Bitcoin and other crypto debit cards work just like any other card you have in your purse or wallet. You can swipe them at card terminals to buy things in-store, use them to withdraw cash at ATMs and enter their numbers when shopping online.

What this means is that your debit card not only reflects money in your account but the Bitcoins or other digital currency that you own.

Even though the list of merchants that accept Bitcoin is continuously expanding, it?s still not possible to buy everything with Bitcoin. However, thanks to several companies in the Bitcoin ecosystem you can now order your own Bitcoin debit card.

How do Bitcoin debit cards work?

Bitcoin debit cards provide cryptocurrency investors with the ability to circumvent the unwieldy steps necessary to convert BTC into fiat currency, and allow them to spend their currency freely. In the case of Bitcoin debit cards, the card providers perform the exchange element of the conversion, which in most cases is not as favorable as market rates, but provides an extra layer of convenience that balances out the slightly increased cost.

They?re designed to make it easier to directly spend your cryptocurrencies as needed, even if a merchant doesn?t accept Bitcoin payments.

What to consider when choosing a Bitcoin debit card

You?ll want to consider all of these factors:

- What are the supported currencies?

- Where can I use the card?

- What are the fees?

- What?s the service itself and how does it work?

You?ll also want to consider any additional features of a card or service. For example, whether it lets you lock in rates to guard against price fluctuations. Bitcoin debit cards are still very new and under development, so it?s also worth considering whether an alternative might suit your needs better.

Getting the card will often lock you into using a particular service. So if you don?t feel like the attached cryptocurrency wallet is secure, feel like it?s not good value for money or otherwise just don?t like it, then you might just skip the Bitcoin debit card entirely.

Cryptocurrency debit cards are super convenient, but not essential. Like anything else, you should consider how the pros and cons apply to your situation.

Can I get a virtual Bitcoin debit card?

In the world of online shopping, security is paramount. There?s always a certain level of risk involved whenever you hand over your personal details and credit card information online, so any way you can make online shopping easier or safer is well worth a look. Virtual debit cards provide a prepaid, disposable debit card number you can use to shop online and over the phone. Some cryptocurrency services will only offer physical cards, while some will offer both physical and virtual cards.

Bringing us to Crypterium. Their goal is to replace your bank. Everything you need in your smartphone: payments, transfers, currency exchange and instant loans. For example: No more wait times for your card to be issued, you will get your virtual card just after registration.

10 OF THE BEST CRYPTOCURRENCY DEBIT CARDS ON THE MARKET TODAY

Monaco

Monaco card is a Visa-branded debit card that draws from a cryptocurrency-funded bank account. Since it?s a Visa card, you can use your Monaco card just like you would any other card. Easy peasy!

The card and Monaco bank account are free for holders of cryptocurrency. In order to open an account, you simply sign up, verify your identity, and transfer any of the various accepted cryptocurrencies to your account. At this time, Monaco is available to customers in Asia. They also have a waitlist for European customers. Customers in the United States cannot currently use Monaco. However, there are plans to change that.

A Monaco card account has no minimum balance and no monthly fees. There is, however, a $200 limit on free ATM withdrawals and an interbank exchange limit of $2,000. If you choose to invest and hold the MCO token, then you can upgrade to a limited edition card. These cards have higher withdrawal limits on ATM and interbank transfers, in addition to looking way cooler, coming in platinum metal ? either in black or space grey. They also have up to 2% Monaco token cash back on all transactions, which you can exchange back to any other cryptocurrency or fiat.

More about Monaco cards (cover picture).

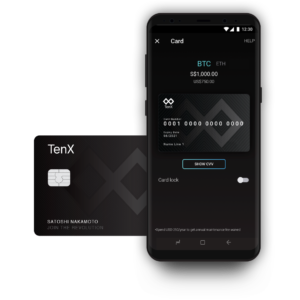

TenX

TenX makes it easy for you to keep and send your virtual currencies as you spend with your TenX card. Harness the power of the Blockchain as you go on your travels. TenX connects your blockchain assets to real world payment platforms. With the app, the TenX card and their forthcoming banking licence, they will be well-positioned to serve as a one-stop hub for seamless interaction between the blockchain ecosystem and the real world. Plus they are super stylish!

Wagecan

Issued by Transforex, Wagecan is a Mastercard debit card, and can be used in the United States. The Wagecan solution is one of the most popular Bitcoin debit cards with digital nomads and location independent freelancers, as it offers a 1.5% foreign currency conversion fee, whereas most other solutions sit at around 3%. Wagecan also offers a slightly lower ATM transaction fee than other Bitcoin debit cards, at 1%. Most of the other BTC debit cards on the market today charge a flat rate fee of between $2.5 to $3.5 USD, so Wagecan?s percentage based fee generally works out cheaper.

