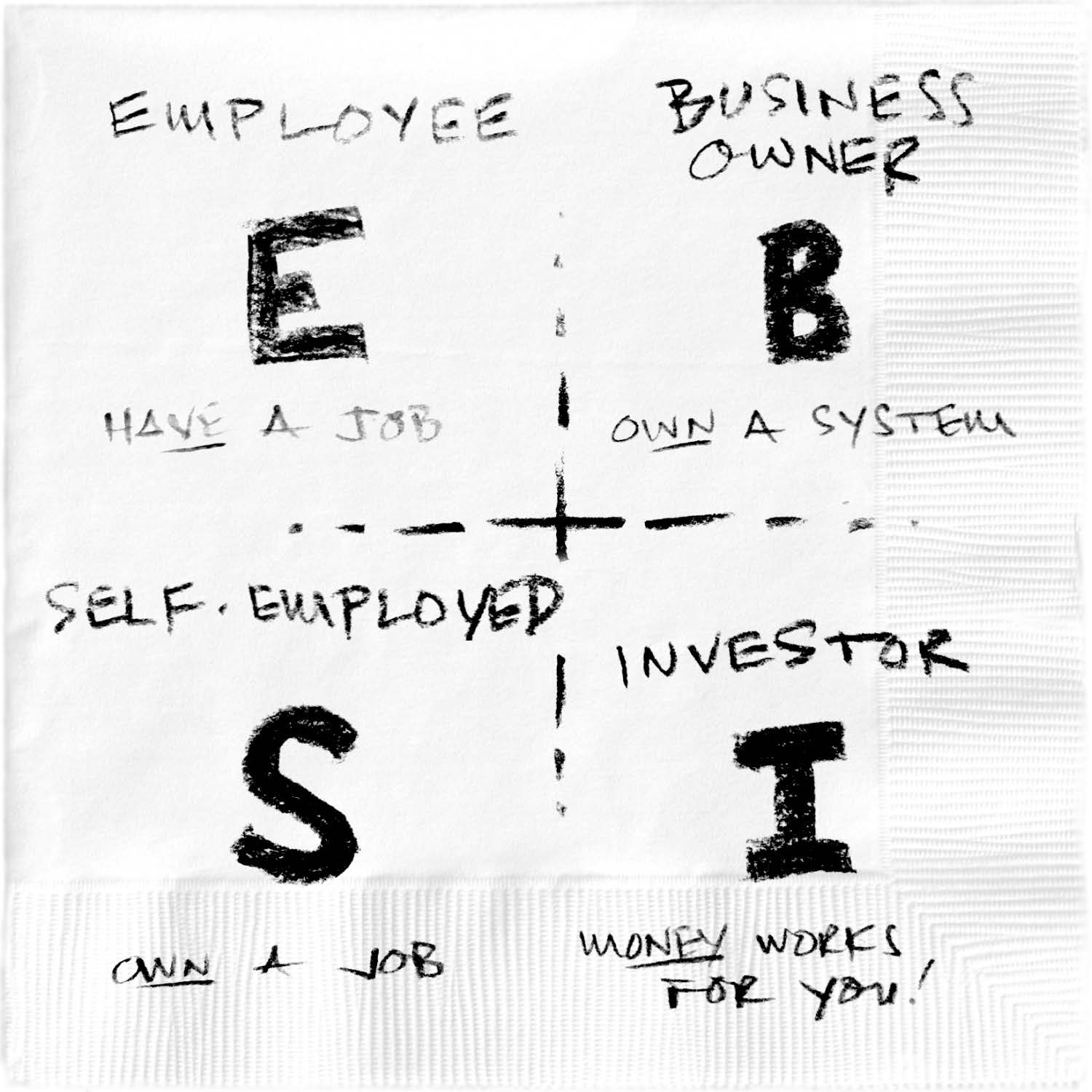

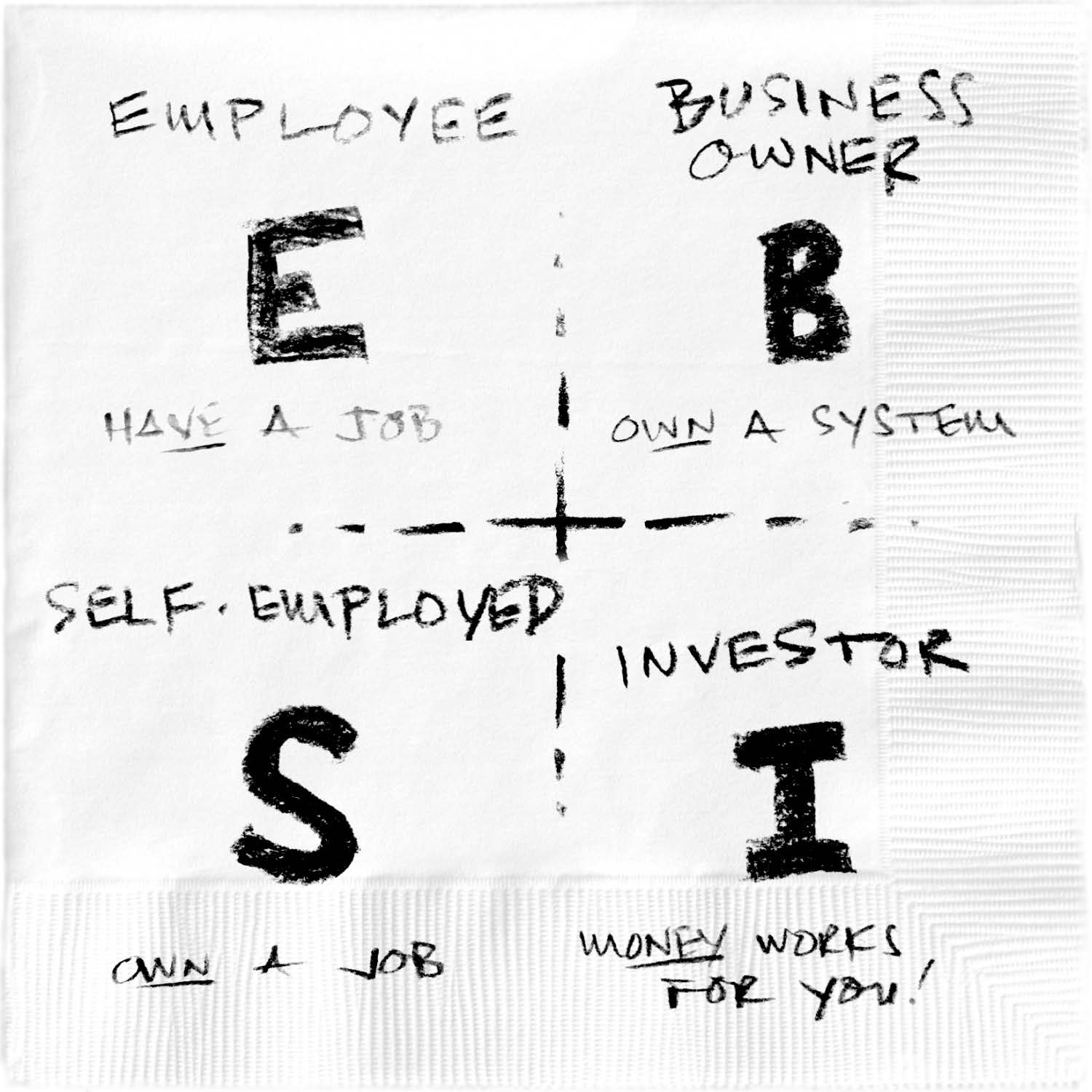

Cashflow Quadrant: source Stark Naked Numbers

Cashflow Quadrant: source Stark Naked Numbers

I had an interest in money from an early age ? mainly because, when I was growing up, we didn?t have much of it.

One of the first books about personal finance that I ever read was Rich Dad?s Cashflow Quadrant: Guide to Financial Freedom by Robert Kiyosaki.

The book has something of a cult following.

In it, Kiyosaki frames four approaches to building wealth. Yet only two can help you to break free of the day-to-day grind.

He explains that each of us falls into one of the following quadrants:

EMPLOYEE ? THE E QUADRANT

Your income is derived via a salary which you cannot control. No matter how hard you work, your income will always be capped.

SELF-EMPLOYED ? THE S QUADRANT

This describes the majority of people who call themselves ?business owners? ? even those with a number of employees. In this quadrant, the company is entirely dependent on the owner?s time.

If he or she stops working, their income stops as well.

BUSINESS OWNER ? THE B QUADRANT

This is the realm of entrepreneurs, people who design systems ? machines comprised of people and processes to generate a profit.

INVESTOR ? THE I QUADRANT

Investors use money to create more money. They don?t have to work because their money is working for them.

Source: Stark Naked Numbers

Source: Stark Naked Numbers

Are You an S or a B?

