Industry Analysis

Netflix is a leading streaming video on demand (SVOD) company operating in 190 countries with 130 million subscribers [1]. The product and revenue model in video streaming industry is very tangible and direct. Users watch TV shows, movies (on-demand) or any video content on variety of devices e.g. Tablets, Laptops, Smart phones. Netflix, being one of the early pioneers in this industry has a managed to make a firm user base and as well as a business model that generates a substantial revenue for the firm. The video streaming industry is growing and is expected to grow at approximately USD 82 Billion by 2023, at 17% of compound annual growth rate (CAGR) between 2017 and 2023[15]. As the prospect of the growth is higher and some of the big market (like Asia-Pacific) remains relatively unexplored so, the video streaming space is increasingly becoming a competitive industry. Companies like Amazon (Amazon Prime/Fire TV), Hulu, HBO, Google (YouTube Premium) have entered the market or adapted their existing infrastructure to enter the market. And other companies e.g. Apple, Disney are planning to enter the market. The barrier to entry in streaming space is low. There is no ?entry blocking? patented technology or any regulation that hinders the entrance of new player. Environment analysis of SVOD industry in presented in Exhibit 1. With no differentiation in the distribution of the content, subscription (annual or monthly) and business model, the video streaming industry is rapidly converging towards becoming an entertainment or media industry or a content generation industry. Users do not incur any switching cost and can quickly change the provider. In such scenarios, the content is and will be the sole differentiator in SVOD space. There two ways the companies get the content, they license it already produced content (popular movies, series etc.) from the studio or they make their own series and movies. With the licensed product, the content remains with the company only for a fixed time. So, there are limited popular content with no exclusivity. Besides, there are contractual obligation (like only for certain region, countries) that company must adhere, and this hinders the same user access and experience across the platform. The content provider companies like Disney themselves are entering into SVOD space and will pull out their content from other SVOD providers [16]. This is the reason that Netflix and other competitors are making their own shows and movies. The company needs a quality content to entice the user to them. And, this demand and creation of ?original? content is expansive and there is no guarantee that every new shows and movies will be received the user favorably. Even if the new content is popular, there is only fixed shelf life for the content. Most content remain popular only during first 6?12 months. Then, there is piracy, one of the biggest threats to SVOD. It quickly starts eating into the potential revenue [13].

Strategic Groups & Positioning

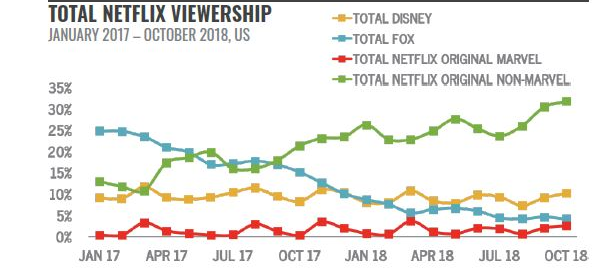

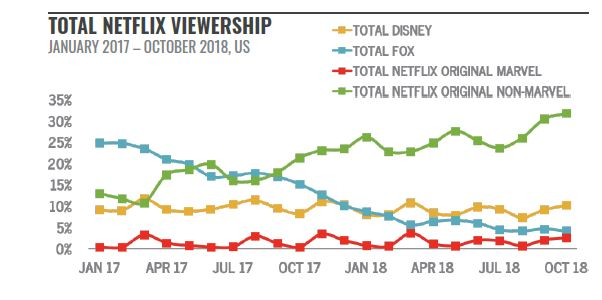

Today, Netflix is the leader in consumer video streaming space. The company has highest number of paying users among the competitors. It has wide variety of contents on its platform to entice the user. It has the user churn rate of only 9% (lowest in the industry). Netflix has also produced its own series, movies which has been very popular (e.g. House of Cards). Overall, the company has taken advantage of being an early start in video streaming space. The Netflix original content is accounted for 37% (63% licensed content) of Netflix stream in October 2018 [9]. But some of the popular license content by Disney, 20th Century Fox, AT&T?s WarnerMedia is going to leave in Q4 2019 as either the license deal is coming to an end and they are also planning to enter the video streaming space [9]. Below is the viewing distribution of shows from Disney, Fox and Netflix original in USA [9]. As we can see the viewing of Netflix original contents (Non-Marvel) is increasing but still it will be tough task in hand to replace the popular licensed contents. SWOT analysis of Netflix presented in exhibit 2.