The Taiwan-based team behind Wagecan have been providing their service since 2014, and offer both web and mobile accessible wallet system that synchronizes with the card. An interesting feature of the Wagecan card is the wallet address that is printed on each individual card, which is convenient for both depositing Bitcoins as well as immediately converting them to fiat currency. Wagecan is accessible to multiple nationalities, and provides a range of purchase benefits. As the most convenient card for international travelers, Wagecan can be used at more than 30 million ATMS worldwide with more than 210 currencies.

Wirex

Previously known as Ecoin, the Wirex solution presents crypto investors with an extremely flexible Bitcoin debit card and multi currency wallet. Offering both virtual and plastic cards, Wirex make it possible to use Bitcoin to pay for instore purchases, online shopping, and international cash withdrawal. Wirex offer two different card options a virtual Visa card, or a plastic Mastercard with a pin and chip. Both of the card options presented by Wirex can default to either GBP, EUR, or USD as the base currency, and are accepted anywhere in the world where Visa or Mastercard are supported.

The London-based team behind Wirex are currently in the process of rebranding the Wirex platform from their previous Ecoin brand, which has been in operation since 2014. Both online and offline purchases are free with Wirex, for both the virtual card and plastic card solution.

Wirex has adopted a flat rate fee for ATM withdrawals. Domestic ATM withdrawal is priced at $2.50 USD, while international ATM withdrawal is set at $3.50 USD. All of the card options presented by Wirex have a monthly service fee of $1, although the plastic card option does have an initial fee of $17 USD. Wirex plastic cards can be shipped to 130 different countries worldwide, and typically take up to eight weeks to arrive after ordering.

Wirex provide users with a dedicated smartphone app for both iOS and Android that incorporates two factor authentication for heightened security. Conversion between Bitcoin and fiat currency is managed via the app, which also provides users with the ability to load balance from other payment solutions such as Paypal.

The Wirex solution is a simple and easy to use Bitcoin debit card that offers a streamlined user experience. The only drawbacks of the Wirex solution is that verification involves submitting several proof of identity and address documents, and can take up to 10 working days.

Cryptopay

Cryptopay is one of the most transparent and upfront Bitcoin debit card solutions available. Founded in 2013 by a Russian crypto enthusiast team, Cryptopay has already gathered more than 167,000 active users from around the world, and has issued in excess of 37,000 Bitcoin debit cards. The Cryptopay platform is one of the largest BTC debit card solutions, and manages round 100,000 transactions every month. Like the other Bitcoin debit cards on this list, Cryptopay offer both plastic and virtual cards, but provide users with a refreshingly transparent breakdown of costs and terms.

One of the biggest features of the Cryptopay platform is that they provide access to their platform to unverified users, although there are a number of limitations placed on unverified accounts. The Cryptopay plastic card is powered by Visa, and thus can be used anywhere in the world that Visa is accepted. Plastic cards are available with EUR, GBP, or USD base currency, each of which are priced at ?15.00 each.

Cryptopay also offers free standard worldwide delivery on their cards, with the option of express worldwide delivery for an additional ?70.00. Domestic ATM transactions with the Cryptopay card are priced at $2.50 USD, while international transactions are priced at $3.50 USD. Cryptopay allow for unlimited online transactions with verified card users, but restrict unverified users to $1000 USD. The daily ATM transaction limit for unverified users is $400 USD, with a total lifetime withdrawal limit of $100. Verified users, however, are able to withdraw up to $2000 daily via ATM, with unlimited lifetime withdrawals.

Cryptopay offers 3% foreign transaction fee, and an additional 1% conversion fee from Bitcoin into fiat currencies and visa versa. Despite the slightly higher overall pricing structure of the Cryptopay platform, it offers unrivaled transparency and provides free card shipping worldwide.

Coinbase Shift Card

Coinbase was the first platform to provide crypto enthusiasts with the ability to spend their Bitcoin directly via their Shift Card solution. Linked directly to the Coinbase wallet system, the Shift Card is currently only available in the United States. The Coinbase Visabased Shift Card can be used at 99% of merchants around the world. Using the Coinbase Shift card is relatively simple once the Shift card is connected to a Coinbase wallet, the value of purchases made with the card are deducted from BTC balance and converted to USD at the current exchange rate.

