A comprehensive look at the leader of electric vehicles.

Preface

Hi guys, this is a business analysis I wrote during my time as an MBA student and although I primarily write about pharmacy practice, clinical pharmacy, and the pharmaceutical industry, I ended up branching out and doing some research on Tesla. If there is one thing I learned about this company, is that Elon Musk is literally a living god. Without him, Tesla would not be where they are today. In fact, without Elon Musk, this company would totally be broke. Despite the swelling debt Tesla has incurred, the confidence in Elon Musk is so substantial that he continues to add so much value to the company and investors literally throw money at him because they believe in him so much. Anyways, I hope you guys enjoy this rather off topic post.

Introduction

Imagine a future in which every person waking up in the morning has a car fully charged from a solar charger. With Tesla vehicles, the future of sustainable and renewable energy may come much sooner than later in the transportation field. The rise of the electric vehicle market was spearheaded by Tesla and its innovative lithium-ion batteries with a range of more than 200 miles per charge. Prior to Tesla beginning its endeavor as the first fully electric vehicle in the industry, other automobile manufacturers had only hybrid gasoline-electric vehicles. Tesla became the first automobile company to successfully create and design a fully electric and rechargeable vehicle that was both beautiful and capable of competing with gasoline powered cars from even the most established automobile manufacturers in the United States.

To better assess the rapid growth of Tesla, this case analysis was developed to assess the impact Tesla is making towards the US automobile manufacturing industry and its current financial situation. Additionally, this case analysis will review the development of electric vehicles as an industry and the expansion of renewable energy.

While Tesla can be considered a pioneer within the electric vehicle industry, other companies have also decided to capitalize on this market by competing with Tesla directly. These companies include General Motors, Toyota, BMW, and Daimler AG.

Industry Analysis

The industry analysis will focus on three primary analyses that will be tailored for Tesla. These analyses will include key aspects of the general environment specific to Tesla, an analysis of Porter?s five forces, and an overview of Tesla?s major competitors involved within the electric vehicle industry.

General Environment

The general environment for the electric vehicle industry is the external factors that may have either a positive or negative impact on a firm?s business strategy. In this case analysis, three primary segments of the general environment will be used to assess the competitive advantage Tesla has gained within the electric vehicle industry.

Global Segment

With the growth of Tesla?s popularity also came the goal to achieve zero emission electric power by focusing on solar powered Superchargers. By February 2015, Tesla had established 2,000 Superchargers worldwide that were free to use for Tesla owners. The expansion of the global network of Superchargers and the rapid success Tesla has made with their functional electric vehicles allowed the expansion of their firm throughout North America, Europe, Asia, and Australia.

Sociocultural

The Tesla Roadster became the catalyst which allowed the production of more affordable electric vehicles such as the Tesla Model S in 2013, the Tesla Model X in 2014, and the Tesla Model 3 in 2017. The successive and more affordable Tesla vehicles allowed a broader portion of the public to have the opportunity to drive a fully electric vehicle. The Tesla vehicles also allowed these consumers to utilize solar powered charging stations and avoid the of rising costs of fossil fuels.

Technological

Tesla became a rapidly growing player in the automobile industry made while making an impact on the renewable transportation energy sector as indicated with the sales of the Model S from 2014 to 2015 increasing by approximately 55%. The desirability of Tesla?s vehicles expanded the electric vehicle industry. The growing rise of green energy allowed the technological advances made by Tesla to ultimately give rise to a competitive and technological market for consumers.

Porter?s Five Forces

Porter?s Five Forces are composed of five sections that collectively allow a business analyst to determine how effectively a firm can set prices and minimize costs. The significance of these five forces allows an analyst to make appropriate business decisions that may have the potential to make an impact on future products or services.

Intensity of Rivalry Among Competitors

The intensity of rivalry among other competitors has steadily increased and is moderately high. Multiple companies have attempted to create an electric smart car to compete with Tesla, but the bottom-line for many of these companies is the fact that their vehicles will never be a Tesla. Competitors have yet to design a car that looks beautiful and futuristic with a performance that is comparable to a gasoline powered car and as efficient as a Tesla. Additionally, no other competitor has yet to replicate a similar network of 2,000 charging stations across the globe.

