Roughly one-third of startups fail because of a lack of funding. They may have brilliant ideas, but not enough financial support to survive.

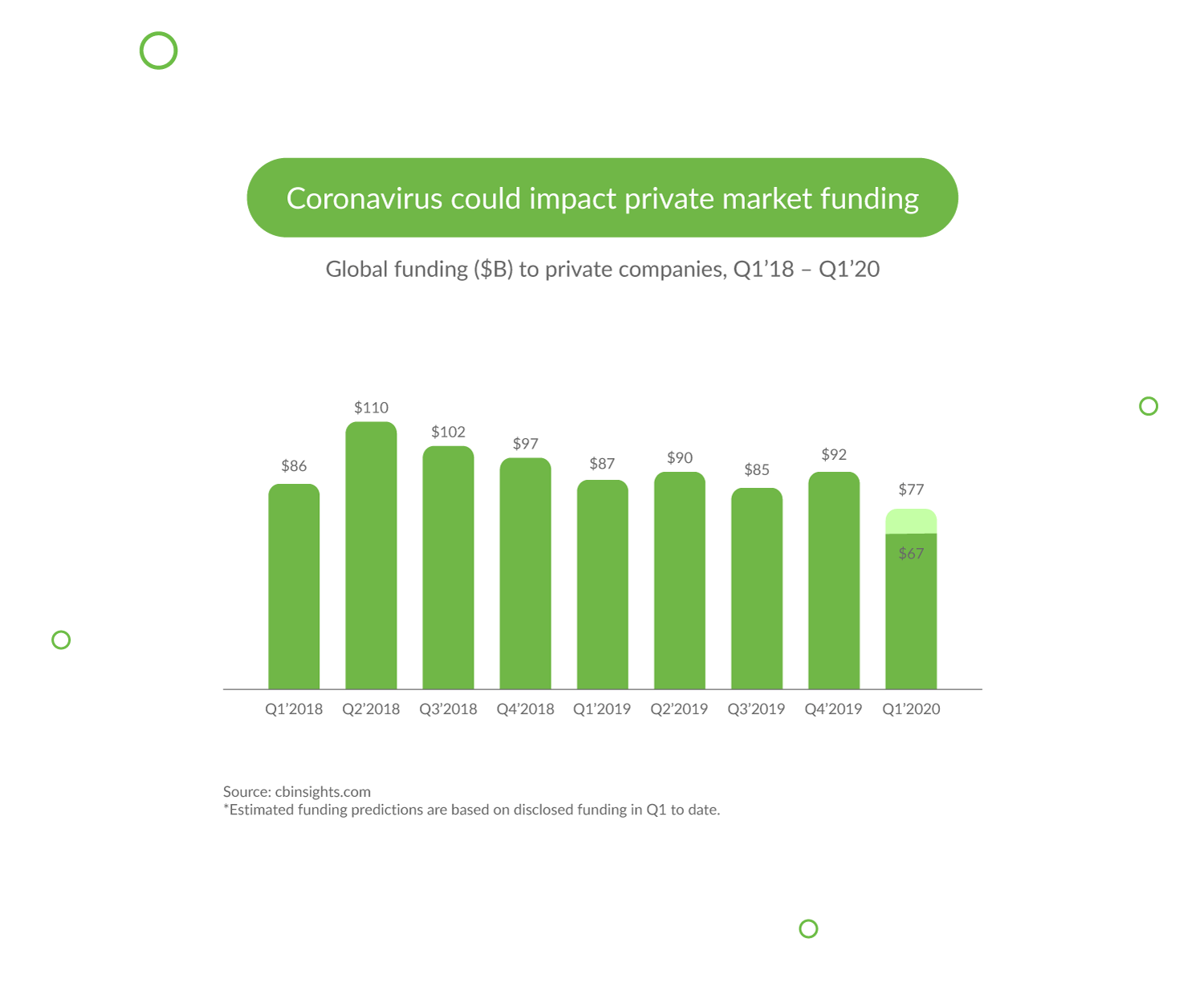

Besides, COVID is changing the startup financing picture significantly. As we see in the graphic, private market funding is projected to fall to $77B in Q1 ?20 ? more than 16% less than Q4?19, and 12% less than Q1 ?19.

This means that the financing industry is becoming very selective and competitive. But don?t put your great idea on the shelf just yet. A compelling investment proposal will give you a good chance to source the funding you need.

