Step-by-step guide on how to launch a digital bank

Co-Founder & Chief Operating Officer, Arival Bank

Hey! My name is Jeremy & I?m 24 years old. I?m an ordinary American dude ? I grew up in the northwest suburbs of Chicago and I graduated from the University of South Florida. After college, I worked in the corporate investment & wealth management world before shifting gears into fintech & startups. One of the startups happened to be my own; even though it failed, the experience shed some light on where to go next. Shortly thereafter, I started to work in venture capital focusing on fintech investments & portfolio management.

Some introductions are like watching TV on a honeymoon ? unnecessary

Let it be known, I?m not the son of millionaires. You could never find money trees growing in my backyard. My parents were immigrants and we had to work for everything we have. I grew up with my father and mother living separately on opposite sides of the world. My father was never around and my mother worked 65 hours a week (and still does). Therefore, it was always me, myself, & I. And we were a great team.

When I was 12, I quickly found myself at the nascent intersection of innovation and entrepreneurship. I did what every other bad-ass hustler was doing in the mean streets of Buffalo Grove, Illinois: building lemonade stand enterprises. Every kid and their mother was selling lemonade within a kilometer radius. In order to remain competitive, you needed a unique value proposition. This meant either selling baseball cards, playboy magazines or having ?deals of the day.? I think my favorite deal of the day was ?buy 1 lemonade, and get a free foot massage from my little brother.? Susan, that reminds me, I think we still owe your grandfather a foot massage.

Fast forwarding to October 2017, when I was 23, I took a blind leap of faith and made the biggest decision of my life. I wanted to come face to face with something idiosyncratic ? especially in my early 20s. I was always eager to do something that not many young Americans typically experience. Sure, I could pursue a stable career in the states and gradually grow in terms of the natural pecking order. However, my risk appetite was convincing me otherwise. For me, it truly felt like it was now or never. I jumped on the next flight to Singapore.

One year later, here I am: preparing to launch a digital bank. And truth be told, the party is just getting started.

Here is an authentic, non-academic, and certainly biased guide on how to build a bank

- Keep your team lean for as long as possible.

We started to develop the bank with only three people. That?s right, 3 hombres. No ms. Slava, 35, is the CEO and responsible for the vision, strategy of the bank, and managing key stakeholders. Igor, 33, is the CFO and responsible for finance, business model ideation, partnerships, and investments. As the COO, I am responsible for the US banking license process, business plan development, financial modelling, investor presentations, managing business units, and so on and so forth. Job descriptions are overrated because we all wear many hats. We leverage each other and know what needs to be done with little direction. This enables a cathartic experience. With that being said, obviously our team has grown and already exceeds three people ? mainly because we are targeting big milestones and want to move fast. In general, it is possible to stay lean in terms of headcount for quite some time. Technically, launching the bank in our jurisdiction (more on this later) only requires five full-time employees.

Don?t kid yourself, you are a startup.

2. Evaluate different jurisdictions before settling on the US.

We looked at numerous jurisdictions as potential landing spots for obtaining a banking license. In fact, there are other options rather than traditionally applying for a banking license that could help achieve your objective. For example, we considered buying a small bank in Switzerland, Latvia, Gibraltar or Malta. Another option was applying for an e-money license or digital bank license in the UK (similar possibilities exist now in Lithuania, Dubai and Hong Kong). Alternatively, we could have partnered with an established bank in Germany, United Kingdom, Singapore or the US ? and run our neobank on the basis of their license. However, due to the fact that we want to serve crypto-related businesses and primarily transact in USD, we came to the conclusion (long story for next time) that applying for a banking license within the US makes the most sense.

3. You think applying for a banking licence is the only way to become a digital bank? Think again.

All digital banks in the US ? whether they are banks for retail customers (Simple, Moven, Chime) or businesses (Seed or Azlo) ? do not have their own banking license. They operate under licenses from other banks (such as Bancorp, CBW Bank, Wirecard). The possibility of leveraging another existing bank?s license doesn?t work for us due to the nature of our business. First, we want to serve customers not only domestically in the US, but also internationally. Secondly, one of our main differentiators is that we can serve and onboard crypto-related businesses such as ICO-backed companies and exchanges. Therefore, partnering with another bank and their license didn?t seem viable because of the compliance and risk.