Threat of New Entrants

The threat of new entrants in the electric vehicle industry is moderately high. The unique aspect Tesla has gained, is the fact that the company produces its very own proprietary lithium-ion batteries with a range of more than 200 miles per charge. As of this time, no other companies have developed a comparable battery that could compete with Tesla. Therefore, the threat of competition is relatively low. However, the desirable nature of zero emission electric power and the vision Tesla created with their beautiful and modern cars with similar performance to gasoline powered cars have raised expectations for consumers.

Bargaining Power of Buyers

The bargaining power of the buyers is moderately low. Although buyers will ultimately decide whether they will purchase a product or not, Tesla and other competitors will set prices for the premium of utilizing their battery powered vehicles. The cost of building proprietary batteries along with solar powered Supercharger stations will take into account for pricing despite the free use of the charging stations to Tesla owners. Ultimately, the buyers will not be able to dictate the price of electric vehicles unless the vehicles become unaffordable to mass consumers.

Bargaining Power of Suppliers

The bargaining power of suppliers is significantly high. When Tesla entered the automobile industry, many suppliers were not capable or willing to change their production to allow the specialized production of Tesla vehicles. As a result of limited suppliers, Tesla became less selective with its choices of suppliers, often having to pay certain suppliers more than others due to minimal competition. Tesla attempted to reduce switching costs by becoming more flexible with suppliers, but typically only one supplier would emerge fulfill components needed for Tesla vehicles and the supplier would ultimately dictate the prices.

Threat of Substitute Products

The threat of substitute products is moderately low. At this time, no other companies have achieved the same success as Tesla with regards to a fully electric vehicle. Other major automobile companies have gain success with Plug-in hybrid electric vehicles (PHEV) such as the Toyota Prius, but no other companies have developed the same propriety lithium-ion battery with a comparable 200-mile range per charge or a comprehensive charging station network that is free to use. Other companies would have to innovate on a level beyond that of Tesla and produce a product that is significantly superior in order to be an acceptable substitute.

Major Competitors

Although Tesla Motors did not obtain a substantial portion of the automobile manufacturing industry (only 4.5% of market share), they quickly became one of the most successful companies to compete in this industry. Tesla primarily competed with General Motors? hybrid electric Chevy Volt, Toyota Motor Corporation?s hybrid electric Toyota Prius, BMW?s i-series, and Daimler AG?s Mercedes-Benz B-Class Electric Drive.

Financial Analysis

The financial analysis will include assessments of the balance sheet, the income statement, financial ratio analyses, and the DuPont formula. The purpose of this analysis is to assess the financial health and stability of Tesla. The primary focus of the financial analysis will include the performance of Tesla over a five-year trend, the financial strengths and weaknesses, and to determine financial worth to stockholders.

