Return on Investment (ROI)

Return on Investment (ROI)

All investors (whether they invest in property or other forms of investment) are looking for the same thing: profit. When it comes to investing in rental property, you make profits by having a good ROI. However, one of the reasons beginner real estate investors lose money is because they chase after unrealistic rates of return on investment. This begs the question ? what is a good ROI for rental property? Similar to other real estate questions, there isn?t a clear answer to this one. The most common answer is ?it depends on a number of factors including the investment location, property?s type, conditions, risks, etc.? For a serious real estate investor, this piece of information is not really a sufficient answer, is it? Let?s take a closer look at some possible answers to what is a good ROI in real estate with examples and numbers that might just answer this question.

How to Calculate ROI on Rental Property

Before we give you the answer, we ought to explain exactly how to calculate ROI so you can do your own ROI calculation on your income properties. We all know that real estate ROI is a way of measuring the performance of investment properties. It?s simply the profit a real estate investor will get in comparison to the cash investment he/she made. Based on this definition, we understand that the ROI formula is:

ROI Formula

ROI Formula

For example, assume you?ve bought an income property for $400,000, paid another $15,000 in closing fees, rehab costs, etc. and charge your tenants a monthly rent of $2,500. This is how to calculate ROI for this investment property:

ROI = (12 x $2,500) / ($400,000 + $15,000) x 100

= (30,000 / 415,000) x 100

= 7.2%

Now, this leads us to our question: what is a good ROI for real estate investors? If you?re calculating ROI using this specific formula, you?ll get different answers as well. After all, the word ?good? is subjective and different investors have different criteria on which they base what they consider to be good. So, you might think that 7.2% is a good ROI while another real estate investor, with a riskier investment, would disagree. Nonetheless, most experts agree that, on average, anything above 15% is a good return on real estate investment.

Check out our complete guide on How to Calculate ROI in Real Estate.

Now, real estate investors are known for using mortgages, which are a form of leverage, to increase the return on their investment. This tells us that if you were to finance an income property with a mortgage, you can expect to get a higher ROI than if you were to pay for it fully in cash. Accordingly, investors need to account for their method of financing when answering what is a good ROI on rental property. It?s not very accurate to say that a good return on a cash investment is also good for a mortgage-financed investment property.

What Is a Good ROI for Cash Investments?

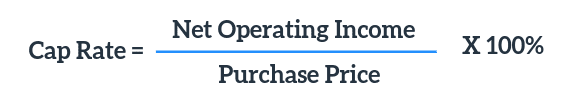

If you?re one of the lucky real estate investors who has the money to buy and own an income property fully in cash, then your ROI calculations should be based on the cap rate formula. Cap rate in real estate is an ROI analysis metric that calculates return on investment in terms of how much income is being made in comparison to the price of the investment property. Investors often use the cap rate when comparing two or more properties in the area to decide which one is best to buy for real estate investing. Here?s the cap rate formula for calculating ROI on rental property that was paid for in cash:

Cap Rate Formula

Cap Rate Formula

Net operating income is simply your annual rental income minus annual operating expenses (excluding mortgage payments and interest rates). Here?s an example. Say you?re planning to buy the same $400,000 investment property and rent it out for $2,500 a month, meaning you?ll gain an annual rental income of $30,000. Say that after estimating your operating expenses, they add up to $8,000. Thus, your NOI would be $22,000. Following the above formula, you?ll get a 5.5% cap rate. Is this considered a good rate of return on a rental property?

Well, when it comes to what is a good ROI for cash investments in real estate, experts suggest that anything from 4% to 10% is a good cap rate. Keep in mind, however, that cap rates of rental properties vary by city. For example, single-family homes in Pittsburgh have a 3.36% cap rate while those in Atlanta have a 2.03% cap rate according to Mashvisor?s data. Of course, the higher the cap rate, the more profitable the location is for real estate investing, yet the higher the risk.

Related: 2020 Cap Rates by City: What Real Estate Investors Should Expect

What Is a Good ROI for Mortgage-Financed Investments?

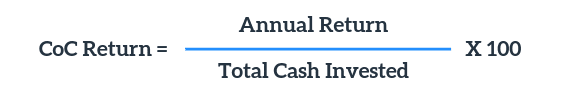

As mentioned, most real estate investors are known for taking out a mortgage loan to finance their investment properties. The reason why this option is popular is not only because it allows them to invest less out of their own pocket, but it acts as leverage to achieve a high ROI as well. So if you were to finance the same income property in the previous example with a 20% down payment, you should be calculating ROI using the cash on cash return formula. This ROI analysis metric gives investors a more accurate projection of their return as it takes into account financing costs. Here?s how to calculate ROI on a mortgage-financed investment property:

Cash on Cash Return Formula

Cash on Cash Return Formula

Your annual return is basically the profit you get after subtracting financing costs (like mortgage payments, mortgage interest rates, etc.) from the NOI. For example, say you?ve paid a 20% down payment on the previous $400,000 property for sale and invested another $15,000 in closing fees, remodeling, etc. This means your total investment is $95,000. Assuming you?ll have the same $22,000 net operating income, now you just need to subtract annual expenses associated with the mortgage. For this example, let?s say these expenses add up to $10,000. This means you?ll earn $12,000 in annual returns. According to the cash on cash return formula, you can now expect a 12.6% ROI from this income property.

Related: What Is a Good Cash on Cash Return?

As you see, the real estate ROI has changed drastically by switching to a different financing method. But now we have to ask: what is a good ROI when it comes to cash on cash return? Most real estate experts agree anything above 8% is a good return on investment, but it?s best to aim for over 10% or 12%. Real estate investors can find the best investment properties with high cash on cash return in their city of choice using Mashvisor?s Property Finder!

Sign up for FREE to get access to this investment tool today.

The Bottom Line

As mentioned earlier, the answer to what is a good ROI on rental property depends on different factors. From the location, property type, risks, to property financing, all these factors can shape your perspective on what real estate ROI you can consider to be ?good?. Once you?ve figured out what is a good ROI for investment property in terms of cap rate and cash on cash return, make sure to use Mashvisor?s Real Estate ROI Calculator. Our investment tool will provide you with the cap rate and cash on cash return for thousands of properties for sale throughout the US housing market. Thanks to this tool, finding profitable real estate deals and comparing investment opportunities has never been easier.

Want to give our tools a try? Click here to start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after!

Originally published at https://www.mashvisor.com on November 5, 2019.