Photo by Philip Strong on Unsplash

Photo by Philip Strong on Unsplash

The newsvendor model is a core concept in supply chain and inventory management. The premise is simple. Imagine a vendor, selling newspapers on the street. Each morning, they have one chance to buy newspapers in bulk from the printer. How many copies of today?s paper should the vendor stock, knowing that unsold copies end up worthless?

All things considered, the newspaper vendor?s dilemma is easy to solve, but the method used to solve it can be applied to a wide variety of more complicated problems. Today, I?ll walk through the basics of the newsvendor model, discuss ways to build a more sophisticated model, highlight situations where it shines, and point out a few common pitfalls. Soon your team will be ready to put the newsvendor model into action!

Stepping Through Newsvendor Basics

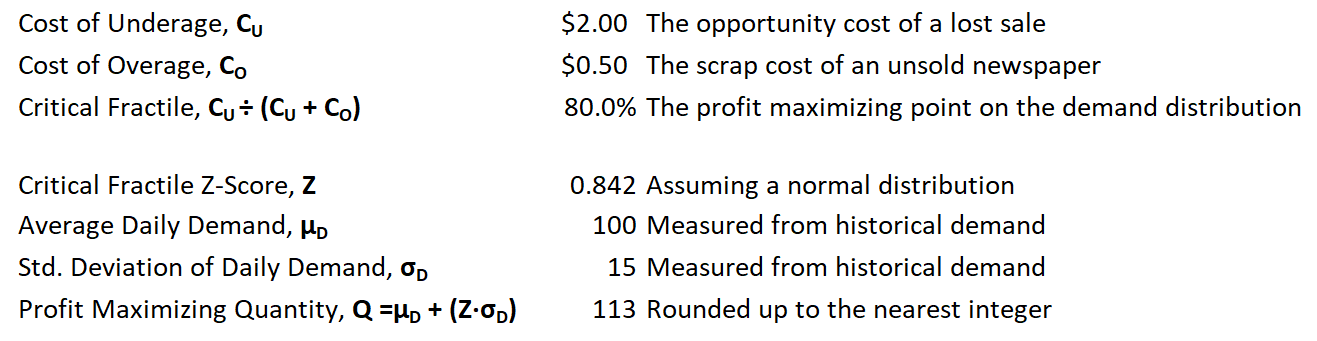

Let?s say the vendor buys papers in bulk for $0.50 each and sells them for $2.50. Every paper sold generates $2.00 in profit, and at the end of the day unsold papers are discarded for a $0.50 loss. Naturally, we expect the vendor to prefer having some extra papers, because turning away a customer is more painful than tossing out a paper. In order to know just how many extra, we?ll need to know a little bit about expected demand. But first, some key terms.

The opportunity cost of turning away a customer is known as the Cost of Underage, CU. In this example, the cost of underage is the profit margin of $2.00.

The cost associated with discarding an unsold newspaper is called the Cost of Overage, CO. For the vendor, it is the price they paid per newspaper, $0.50 in this case. Both of these costs can include other factors ? more on that later.

To find the profit maximizing point, we?ll have to compare these costs while also considering demand. The ideal point on the demand distribution is called the Critical Fractile (C.F.), calculated as follows:

C.F. = CU (CU + CO) = $2.00 ($2.00 + $0.50) = 0.8, or 80%

Let?s say demand is normally distributed, with an average of 100 and a standard deviation of 15 newspapers per day. Now, we have enough information to translate the 80% mark into an actual quantity by calculating a z-score and applying it to the demand distribution?s parameters.

Voila! The profit maximizing quantity is 113 newspapers! Be sure remember the ?round up rule.? Always round up! For example, if bulk newspapers were only sold in packs of 10, you would stock 120, not 110. For a formal derivation, check out the Wikipedia page.

Getting More Advanced

In the real world, newsvendor problems are more nuanced and we need to account for more factors. The first step is to use more sophisticated overage and underage costs.

The cost of overage tends to be easier to determine. Here are some commonly added components:

- Salvage Value ? Can you reclaim any amount of value? Metal parts can be sold to scrap yards, perishable food waste can be sold to composting companies.

- Inventory Holding Costs ? How much does warehouse space cost? What about overhead? Often these can be estimated per pallet or per square foot.

- Opportunity Cost of Capital ? Instead of investing in inventory, what else could you do with the money? Perhaps there are other projects your business wants to pursue. At worst, you could buy US treasury bills and earn some risk-free interest.

There are fewer terms added to the cost of underage, but they can be tricky to figure out:

- Goodwill Cost ? The penalty to a company?s reputation for turning a customer away. The customer might get upset or frustrated and think twice before placing an order next time. You might think of this as a reduction to the lifetime value of a customer.