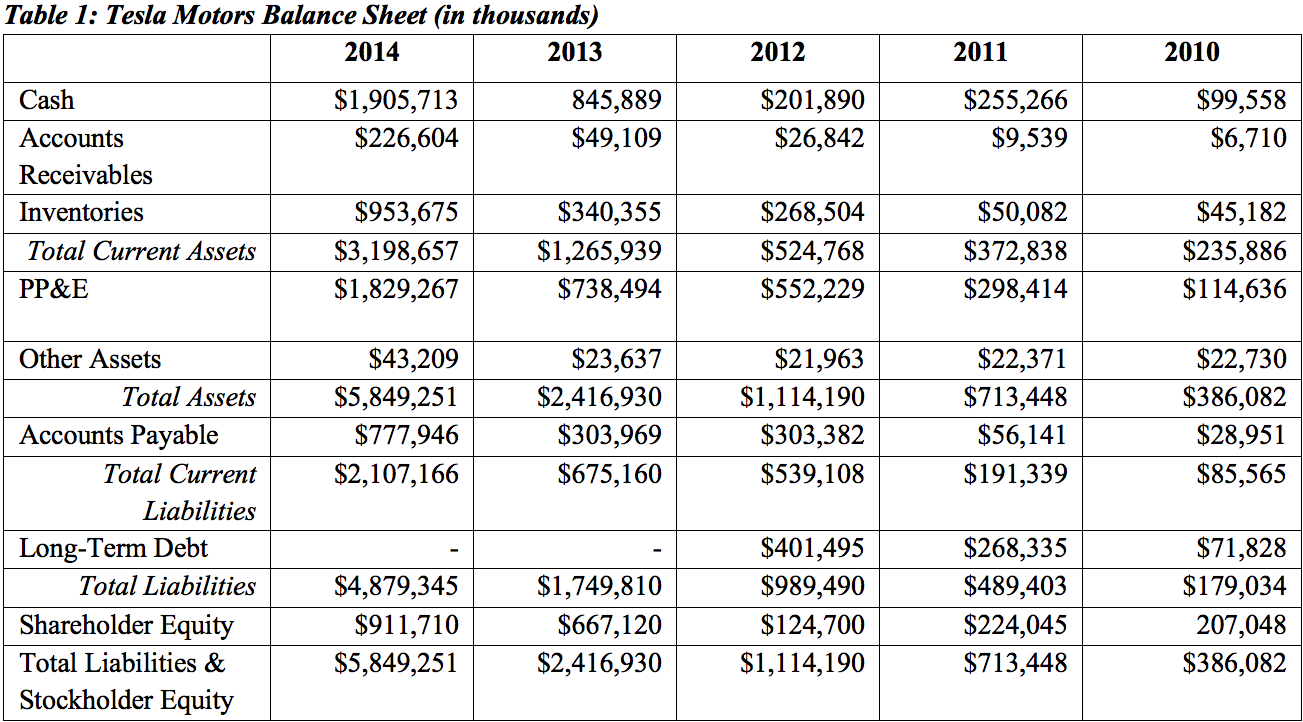

Balance Sheet Analysis

Based on the balance sheet (See Table 1), Tesla?s total assets and total liabilities have rapidly increased. In 2010, Tesla total assets were $386,082 and have increased to $5,849,251 in 2014. However, Tesla?s total liabilities have also increased from $179,034 in 2010 to $4,879,345 in 2014. Tesla generated an exponential growth in cash from $99,558 in 2010 to $1.9 million in 2014 likely as a result of an increase in sales and debt. Tesla?s shareholder equity has been steadily increasing from $207,048 in 2010 to $911,710 in 2014.

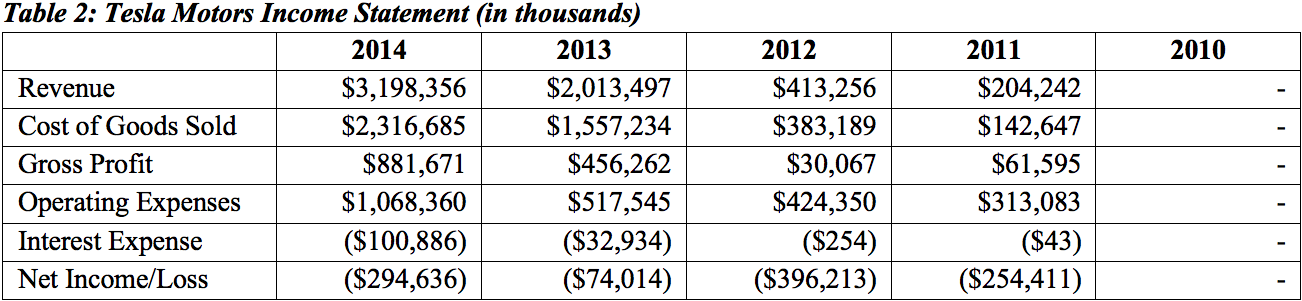

Income Statement Analysis

Tesla?s total revenue has exponentially increased from $204, 242 in 2010 to $3.1 million in 2014 (See Table 2). Tesla?s cost of goods sold continue to increase from $142,647 in 2011 to $2.3 million in 2014 while the company?s gross profits also continue to increase from $61,595 in 2011 to $881,671 in 2014. However, the substantial annual increases in operating expenses from $313,083 in 2011 to $1.07 million in 2014 in addition to rising annual interest expenses have resulted in consistent annual net income losses averaging $197,576 between 2011 to 2014.

