If you?re addicted to the convenience of online shopping (guilty as charged), you may have noticed some of your favorite e-haunts offering installment-based payment alternative, Afterpay. The Melbourne-based financial tech firm has expanded rapidly in the US market after its May 2018 launch.

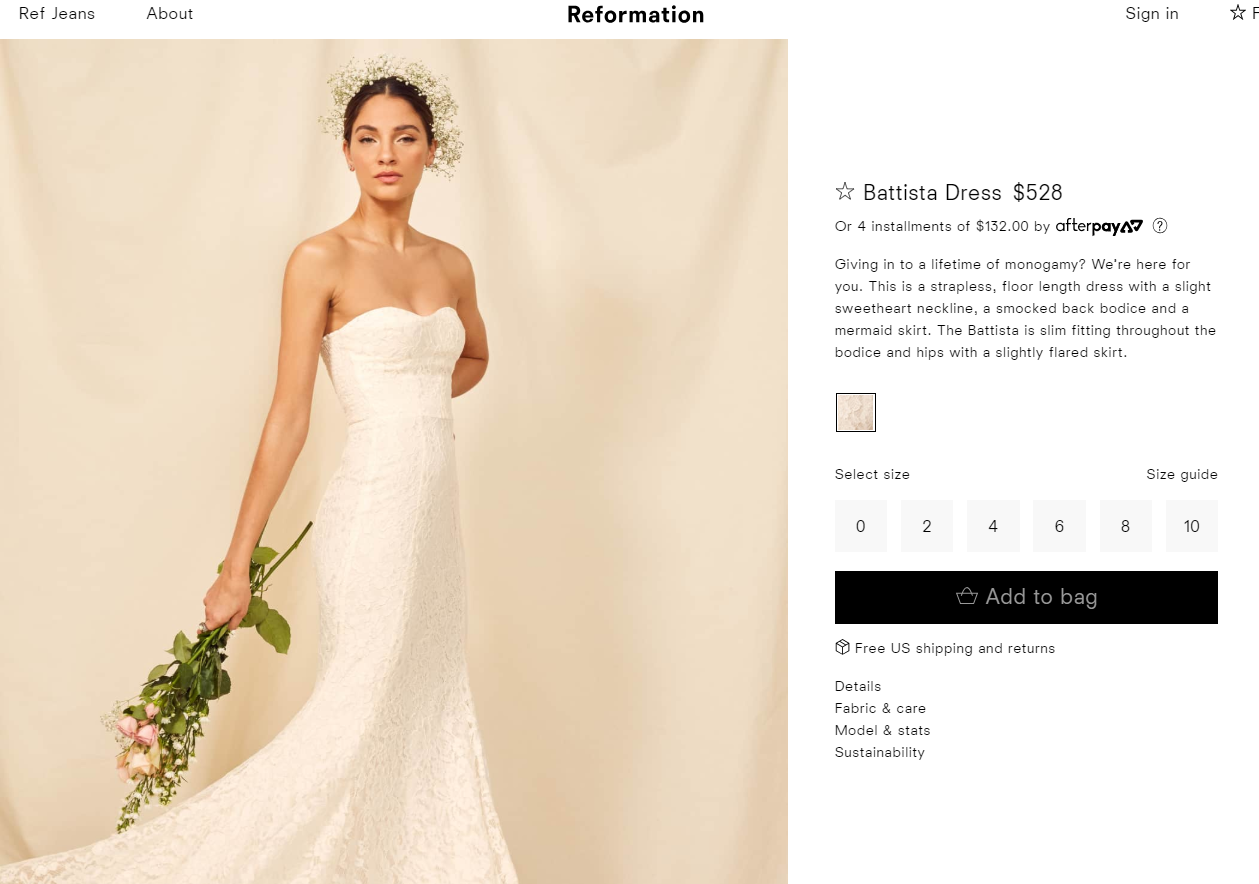

Afterpay tested the waters of its international expansion through partnerships with the likes of millennial-focused fashion juggernaut, Urban Outfitters, quickly expanding its online index to feature hundreds of trendy retailers, including Reformation, Anthropologie, and Revolve, to name a few.

Since its debut, Afterpay?s financial model has received its fair share of media scrutiny. The Sydney Morning Herald referred to the service as ?a quasi-credit product with none of the regulatory oversight.? Since its US expansion, the American press has, of course, weighed in on the matter. The New York Times took a cautiously neutral tone when it recently dubbed Afterpay, ?Layaway, but for a post-recession economy.? However, other reviewers haven?t shied away from throwing a punch or two.

The company?s innocuous slogan ?Shop Now. Enjoy Now. Pay Later.? has enticed an estimated 3.1 million active users to opt-in at the check out. After signing up, Afterpay allows users to break up the larger sum of a purchase into four, more palatable installments paid over a six week period.

To sweeten the deal, Afterpay doesn?t require a credit check, nor does it charge any interest or fees when installments are paid on time. The guidelines for regulated lending ? which protect both the lender as well as financially vulnerable shoppers ? do not apply. Afterpay?s marketing team has preemptively peppered its website with make-shift guidelines, such as their Responsible Spending guide, which asserts ?Afterpay makes money by charging merchants, not customers. This is our north star, our guiding light.?

So exactly what percentage of Afterpay?s profit is made up of penalty fees from missed payments? ABC Australia reported in August 2018 that Afterpay?s annual report showed the firm made 24.4% of its earnings from late fees ? just north of $28 mil in revenue.

Okay, got it ? I?ll make my payments on time.