The second option is to buy a small bank. We connected with 20 small banks from the US ? with a selling price in the range of $5 to $30 million before finding out this option doesn?t cut the time-to-market. In the United States, arranging the funds to buy the bank may very well be the easiest part. You need the regulator to approve the sale and purchase. This, combined with foreign capital structure (and management), and clear plans of changing the bank?s business model will most definitely delay time and hurt the chances of getting approved by US regulators. In reality, buying a bank versus starting a new one from scratch (applying for a licence) takes more or less the same time and effort. (We don?t recommend this, but I suppose you can try to deceive the regulator by conveying the purchase was made by 100% American investors and not having plans of transforming business models. Surely this may speed up the process, but when the truth comes out (and it will), you will lose everything.

The third option is to apply for a new license. You may already be aware, but US regulators (like most in the world) are not interested in issuing new licenses (especially in the past few years). On the contrary, they are more interested in reducing the amount of existing ones. Therefore, you will need to explain in great detail what your new or innovative approach is and how current licensees are not excelling in this space.

4. Research the types of US banking licenses and choose the best one based on your core expected activities.

There are a lot of banking licenses. My apologies, but I will not enumerate them all. The licenses depend on the type of customers, the geographic locations, and products/services you will provide. Recently, there has been a new license that was introduced ? the US-based fintech charter for fintech players, but so far none have been issued. The boundaries between licenses issued at the state and national level have become less visible. Most licenses allow you to serve customers online from other states and you are not required to open a branch. Each state is included in one of the 12 districts of the US banking regulator, the Federal Reserve.

We chose the option to apply for an IFE (International Financial Entity) license in Puerto Rico, which is a US territory and falls under the US banking system. The IFE allows us to serve international clients, the possibility to become FDIC insured, and share all the other benefits of building a bank under the US system.

5. Make sure your partners are experienced and reputable.

If you are going to buy a bank, just know they are almost never sold directly. There are brokers who work exclusively on these acquisitions. Depending on the complexity of the case, the intermediary will take between 1?5% of the sale amount.

If you are going to apply for a new license, there are many companies and third-party consultants who will manage and organize the process on a turn-key basis, which will cost you anywhere from $30k to $150k. From the get-go, our intention was to understand, study, and control the process as much as possible. Taking into account our ?startup and agile mentality,? we decided to manage the licensing process ourselves and remain cost-efficient.

You also need lawyers to help prepare, review and submit documents on your behalf. Although technically it is not mandatory, it will make your life much easier. Evidently, there has to be a high level of trust for your license to be issued. The regulator will feel much more comfortable if the application that falls on his desk was submitted by a credible financial services lawyer. We chose one of the top ranked law firms in the world: DLA Piper.

One of the most fundamental aspects of any strong banking application is your compliance policies. I can?t stress this enough, but you need compliance specialists. If your customers and products are typical and relatable to what exists on the market, then perhaps you can write compliance policies and procedures using basic consultants for around $30?50k USD. However, if you are going to attract ?unusual? or ?non-standard? customers and/or provide them with ?non-standard? products, then you need a larger and more prominent consultant. Considering our case is complicated, we decided to pour most of our resources into creating a sophisticated compliance system. We chose to hire and work with Promontory Group, an IBM Company (super expensive, but worth it).

I?ll fill you in on a little secret: none of your partners or consultants will do any of the work for you ? regardless of how much you pay them. They are more or less going to act like your psychologist or therapist: asking you the right questions, listening and analyzing your answers, and giving you generic feedback along the lines of ?looks reasonable? or ?think different.? I doubt they will give you clear responses of ?yes, this is the right answer? or ?here, let me do this for you.? In general, the presence of partners shows that you are actively engaging with the right people and doing something (if anything) correctly.

6. Define the customers you will serve and what products you will deliver.

You need to decide what type of clients you are going to work with: retail customers, business clients, Americans, foreigners, etc. Next, what products will you provide? Current accounts, transfers, deposits, loans, investments? The more clearly you describe your customers and the origin of their funds, the types of businesses, the anticipated turnover and types of transactions ? the easier it will be for you to determine the most optimal banking license. Not to mention, it will strongly help formulate your compliance policies.

In our case, we want to serve small and medium-sized businesses from both the US & abroad. During our early stages, we will focus on three types of clients: ICO-backed startups, crypto-exchanges, and GIGs (freelancers).

7. Don?t get overwhelmed by the application itself ? focus on the supplemental documents.

Although not easy enough for a 5th grader to fill out, the application is not complicated and pretty straight forward. You will provide basic information such as name of entity, place of business, stakeholders, directors, sworn statements, tax documents, background checks, etc. Your will also need to identify your list of planned activities as a bank, customer segments, customer forecasts, staff and transaction forecasts (for 3 years), expenses and financial projections.