Figure 1:Netflix licensed and non-licensed viewing distribution. Source: 7Park Data [9]

Figure 1:Netflix licensed and non-licensed viewing distribution. Source: 7Park Data [9]

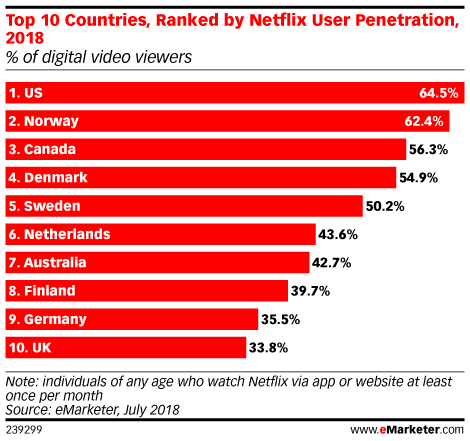

The internationalization strategy of Netflix has also been successful, the company has rapidly expanded into 190 countries with approximately 70 million users in countries other than USA [8]. In USA, the user penetration rate is 64 % and internationally user penetration rate is on upward trend [8]. Below is the snapshot from July 2018 by eMarketer [8].

Figure 2:Netflix User Penetration ( TOP 10 countries ) [20]

Figure 2:Netflix User Penetration ( TOP 10 countries ) [20]

Amazon, YouTube Premium, Hulu, and HBO are the main competitors of Netflix (please see exhibit 4). Besides, these direct competitors Netflix will also have to fight the local on demand video provides like ISPs, TV channels and piracy. Netflix is stepping up to fight the piracy and it has been successful, but it is a continuous effort and cost [14].

The video streaming industry is in growth phase. So, there will be more players globally and some local players (Disney+, iQiyi in China) will deploy more resources to make their services more differentiated. There are niche areas for video streaming like live events (Amazon is committing resource here) that remains unexplored.

Netflix till now, has performed quite well in shoring up the user number and keeping the cash flow constant (but negative). But, generating new content is becoming costlier and costlier for Netflix. And, if the company is not disciplined to keep the cost for new and licensed contents low then it will adverse effects on the prospects of the company. Five forces analysis for Netflix is presented in exhibit 3.

Other aspect that will play a crucial role in the video streaming space is regulation regarding ?Net neutrality?[19]. Currently, Netflix consumes roughly 15% of the internet traffic [ 6]. If the Net neutrality gets discontinued or been made less enforceable than today, Netflix streaming quality can be controlled by ISPs and they may charge Netflix to maintain the same quality of streaming.

Competitor Analysis

The videos streaming space is increasingly getting crowded. As the barrier to entry is low, especially for old media entertainment companies like HBO, Fox 21st Century, Disney which already has the content and can make content. They have started or in the process of starting the video streaming services [16]. Currently every provider has the same mode of revenue i.e. direct consumer subscription (either monthly or annually) consumer no cost for switching. The subscription cost varies from $8 ? $14. So, there is not much of cost differentiation across the providers (more in exhibit 4).

The companies will have to offer the popular content to keep and attract the users. So, there is fierce competition among the companies is to either get the popular licensed content from the media companies or create their own content.

Amazon Prime has 100 million users is a strong challenger to Netflix [3]. Besides, Amazon ($5 billion) and Netflix ($8 billion) are the biggest content spenders in 2018 [4]. Besides Amazon, there are no strong revenue generating player (as of today) in video streaming space. YouTube Premium has a strong viewer base and it also generate content organically. But its subscription-based service YouTube is not gaining traction after 2 years of its release [5]. They are now more geared towards music streaming service [5]. It does have a capability to become a niche competitor in the video streaming space as it is more driven by the creators on the platform. Even, YouTube does not intend to compete in terms of spending with Netflix and Amazon for content creation. Exhibit 4 shows the competitor analysis.

