It may happen that you misplaced or lost your Employer Identification Number (EIN).

Lost or Misplaced Your EIN?

If you previously applied for and received an Employer Identification Number (EIN) for your business, but have since?

www.irs.gov

Without an official letter from IRS with the company?s name, address, and EIN, it is usually impossible to open a bank account, verify Payoneer or Paypal business profiles, etc.

The good news is that you can get a same-day online 147C replacement if you don?t mind hanging on the phone for 30 minutes. Here is how:

- Get yourself a virtual fax, write down your fax number;

- Get your company documents ready (for verification of your relationship to the company);

- Call IRS at 800?829?4933;

- Request a new verification letter to be faxed to your virtual fax.

- Download the pdf.

Detailed description of the steps below?

Get your fax ready

Oh, you don?t have one? Don?t worry, everyone stopped using fax 20 years ago (except IRS, obviously). To work this around, we will use a virtual fax service. I recommend faxburner.com since it doesn?t require installing malicious chrome plugins as others do.

Disclaimer: fax is not a secure way to trasfer data. A third party, such as virtual fax service provider, may potentially access your tax information.

Get the company information ready

The IRS agent will want you to prove your relationship to the company by asking questions such as your position at the company, incorporation date, state, number of employees, current address, phone number, EIN number, etc.

Call IRS at 800?829?4933

I use Google Hangouts or Google Voice to call from outside of the US for free.

Once in the main menu, press #1 for EIN information, and then for #3 to get the EIN confirmation. You might have to wait up to one hourtobeconnectedtoarepresentative. Once connected, ask the person to fax you a copy of the verification letter.

Voila! It should show up in your virtual fax inbox instantly. If it doesn?t, give it a few minutes, the IRS operator would not mind holding the line.

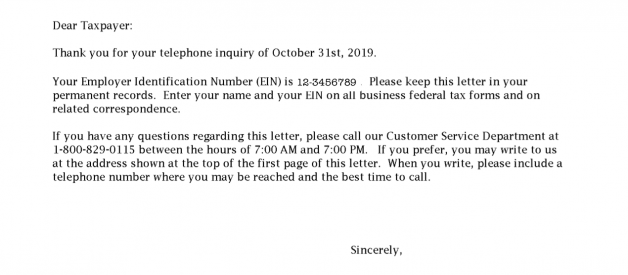

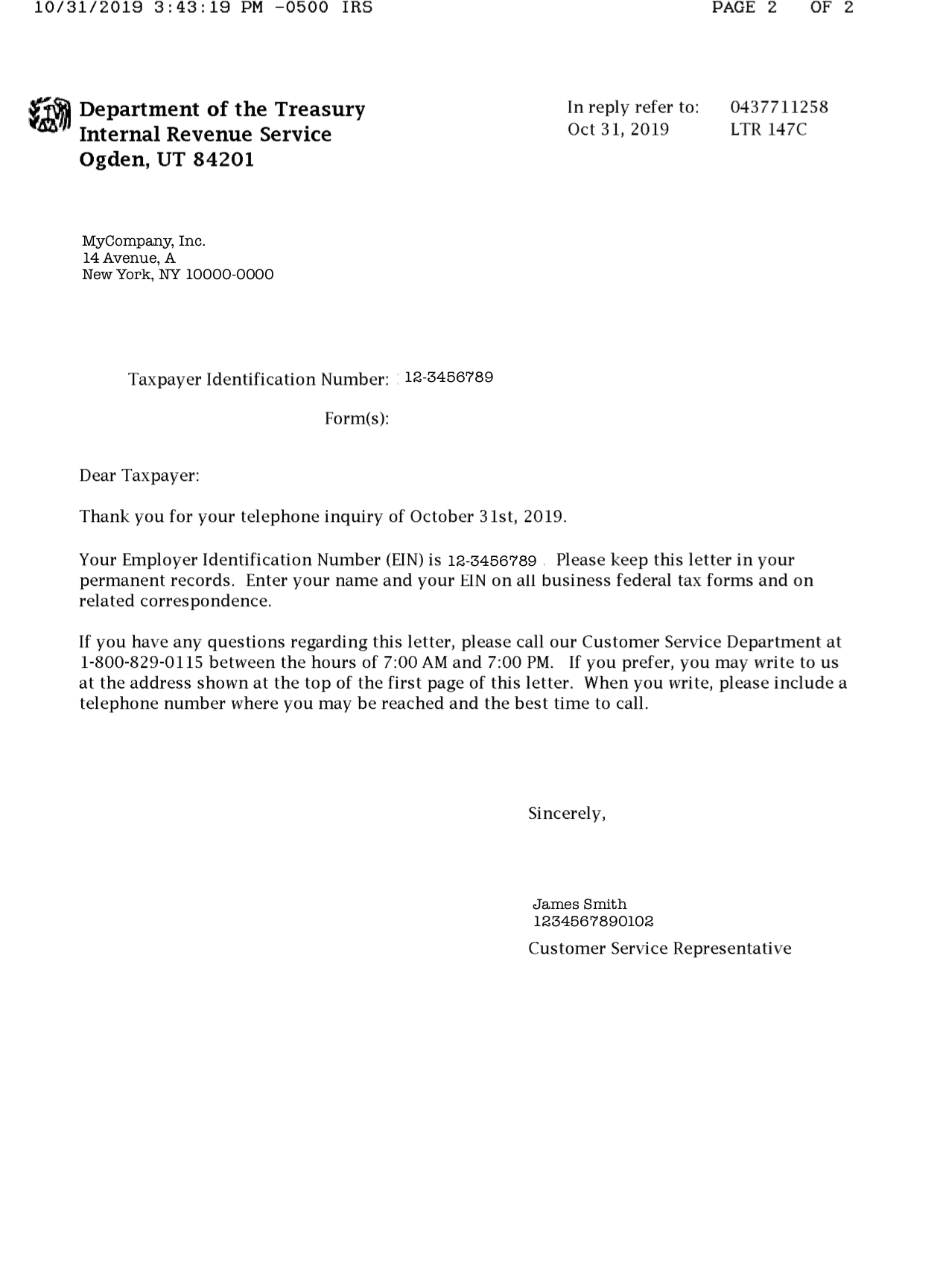

Example of IRS replacement received through virtual fax.

Example of IRS replacement received through virtual fax.