Say Goodbye to Stress

https://images.app.goo.gl/Zf9xuPbEqvjhDWXj7

https://images.app.goo.gl/Zf9xuPbEqvjhDWXj7

Are you tired of scraping by? Living paycheck to paycheck?

You feel like you are doomed to living this way. You don?t know how to change or even where to start.

Have you heard of frugal living and what a difference it can make in people?s lives?

Did you know living a frugal life can help you excel at work and home?

Or that it can help you live your dream life forever?

You may have already searched the topic and only found frugal living tips or ideas on what it is but discovered nothing comprehensive.

You?re intrigued but you don?t want to jump from one site to the next. You have not found that one-stop shop that will answer all your questions.

Until now.

In this post, I will dive deeper into the world of frugal living. You will learn what it is, why you should start now and how you can make the most of it.

Table of Contents

- What is Frugal Living?

- Why You Should Live Frugally

- 8 Benefits of Living a Frugal Life

- Common Misconceptions About Living Frugally

- Take Action Today With These Simple Frugal Living Ideas

- A Little Help From Your Friends

- The Final Word on Frugal Living

What is Frugal Living?

What does frugal living mean to you? Well, if you are like most people it brings up images of cheap living or cutting back on things, living meekly, or being perceived as a cheapskate.

You couldn?t be more wrong.

Frugal living is getting the most from your money and making it go further. It is a lifestyle like having no kids or being a swinger or pretending you are living in the Victorian Era. (Believe it or not, that is a lifestyle.)

It is a choice to be better at money management and not spend lavishly on things you don?t need. It means not going out to buy the latest iPhone when it hits the stores. It is a lifestyle that will grant you financial independence and provide stability for the rest of your life.

Living a frugal life is becoming more and more popular because of its benefits, both short and long term. People are finding that in adopting this lifestyle they have discovered new interests, think more strategically and learn how to want ? responsibly.

This leads to an improvement in your work and home life as well. You will be more curious about things and want to learn how they work. A naturally frugal person will educate themselves more which will lead to smarter and better decisions.

You now know what frugal living is. Let?s take a look at why you should be doing it.

