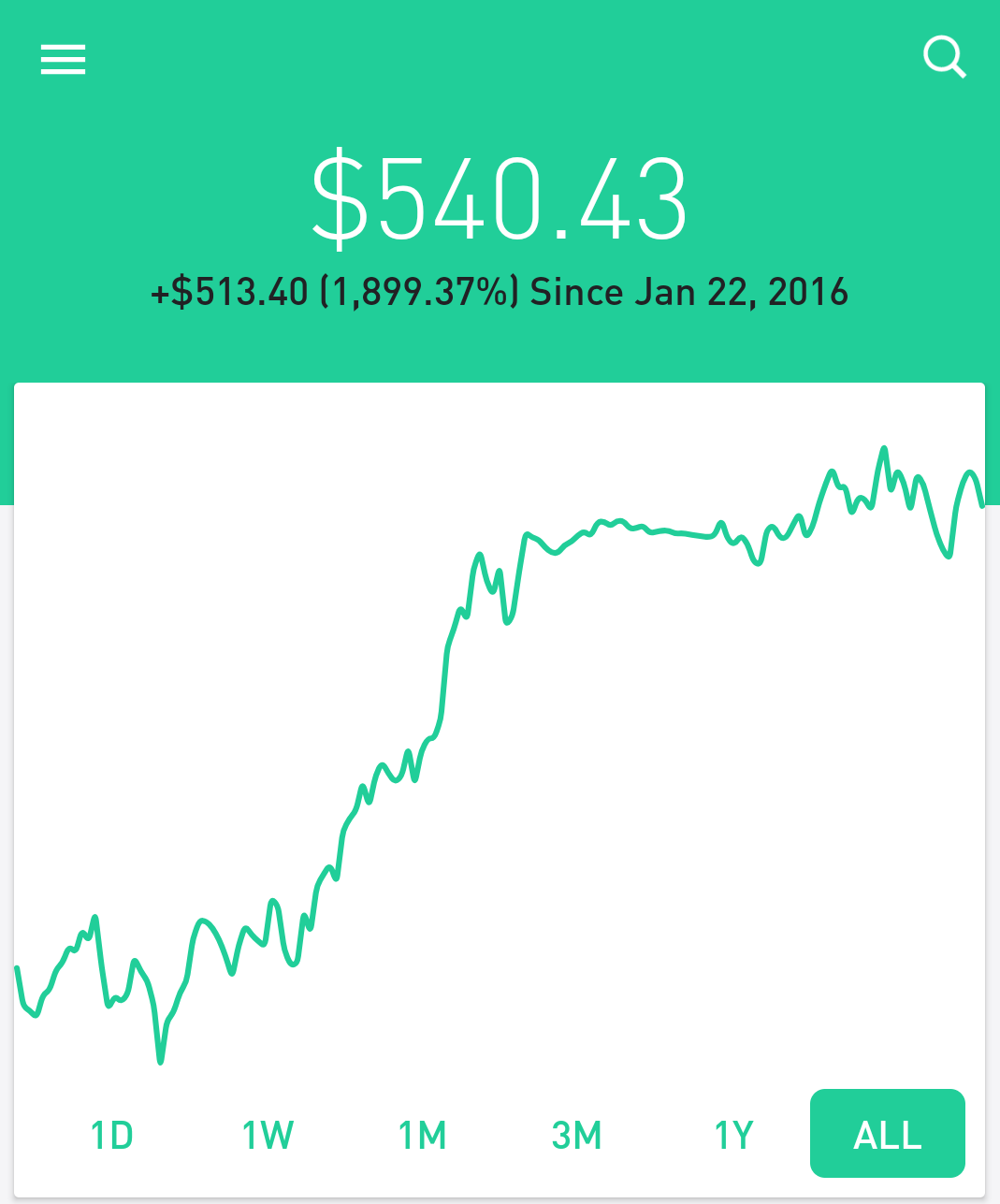

I picked some good ones on Robinhood! But this could have looked a lot differently?

I picked some good ones on Robinhood! But this could have looked a lot differently?

For the last 2 years, I have been using Stash, Acorns, and Robinhood all for investing. I plan to continue using all three as a part of my savings strategy. But I have found each to have pros and cons that may work better for some people than others! I don?t have a lot of money to invest, but I do what I can. These tools have been a great learning experience and really have helped me not only save money but get into a better mindset when it comes to money and saving.