The actual application may be the easiest part. In parallel, we prepared and submitted: the business case analysis of the problem we are solving (why banks won?t open accounts for crypto-related businesses), competitive analysis of other digital banks (focusing on the US market and banks for SMEs), our review of legislative initiatives and the regulator?s response to crypto-currencies and ICOs in different states (and countries), the draft of our KYC & AML Policy (how we will verify our customers, manage fraud detection, and make sure we stay compliant with regulations), an analysis of our proposed product line and potential partners, and lastly ? the business plan. After all said and done, our total submission including these supplemental documents exceeded 350 pages.

During the application period, you may find yourself in a position where you can tell the regulators what they want to hear in an effort to speed up the review process. To an extent, you are not telling a lie, but just not providing the entire truth. Don?t do this. My personal advice: be as honest and transparent as possible. Don?t hide anything. Putting lipstick on a pig will get you nowhere. Be open and share your real strategy.

8. Do you know the steps to receiving the license?

The first step is the preparation and submission of the application, supplemental documents (business plan, compliance policy, etc) as well as other legal items such as tax statements and background checks. The second step is an official interview with the Commissioner (or regulator) and his team. This is where you present your project. If passed successfully and your application is approved, you achieved the first (of two) key milestones: the Permit to Organize. This brings you much closer to the reality of launching your bank.

Then, comes the second stage. This part consists of: opening up your office and hiring other key employees, showcasing your core banking system with the regulator, testing your compliance system(s), completing the development of your product line, and flushing out your cybersecurity and data protection measures.

If the regulator feels satisfied and it meets his or her expectations, then you are issued the license. After this, you must apply for membership with the Federal Reserve in addition to finding at least one correspondent bank for making money transfers.

9. Understand the purpose & importance of a core-banking system.

Core-banking system is a software that helps open accounts for customers, processes basic transactions, stores the receipt and expenditure of funds using financial records, and provides access to different ledger interfaces and reporting tools. This is the core of the bank. For any regulator, this is an important factor in evaluating your application because this is where the money of your customers will be stored.

Very few banks in the world have their own core-banking systems. They are almost always paid for and its never cheap. Core-banking system providers will not work with just anyone. They perform their own due diligence to understand who the bank is, why they need it, and how they will use it.

We reviewed a plethora of core-banking systems from different countries ? both large and traditional, and new ones more oriented to digital services. As a result, we chose Mbanq from San Francisco: the system is new (thus, avoiding legacy-like qualities), proven (more than 9 other banks already use it), focused on new digital services (cloud-based and open API oriented), with a minimum installation price and maximum pay-per-use (depending on the selected capacity), and all-in-one features (no need to pay separately for updates or new products).

10. You don?t need to create the MVP version of the Bank right away.

Theoretically, you don?t need to integrate the core-banking system and begin developing products by the time you submitted your application. That would be costly and risky depending on the status of your financial situation. You need to explain what you plan on doing, how you will execute it, and then begin implementing it later (either before the license or after).