Why You Should Live Frugally

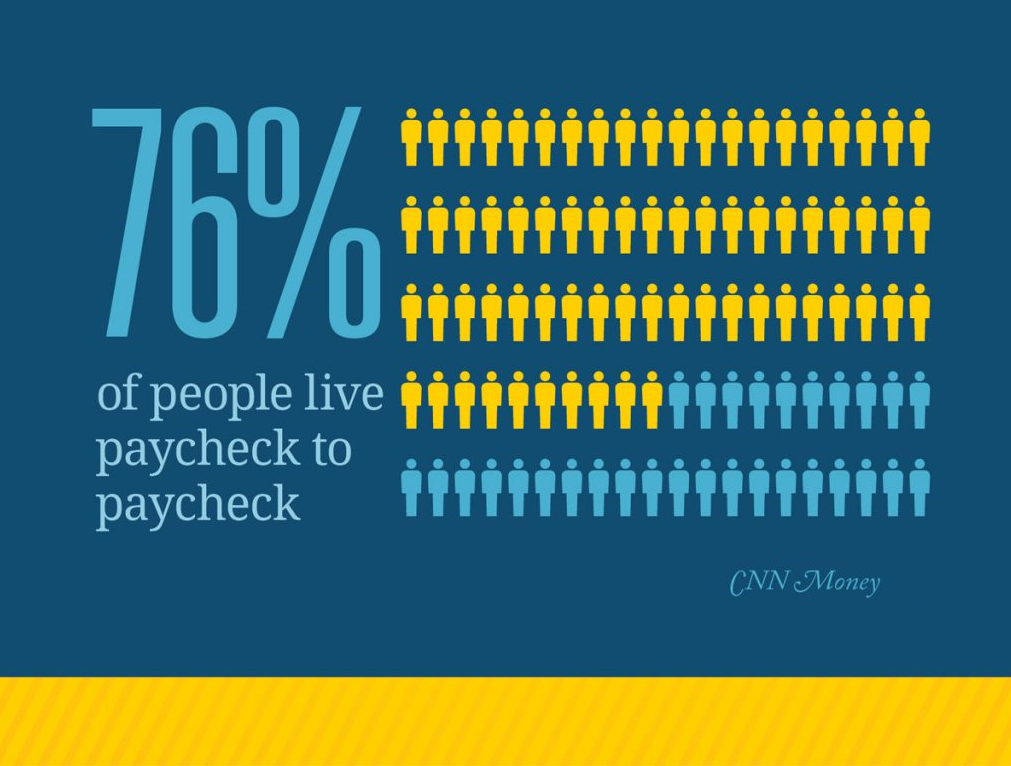

How many people do you know who live paycheck to paycheck? I know many people who struggle to save money or curb their impulse control in buying things. Did you know close to 80% of people live paycheck to paycheck?

https://images.app.goo.gl/dEVki8XmNRe1edBx8

https://images.app.goo.gl/dEVki8XmNRe1edBx8

Imagine a life where you are the minority that do not adhere to this statistic. Have you ever come upon a deal that was so good but had to pass it up because you didn?t have the money to spend on it?

Well, I have ? and I kicked myself for being in that position. So I made a few adjustments and was able to take advantage of deals that came my way later.

But does that mean I have to stop living my life?

No, not at all.

Living frugally means taking charge of your life and making smarter decisions on how to live it. Many people get their paychecks and go out and immediately spend the money they just received. This is a recipe for disaster.

8 Benefits of Living a Frugal Life

You?re probably not going to do something long term unless it benefits you, right?

We are all self-interested creatures and want to know what are we going to get out of it. It?s only natural. Here are some of the biggest benefits of living frugally.

