Anyone can publish on Medium per our Policies, but we don?t fact-check every story. For more info about the coronavirus, see cdc.gov.

Aussie property is primed to collapse at the hands of Coronavirus

?Only when the tide goes out do you discover who?s been swimming naked? ? Warren Buffet

?Only when the tide goes out do you discover who?s been swimming naked? ? Warren Buffet

In Australia, where the last recession predates the invention of the web-browser, property prices have been steadily outpacing earnings since the 1980s. The number commonly used to measure housing affordability, the median multiple, capturing the ratio of median house prices to median income was around 6 for Australia in 2017 (and 12.5 for Sydney). That?s nearly the highest in the developed world, lagging only Hong Kong (anything over 5 is considered ?severely unaffordable?). However, it?s all about to come tumbling down at the hands of a complete economic reset.

Necessarily, to support these high prices, high levels of debt have been required for buyers to get into the market. On its own, high debt isn?t a problem, it?s the ability to service debt that risks tipping the first domino of the housing market over. When owners are struggling to meet mortgage payments it?s called ‘mortgage stress?. According to Digital Finance Analytics, around 33% of mortgage holders were in mortgage stress before Coronavirus struck.

High mortgage stress leaves property prices vulnerable to small increases in unemployment since owners are already running on tight cash flows, so can easily tip over the edge should they lose their job. However for years the unemployment numbers in Australia have remained consistently strong. Even through the global financial crisis, the Australian economy came out of the other end remarkably unscathed, largely due to the lucky timing of a mining boom. But something happened after all this; complacency and overconfidence took hold of the market as people convinced themselves that houses were somehow risk-free investments. All of this was in spite of the fact that Australia (and New Zealand) were, for the most part, outliers in their affordability. Regardless, buyers kept their blinkers on and the market continued to overheat.

The period following the GFC became characterised by a culture of exuberance eerily reminiscent of the 1920s as people came to think the markets were bulletproof. The media, the banks and even the government all played a part in encouraging the delusion. As investors took out more and more debt to fuel the cycle, it was no accident that companies like ?Afterpay? became the new stock market darlings, usurping businesses that produced anything with inherent value. The mainstream view of debt shifted from being frowned upon, to accepted, to actively encouraged of all. To inflate unsustainable GDP numbers the government asked its citizens to ?go out and spend?. When the people heeded the government?s request, it may have served as a temporary shot in the arm to GDP, but it came at the expense of a protective buffer to those households and businesses should we slip on our economic footing and unemployment should climb. Despite Australia?s extraordinary wealth and great quality of life, Aussies had next to no cash in the bank. As of 2019, the bottom 50% of Australian households had less than $7,000 stashed for a rainy day.

Now, with Coronavirus, Australia is about to be hit by an unemployment Tsunami. Estimates from AMP capital and Westpac are expecting unemployment to go to roughly 11%, however these numbers seem hopelessly optimistic considering just the ?Retail? and ?Accommodation and Food? sectors of the economy employed two million Australians in 2019 (or 16% of the working economy). For context, FRED economist Miguel Faria-e-Castro expects the US to land somewhere between 10% and 40% next quarter. Even at a 10% unemployment rate, AMP Chief Economist Shane Oliver recently stated that property would be expected to drop 20%, so now, as unemployment continues to deteriorate, it?s unclear just how far we may end up falling.

The biggest four Australian banks have, of course, recognised that their cash cow is on life support, and rushed to announce mortgage deferrals for 6 months. However this will only stem the bleeding temporarily, since homeowners will come out the other side owing more interest with less savings and likely, no job. Further, not every lender will offer relief, and not every loan will be eligible, so it is inevitable that we will see more forced sales coming sooner rather than later which will swing momentum and begin to apply unprecedented downward pressure on prices.

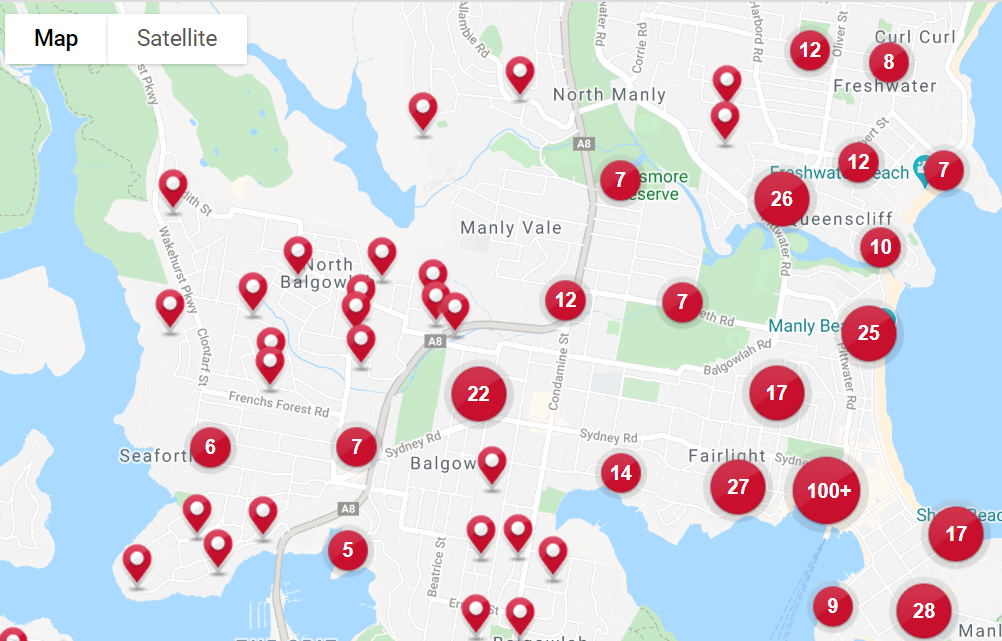

Exacerbating the local supply and demand issues are the global effects of Coronavirus, the closure of our borders will see thousands of Airbnb properties reintroduced onto the Aussie market and stifle offshore demand for Australian property as money is lost around the world. Here?s what you see when you search for furnished apartments in the area of Manly (note that rentals in Australia are usually unfurnished):

Hundreds of ex-Airbnb rentals are flooding the rental market in Sydney

Hundreds of ex-Airbnb rentals are flooding the rental market in Sydney

It really is the perfect storm, but while it?s true that we are on the brink of a significant correction in Aussie house prices, it?s not all doom and gloom. Generations have been excluded from the joys of home ownership by leveraged investors with flagrant disregard for the risks they were taking. So, for the next 6 months, I?m going to watch the market change shape with some enthusiasm (and of course, some Avocado toast).