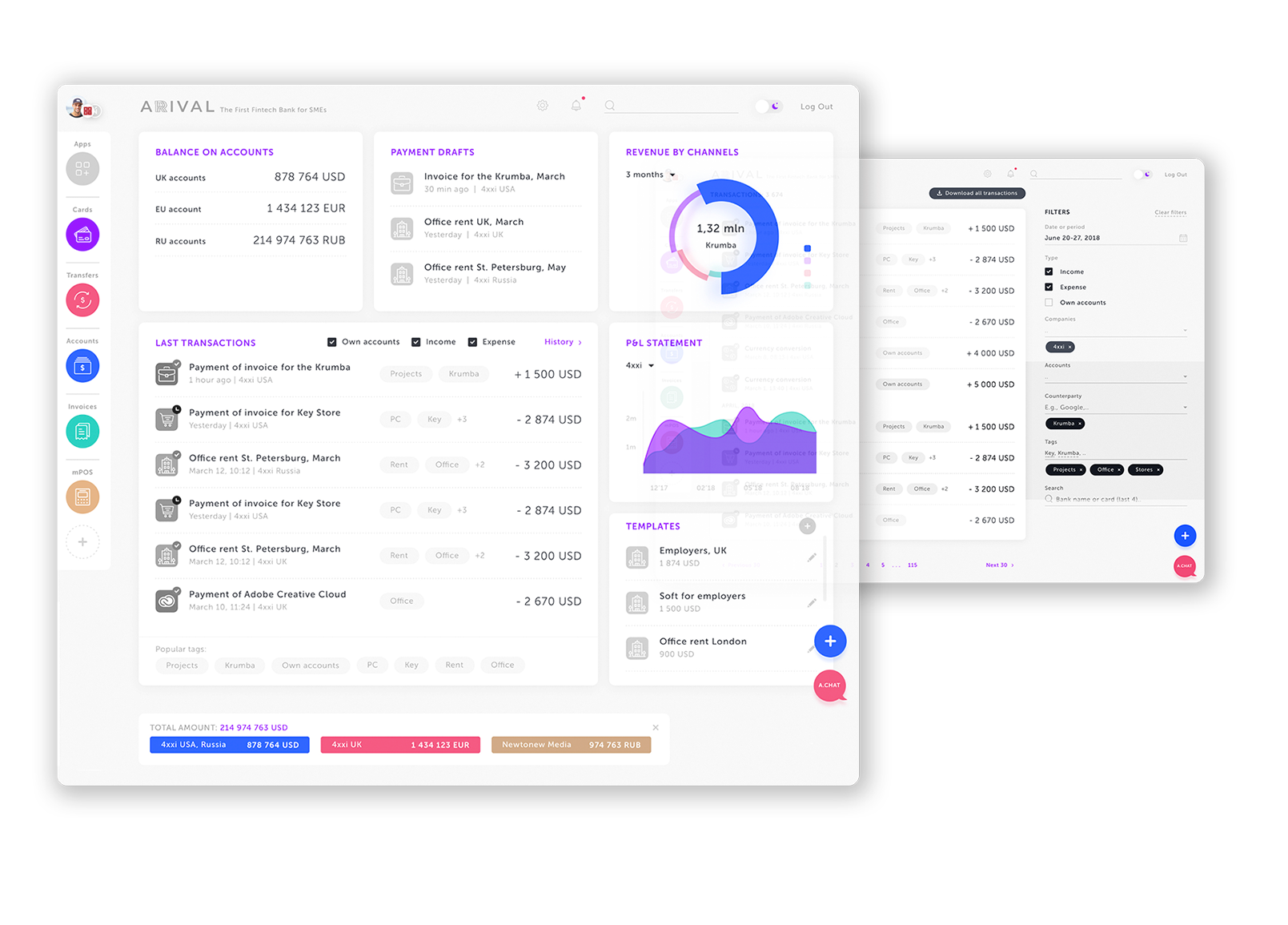

However, since our objective is to show and do more than what is expected of us, we started product development from the beginning of preparing our application. It?s too easy to talk the talk if you can?t walk the walk. We were joined by a strong team of nearly 10 developers who collectively worked together previously in a number of well-known fintech startups and banks, an art director who created our brand and identity, and a Chief Compliance Officer.