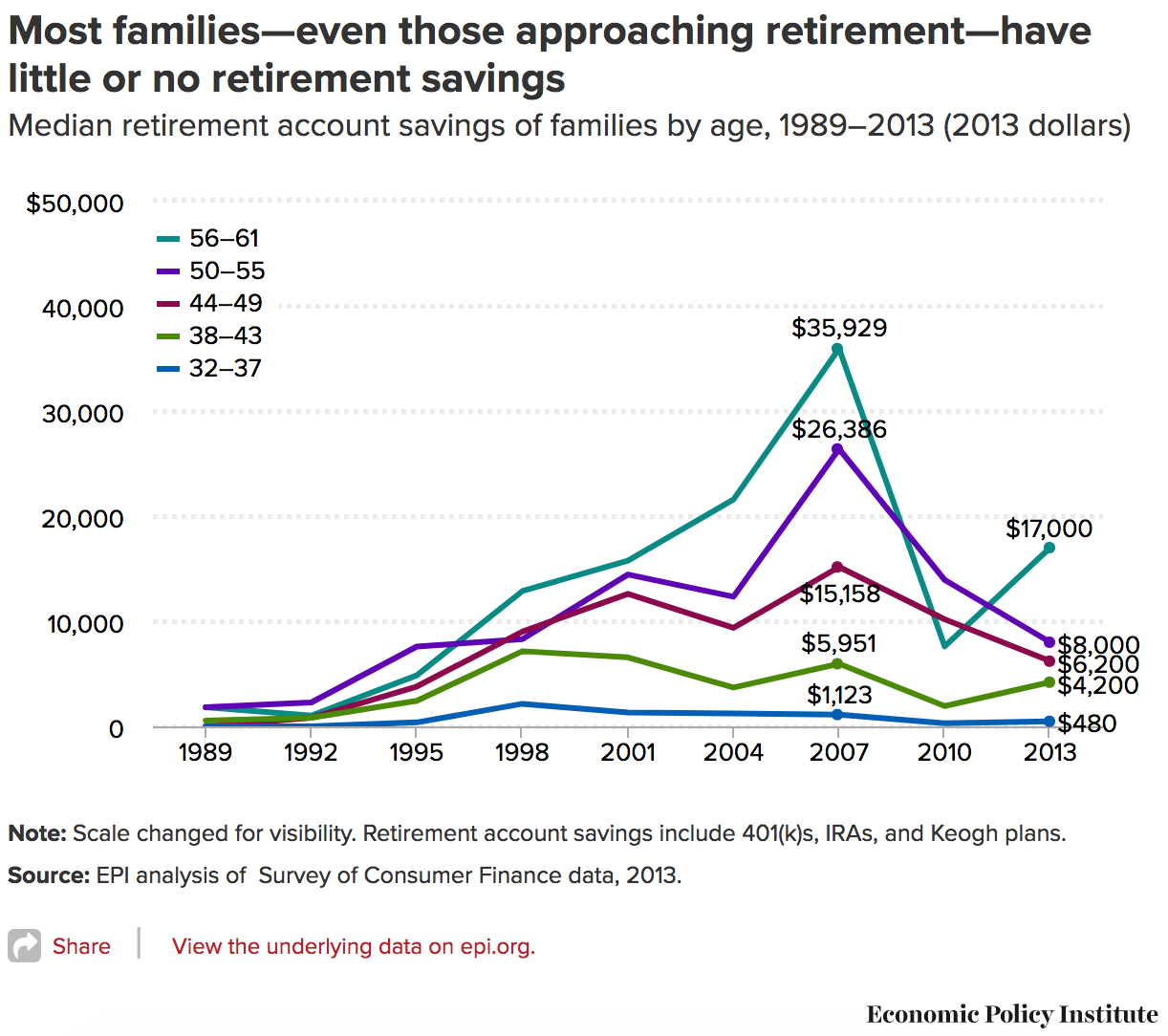

1. You?ll Rest Easy About Your Retirement

Over 40 % of Americans are likely to retire broke and have less than $10,000 in retirement savings stored up. You don?t have to be one of these people. You can make a change in how you handle your finances and be ready for a comfortable retirement with no money worries. There a number of vehicles to put money to ramp up your retirement: 401K, IRA, and Roth IRA.

https://images.app.goo.gl/7a4xMkmwBwByvGf4A

https://images.app.goo.gl/7a4xMkmwBwByvGf4A

2. You?ll Be Debt Free Faster

Debt feels like a noose around your neck that walks with you no matter where you go. Americans carry over $800 billion in credit card debt. That is enough money to pay the United States budget deficit in full. That is a huge amount of debt that was spent on consumer items like televisions and computers more than likely. Picture going to the mailbox and finding no bills or any overdue late notices.

3. You?ll Own Your Score

As your debt falls your credit scores go in the opposite direction. A better credit score leads to more and more deals and less and less on interest paid. This is a HUGE advantage if you plan to purchase a big ticket item like a house. The terms on the deal will having you paying minimal interest.

4. You?ll Enjoy More Time Off

Frugal living provides ample free time to spend doing what you want to do and go where you want to go. Spend it taking the family to Europe for a summer, going on an Alaskan cruise, or visiting the Far East. When everyone else is squeaking by to take two weeks off, if they can be away from work that long, you can afford to be away for a couple of months at a time.

5. Your Bank Account Will Soar

You will have more money to put in the bank or invest. The words compounding interest will be your best friend. Watch as your accounts grow faster than your friends. What would normally take a lifetime to build up a nest egg could take you a lot less time. Many working people live paycheck to paycheck with nothing to show for it in the bank.

6. You?ll Own Your Home Sooner

How would it feel if you didn?t have a mortgage payment anymore and owned your house outright? Pretty darn good, wouldn?t it? Paying off your 15 or 30-year mortgage in 5 or 10 years will seem like it was done in record time. Paying just a little more each month can shave years off your payment schedule. Tell the bank to kiss off.

7. You?ll Have Money For a Rainy Day

Most people can?t come up with a few hundred bucks when disaster strikes. But when you live frugally, if you have to go into the hospital for any reason and insurance won?t cover all of the bills, you will be covered. You will never be in their boat again. You will be prepared for whatever comes your way.

8. You?ll Be Able to Relax

Everybody has worries about money ? even people with a lot of it. But if you have a system in place you will never be in that boat. Money stress is the number one thing people worry about. Imagine not having that worry. All of life will seem like a breeze. You will be in a position of strength and a feeling of self-control will come over you.

https://images.app.goo.gl/3keY9jHyvv9tzDoa6

https://images.app.goo.gl/3keY9jHyvv9tzDoa6

Now that you can see the benefits of frugal living, let?s debunk some common misunderstandings.

Common Misconceptions About How To Live Cheap

Images of cheap living come to mind when people think about this lifestyle. You might imagine people cutting coupons, counting out change, or always saying no to any activity that costs money. These and others are what people see in their minds when the term frugal living is mentioned.