Netflix spends a lot($7.5 billion in 2018) to get the licensed shows. These shows are discontinued from the platform after some time. The creator of these licensed product has a leverage over Netflix, if their show is very popular then they can charge more from Netflix or discontinue from the Netflix. This will have an adverse effect for the Netflix (please see exhibit 3 for five forces analysis).

Other competitor in video streaming space like Hulu with 20 million users and Direct TV, HBO is far behind Netflix. Hulu, Direct TV are also present in live streaming TV. But still, the competitor of Netflix except the Amazon is still present in USA.

Amazon and Netflix are both have Internalization strategy. Amazon is present in lesser countries than Netflix, only in 12. But Amazon uses their existing capability to offer other services along with Prime (Amazon Music, discounts) for the same (bundled with prime) price. And Amazon content is also becoming popular in some countries [10]. Both Amazon and Netflix are similar in prices, video quality, device supports. They also have the similar content strategy i.e. they are shifting towards making their own content and even the local content for specific market. One major difference between the two is that Amazon has deeper pockets than Netflix. Netflix net cashflow is negative because of ballooning content cost.

At this point of time, Netflix does has an edge but Amazon is slowly catching up and if the Netflix does not get its content strategy right then it will be in serious trouble. Media entertainment industry has written the obituaries for many companies.

Competitive Positioning

Netflix has clearly demonstrated that it has the capability to change the industry and become a leader in the space. But the rules of game in Videos streaming industry is rapidly changing. It is becoming an entrainment industry with its own demands and cost [16].

Netflix is the current leading player in the space with Amazon as challenger. Netflix has invested a lot in the content on the platform. It wants to continue with the two-pronged strategy, exploring partnerships for licensed content and producing local contents. It has gone into partnership with Sky and BBC in Europe and at the same time it is producing content in countries like Denmark, India. These local contents have also been made available to global audience and it has been popular [11]. Similar strategy is being followed by Amazon. Besides, Amazon is also targeting live sports content which is not the focus of Netflix. Netflix wants to focus on movies, series. This strategy can keep the cost low and at the same time they can focus on the quality of content.

Netflix added record number of users 6.96 million in Q3 2018 and has revenue of $4 billion an increase of 36% in Q3 2018 as compared to Q3 2017. It is projecting to add 9.4 million in next quarter. Its international user addition is 5.87 million in 2018. But still, the net cash flow is negative (-$3 billion in 2018 Q3) , and company is running at loss. And, the reason is increasing content cost. Netflix?s average monthly revenue per paying member in its domestic segment grew by 6% compounded annually from 2013?2017, but its content spending grew 34% compounded annually over that same time [12]. And, in 2018 year to year domestic revenue per user is up by 12% and internationally it is up by 14% but the content spending has increased by 40 %. For accommodating this high content cost and debt of $10 billion and total obligation of $19 billion in 2019 (increasing interest rate), Netflix must increase the user subscription fee. Similar costs are also for Amazon, Disney, Apple but they are the company with deeper pockets and other source of revenue than video streaming.

To summarize, as of today Netflix is the leader in the video on demand streaming industry globally, but it is challenged by the company with deeper pockets and multiple revenue source to accommodate high content cost. In the near term, Netflix must reduce its content cost to be able to compete effectively and reduce its debt.