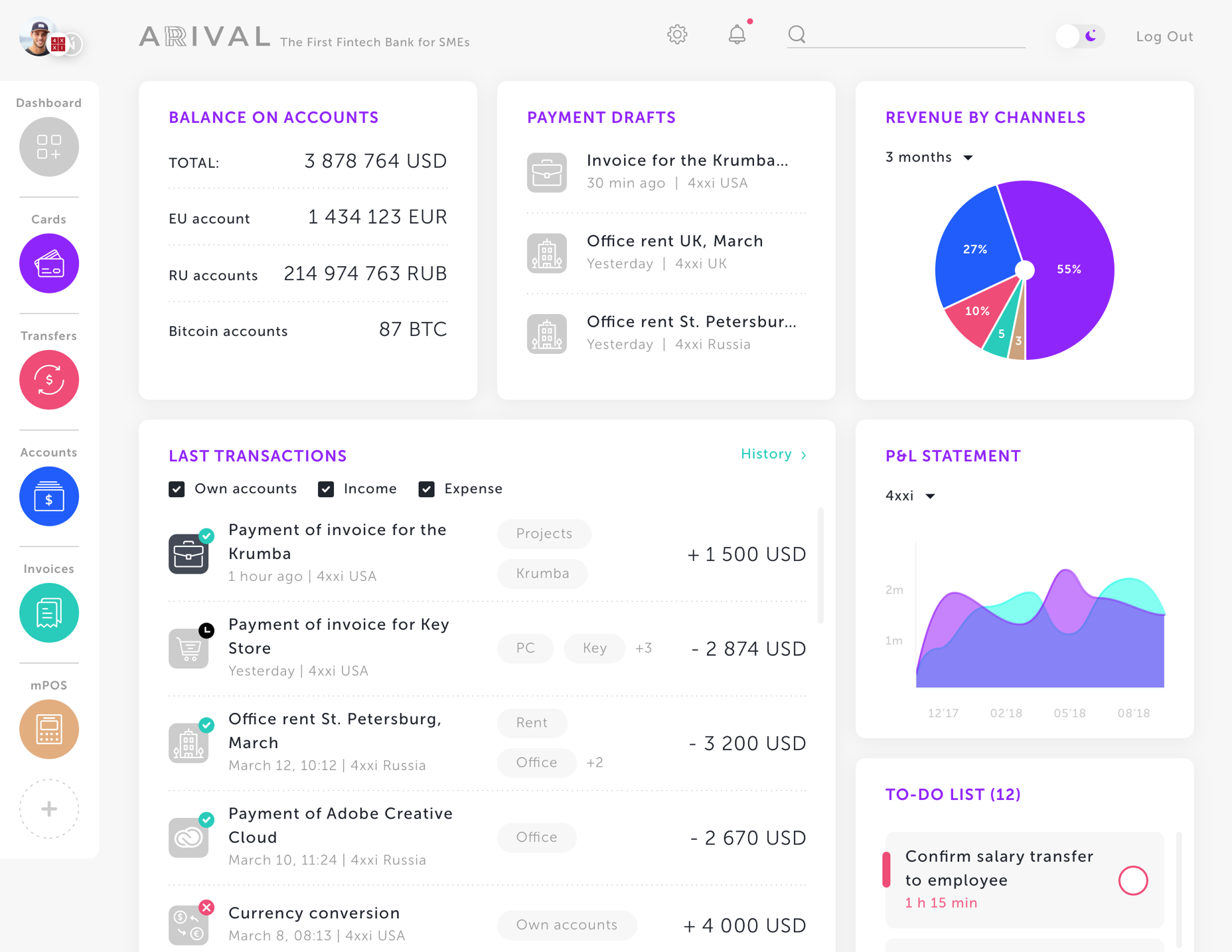

To date, we have created the main interfaces of the bank, the API layer for integration of products, and successfully integrated with the core-banking system. You can now enter the bank, open an account, and make transfers between bank accounts.

11. Don?t wait to raise capital.

As I wrote above, if you want to buy a small bank in the US, then you can find a batch of banks in the range of $5M (maybe even $2?3M) to $30M. The problem here is not the presence of money, but putting the risk of the sale getting denied straight into the hands of the regulator.

Before we applied for a license, we raised $1M from venture investors for the first stage. $250k and $300k was set aside as capital requirements and first year operating costs ? at the time of applying for a license. The remaining $450k is for team salaries, legal costs, compliance consultants, and the initial payment for the core-banking system.

If and when we get a license, we will need another $5M USD to contribute to the bank?s capital and another $5M USD for operating expenses including the development of our product suite and customer support ? all before reaching the break-even point. Therefore, the next round we are targeting a raise of $10M.

12. Most bank product lines are opaque and not innovative. Have you heard of fintech banking?

Those who can open an account and provide online access to it are quick to call themselves digital banks. And those who offer the simplest of products ? such as money transfers ? often times identify themselves as full-fledged banks.

If you want to become a real high-grade bank, not just an additional account or a card for your customers, then you need robust products. There are a number of ways how this can be done. You can code and create all the products (and the technology and business logic) by yourself as most traditional banks do. The risk here is that your staff is constantly expanding and none of the products are the best on the market (think of it as inventing the wheel a second time). The second approach is to buy pre-made products (the technology plus a basic designer for business logic) from external suppliers of white label solutions, which are sometimes offered by the suppliers of core-banking systems.