These perceptions are wrong and we need to start thinking differently when it comes to frugal living. It is a worthwhile lifestyle with many benefits that could change your life forever.

Myth #1 ? Being Frugal Is Boring

Everyone wants people to think they have an exciting, fun-filled life. Everything they do or say they do paints pictures of buying a big mansion, driving a fancy car or going on cool vacations. Many folks who go out to purchase expensive toys like a new boat or car often buy those things on impulse and later regret how much they spent on an item. They quickly fall into ?buyer?s remorse? and wish they never made the purchase.

Myth #2 ? Saving Little by Little Gets You Nowhere

Most people think that people get rich by coming into a boatload of money from the sale of a company or a big inheritance. They believe that saving a little at a time is useless and won?t get you anywhere. But with investment ideas like compounded interest and dividends, you would be surprised how fast your money starts to accumulate. It is never too late to start saving even if you think you are too old.

Myth #3 ? You?ll Have To Go Without Certain Items

Living a frugal life does not mean you have to miss out on things like owning a house or a car. In fact, you will be at an advantage to purchase either when the time comes. You should be able to make a deal with the seller by providing more cash up front. Also with your high credit score, the interest you would pay would be minimal compared to everyone else.

Myth #4 ? You?ll Be Seen As a Cheapskate

There is a huge difference between being frugal and being a cheapskate. Let me clear up the dissimilarity. When you steal office supplies or even take extra condiment packets wherever you go, you are cheap. Replacing your paper towels with cloth rags is a way to live frugally. Instead of spending money on replacing the paper towels you can wash the cloth over and over.

Myth #5 ? It?s Impossible To Achieve Cheap Living These Days

When they are bombarded by ads, commercials, and in-your-face pop-ups, people believe frugal living is an impossible task. Constant pressure and judgment surround you. Keeping up with the Joneses? is very real. But if you are committed to this lifestyle you can live this way. All it takes is making it a habit and using a little creative ingenuity.

People are discovering more and more that these misconceptions are not true. Now that you know they are false too. Let?s see how to get started on simple frugal living.

Take Action Today With These Simple Frugal Living Ideas

Now you learned the what and why of living a frugal life. The next step is to learn how to take action and get started taking advantage of all this lifestyle has to offer. The ideas listed below will set you on your way to accomplishing this goal.

- Seek out the best deals online ? With the Internet, it is easier than ever to locate the best deals online. Multiple sites provide coupons, membership clubs and other ways to not pay full price for items. While others are not willing to do a little research to save money, you will be not one of them.

- Buy in bulk ? Invest in a membership club like Costco or Sam?s Club. They will save you money because buying in bulk is cheaper long term. Stock up on paper products, frozen items, trash bags, laundry detergent and other things that run out quickly. Save money by not having to drive there every time something runs out.

- Pick your own fruits and vegetables ? Find farms that will allow you to pick your own fruits and vegetables. These can cost a pretty penny at the supermarket. You can?t get any fresher than picking it off the branch yourself. You can make it a weekly day out with the family.

- Use the local library ? This is a real money saver if you are a reader like I am. Books on Amazon go for around $13-$25 a piece. An avid reader can plow through a book every 7?10 days. You could easily blow almost 100 bucks a month on reading material. This is another bill you have to pay like electric or water.

- Learn how to be a DIYer ? Repairs on anything can be expensive especially in your home and car. You can put how to fix [blank] into YouTube and up pops a video showing you step by step instructions on how to do that task. Be careful, though, when dealing with electricity unless you know what you are doing.

- Harness the power of vinegar ? Vinegar is a versatile cleaner that can be used on windows, mirrors, bathroom fixtures, linoleum floors, and appliances to name a few. Make your own concoction instead of buying expensive name brand cleaners.

- Seek alternatives to cable ? There are cheaper ways to be entertained than forking over close to $200 for a monthly cable bill. Pick up a hobby like reading, have a board game night with the family or play a sport. Challenge yourself and learn a new language. You spend most of your time searching for something to watch with all of the channels they provide. Most of the time there isn?t anything on you want to watch anyway.