But if you haven?t done it before, you probably have a bunch of questions. How do you write a good investment proposal? How long or short should it be? And what should you write about?

You?ll find all the necessary information in this guide.

This guide about How to Write an Investment Proposal: A Step-by-Step Guide was originally posted on Django Stars blog. Written by Editorial Team at Django Stars.

In simple terms, an investment proposal is a text document, PDF, or slide show presentation about your startup (product or service) whose purpose is to raise capital. It appeals to people who have money and may be interested in contributing financially.

The Best Way to Use Stock Market Correlations | Data Driven Investor

When Alfred Winslow Jones pioneered the world’s first “hedged” fund (the “d” was dropped later) he blew other investors?

www.datadriveninvestor.com

A successful investment proposal delivers solid arguments as to why your startup is worth investing in, which requires preparation before you start writing. Also, the proposal should be presented at an appropriate stage of product development ? that is, at the MVP stage.

Necessary Preparation before Writing

Before you start writing an investment proposal, you need to prepare, and do it in stages:

#1. Research Your Market and Competition

A startup?s success greatly depends on the pre-development, or discovery phase. This is when you gather data from a market analysis and use it to define the product-market fit. The discovery stage helps you eliminate many of the risks related to unexpected expenses, lack of market demand, and other potential issues.

Let?s take a detailed look at the different parts of the discovery phase:

Market Size, Potential, and Competitors

Identifying and scoping your segment of the market, customer and product demand, and competitors is half of the discovery phase. This is a vital part of the process, since it helps you figure out the size and potential of the market, find the gaps in the industry, and define your product-market fit. Along with that, it?s also useful in that it helps you figure out how to withstand the competition ? and you might lure clients away from it.

Buyer Personas and Customer Journey

The discovery phase should yield a customer journey map. This map is based on your buyer personas ? the marketing avatars of people who would use your product ? and basically identify the touchpoints that your users will interact with. It?s a crucial part of the discovery phase, since the first contact a customer has with your product can make or break their experience. So does each contact after that.

A customer journey map will help you anticipate some of the difficulties your buyer persona might encounter, find the best ways to address them, and help ensure a better user experience.

#2. Review Your Product

As mentioned above, the best time to start writing an investment proposal is when you have your MVP ? minimum viable product ? or an early version of your product that has enough functionality to make it viable for users, but still requires some development effort and time. At this stage, you should also have figured out your business goals and buyer personas.

Presenting your MVP will show a deep understanding of your potential audience and demonstrate that you can satisfy their needs.

#3. Gather Information about Investors

First, you should identify what investors you wish to attract. They can be grouped into a few different categories:

- Angel investors and angel groups. These are high-net-worth individuals and groups that fund startups in return for stock, which makes them just as invested in a startup?s success as they are in getting returns. Most of the time, they also have a wealth of entrepreneurial experience, so they can also mentor or coach you.

- Banks. These are not the most common source of investments for startups, but you can still take your proposal to a bank once your project starts to show progress (e.g., by gaining customers).

- Venture capital firms. These companies usually close more deals than angels, as they have more fuel to power startups. Your choice of VC will usually depend on your location, as most of them are created equal.

- Corporate investors. Some corporations take an interest in funding startups as a way to acquire new assets and identify new technology, all of which can help them grow their revenue.

- Peer-to-peer and personal investors. This group can include your close relatives and acquaintances, P2P lenders, and crowdfunding platforms. Friends and family are usually the first people on the list, and sometimes they can lend you a decent sum. However, you can also go straight to potential customers and launch a crowdfunding project.

Another source of funding is accelerator programs, which help develop your idea and gain traction. These can offer you from $10K to $120K in seed money, as well as additional startup resources such as industry or financial management knowledge.

After you determine the type or types of investors and form a list of target entities, you should do research on:

- Their main field or focus

- If they plan to venture into new territories

- What projects they?ve already funded

- What projects they rejected, and why

- Any additional public information that might be useful (such as interviews, area of interest, etc.).

Also, keep in mind what kind of investor you will be writing for, and consider writing a couple of tailored proposals. For instance, if you seek help from bankers, they will be more invested in the financial side of things, while an angel investor will want to know more about your finances and marketing ideas.

What an Investment Proposal Should Include

As mentioned above, an investment proposal can be an ordinary text document or a PDF with graphics. It can also be a presentation created with software such as PowerPoint or Keynote. The format of your proposal largely depends on the type of investor you choose, but it?s always possible to go with all three formats.