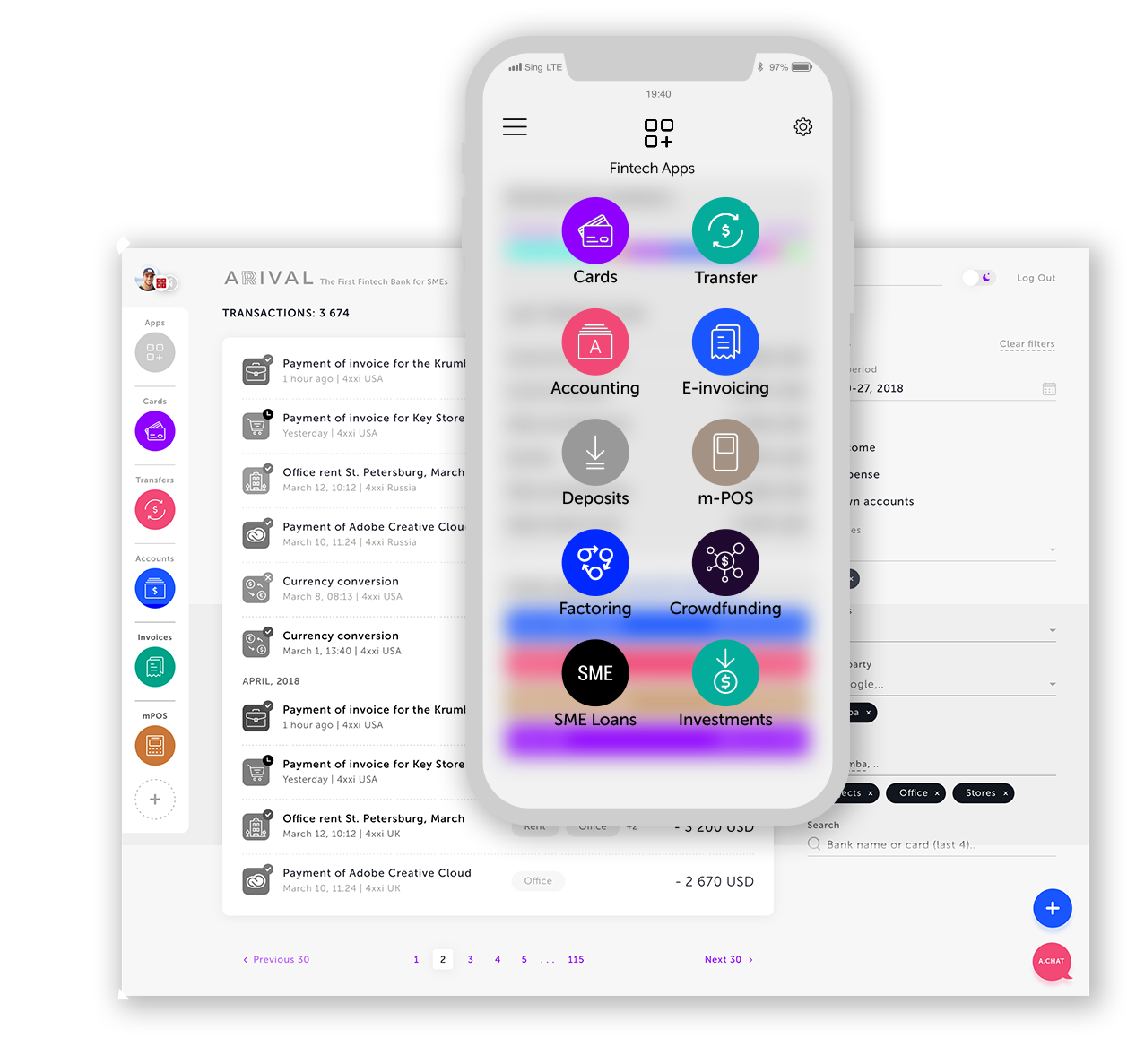

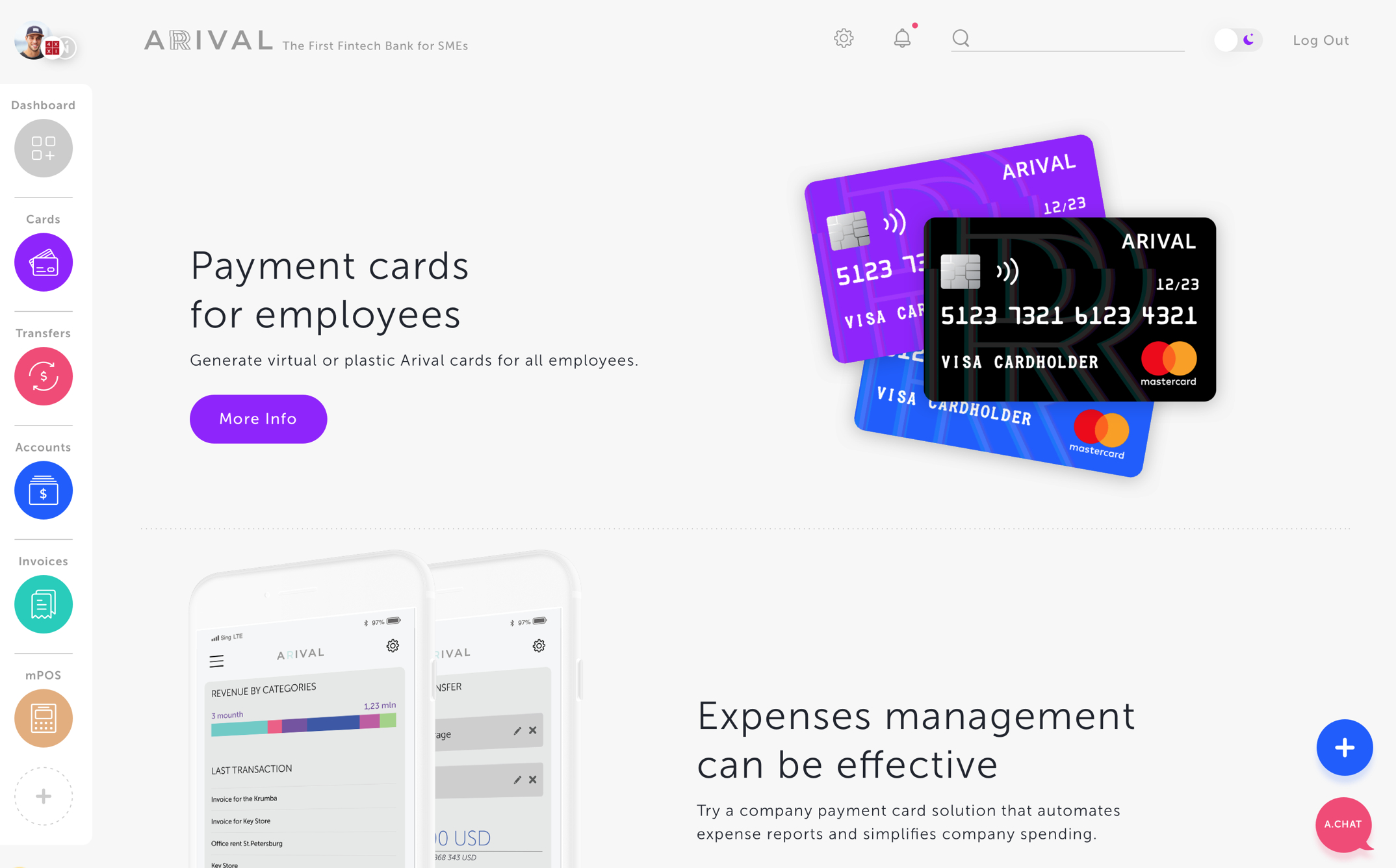

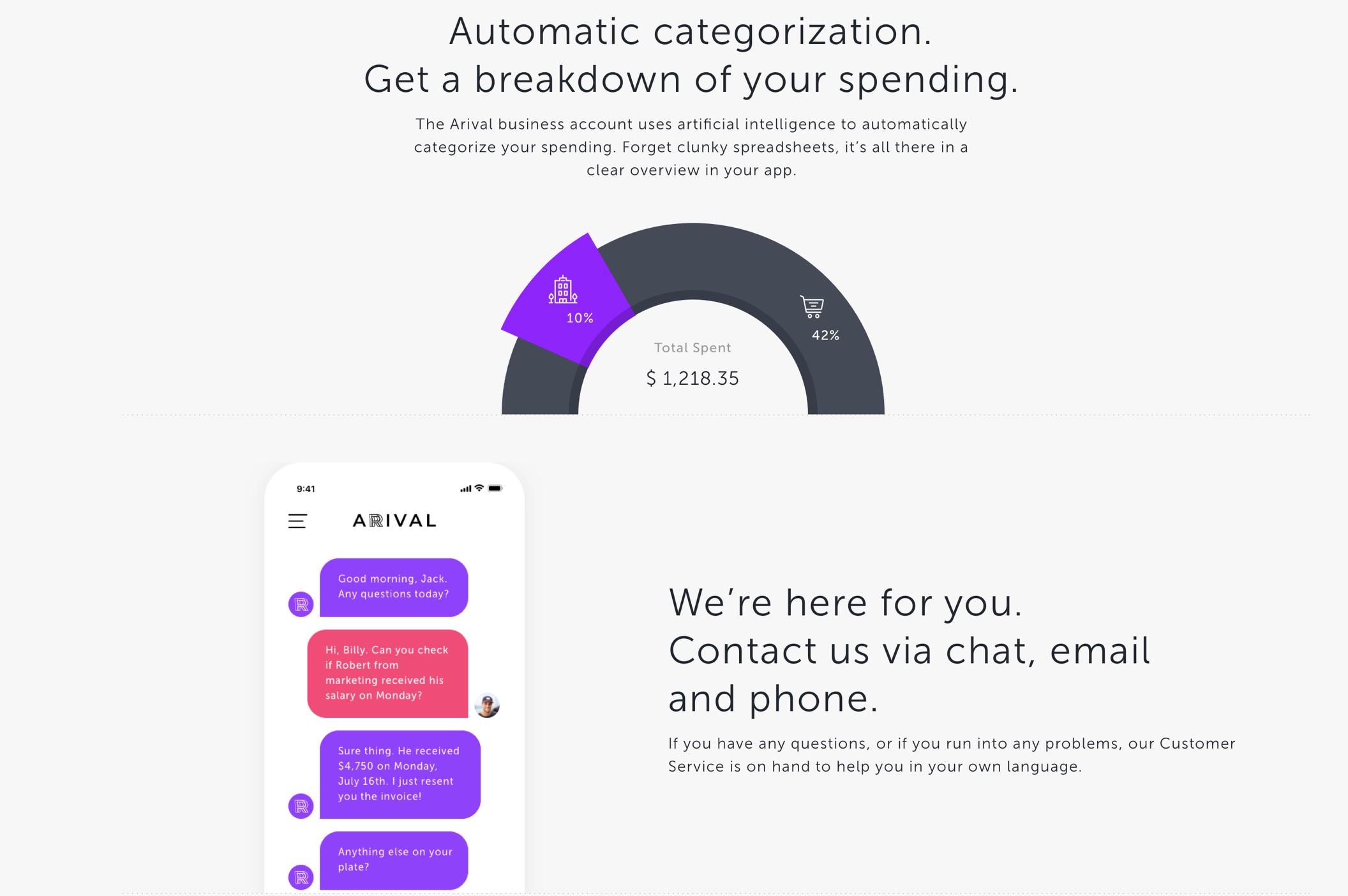

We chose the third scenario ? something called fintech banking. Our CEO, Slava introduced the ?fintech-bank? concept in his book, ?The First Fintech Bank?s Arrival.? In this scenario, we don?t create any products ourself or buy pre-made ?templates.? Our strategy is built on the premise that many fintech products have already been created (and will be created) in the world. These fintech companies are led by excellent teams and have generated strong traction with users. The problem with fintech companies is that their individual products and services don?t substitute a bank?s entire product line, but by building an ecosystem of different fintech products ? it very well could. Therefore, we are going to work with hand-picked fintechs using a partnership model. We have identified 12 product verticals, that fits the needs of our future clients and their businesses. In each vertical, we find the best fintech product to integrate into Arival Bank?s platform. And when the client comes to us ? they access an entire suite of services tailored for his company. Customers no longer need to browse and navigate the market for the best products and services. They don?t need to download or sign up with 20 different financial services and products for their business. Now, they have one unified login and password (via Arival) and can avoid the chaotic registration procedures over and over again. All the data is aggregated in one window (so you don?t need to worry about add-ons for import or export