- Get a second opinion on a health issue ? Don?t just go to the doctor when you have a problem and blindly accept his remedy. Educate yourself on the issue and research potential solutions. Ask questions based on what you have learned. Visit a couple more to see if there is a better more cost effective solution. You could save yourself hundreds if not thousands.

- Invest in a deep freezer ? Buy meat and other frozen items in bulk and store them in a deep freezer. Keep it in your garage or basement for ideal storage. Bulk items cost less and last longer when frozen. It takes the pressure off your monthly grocery bill.

- Switch to a cheaper wireless phone plan ? There are numerous wireless phone companies you can receive service from. Verizon and AT&T aren?t the only options on the block. Sometimes companies will provide you with a cell phone for your service. Explore other non-mainstream carriers like Tracfone or Consumer Cellular.

- Seek alternatives to using your car ? If you plan accordingly you can save money if you own a car. First, ask your employer if you can telecommute. Also, consider becoming a one car household, do all of your errands in one day, walk or bike to work if possible, and roll your windows down when traveling locally to save on gas.

- Call utility companies for a better plan ? Ask them if they have a budget billing program that allows you to set your monthly payment based on your average costs. This will allow you to have predictable monthly electric bills month after month. No more spikes during hot or cold seasons

- Shop for discounted clothing ? Shop second-hand clothing stores like thrift shops or Goodwill. Buy clothes at the end of season, for example, you can purchase shorts and bathing suits in the fall. Purchase basic items like T-shirts from Target, Old Navy and similar stores.

- Never do anything on impulse ? This may be the last frugal living tip on the list but it is the most important. Always plan your purchases ahead of time to save money. Buying on impulse is an emotional activity most of the time and should be reeled in.

You are probably itching to put most of these ideas in place but don?t really know where to start. The next section will guide you to various resources to make life a little easier.

A Little Help From My Friends

Explore these sites to help you achieve the life of cheap living. I have used them all to help me save money.

- Pick Your Own? Find the best local places to pick your own fruits and vegetables near you. Avoid paying high prices in the supermarket and enjoy fresh from the farm. They also provide tips to save 95% off the cost of starting your own vegetable plants.

2. Ebates? This is a cash back and coupon finding resource at over 2500 stores including Amazon, Walmart and Macy?s. You can find deals on hotels, flights, cars and vacation rentals. There is a welcome bonus when you sign up.

3. YouTube? You can look up how to do anything from small repairs in your home to learn how to cook crab legs. Learn how to unclog a toilet, change your own oil, perform a mani/pedi on yourself and many others to save money.

4. Nerdwallet ? An extremely helpful site to help you get the most out of your money. It offers tailored advice, content, and tools to receive the best rates on insurance, credit cards, mortgages, and loans.

5. Restaurant ? You can get gift cards to restaurants for a fraction of the cost. When you do decide to ?splurge? and dine out you still won?t be paying full price. New restaurants added daily.

6. Gasbuddy ? This app helps you find the best deals on gas in your neighborhood. There is a handy dandy app that works great on your phone when you are out of town and searching for cheap fuel. Offers a free trip cost calculator when you are planning a road trip.

7. GoodRx ? Prescription medicine can be costly for most people who need to have it. This site compares prices and discounts from 60,000 U.S. pharmacies to get you the best deal on your prescription. Save up to 80% by shopping around.

8. Zipcar ? Owning a car can be expensive with all the upkeep and maintenance. Zipcar rents cars out for an hour or a day. So if you are really in a jam and need a car for whatever reason this is a handy option.

9. Letgo ? Frugal people usually own less stuff and this site is a great place to sell off unwanted goods. Easy to use and sign up. Have a piece of furniture or an older model car you are not using anymore? Sell it here and make some quick cash. Need a replacement lamp or coffee table? Bargains are all over this site for you to take advantage of.