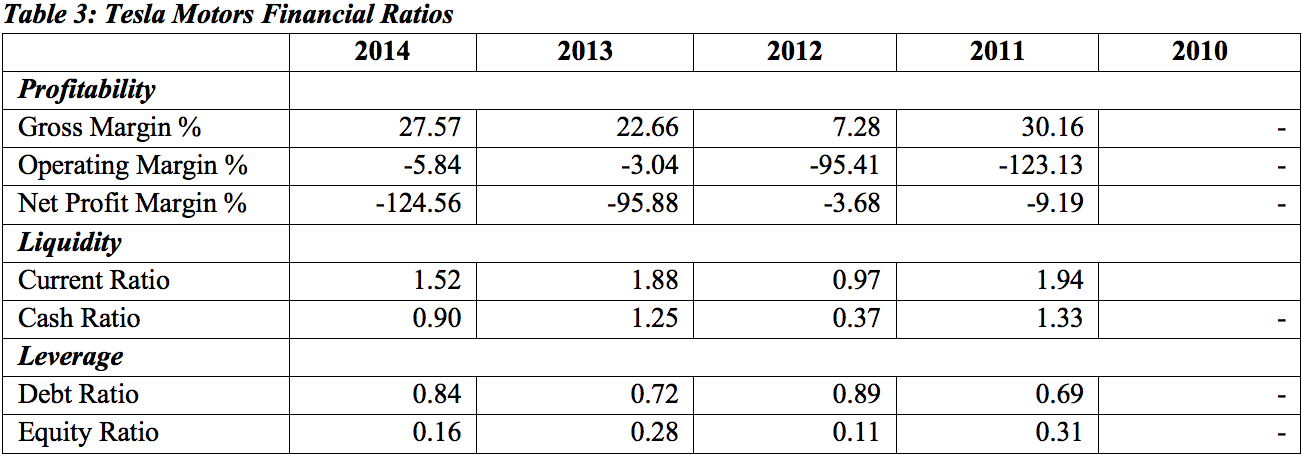

Ratio Analysis

The ratio analysis will include each of the following ratios: liquidity ratios, profitability ratios, and leverage ratios. The analysis of each individual ratio will allow an analyst to determine critical information in order to fully assess Tesla?s ability to pay off short term debt, determine profit generating capabilities, and assess the risk of solvency.

Liquidity Ratios

The liquidity ratios are used to determine Tesla?s ability to meet short term obligations. As of 2014, Tesla?s current ratio is 1.52 and cash ratio is 0.9. The most significant change in current ratio was between 2012 to 2013 in which the current ratio increased from 0.97 to 1.88. This was due to an increase in current assets and more specifically, a substantial increase in cash. The increase in cash can be attributed to substantial increase in total revenue (See Table 3).

Profitability Ratios

The profitability ratios determine how well a company is generating a profit with each ratio providing details on a different aspect. Tesla?s gross margin in 2014 was 28% and has remained relatively flat except for 2012 when the gross margin dropped to 7.28%. This drop in gross margin was a result of a 50% reduction in gross profit due to a 270% increase in cost of goods sold, likely due to issues in supply chain process and limited suppliers. The most significant change in operating margin was between 2012 and 2013 in which the operating margin improved from -95% to -3% likely due to a significant increase in total revenue. The net profit margin continued to trend downward with the largest difference between 2012 and 2013 from -3% to -95%. This was likely due to sustained annual net losses (See Table 3).

Leverage Ratios

The leverage ratios are used to determine Tesla?s degree of risk associated with debt. The most significant change in Tesla?s equity ratio was between 2011 to 2012 in which the equity ratio decreased from 0.31 to 0.11 as a result of a decrease in total equity and an increase in total assets. The most likely cause of the increase in total assets between 2011 to 2012 is the 500% increase in inventories, although an increase accounts receivables and PP&E may also make some contributions to the equity ratio. Coincidentally, the debt ratio also increased between 2011 to 2012 from 0.69 to 0.89 indicating that the increase in total equity was financed through increases in accounts payable and long-term debt thereby increasing the debt ratio (See Table 3).