However, there are certain must-have elements in every proposal. They are:

Investment Title

Everything starts with a name, and your proposal needs one as well. Ideally, it should be a few words that describe the value of the future product or service and the direction you are taking it, such as the market segment.

Example: Campervan Booking Platform

Catchy doesn?t necessarily mean enthralling. A title like our example gets straight to the point ? in this case, you want to build a platform people can use to rent a campervan.

Executive Summary

A business proposal for investors starts with a cover page, followed by a table of contents. The body of the document should begin with an executive summary. In this summary, you should include your value proposition ? that is, a short statement that conveys information about your target customer, their problem, your proposed solution, and the benefits your solution offers to the customer and the investor.

You should mention the ROI you expect to yield from the required investment right away. It?s also good to relate success stories, if any, of your experience as an entrepreneur or of your company (in case your startup is branching out from an established business) to further instill confidence in your competence.

Keep it realistic, and keep in mind a key question: What?s in it for the investor? Make your proposal scream out that your idea can actually make money by creating a convincing proposition.

Project Details

This section requires all the facts and arguments supporting you as an entrepreneur, your company (if you already have one), and your MVP ? specifically, how you plan to bring it to life.

Company performance

If it?s an existing company, include a business description and provide historical and current financial data. If you haven?t yet established a business, share information about products you?ve been involved in and made a significant contribution to, the stakeholders in the current project and their achievements, and compelling market statistics that underscore your startup?s potential.

Planned marketing and sales methods

In this part of the document, present all the research you?ve done on your market and its competition.

This section should also outline your marketing strategies and channels, and your sales strategy. A key point here might be the pricing model you?ve chosen for your product and a rationale for why it?s the most profitable one.

Operational team logistics

Another piece of information that can help potential investors form a positive opinion of your startup and its potential is the structure of your current team ? the one that will achieve your goals. This can include the location of your business, the number of employees you have hired/ plan to hire, the equipment and/or technology you need to get the project up and running, and any applicable operational expenses.

Project financing

Seeing how this is the entire goal of the proposal, make sure you use accurate numbers and include lots of detail. This part should specify the sources of funding, forecasts, timeframes, ROI, and the investment exit plan.

An exit strategy is a crucial point in an investment proposal that?s necessary in two situations:

- When a business has met predetermined investment criteria; or

- When a business has failed to achieve its defined profit objective.

Usually, it?s a contingency plan with information on what to do to limit financial losses if the business goes under.

