The Federal Reserve is the cornerstone of the American economy. For just over a century, The Fed has overseen the financial system of the US, but its track record has been far from perfect. Worse yet, it has such a unique and convoluted structure that it?s very difficult for people to really understand it, which is why unsurprisingly The Fed has been subject to various conspiracy theories, from being owned by the Rothschilds to being operated by lizard people.

Before the Fed

During the late 19th century, Amerca was a nation in turmoil, and not just in the literal sense. The Civil War was no doubt devastating, but even in the peace that followed, America was plagued by frequent and deep economic depressions. The underlying cause was simple; America just lacked a proper financial system, and more importantly, it didn?t have a central bank to save the day when things turned bad.

Now, keep in mind, central banking wasn?t a new concept. The Dutch were the first to come up with a central bank in 1609, and it was instrumental when transforming the Netherlands from a swampy backwater, into a global economic empire. Following the example of the Dutch, the English created the Bank of England in 1694, which of course became the backbone of the British Empire.

The first central bank, Amsterdam, 1609

The first central bank, Amsterdam, 1609

But it?s exactly this association with the British that made the Founding Fathers reluctant to use the same model in the United States. There were two attempts at establishing a central bank even despite public opposition. Alexander Hamilton himself led the first movement in 1791. But in both cases, the systems lasted under 20 years and did little to stabilize the situation, and by all accounts, the situation was very, very bad.

Back then, even a single local bank failure could result in nationwide panics. People knew that no one could save their bank if it went bust, so as soon as rumors of insolvency started spreading, everyone frantically started withdrawing whatever they had, bankrupting otherwise healthy and solvent banks simply out of fear.

Such bank runs happened with frightening regularity, and the depressions that followed were long and painful.

The Panic of 1907!

Of course, American bankers realized very well just how bad their industry was doing. Paul Warburg, one of the great American bankers of his day, said in 1907 that the American banking system then was at about the same point as 15th century Italy, or Babylon in 2000 BC. Just a few months after Warburg made that statement, the country suffered the panic of 1907, and it was particularly severe.

To start things off, in 1906, a devastating earthquake destroyed 80% of San Francisco. With reconstruction efforts underway, the capital was very tight. And because all of the money back then was in paper form, it was much more difficult to reallocate it across the country. One banker tried to abuse that by manipulating the stock price of the United Copper Company back on Wall Street. He hoped to see the shares rise exponentially in value, but instead, they crashed, dragging down the entire stock market with them.

The Heinze brothers caused the Panic of 1907

The Heinze brothers caused the Panic of 1907

That banker was involved in 10 different banks across the East Coast, and one after another these banks failed as people assumed they were insolvent and withdrew all their money.

Pretty soon, even banks that had nothing to do with the guy were going under, and so the fearful bankers of America turned to the only man with the power to save them, J.P. Morgan.

Back then, John Morgan was the king of Wall Street, and even today the bank he created is the largest one in America. He wasn?t the wealthiest man at the time (that title belonged to John Rockefeller) but Morgan was certainly the man everyone turned to when things got bad.

How they created the Fed

In October 1907, Morgan summoned the great bankers of the day to his office at 23 Wall Street. With the collective capital of America?s big banks, Morgan arranged for the rescue of the healthy banks that were nevertheless near bankruptcy due to irrational fears. Virtually the same thing would happen a century later in 2008 when the government bailed out the banks, but this time, it was happening entirely thanks to private individuals like John Morgan.

Once the panic was contained, it became clear to everyone that a central bank was necessary, and Congress immediately passed legislation to create one. However, that was pretty much the only thing everyone agreed on. The actual details of how it would work sparked long and fierce debates that halted any progress.

The agricultural South, for example, was afraid that a powerful central bank would give Washington and Wall Street too much power over them. The bankers, meanwhile, wanted to make sure that the central bank would not be manipulated by political interests. They wanted it to be as independent as possible from Washington. The sheer number of competing parties made creating a central bank extremely difficult, and negotiations would, in fact, take over five years to finalize.

The gentlemen would hang out here, on Jekyll Island in Georgia

The gentlemen would hang out here, on Jekyll Island in Georgia

What?s interesting, though, is that these negotiations weren?t happening on Capitol Hill. Instead, they were held 600 miles South of Washington on Jekyll Island in Georgia. That resort was home to an exclusive club of over 100 of the wealthiest men of the time, including John Morgan. Of course, only a select few would help draft the actual plan for the central plan, and it wouldn?t be until 1913 that legislation would actually come to pass.

How the Fed evolved into what it is today

The newly created Federal Reserve was truly a miracle of compromise. To accommodate all the various interests of the diverse United States, The Fed became a central bank unlike any other in the world. To begin with, it wasn?t a single bank. Instead, it was a network of 12 regional banks, each governed by local bankers and businessmen.

Some of these banks were in obvious places, like New York and Chicago. But many of the other locations came down to politics. The Senator for Missouri, for example, was a key vote needed to pass legislation, which is why today, Missouri is the only state to have two Federal Reserve Banks within its borders.

To appease Washington, these 12 regional banks would have a single governing body comprised of seven people appointed by the President and confirmed by the Senate. To limit the President?s power, he can only appoint one governor every two years with a 14-year term. But the really unique part of The Fed?s structure, and you can thank John Morgan for that, is the fact that each regional bank is actually structured as a private corporation that has its own stock.

The Federal Reserve building in Washington (image source )

The Federal Reserve building in Washington (image source )

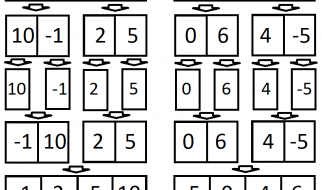

Here?s how it works. Every nationally chartered bank in America is required by law to keep 6% of its capital in its regional reserve bank. In exchange, that private bank receives an equivalent amount of shares in the regional reserve bank. These shares, however, are quite different from the shares of public companies; their price is fixed at $100 per share, and they can?t be sold or traded. They carry voting rights to about two-thirds of the board of directors for that regional reserve bank. But as we know, the real power is in the Board of Governors appointed by the president.

What these shares do have, however, is a fixed 6% dividend per year. Now, it?s worth noting that this dividend doesn?t entitle the banks to any of The Fed?s profits. Instead, everything The Fed earns above that 6% payout goes directly into the Treasury.

And keep in mind, The Fed is very profitable. In 2017, it sent $80 billion to the Treasury, while only paying out $40 billion to the regular banks that hold its stock.

So who are the shareholders of the Federal Reserve? Well, basically every big bank in America. The full list is 150 pages long, but pretty much every name you know appears on it. But here is the beautiful thing: most of America?s big banks are public corporations. In other words, if you want to benefit and make money off of the unique structure of the Federal Reserve, you can do that by purchasing stock in American banks. Since ownership in The Fed depends on capital, the bigger the bank, the bigger its ownership stake. Therefore, it would be wisest to start from the top of the list.

If you enjoyed learning about the Fed, click the clap button for us ?? You can also visit our YouTube channel to find content on similar topics. Stay smart!