There?s a popular meme going around that says ?if the church paid taxes, everyone would only have to pay 3% taxes.?

That sounds great, right? But what?s the math? I decided to work it out.

First of all, the statement is incredibly vague.

Everyone would pay 3% of what kind of taxes? Income tax only? All our taxes combined? Federal, state, and municipal? What are they even talking about?

Then the question is, how do they want to change the tax code? Are they saying all nonprofits will become taxable?

If we keep the 501(c)(3) exemption for nonprofits, but make churches taxable, all any church would have to do is simply register as a nonprofit. The tax codes are virtually identical.*

If we?re saying that all nonprofits should be taxed, then we?re in complete fantasy land. I can?t picture any scenario where that could happen, short of a complete and radical overhaul of the entire tax code in some Steve Forbes flat tax upheaval.

But let?s pretend we could find a way to tax churches, yet not tax any other nonprofits. Let?s figure out how much revenue would be raised by taxing churches, and only churches. (I?m assuming that ?churches? in the meme refers to all religious organizations, not just Christian ones.)

Side note: it?s important to explain that while religious organizations are tax-exempt, people who work for them are not. Clergy pay income tax just like anyone else. Now let?s run the numbers.

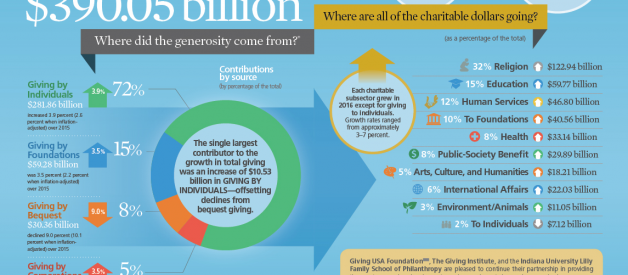

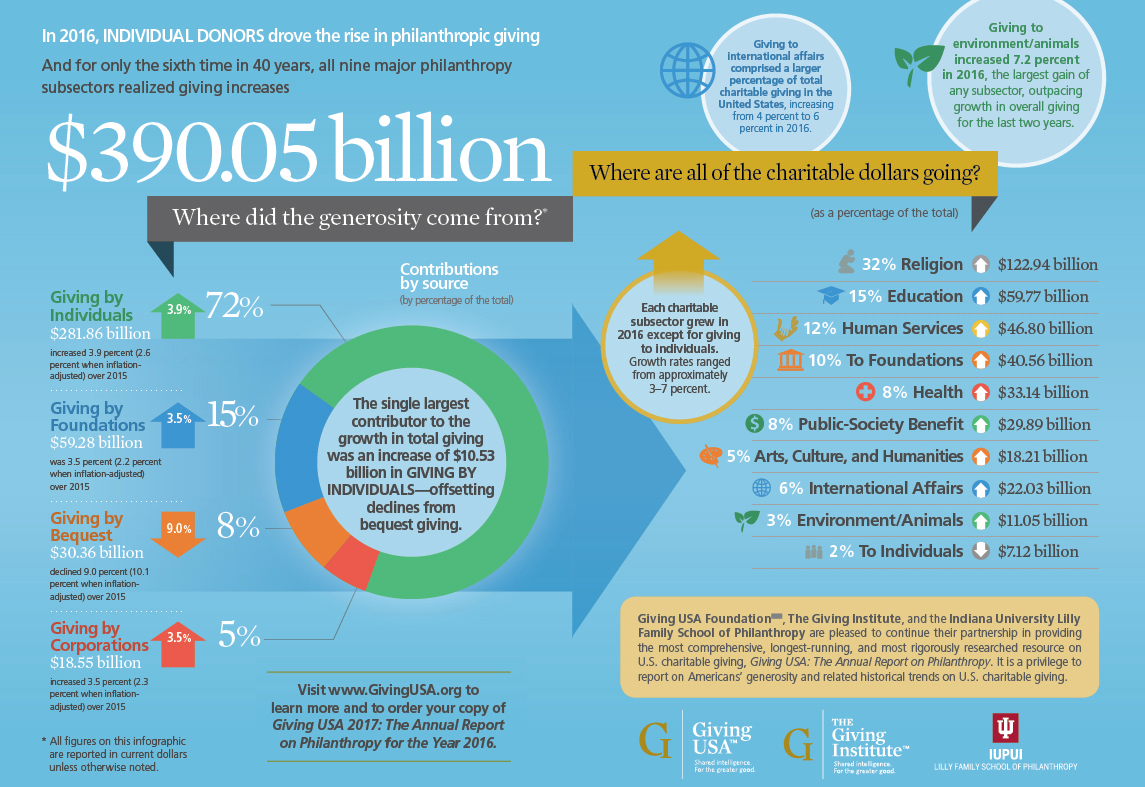

Giving USA estimates $123 billion was donated to religious organizations in 2016 (out of $400 billion total to all nonprofits).** Let?s be charitable (ha) to the meme and assume that they?ve come up with some way to tax churches, but not other charities. Taxes are incredibly complex things, but to keep it simple, we?ll look at the average corporate tax rate that?s actually paid in the U.S. ? 25%?