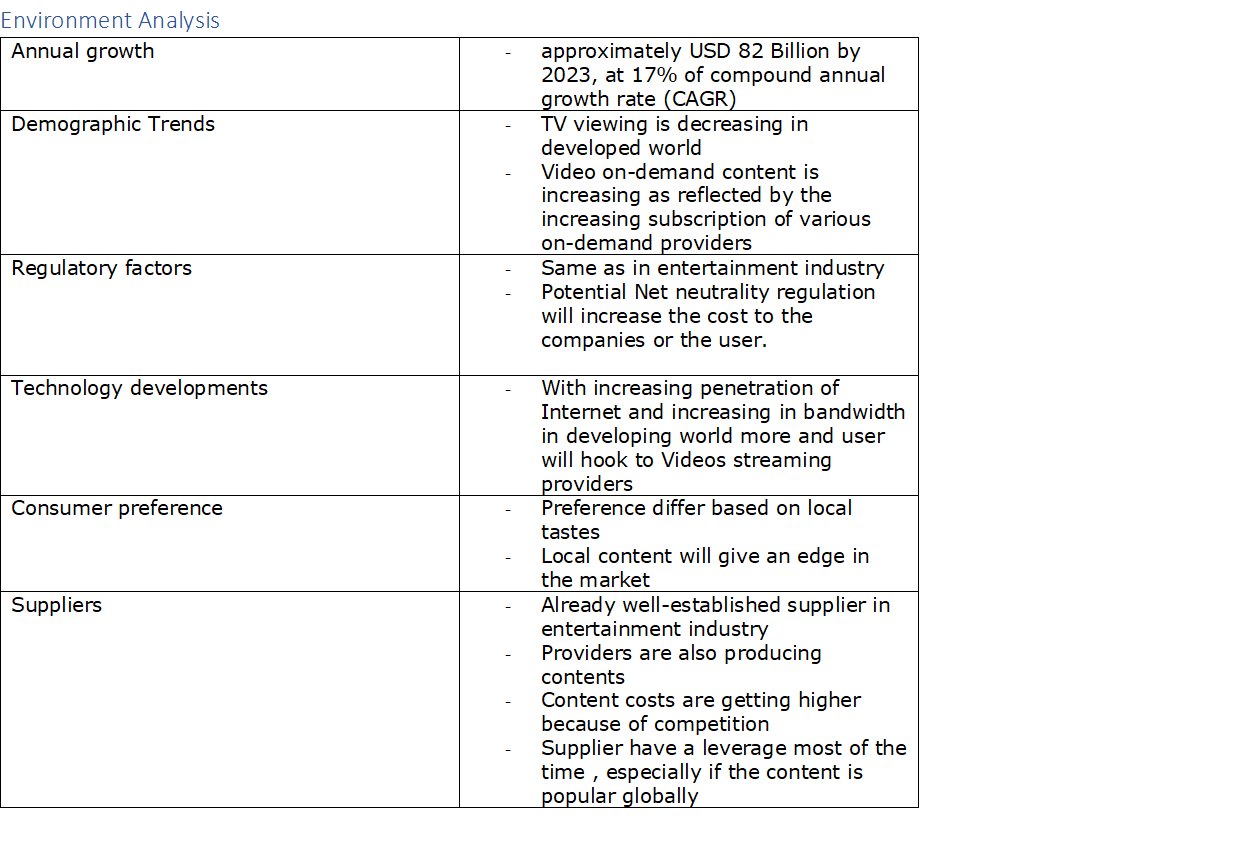

Environment Analysis

Exhibit 1: Environmental analysis

Exhibit 1: Environmental analysis

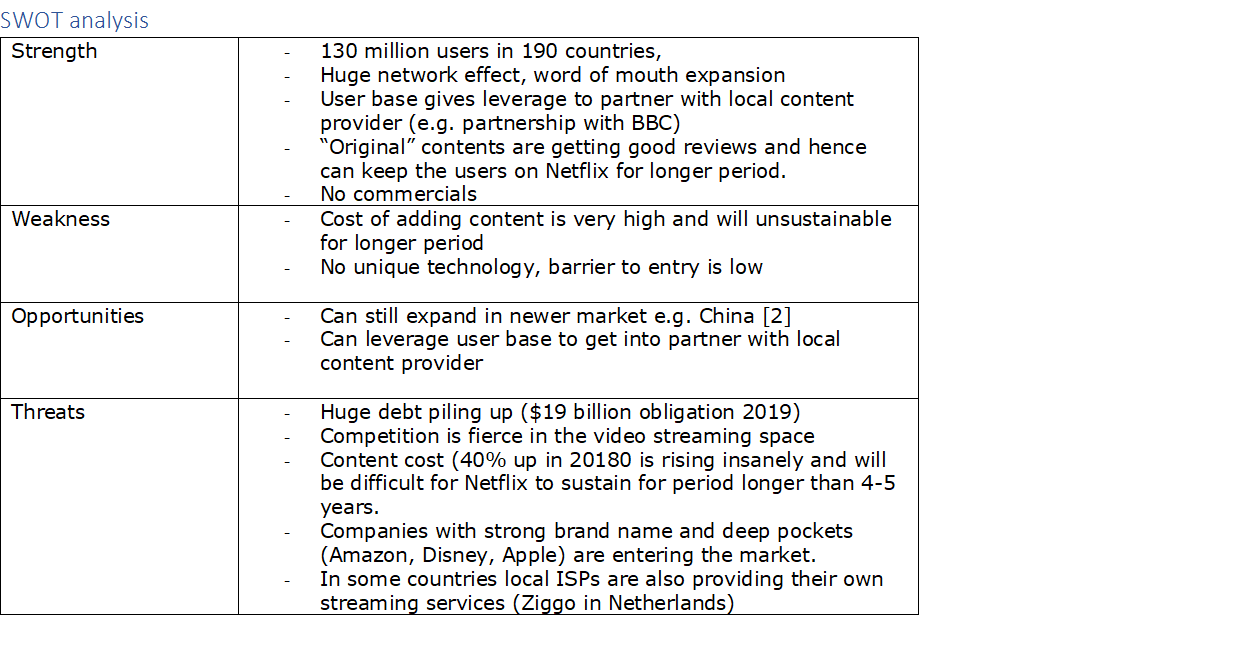

SWOT analysis

Exhibit 2: SWOT analysis

Exhibit 2: SWOT analysis

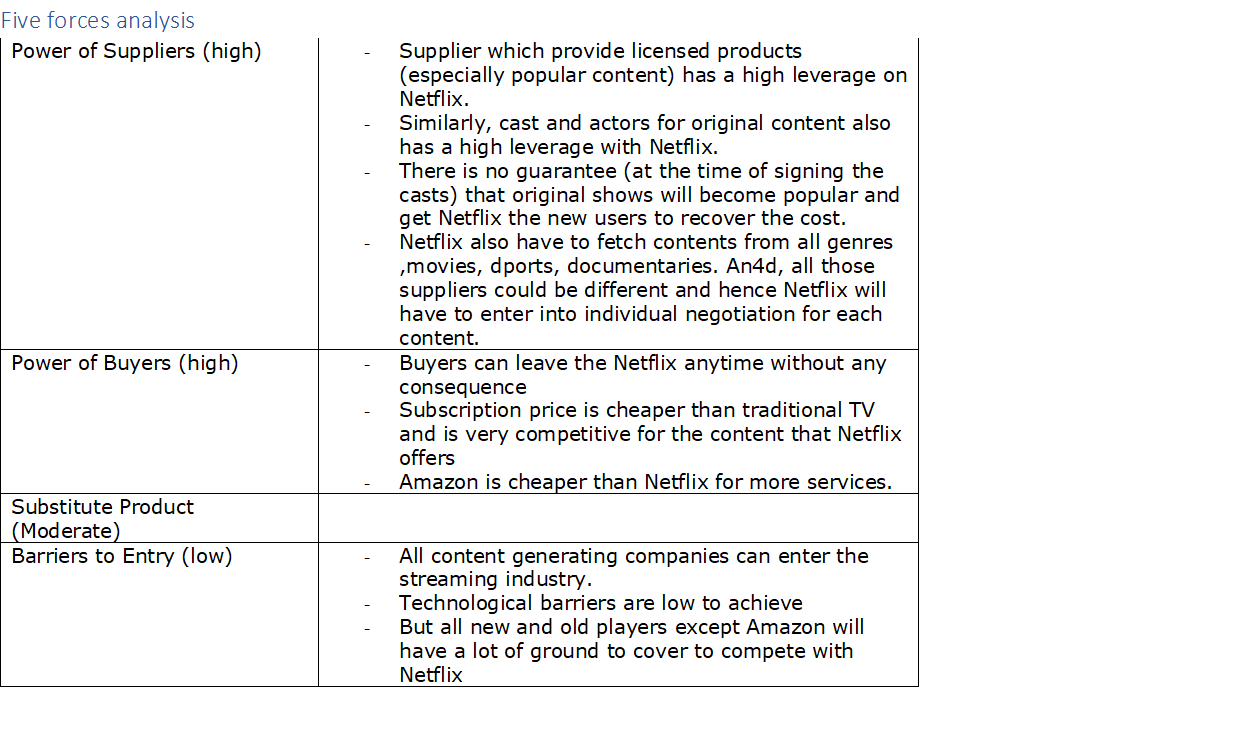

Five forces analysis

Exhibit 3: Five Forces analysis

Exhibit 3: Five Forces analysis

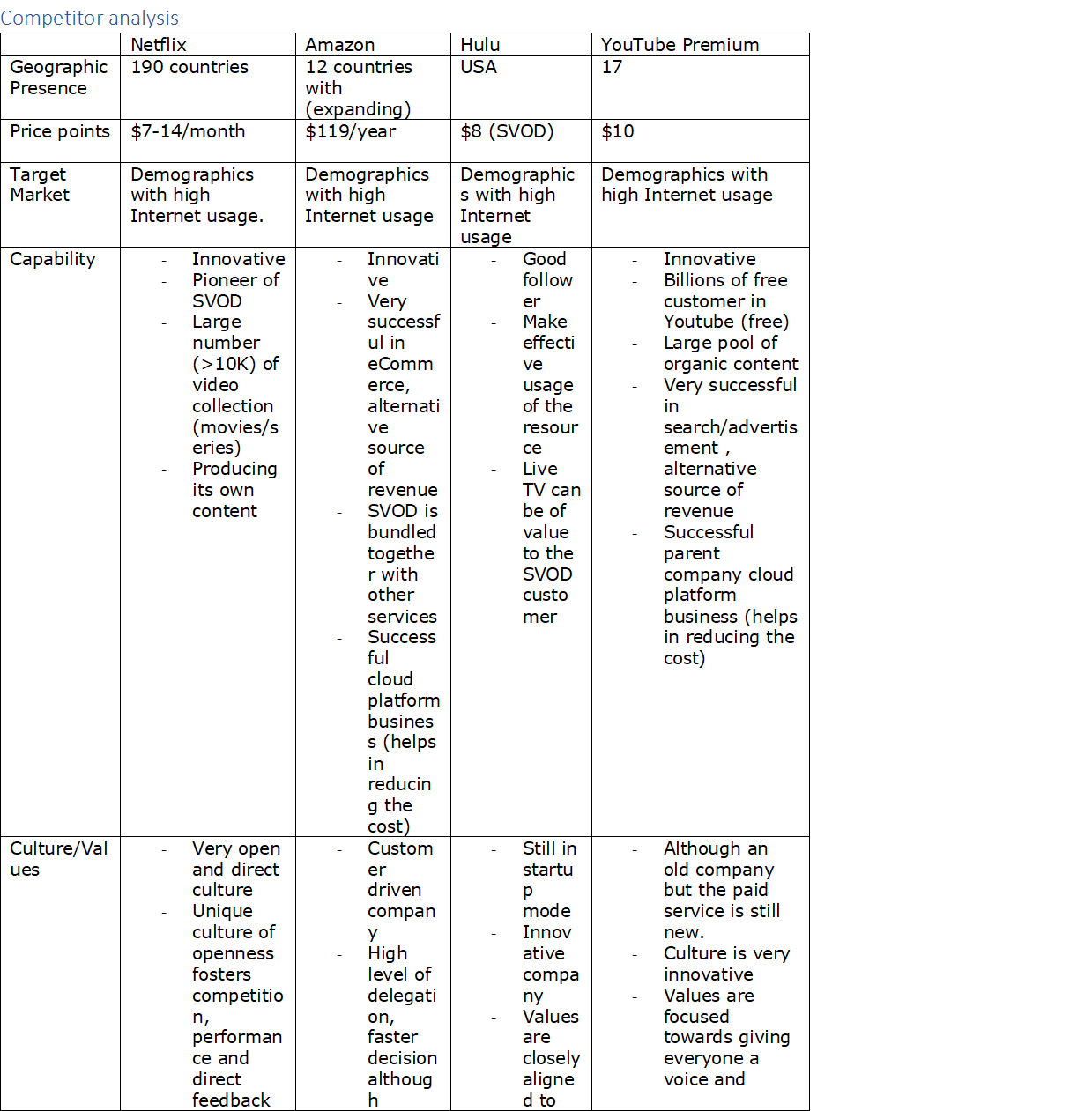

Competitor analysis

Exhibit 3: Competitor analysis

Exhibit 3: Competitor analysis

References

[1] https://hbr.org/2018/10/how-netflix-expanded-to-190-countries-in-7-years

[2] https://techcrunch.com/2017/04/25/netflix-china-iqiyi/