When compared to other debit card solutions in the industry, the Shift card offers a number of attractive advantages. With no monthly fee or POS charges, the Shift card offers a domestic ATM withdrawal fee of $2.50, and an international ATM withdrawal fee of $3.50, which is standard in the Bitcoin debit card sector. The initial issuance fee of the Shift card is just $10, but it does come with some more limiting restrictions than other Bitcoin debit cards. Daily spending limit is capped at $1,000 USD, and the daily maximum ATM withdrawal is just $200 USD.

Bitwala Visa

The Bitwala Visa Bitcoin debit card is a promising new Bitcoin card solution that is powered by the Bitwala platform. Boasting the fastest global bank transfer across borders, Bitwala claims to offer the world?s leading prepaid card for bitcoiners. As an all in one cryptocurrency debit card, the Bitwala Visa allows crypto enthusiasts to access more than 20 different currencies around the world with over 40 cryptocurrencies. Bitwala already boasts more than 15,000 users from 120 countries around the world, and has been developing their platform from a Berlin base since 2012.

The Bitwala solution presents both virtual and plastic options, and is compatible with a wide range of different currencies, including USD, EUR, GBP, JPY, KRW, VND, AUD, and even several South American currencies. By partnering with ShapeShift, Bitwala accepts a broad spectrum of altcoins as top up methods, including Litecoin, Monero, Zcash, and Dogecoin.

Bitwala offers three levels of membership, each of which offer different monthly limits, withdrawal limits, and topups. Unverified level 1 users are provided with only limited service, while verified level 2 users are able to access unlimited purchases and ATM withdrawals. Level 3, which requires a Skype interview, provides a massive monthly limit of ?50,000 EUR.

As one of the most flexible cryptocurrency debit cards, Bitwala is accessible to individuals in over 120 different countries. Both the plastic and virtual cards issued by Bitwala are priced at ?2 EUR, with a ?1 EUR monthly fee. The ATM withdrawal fees offered but the Bitwala Visa solution are slightly more lenient than other options, with a domestic fee of ?2.25. International ATM withdrawal fees are priced at ?2.75, with a 3% currency exchange rate.

Unlike other Bitcoin card solutions, Bitwala also offer an exceptionally transparent exchange rate. Bitwala also provide a market Bitcoin conversion rate with no added margin. As a powerful all in one multi currency solution, the Bitwala Visa is the ideal solution for crypto enthusiast that have exposure to multiple cryptocurrencies. The only drawback of the Bitwala Visa is that due to current legislative restrictions in America it can?t be issued to US citizens.

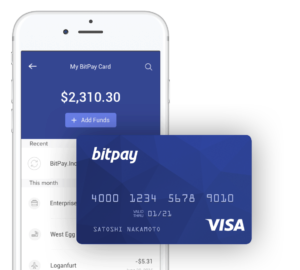

BitPay Card

Bitpay offer what is the most refreshingly honest approach to Bitcoin debit cards, and provide a significant amount of guidance on how to best leverage the benefits offered by their solution without incurring excessive fees.

The Bitpay card is powered by Visa, and offers virtually identical fees and terms to the Xapo card above, with a 3% foreign exchange rate. While the Bitpay solution doesn?t offer the flexibility some of the other solutions in this list offer, it is available to US residents, which makes it an attractive option to US-based crypto enthusiasts.

Before deciding which card feels like the right fit for you, remember to keep in mind a few key factors, such as the fee structure, exchange rates and inactivity penalties. When it comes to fast access to funds without the large costs associated with traditional card solutions, however, Bitcoin debit cards are a far more attractive solution than their contemporary counterparts.

Naga

Users of the NAGA debit card will have global access to anywhere, which already accepts Mastercard. Funding of the card has been made with usability in mind, loading the NAGA debit card with funds is simple and follows the usual conventional methods of funding a bank account or card. The advantage of the NAGA debit is that users are able to find with cryptocurrencies, including the native NAGA token, NAGA Coin.

Paycent

Paycent, a Singaporean financial technology company billing itself as ?the better bitcoin debit card? while still working on the service that plans to be ready in a couple of months has offered interested users early access rewards. Those who email potential users such as friends or family an access code can earn 0.01 BTC along with the referral if the person spends 0.1 BTC or more when the Paycent debit card is released.

No fiat currency is held on Paycent Visa debit cards. When using the Paycent card for shopping, the company approves the card transaction and converts the amount spent into bitcoin at the time of the transaction.

SOURCES: FINDER BITCOIN EXCHANGE GUIDE 99 BITCOINS

Originally published at VISIONAIRE.