on Medium about the idea of an unconditional basic income was that all prices would inevitably go up as a result, immediately reducing the value of each dollar and essentially creating a new zero. Let?s call it the ?New Zero Argument? against basic income.

The New Zero Argument: Although a noble idea to give money to those in need, no one would actually be better off as a result of basic income due to everything costing more ? especially rent ? and therefore the policy idea is entirely pointless because the only thing it would attain is a new zero.

In economic terms, this concern is the fear of inflation or even hyperinflation, and it is possibly the most common reflex to the notion of just transferring more money to the lower and middle classes. So how grounded in reality is this concern?

First, a quick three minute TED-Ed lesson about inflation and deflation:

Not Printing Money

Now that we know more about what gives money its value, and how we actually want a small amount of inflation, we need to understand that basic income is not the idea of printing $3 trillion new dollars every year and dropping it on everyone from helicopters.

(Although there are arguments to be made that to a lesser degree this could be done on a temporary and varying basis as economic stimulus according to perceived economic conditions as a kind of ?quantitative easing for people? instead of banks)

The money for a basic income guarantee would be already existing money circulated through the economic system. It would not be new money, just money shifted from one location to another. This means that the value of each dollar has not changed. The dollar itself has only changed hands.

It is also important to note the observation that even when money supply is vastly expanded, the effects on prices need not be extreme. For example, the Fed?s quantitative easing added over four trillion new dollars to the U.S. money supply, and the results were not enough inflation, as defined by the Fed.

?But even with the trillions of dollars pumped into the economy, the Fed has been perpetually unable to get inflation up to the 2 percent level it aims for, except for the occasional brief period. There is good news in that predictions by many Fed critics that Q.E. would unleash vicious hyperinflation have come nowhere close to materializing. But neither has it been enough for the Fed to reach its self-imposed goal. In an economy trying to get out from under an overhang of debt, where excessive unemployment is the leading problem, too-low inflation can be deeply problematic and hold back growth. Q.E. has not been powerful enough to generate as much inflation as the Fed says it wants.?

So even though basic income would not be printing new money for everyone, even if it were, inflation would not be a guaranteed result.

With that understood, to then understand how much we should actually fear rising prices as a result of redistributing existing money from one place to another instead of printing new money requires some studying, but the short answer is that capitalism not only still exists with basic income, it is enhanced.

By enhanced, I mean there is growing evidence from where basic incomes have been actually tried that it increases entrepreneurship. We also have actual examples of partial basic incomes, that we can examine for inflationary evidence.

Aside from this evidence, we also need to understand how increased demand leading to higher prices isn?t as simple as we might think is is, and how when it comes to housing prices, in a future where everyone has basic incomes, we are likely to see some very interesting market adjustments. Meanwhile, fears involving unearned income and increased velocity require a closer examination.

Because of all the above that needs to be understood in order to more fully examine the question of basic income and inflation, I have split off the above information into four separate smaller articles. Let?s call them Exhibits, A, B, C, and D.

If you wish to learn more about each collection of evidence, just read the attached sub-article before moving on. Or you can just keep on reading.

Exhibit A:

Evidence and More Evidence of the Effect on Inflation of Free Money

From Alaska to Kuwait and Beyond

medium.com

A is for Alaska

In 1982, Alaska began providing a partial basic income annually to all its residents. Until the first dividend, Alaska had a higher rate of inflation than the rest of the United States. But ever since the dividend was introduced, Alaska has had a lower rate of inflation than the rest of the United States.

A partial basic income was also provided in Kuwait in 2011, when every citizen was given $4,000. Fears of increasing inflation were rampant, as Kuwait already had high inflation. Instead of bad inflation getting worse, it actually got better, decreasing from record highs to under 4 percent.

Elsewhere, where basic income experiments have been actually tried and studied, the result in each case is increased entrepreneurship. People use their basic incomes to invest in themselves and their futures, creating new businesses and helping to drive the economy beyond what would be possible without it. This means more people competing for basic income dollars, with better goods and services and lower costs.

All of this represents real evidence to counter any fear of inflation.

Exhibit B:

Supply and Demand Variables

How not all basic income effects lead to rising prices

medium.com

B is for Basics

To further inform inflationary fears on a more academic basis, it?s also important to understand the basic variability of supply and demand and how it applies to various goods and services.

Where demand already exists and supply is already paid for, demand is unlikely to change as basic income simply replaces one method of payment with another. E.g., replacing food stamps with basic income is unlikely to make people buy more milk. It just means people will likely buy the same amount of milk with cash instead of SNAP.

Where demand is actually increased, depending on the good or service, supply can also easily be increased, be increased with some investment in capacity, or not be increased. It is this third case where prices can rise, and points more to increases in prices for luxuries, and not basic goods and services.

All of this represents academic evidence to counter any fear of inflation.

Exhibit C:

Google Homes and WikiHouses

Disruptive ideas that will transform housing markets

medium.com

C is for Creation

Rising rent is a particularly worrisome fear for many when first introduced to the idea of basic income. However, two very important things in particular need to be understood when it comes to housing.