Unless one is a child prodigy entrepreneur, all of us started in the E Quadrant; we were employees once upon a time. Then we created our own business. And bought into a misconception. We thought we were heading straight to Business Owner (the B Quadrant).

But what typically happens is that we shift from Employee to Self-Employed. Rather than owning a business, we own a job.

Let that sink in.

And I?m not just talking about solopreneurs here ? the freelance graphic designer working from a home office, for example. You can be in the S Quadrant and have a dozen employees in a fancy office space downtown. You may own the company, but the company owns you, too.

Believe me, I know. I was in the same situation. When I first started my business, I took on a ton of debt: ten times more risk than I ever imagined. Sure I was proud of the leap I?d made, the vote of confidence in my capabilities.

But, as my business grew, I was working more and more hours. Sure, I had employees, but they needed me to stand over their shoulder. My clients needed me, too. My company was completely dependent upon my time. And, thus, so was my income. I bought into a lie.

3 years later my business is still dependent on me, but the majority of the time I do spend is leading at the helm of the ship, not in the engine room.

The Cashflow Quadrant is a useful model that helped me frame what it means to be a business owner.

Maybe it?s of use to you too.

From Stark Naked Numbers: Uncover Your Financials, Unlock Your Cashflow and Unleash Your Profits Copyright 2018 by Jason Andrew