of information from different services). The money between services moves instantly and free of charge (considering all the money is in one bank). Best of all ? if you have any issues or problems, you can contact just one customer support team. Lastly, Slava & Igor are the perfect guys to introduce and deliver such an experience. They have invested in many different fintech companies over the years and know the fintech landscape as well as anyone else.

13. Patience is a virtue. Whatever your timeline is ? expect to double it.

If you want to buy a bank, you will immediately be told that it will take at least a year. If you decide to apply for a license ? it will most likely take between 1 to 2 years (sometimes even 3 years depending on the complexity). Just so you know, my estimations are optimistic, made under circumstances that the process went smoothly with little hiccups.

In our situation, from September 2017 to January 2018, we validated the problem, the potential customer demand and strategic ways of implementation. From January to May 2018, we prepared the application and all the documents for the IFE application. In June, we officially submitted our application. Currently, we are waiting to receive our Permit to Organize (which could more or less be viewed as a banking permit).

As for the next steps and timeline to receiving our license, there is no point in making a guess. Of course we hope we will receive it at the end of this year, but all we can do is continue moving forward and prepare for launch ? hoping the paths will cross sooner rather than later.

14. My last two cents.

On the way, we met a lot of teams that were trying to do more or less similar things. Despite the fact that we started later, we see that we are moving faster than they are. So what useful conclusions and observations can be made? How could this happen?

Having a good idea and the money to create a bank is not enough. It is important to understand who the regulator is, what their role is, and really what makes up a bank. To be honest, it is not important how innovative your technology will be, or how you will ?disrupt? the market. The simple things are more vital: who you are, how well you understand your future customers, how your experience and reputation will help the regulator believe you are not an accidental player, and what money you are using to fund the bank.

Furthermore, compliance is everything. The more unusual your customers and products are, the more time you will spend on this. Compliance, KYC, AML, and risk assessments are something you will fall asleep with and wake up to. I promise you. This ?homework? is something that your customers will never see, appreciate or feel, but it will certainly require 80?90% of your time. Without this, your chances of opening a bank are minimal.

?Is it difficult to have a nice lawn? It?s not easy at all. Just cut your grass neatly everyday for 200 years.?

And then, you will succeed.

If you are interested in staying in the loop, I will continue to share updates on our journey.

Thanks for your indulgence,

Jeremy Berger

Find me on LinkedIn

P.S. Catch us in Hong Kong next week as I give the first ever public demo of Arival Bank on the biggest stage in fintech!