This reviews each platform weighs the pros and cons and explains why I abandoned one in favor of the other two. At the bottom, you can see a side by side comparison of the three platforms, including how well the return on my own investment worked out on each platform.

Acorns

Acorns was the first app I started using. I loved the idea of ?Roundups?, which is where when you make purchases on a debit card which is linked to your Acorns account, it will invest it for you! Instead of saving spare change in a jar, it goes into an account that bears interest!

In addition to roundups, you can also deposit or withdraw at any time, and schedule regular automatic deposits. Once I got going on the platform, the novelty of the roundups wore off a bit. It is just as well to set up an automatic deposit. But for anyone who wants to save, but doesn?t always have much money in their checking accounts, the roundups are great.

Acorns invests your money into a specific kind of fund. Specifically, your investment is distributed over six Exchange Traded Funds through their partner Vanguard. Using these six funds, your investment is distributed in over 7,000 stocks. So you can be sure your investment is diversified and robust.

The app itself is beautiful. It is very intuitive to use, I can?t recall a single time of not being able to find what I needed.

Bottom line: A fantastic app, and a good return on investment. Best for beginners who want a low effort way to save some money.

Note: Acorns now offers two new services, one for saving for retirement called Acorns Later, and another called Acorns Spend, which is a debit card that is integrated with their other services. Thes his review does not cover this, but only their core offering, which is designed for more mid-term savings.

Get $5 when you use my invite link: https://acorns.com/invite/QMMYSU

Robinhood

Robinhood is different from the other two, as it does not deal with diverse portfolios, but with individual stocks (and more recently, cryptocurrencies).

This means a higher learning curve, higher risk, and higher potential reward. I learned a lot about investing through my use of Robinhood, and personally, I enjoy the extra attention trading single stocks needs. I mostly just buy tech company stock, because that is the field I work in and know best. I also have bought a couple of stocks based on tips from a trusted resource.

This is the only platform I?ve made any real money using, but its also the only one that where there is hope for more than a single digit return. Along with that comes much greater risk. I picked some good ones and did great, but I just as easily could have lost most of my investment.

One thing that is great about this service is that there it is freemium, so there are no fees beyond what the regulators require!

The app itself is beautiful, polished and intuitive.

Bottom line: This is a great app if you want the excitement, risk, and potential reward of trading single stocks. It?s the largest learning curve, so would be best for people who want to be involved, not set something up and forget it.

Join Robinhood and we?ll both get a stock like Apple, Ford, or Facebook for free. Sign up with my link:http://join.robinhood.com/alexw94

Stash ? DO NOT USE

EDIT: Unfortunately, in the last year and a half, I have had a huge problem with Stash, and can no longer recommend their service. Here?s what happened.

Over a year ago I closed the bank account I had connected to Stash, and opened another one. Since then I have not been able to access a single dollar of my money. I have tried opening TWO bank accounts for the primary purpose of using it to connect to Stash so I could retrieve funds. Both produced cryptic errors like ?We?re sorry, this routing number is not accepted.?

When I complained to Stash customer service, I got passed around from person to person for months with no one able to, or much interested in, helping me. All I wanted was my money that I entrusted in them, or at the very least an explanation of why my bank accounts were not being accepted. I wanted to know the criteria by which they choose to accept or not accept banks so that I would not be opening a THIRD bank account and have that not work either!

I got NONE of these.

Additionally, my repeated requests to be connected with a manager were ignored. I?m not sure if that is even legal. I was generally treated like a complainer and a problem, rather than like a client who had invested thousands of dollars into their app and entrusted them with my money.

As of this writing, there have been dozens of emails over the course of more than a year, and I still do not have access to my money. This has undoubtedly cost me several hundred dollars, as I would have cashed out a few months ago when the economy was strong and I could have really used the cash.

This whole thing has left me feeling like my cash is being held hostage by a corporation that couldn?t care less about the impact this is having on my life.

DO NOT USE STASH.

I?m removing my promotion code from here, even though that means that I might miss out on some money from people using it. I absolutely cannot in good conscience suggest that anyone use this service.

In contrast, Robinhood and Acorns? respective customer services have been excellent, and I?ve had no problems accessing my funds, even though I was in the same situation with those apps where I had to change banks.

I?ll leave the old review below so people can still learn how it works in comparison to the other apps.