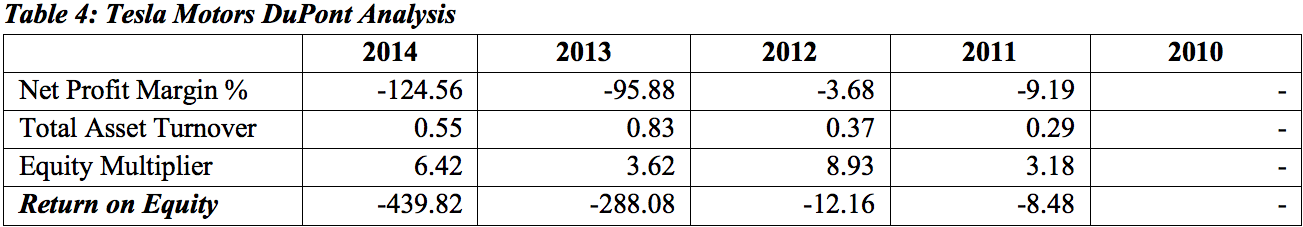

DuPont Formula

The DuPont formula consists of three primary ratios that are multiplied together to determine Tesla?s earnings from its assets (ROE). The formula consists of the operating efficiency (profit margin), asset efficiency (total asset turnover), and the financial leverage (equity multiplier). Tesla?s most significant change on return on equity was from 2012 to 2013 in which return on equity substantially decreased from -12% to -288% (See Table 4). Upon analyzing the components, we see that there is an increase in profit margin in 2013 to 2014 from 10% to 28% resulting from an increase in net losses despite an increase in total revenue. The total asset turnover increase between 2012 to 2013 from 37% to 83%. This was a result of an increase in total revenue. The equity multiplier also decreased between 2012 to 2013 from 8.93 to 3.62. This was a result of an increase in total equity, and more specifically from the massive increase in stock price Tesla experienced in 2013. Ultimately, the reduction in return on equity between 2012 and 2013 resulted from the reduction in net profit margin, more specifically the sustained net loss of income (See Table 4).

Company Analysis

This company analysis was specifically tailored for Tesla, to asses key business aspects that are vital for its success. This section includes Tesla?s Mission and Vision, a methodical resource-based view (VRIO), key success factors, and the attractiveness of Tesla as a company.

Mission and Vision

Tesla?s mission and vision is to accelerate the world?s transition from a mine-and-burn hydrocarbon economy towards a solar electric economy. The primary goal of the company, since 2003, was to produce electric cars that are charged with zero-emission electricity while also outperforming gasoline powered cars both in driving experience and efficiency. Today, Tesla has continued to focus on this mission by continually making electric cars more affordable to reach a broader consumer base.

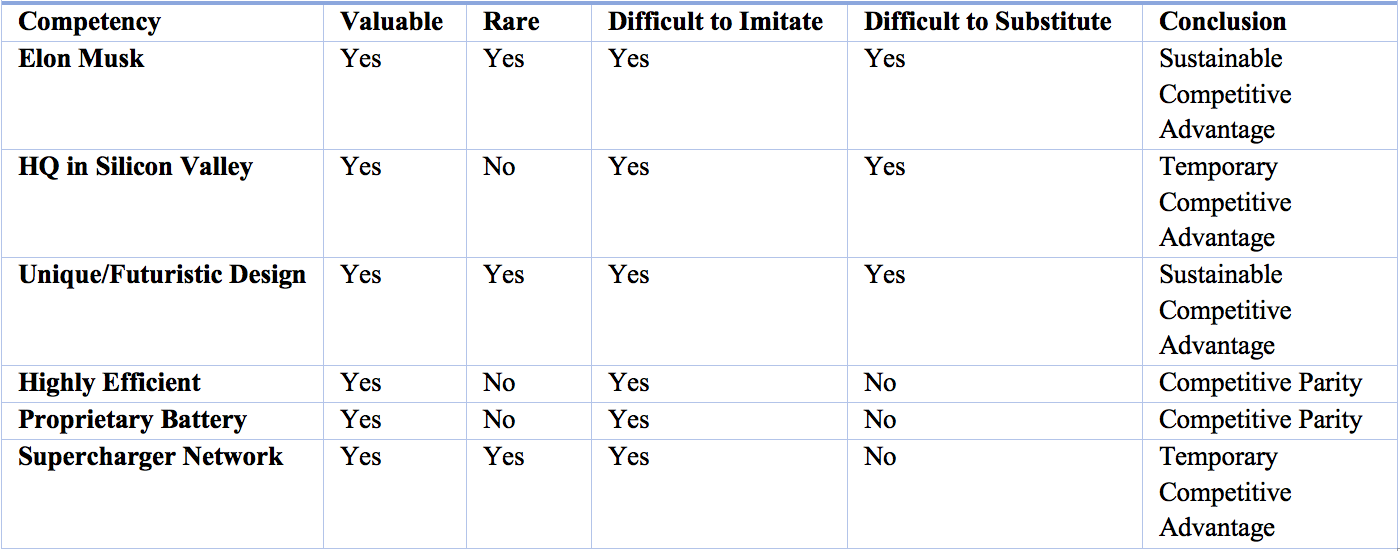

Resource-Based View (VRIO)