Beyond the financial risks of opening multiple lines of faux-credit with your favorite retailers, there is, of course, a catch. Mike Fowler summarizes how Afterpay gets you to increase your overall spend, or the ?Afterpay Effect? for Medium:

?People will shop where Afterpay is accepted. They will spend more than they would if they were paying for the entire transaction e.g. the jeans and the shoes vs. just the jeans.

So as an e-commerce gun, it?s a payment method that works to attract new customers, increase engagement of existing customer, and increase the cart and bag size for both clicks and bricks shopping.?

Retailers aren?t exactly protected, either

Perhaps your inner Dave Ramsey buckled when you saw that $528 wedding dress you weren?t so sure about could be yours for four installments of $132; when used wisely, Afterpay can truly alleviate the financial burden of high dollar purchases, like a wedding gown. After all, the dress might not work out, and you can return it before your second payment is due.

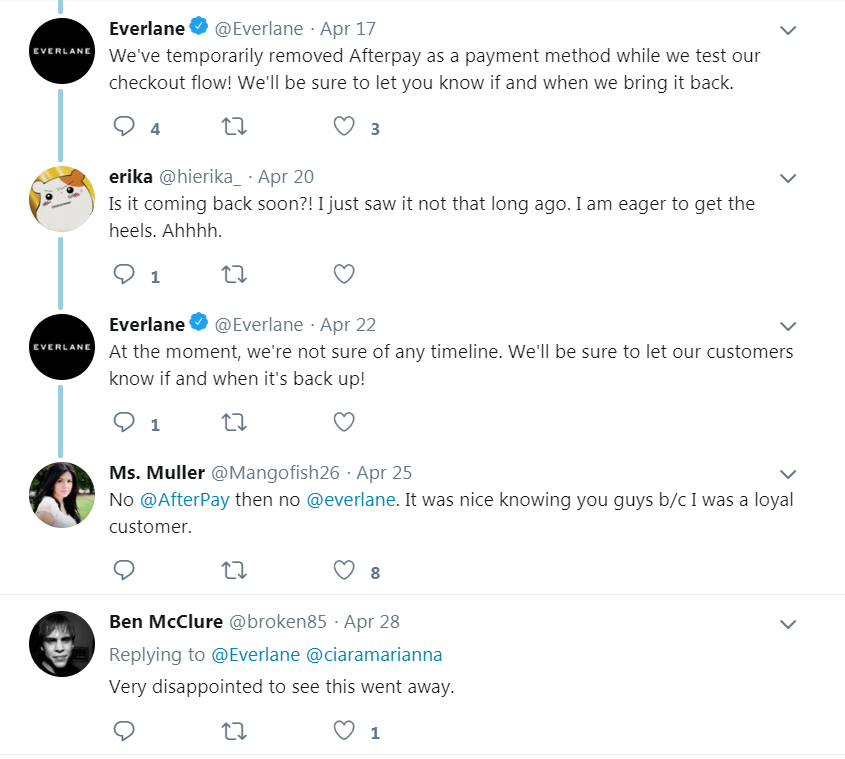

This exact logic put the kibosh on Aterpay?s partnership with sustainable retailer, Everlane.

What follows is entirely speculative and anecdotal, but my experience with the duo was brilliant ? as a consumer. Afterpay enabled me to purchase multiple colors and sizes of Everlane?s high quality minimalist basics; I could try-on at home, and return what didn?t fit or strike my fancy long before my second installment was due. On average, I kept ~30% of what I ordered, and felt great that Afterpay was allowing me to retain liquidity while I mulled over what to keep.

The crux of Everlane?s marketing is that their clothing is sustainably and ethically produced. This self-imposed code of ethics extends to their workers and factory conditions. According to their mission statement, their factories are audited to ensure their employees are paid fair wages and working ?reasonable? hours.

One can conjecture that their partnership with Afterpay substantially increased the volume of returns due to shoppers ordering multiple sizes and colors given the scaled-back financial commitment, which likely resulted in an uptick of return processing and restocking work.

Everlane, which has maintained a small-business feel despite its overwhelming popularity, would be up against inventory-control issues, an increased workload for warehouse/admin employees, and an inability to accurately analyze profit data.

Everlane is also unique in that their clothing is manufactured in small batches ? recently they?ve introduced hyper-limited quantities, or ?drops?of highly coveted styles only available for purchase by waitlisted buyers. My theory that I wasn?t the only one buying several colors and washes at a time was corroborated when their second wait-list-exclusive ?denim drop? took place last month and both available washes sold out within minutes.

Following the drop, I was browsing the Everlane hashtag on Instagram to assess exactly how bitter I was for failing to secure a pair for myself, when I came across a popular blogger?s post about the denim in question. A number of comments on the post were from customers who had ordered both available washes in a variety of sizes. My first thought was that using Afterpay would surely cut down on the sticker-shock of buying six pairs of jeans at once, especially when you?re only planning to keep two at most.

Everlane has since quietly severed their relationship with Afterpay, and has remained vague about the likelihood of reinstating the service. It?s unlikely that other marquee Afterpay retailers will encounter the same troubles as Everlane. For example, Everlane has two brick and mortar stores, whereas Urban Outfitter?s boasts 245; physical locations enable customers to try-on in-store, thus removing some of the guesswork from online ordering. Further, having so few locations means Everlane must rely on its warehouse for processing and restocking returns.

Everlane?s product is high quality, versatile, and timeless ? and sustainably produced! ? which makes purchasing their basics in a variety of colorways a no-brainer, with or without a payment plan. The Afterpay Effect, however, might determine whether you?ll shell out for two pieces at a time, or ten.

What are your thoughts on Afterpay? Have you tried it, and if so, what do you think?