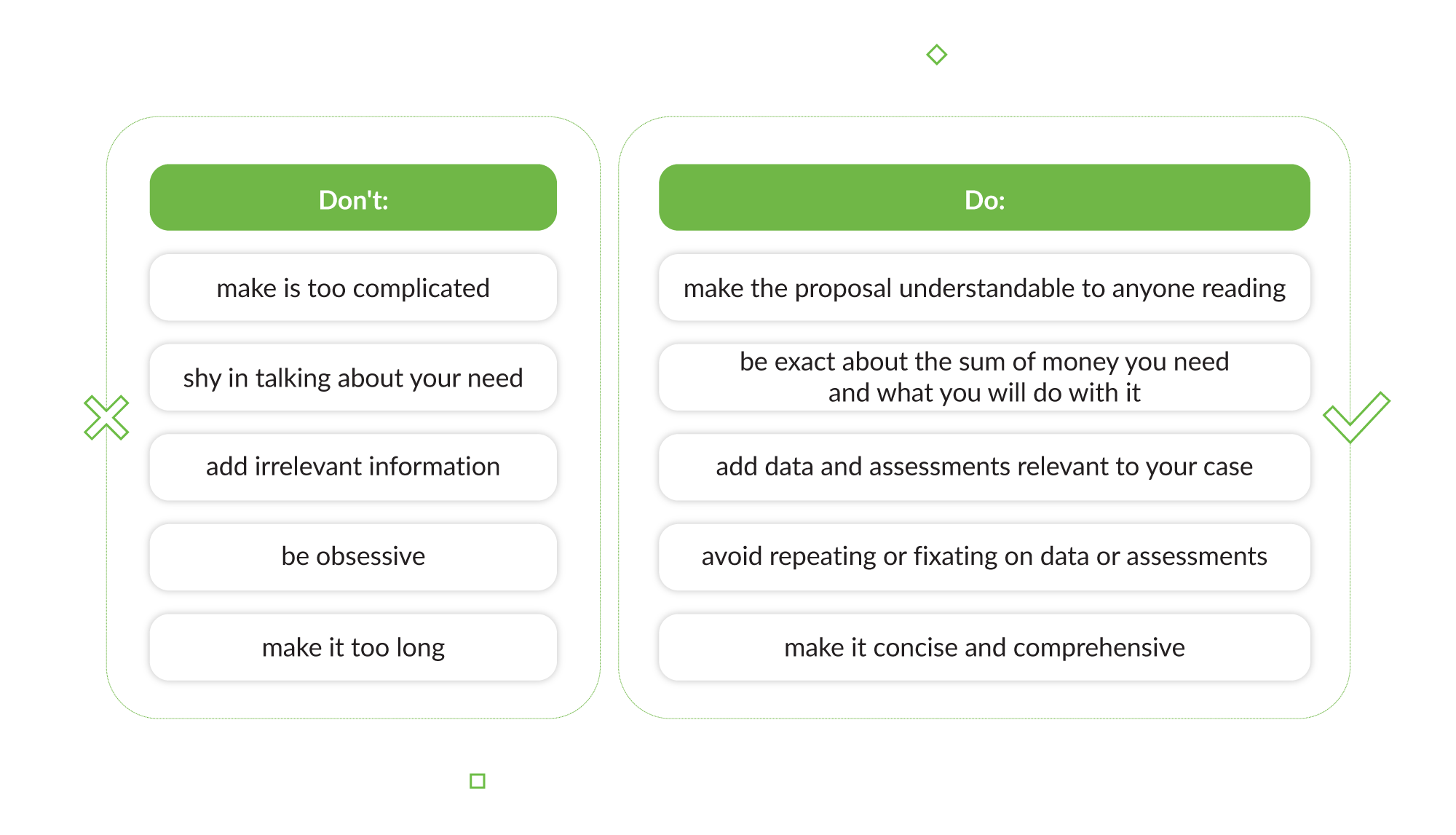

Things to Avoid When Writing an Investment Proposal

The investment proposal can be a lifeline for any startup, so it?s crucial to make a compelling argument for your case. At the same time, it has to be straight to the point and factual to highlight your competence in your field. We?ve already discussed what will get you there, so here are some things that you should avoid along the way:

- Don?t make it complicatedThe text should be understandable to anyone who reads it, not just your peers. Besides, using a lot of jargon or complex phrases might sound like you have copied information instead of describing it in your own words. Simple wording also shows you can be on even footing with your potential customers. How can you attract someone?s attention if they don?t understand what you?re talking about?

- Don?t be shyDon?t beat around the bush when talking about the financial support you require. Be precise about the amount of money you want to raise, what you will do with it, and why you need it.

- Avoid irrelevant informationInclude only the information that is relevant. Your skills and experience may be impressive, but if they aren?t complementary to the business or the proposal, they?ll simply create information noise.

- Don?t be obsessiveDon?t fixate on any information you provide in the proposal, as this might be viewed as unprofessional.

- Don?t make it too longA long proposal may not be read at all. Be considerate of the time someone will need to spend reading and assessing your proposal, as well as of your own time.

Three Diverse Investment Proposal Examples

Here are some excellent templates you can draw inspiration from.

1) The first investment proposal example is the form of a landing page accompanied by descriptions and illustrations of the startup and its competitive advantages. The proposed startup wants to build invoicing software for small businesses.

2) The second startup investment proposal is a presentation that can be shown to an audience or sent as a PDF. The template provides cues as to where you can insert in your own information.

3) The last type of investment proposal template is a traditional text document written as part of a business plan. Click this link to download an editable template.

Conclusion

A project investment proposal is a key document that every startup needs to obtain financial support. An ideal proposal provides accurate data and predictions that demonstrate to investors your competence and ability to profit, which ultimately will repay their contributions.

If you want to increase your project?s chances of success, don?t jump into creating a proposal. Take time to prepare the necessary information and make sure you write the proposal according to universally accepted guidelines. After all, an investor might not even read it if the title isn?t catchy enough. So, pay special attention to the proposal?s structure, and include only relevant information that creates a positive, but realistic assessment of your startup?s potential. Don?t make abstract statements, and be precise in your calculations.