The resource-based view (VRIO) analysis is used to determine if competencies within a firm can provide a competitive advantage. The VRIO constructed below (See Table 5) highlights Tesla?s important competencies and strategic advantages. Based on Table 5, the greatest competencies of Tesla include its innovative CEO, Elon Musk and the unique/futuristic design of its modern electric vehicles with each competency achieving a ?sustainable competitive advantage? as these competencies cannot be easily replicated. Temporary competitive advantages include Tesla?s current headquarters in Silicon Valley and its Supercharger Network since other companies will eventually develop these competencies over time. However, the high efficiency of Tesla vehicles in addition to its proprietary batteries are competitive parities since other companies can replicate both with hybrid electric-gasoline powered vehicles.

Table 5. Tesla?s VRIO

Key Success Factors

The primary key success factor is the CEO, Elon Musk. His success in turning small startup companies into multibillion dollar companies in addition to his goal of innovation has garnered a culture for hiring only the best talents. The location of Tesla in Silicon Valley allowed for the acquisition of excellently trained, ambitious, and highly committed individuals that help pave the success of Tesla. The unique futuristic design of the cars along with the excellent performance that could rival even the most powerful gasoline powered cars also created a strong desire for driving and obtaining a purely electric car. Lastly, the Supercharge Network of almost 2,000 all over the globe allowed Tesla owners to charge for free, provided a great service for Tesla consumers.

Attractiveness of Company within the Electric Vehicle Industry

Tesla was able to capture a unique niche in the automobile manufacturing industry. Despite other companies attempting to replicate smart electric cars, no company has been as successful or mainstream as Tesla. When one considers an electric vehicle, they simply think of Tesla.

Case Presentation

Tesla?s current business model has relied heavily on the its ?Secret Master Plan?, which was unveiled in 2006. This four-step chronological action plan was the blueprint Tesla utilized to manufacture electric cars with the goal of charging with zero-emission electric power. The four-step plan was initiated with the launched of the Tesla Roadster in 2006. The Roadster was a purely electric sports car and the goal was to enter the sports car segment of the automobile industry where consumers were prepared to pay a premium. Once Tesla gained credibility, the company was able to drive down markets as fast as possible to higher unit volume and lower prices with the next models to be produced.

The first step of the plan created the electric sports car segment and was successful enough to fund further R&D of the next Tesla vehicle. With the production of the Tesla Model S, the second step of the action plan was implemented. The goal during this step was to build a more affordable car for a family. In 2012, Tesla launched the Tesla Model S with a focus on a broader and more consumer-friendly vehicle and a greater range (265 miles per charge) along with seven seats. The Model S quickly won several awards including 2013 Car of the Year.

Following the success of the previous Tesla vehicles, the third step of the plan was implemented with the announcement of the Tesla Model 3 in 2014. This third step emphasized an even more affordable car with the Model 3 being priced at $35,000 and to be available in 2017. The final step of the plan was to also provide zero-emission power generating options and this resulted in the expansion of over 2,000 solar powered Supercharger stations and the Tesla Powerwall home battery.

Problem Identification

Despite the rapid growth and success of Tesla since 2003, the company has steadily been sustaining net income losses annually since 2011. The initial launch of the Tesla Roadster earned a high margin but most of the earnings were reinvested into R&D to produce successive Tesla vehicles. When Tesla launched the Model S in 2012, its revenues increased significantly each year following the launch. However, Tesla continued to experience constant net income losses annually since 2011. Even after investing $1.9 million of generated cash into the production of the Gigafactory to produced lithium-ion batteries on a larger scale, Tesla continued to experience net income losses despite expecting a net profit.

During the initial public offering of Tesla in 2010, the company closed with shares valued at $23.89. The issuance of stock allowed Tesla to earn $238 million in public offering and continued to expand its company. Three years after going public, its stock price rapidly increased up $291.42 in 2014. Continued growth and development in addition to the future outcomes of sustainable energy provided confidence for investors despite net income losses annually. The strength of Tesla?s increasing stock price was the expected future returns.

The issue Tesla is facing from a business perspective, is the fact that the company is not a very profitable company. They continue to increase their total liabilities and it has constantly exceeded the revenue annually. Between 2011 and 2014, the company continues to underperform with constant net income losses. Based on the DuPont Analysis (See Table 4), the company has exponentially decreased in return on equity from -8.48% in 2011 to -439.82% in 2014. The company is eventually going to reach a breaking point in which the confidence of the investors will no longer be enough to fully sustain continued net income losses.