[3] https://www.sec.gov/Archives/edgar/data/1018724/000119312518121161/d456916dex991.htm

[4] https://www.mediapost.com/publications/article/315055/amazon-expected-to-spend-5-billion-on-video-conte.html

[5] https://www.recode.net/2018/2/9/16996958/how-to-watch-live-stream-youtube-ceo-susan-wojcicki-code-media

[6] http://fortune.com/2018/10/02/netflix-consumes-15-percent-of-global-internet-bandwidth/

[7] https://www.aclu.org/issues/free-speech/internet-speech/what-net-neutrality

[8] https://www.emarketer.com/Chart/Top-10-Countries-Ranked-by-Netflix-User-Penetration-2018-of-digital-video-viewers/220373

[9] https://variety.com/2018/digital/news/netflix-original-series-licensed-viewing-friends-the-office-1203085230/

[10] https://www.fool.com/investing/2018/02/14/the-3-countries-where-amazon-prime-video-is-beatin.aspx

[11] https://variety.com/2018/tv/news/netflix-looks-partnerships-growth-no-plans-live-sport-1202942082/

[12] https://www.forbes.com/sites/greatspeculations/2018/11/07/netflixs-momentum-has-run-out/#7175630e2886

[13] https://www.forbes.com/sites/greatspeculations/2015/03/17/is-piracy-a-serious-threat-to-netflix/#3634ca627856

[14] https://www.express.co.uk/life-style/science-technology/979412/Netflix-online-piracy-movies-TV-shows-illegal-streams

[15] https://www.statista.com/outlook/206/100/video-streaming–svod-/worldwide

[16] https://finance.yahoo.com/news/netflix-disney-media-giants-will-battle-streaming-2019-210353678.html

[17] G. Kovacs An Analysis of Strategies by Netflix in the Television Market ? http://pure.au.dk/portal/files/86448002/Thesis_GaborKovacs_201208049.pdf

[18] Waterman and Sherman (2013) ?Technology and Competition in U.S. Television: Online vs. Offline?

[19] Yuani Fragata and Francis Gosselin Who Said Disruption Would Be Easy: the economic & strategic challenges of Netflix ? http://www.xnquebec.co/pdf/NETFLIX_FG8_EN.pdf

[20] https://www.emarketer.com/Chart/Top-10-Countries-Ranked-by-Netflix-User-Penetration-2018-of-digital-video-viewers/220373