Here?s my original review of Stash:

Stash is similar to Acorns, in that it allows you to easily invest in nicely diversified stock portfolios and ETF?s curated by the company. The biggest difference is rather than having only one offering, as with Acorns, the user can choose from a growing number of customized portfolios, which are grouped by industry and causes.

I absolutely love this flexibility. You can choose custom portfolios based on what industries you feel might be poised for huge gains, like ?Internet Titans? or ?Data Defenders?, and invest in companies that champion causes that you care about like ?Combat Carbon? and ?Equality Works?. And some that do both, like ?Corporate Cannabis.?

I believe on voting with my money. When I realized by investing through Acorns I was supporting some companies that I ideologically don?t wish to support, and that through Stash I can actually invest in things I believe in, I was wooed pretty hard towards the latter.

This is a trade-off. The Acorns app is simpler, as it invests everything in their own portfolio. Stash takes a little more time and energy to decide what you want to invest in. For this reason, it is possible to get a worse return based on bad picks, which is something I experienced! But due to the extra effort, I also learned a lot more about investing by using this app than I did with using Acorns, where the learning curve was pretty non-existent.

Yes, I lost money in the last 2 years. However, to be fair, Stash is designed for ?buy and hold? over a longer time. Market volatility should even out long-term and even the poorest of choices in portfolios should still give you an overall net gain.

The app itself is quite good. It is not as polished and beautiful as Acorns, but being able to pick your portfolio adds quite a bit of complexity! There?s a lot going on in this app, and they do a very good job of organizing it.

Bottom line: A great app that gives you the freedom to maximize your investment ? or minimize it by making poor choices as I did! Best for people who want to learn about investing without too much risk involved, or for people who want to invest in companies that do right by causes they are passionate about.

Note: Stash has also gotten into the retirement savings business, and into more traditional banking, including a debit card that is in the works. This review only includes their initial offering, their investment service.

Reminder: I wrote the above review before they held my money hostage, and refused to answer my questions or put me in touch with a manager. Dealing with this company has possibly the worst experience I?ve ever had as a customer of anyone, and I used to be a Comcast customer, so that?s saying a lot. Stay away from this company.

Side by Side Comparison

How you invest:

Acorns: Round ups, deposits, auto recurring deposits

Stash: Deposits, auto recurring deposits

Robinhood: Deposit money from your bank account, and use that balance to buy stocks.

What you invest in:

Acorns: ETF?s consisting of over 7k stocks

Stash: Pick and choose your own custom portfolios

Robinhood: Individual stocks

Minimum Initial Deposit:

Acorns: $5, which is free with this link: https://acorns.com/invite/QMMYSU

Stash: $5

Robinhood: $0, Sign up with my link and get a free stock: http://join.robinhood.com/alexw94

My Personal Return on Investment, and market and cash comparison for the last 2 years:

Market: 3.66%

Cash: -5.4%

Acorns: 2.32% ?

Stash: -5.51% <- I did worse than mattress money! ?

Robinhood: 1,900.1%!!! ?

My Rating for the App Itself:

Acorns: 10/10

Stash: 8/10

Robinhood: 10/10

Other features:

Acorns: ?Found money? feature where when you shop at certain retailers, those retailers will give you a discount and the difference gets invested in your Acorns account.

Stash: Same deal as above, just with a different name and different partners.

Robinhood: Some perks available to premium members. Also, Robinhood allows investment in Crypto, which is pretty cool. (Now is either the best time in a while to buy, or a terrible time depending on your perspective.)

Summary

Robinhood is the best for those who want to learn, risk more, and hope for a larger return. It is my personal favorite, and I think it would be my favorite even if I didn?t do so well on it. I just really enjoy learning and trading single stocks.

Acorns is best for people who just want to set something up to save money and not think too hard about it.

Stash lies somewhere in between. All of these are great apps and great tools for saving money. If I had to delete one of them today, I?d delete Stash, but I?d be sad because I love to vote with my dollar, and they make that very easy. But at the end of the day, it?s the worst performer, and these are tools for saving money, not giving it away!

Disclaimer: I do benefit if you click these links and sign up. But otherwise, I am in no way affiliated with these brands. I don?t personally ever promote anything I don?t personally use and benefit from.

Start investing with Acorns today! Get $5 when you use my invite link: https://acorns.com/invite/QMMYSU

Join Robinhood and we?ll both get a stock like Apple, Ford, or Facebook for free. Sign up with my link: http://join.robinhood.com/alexw94