Alternatives

Since Tesla continues to earn net income losses annually, some alternatives this company may consider pursing includes: transitioning towards the development of hybrid electric-gasoline cars, executing only step three of the master plan, or focusing only in the development lithium-ion batteries.

The issue with purely electric cars is the fact that they are limited with the ability to be charged. Tesla owners are limited to roughly 200?265 miles per charge forcing Tesla consumers to remain within close proximity to home charging or relying heavily on a Supercharger station which may or may not be near their local area. By transitioning into developing hybrid gasoline-electric cars, Tesla will be able to reach a broader consumer base.

The second alternative Tesla should consider is to focus purely on the Tesla Model 3. The most affordable version of the Tesla line will have the broadest consumer target and will allow more consumers to have the opportunity to purchase the car and generate more revenue for Tesla. This alternative would also mean discontinuing or reducing the production of the earlier Tesla vehicles and limiting R&D in order to fully manufacturer the Model 3 in larger batches. Additionally, Tesla would also be required to fully expand the Supercharger stations with a goal of at least one station in each major city in the United States.

The third alternative Tesla should consider is to stop the production of the vehicles and focus only on the production of lithium-ion batteries. Tesla was incredibly successful in producing their proprietary lithium-ion batteries with a range of over 200 miles per charge. The batteries have been the backbone of the company and being able to sell these batteries to larger and more established automobile manufacturers would significantly increase revenue for Tesla.

Solutions, Recommendations, and Implementation

The solutions provided for Tesla will be based on the assumption that the company will want to continue to manufacture and develop electric cars. As the primary issue currently facing Tesla involves its financial situation, the solutions, recommendations, and implementation process will be based upon the improvement of Tesla?s current financial status. The solutions and recommendations will also be implemented on a time frame beginning with a short-term solution and recommendation, followed by mid-term and long-term solutions and recommendations.

Short-Term Solution

A short-term solution Tesla should consider is to develop cost-reducing contracts with suppliers that are willing to alter their supply chain production to fulfill parts required in the production of Tesla vehicles. The significance of this solution is the fact that many suppliers were not able to accommodate the initial requirements Tesla needed in order to efficiently manufacture its vehicles. Therefore, by having limited options in terms of suppliers, Tesla was forced to incur high production costs resulting in high prices of Tesla vehicles and significant profit losses. By optimizing the supply chain process and having dedicated suppliers to maximize economies of scale, Tesla could significantly decrease cost of goods sold and further increase total revenue.

Short-Term Recommendation

Tesla needs to contact each of two hundred suppliers that were used during the production of the Model S and negotiate specific production contracts that each supplier must agree to. If a supplier is not willing or cannot accommodate the requirements Tesla needs to produce its vehicles, then alternative parts or suppliers must be pursued immediately. Suppliers who are the only single source for a specific component must be prioritized and contracts must be negotiated with these suppliers first. In order to promote competition among suppliers, Tesla should consider exclusivity contracts in which each supplier is guaranteed a manufacturing contract if they remain committed towards providing necessary Tesla parts.

Short-Term Implementation

Changing the supply chain process overnight would significantly disrupt the manufacturing process. The improvement of the supply chain process should be conducted in four major steps. The first step is to determine the suppliers that provide only essential or one component of a Tesla vehicle and negotiate a manufacturing contract with these suppliers immediately. The second step is to negotiate with the remaining suppliers for the parts that are deemed essential or a single component. If suppliers are not willing to negotiate, expand search for suppliers who will be able to accommodate Tesla requirements or suppliers with alternative parts. The third step is to finalize all the suppliers who are willing to provide all the parts for Tesla vehicles. The final step is to begin using the parts from the establish contracted suppliers moving forward.

Mid-Term Solution

A mid-term solution Tesla should consider is to expand partnerships with other automobile manufacturers in the development of electric powertrain components. The significance of this solution is that Tesla is a supplier of powertrain components for many of the major automobile manufacturing companies. With the increase in popularity of Tesla and its continued innovation, other automobile manufacturing companies would pay a premium to have the expertise and technology developed by Tesla. In addition to generating more cash for the company, Tesla could indirectly promote their core mission of accelerating the world?s transition to sustainable energy by increasing the efficiency of other vehicles thereby reducing the use of nonrenewable energy.