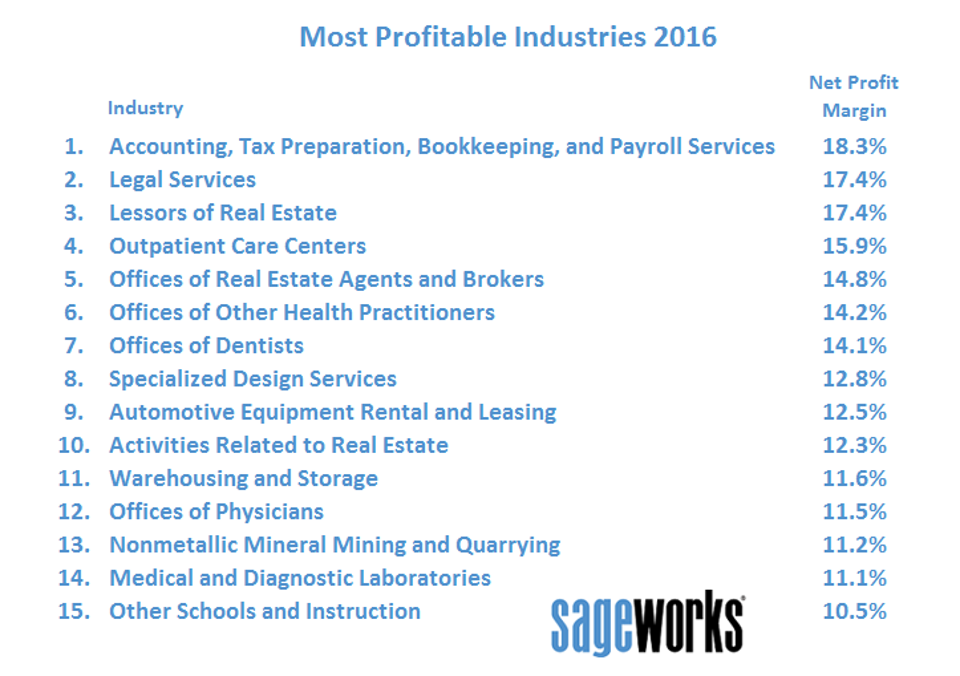

Now, keep in mind that the average of 25% is on profits, not total revenue. The total revenue of all churches is $123 billion**. The average profit margin for corporations in America is 7.5%??. Let?s assume that churches would have an incredibly high profit margin, the highest in the entire country. The most profitable industry in the U.S. is accounting, at 18.3%***. So let?s give churches a 20% profit margin. Now we?ve got $24.6 billion in taxable profits. Take 25% of that, and you?ve got?

$6.15 billion in taxes.

Total federal receipts last year were $3.3 trillion. Of that, 47% came from individual income taxes, or $1.55 trillion. In other words, the tax revenue we would get by taxing churches would amount to

0.4% of all income tax paid.

If you?re paying $15,000 a year in income tax right now, by taxing churches, you could pay only $14,940. That?s a sixty dollar savings!

To sum up ? no, taxing churches would not mean you?d only have to pay 3% taxes. If a law were somehow drafted that separated churches from nonprofits, and no churches were able to figure out a way to claim nonprofit status, AND many churches didn?t go bankrupt from the new tax rules, AND people kept giving to churches in the same amount once their donations were no longer deductible? everyone would still pay pretty much the same amount they do today.

*The only difference is the ?parsonage allowance,? which accounts for about 1% of the tax exemption churches get. https://skeptics.stackexchange.com/questions/19693/if-american-churches-paid-taxes-how-much-revenue-would-that-generate

?https://www.cbpp.org/research/federal-tax/actual-us-corporate-tax-rates-are-in-line-with-comparable-countries

**https://givingusa.org/tag/giving-usa-2017/

??http://www.aei.org/publication/the-public-thinks-the-average-company-makes-a-36-profit-margin-which-is-about-5x-too-high/

***https://www.forbes.com/sites/sageworks/2016/08/06/the-most-profitable-industries-in-2016/