- Expedite Fees ? Sometimes stock-outs are simply not acceptable, and you might be forced to pay expedite fees to a supplier to deal with an impending shortage.

- Increased Costs from Flexible Suppliers ? Some companies have a dual supplier strategy, with a long lead-time/low cost primary option and a short lead-time/high cost secondary option. This cost difference can be considered in the underage cost.

The other component of the model is the demand distribution. In our example, we assumed demand to be normally distributed, which is not an insignificant assumption. If you are using the normal distribution you should be prepared to justify it with data. Sales can never go below zero, so the normal distribution is often inappropriate for slow-moving items (consider the gamma distribution instead). Alternatively, set up the problem to make use of the central limit theorem so you can use the normal distribution.

With a little creativity, the newsvendor model can help solve a wide variety of problems. Tiered pricing, protection levels, discounts, and many other considerations can be taken into account. Truly it is a powerful technique!

Situations Where the Newsvendor Model Shines

Whenever Demand is Uncertain

One core concept of the newsvendor is that you should favor outcomes that are less painful. That is to say, if you are going to be wrong, would you prefer to be overstocked or understocked? And just how far are you willing to go? The newsvendor model provides a structured way to think through such decisions and choose a stocking point in the face of uncertainty. Structured decision-making is especially valuable in situations with multiple stakeholders, each with different priorities. The newsvendor model combined with a solid business process can get everyone on the same page and stop finger-pointing if things go awry.

One-Shot or Seasonal Decisions

If you have to make a decision and stick with it, the newsvendor model is great. Many companies use the model to decide how many Halloween costumes or Christmas decorations to stock, since order must be placed months in advance. Legacy electronic component purchases can also lend themselves to the newsvendor. Many components go obsolete and companies must place ?last-time-buys.? The newsvendor is a great strategy to determine how many legacy parts to buy while engineering updates the design.

Competitive Markets

Products sold in competitive, liquid markets lend themselves well to the newsvendor model because overage and underage costs are easy to calculate. Often, goodwill cost can be ignored, as customers have very low switching costs and might not even notice stock-out events. Price elasticity also plays an important role. Many products are practically guaranteed to sell given a sufficient discount, which helps to enumerate overage costs. These market conditions are ripe for profit-maximizing behavior.

Common Challenges With the Newsvendor Model

Overage and underage costs can be hard to determine, especially for items without a shelf life

No one ever wants to turn a customer away because of a stock-out. You might lose their business for good! Industries that rely on deep customer relationships (often with high switching costs) may have a substantial goodwill cost associated with underage events. How do you value the likelihood that a stock-out will be ?the straw that broke the camel?s back,? causing your customer to start looking at new suppliers? The concept is intuitive, but coming up with a number is challenging, which often leads companies to be excessively risk-averse.

Overage costs are generally more straightforward, but a common trap is to assume all inventory will get used eventually. Another pitfall is counting on the engineering department to find ways to use excess inventory. Parts go obsolete, customer preferences change, and engineers have long lists of projects that need to be prioritized. Scrap is a fact of life, but estimating probability-weighted scrap costs or engineering costs can be puzzling.

Sometimes, you have no idea what demand will look like

There is a big difference between demand uncertainty and demand ignorance. In the former case, the shape and nature of demand are reasonably well known, with informed estimates for high and low outcomes. In the latter case, the range of potential outcomes is very large and demand estimates are speculative rather than backed up by data. The most frequent instance of demand ignorance is in brand new products without a track record. Companies should look for opportunities to get early indications of demand and use that to inform their decisions. Making wild guesses is a recipe for disaster.

It is better to be lucky than good

The newsvendor maximizes the expected value of profits, but this doesn?t mean actual outcomes will be the most profitable. Imagine flipping a coin 1,000 times ? you can expect to get heads close to 50% of the time. But, if you flip a coin 5 times, there?s a chance you?ll see 100% heads. Take special care with big, infrequent decisions, especially those with all-or-nothing outcomes. The newsvendor model can help you identify whether you prefer to bet on heads or tails, but the story shouldn?t end there. Communicate well with stakeholders and look for creative ways to reduce uncertainty.

Final Thoughts

I hope this has been a useful introductory primer to the newsvendor model. It is a powerful tool at the core of many supply chain and operations strategies. My last takeaway for you is to remember that numbers don?t make decisions, people do. Any time you use a model like this, focus on clear and concise rationale for what you include. Identify sources of bias and give them a name. Don?t make things more complex than they need to be. With a solid understanding of the basic theory and a little thought, the newsvendor model can help your company achieve success. If you need some help, don?t hesitate to reach out to us.

What has your experience been like with the newsvendor model? Have you used it effectively, or found it difficult? Leave a comment below!

This article was originally posted at https://gearsanalytics.com/the-newsvendor-model/