Mid-Term Recommendation

Tesla should determine the automobile manufacturing companies that it would be interested in partnering or working with. These companies must be interested in either gaining Tesla?s expertise, technology, or both. Tesla must utilize the connections it has made within its powertrain production network, to reach out to companies it has previously worked with or companies Tesla would like to work with in the future. Additionally, Tesla should consider working with companies that would provide a synergistic relationship. For instance, when Tesla worked with Toyota in 2010 to develop the powertrain for the RAV4. A similar relationship could be made with other companies that would be interested in the innovate battery technology Tesla has created.

Mid-Term Implementation

The mid-term implementation should be conducted in three steps. The first step is to determine companies that would be willing to partner or work with Tesla and negotiate contracts that would be beneficial for both Tesla and client companies. The second step is to determine what the companies would like to accomplish. Would they like to expand their powertrain electrical components? Improve vehicle efficiency? Or perhaps expand hybrid capabilities? The third step is to continuously assist in the development of these projects by sharing ?limited? expertise and technology to client companies. It is important to fulfill contractual obligations to the client companies but to also limit their abilities to outcompete Tesla.

Long-Term Solution

A long-term solution Tesla should consider is to further expand the Supercharger Stations all over the United States. One of the primary issues many consumers face is the charge-ability of Tesla?s electric battery. Despite having a range of over 200?265 miles per charge, this range cannot accommodate long distance travel. Consumers want the option of being able to travel long distances and if Tesla wants to compete with gasoline powered vehicles, the company has no choice but to expand its charging stations. The significance of this solution is the fact that many of the charging stations are exclusively powered through solar energy thereby minimizing maintenance costs. The initial investment of expanding the stations may be costly, but the long-term benefits of having a station in every major and minor city in the United States could prove to be invaluable for future revenue.

Long-Term Recommendation

Tesla should note the primary locations in which its cars are being sold to. Focusing on the areas that contain the most consumers and expanding Supercharger stations in these areas first, will become the starting point for expansion. Tesla should also consider the major and minor cities that would receive the most benefit by having a Supercharger station. If the cost of implementing becomes too expensive for Tesla, they should consider acquiring previously owned gasoline stations that are no longer in business or partnering with a major grocery store such as Walmart to install their Supercharger stations alongside gasoline pumps.

Long-Term Implementation

To implement this long-term recommendation, Tesla will need to complete three major steps. The first step is to research the primary locations in which their cars are being sold to. Tesla needs to determine how many consumers are in each area and expand the Supercharger stations accordingly. The second step is to determine the most likely major and minor US cities that would benefit by having a Supercharger station. Taking a poll would be an excellent baseline study. The third step is to determine what companies would benefit by having a Supercharger station within their physical stores. Companies such as Walmart would benefit from having a Tesla Supercharger station within their stores by driving consumer traffic.

Conclusion

The electric vehicle market is currently dominated by Tesla and the company has made a lasting impact towards the automobile industry. The futuristic concept of the vehicles and the eco-friendly mission of the company has helped drive Tesla?s stock price from roughly $20 per share up to $300 per share. The ?Secret Master Plan? implemented by Tesla helped develop and fund the necessary R&D to develop the Tesla vehicles but the inefficiencies in supply chain process resulted in the company to incur massive production costs that limited profits.

Even though Tesla continues to rise in popularity and in total revenue, the excessive amounts of total liabilities and operational costs are significantly preventing this company from making any net income. If Tesla continues to incur sustain net income losses, then shareholders and debt financers will eventually lose confidence in the company. It is essential for Tesla to recognize its current financial situation and make the necessary changes in order to make a profit in future years. Other competitors will also by vying to earn market share within the electric vehicle industry. However, only the first manufacture who can provide an affordable electric car with no limitations in charging stations will ultimately become the leader in this industry.

Thank You For Reading!

Did you find this post helpful? Perhaps even insightful or game changing? If so, please make sure to support my blog. As a small content curator, I am always looking for ways to provide new content.

Support Minimalist / Pharmacist

Patreon | Paypal | Square

Business

Media Kit | Legal | Contact: [email protected]

Social Media

Instagram | Facebook | Twitter | Tumblr| Google+ | Pinterest | Reddit

Personal Favorites

Spotify | Essential | Bambino | Lunar Tempo 2 | Oblivion | NordVPN

Umoro | reMarkable