- There are five times more vacant homes than homeless people in the United States today. This represents a large unused supply that need only be made available. The reason many people are not living in these homes is because they were at one time but couldn?t afford to keep them. Basic income rectifies this and puts people back in homes.

- Technology represents a major factor in future housing prices, especially a future where everyone has a basic income. Everyone will receive a monthly check to afford rent, and will want to spend as little of it as possible on rent. Meanwhile, owners will want to compete for this money with other owners. Those offering the lowest rents will win. One example of this would be Google deciding to create Google Homes and leasing them out to people for a fraction of what people are paying now. Another example would be super affordable WikiHouses.

For these two reasons in particular, in combination with the ability of everyone to truly live anywhere for the first time in history, a nationwide market for ultra-affordable housing will be created, and smart businesses will step into this space in hopes of dominating it.

All of this represents theoretical evidence to counter any fear of inflation.

Exhibit D:

Unearned Income and the Velocity of Money

Two lesser known variables in the inflation equation

medium.com

D is for Depression

Two lesser known economic concerns among those who know of them, are possible differences in how we perceive the value of money depending on how it was received, and how quickly it is spent.

There is a popular conception that unearned income is perceived differently than earned income, and therefore spent more spuriously. Because people are considered more likely to spend money they didn?t earn, the fear is that people will pay more for goods and services with basic income, and therefore increase prices. This is a misconception though, and not backed by evidence, with the opposite observed in Alaska, where the dividend is treated virtually identically to earned income.

The frequency with which a single dollar is spent in the economy ? known as the velocity of money ? is another variable in the inflation equation. The faster the velocity, the higher inflation can get. However, velocity as measured by the entire money supply is currently lower now than ever in U.S. history. And as measured by the real money supply, it has been crashing since 2007.

We want higher velocity for a healthy economy, and the fear that unearned income has less value is unsupported.

All of this represents economic evidence to counter any fear of inflation.

The Inflation Bogeyman

Inflation is not the unmanageable danger it is made out to be. It is a complex equation involving multiple variables, and in the context of evaluating the idea of a universal basic income guarantee, because a basic income will be set at a basic level, there is even less to fear.

Because we have actual evidence, there is less to fear.

Because capitalism will be enhanced, there is less to fear.

Because technology will continue to advance and make goods like housing cheaper, there is less to fear.

Because our economic capacity is underutilized and underconsumption is systemic, there is less to fear.

There is however one real thing to fear?

Increased Wages and Salaries

Basic income could provide an upward force on wages through increased individual bargaining power and slightly decreased labor force participation rates, and businesses as a result of new higher labor costs could raise their prices so as to keep their profits unchanged.

This would mean that if you are currently earning $20,000 per year, you?d not only get an extra $12,000 per year in basic income, but also $10,000 in higher wages. Your new yearly income would be $42,000 and groceries might end up costing you an extra 1.4 percent per month.

Would you personally have a problem with earning an extra $22,000 and paying an extra $50 on groceries? Let?s assume you would, and that you also think it?s wrong the cost of food would go up for everyone else as well, including those with only $12,000 per year basic incomes, and therefore with tighter fixed budgets. There is one last final detail to understand.

Any basic income can and should be indexed to match or beat inflation.

Indexing Basic Income

Just as the minimum wage has eroded over time because of inflation and the political fight over ever raising it, a basic income should automatically rise each year to match inflation so that it doesn?t erode in the same way.

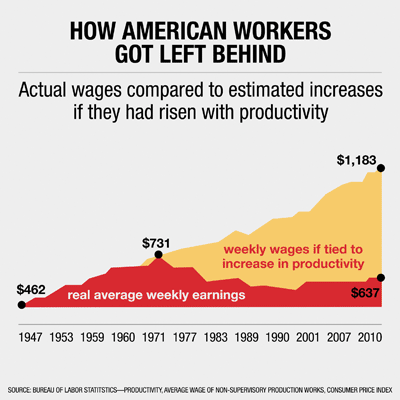

Better yet, instead of just indexing a basic income to CPI, it could even be indexed to something like productivity, so that the gains of society continue to accrue more widely for everyone, instead of only the few.

Source: http://www.cwa-union.org/news/entry/89_out_of_100_workers_dont_have_collective_bargaining#.VGu38sk–WI

Source: http://www.cwa-union.org/news/entry/89_out_of_100_workers_dont_have_collective_bargaining#.VGu38sk–WI

(Because wages and salaries certainly aren?t rising with productivity and haven?t for decades.)

The result of this would be a basic income that always increases faster than inflation, so that each and every year, we would be able to buy a greater amount of goods and services than the year before.

It cannot be stressed enough that this ability is especially important to enable in advance of the decades ahead of us as software and hardware continue to decrease the need for human labor, and as a result, decreases availability of ever decreasing incomes derived from human labor.

So why again was I ever worried about inflation?

Good question.

Or take The BIG Patreon Creator Pledge

Or take The BIG Patreon Creator Pledge

If you find value in this article, you can support it and future articles with a patron pledge on Patreon.

Scott Santens has a blog. You can also follow him here on Medium, on Twitter, or on Reddit where he is a moderator for the /r/BasicIncome community.