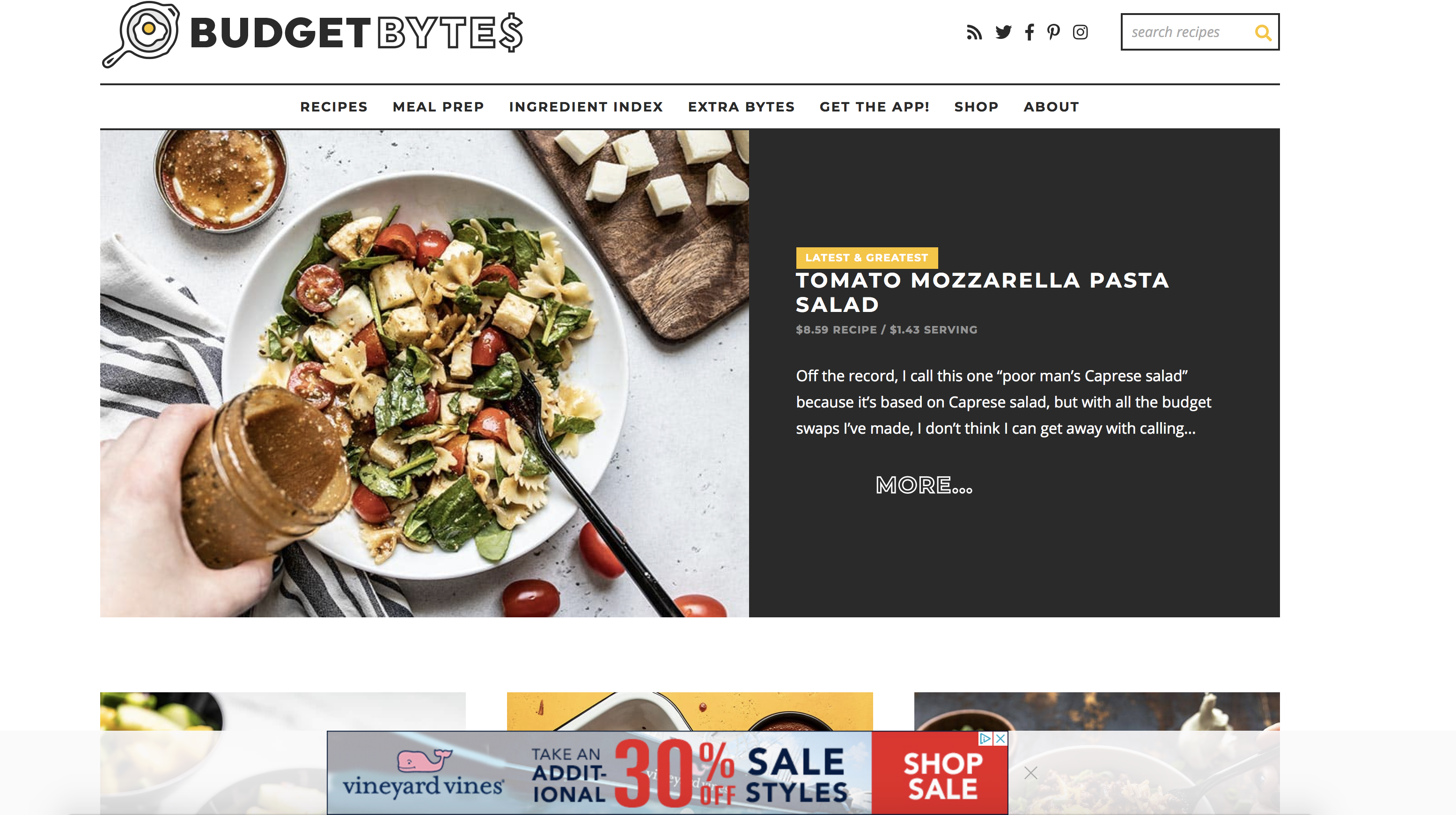

10. Budgetbytes ? This is a beginners cooking site which teaches you how to prepare meals at home for cheap. It gives you step by step instructions along with whatever ingredients you will need. There are recipes for every meal including vegan and vegetarian options.

11. Craigslist ? You can find excellent deals here ? from cars to furniture to clothing to household items ? all in your area. You can also sell your unwanted goods and even get a ride through the rideshare community.

12. The Zebra ? Compare home and auto insurance and get the best rate for you and your family. It provides what goes into insurance prices and how to ship for an insurance policy.

The Final Word on Frugal Living

Frugal living gets a very bad rap among Americans. We live in a culture of spend, spend, spend and have new products constantly shoved down our throat. Car manufacturers produce new models every year and run ads to entice you to purchase their latest and greatest product. New phones come out every year that seduce you with all sorts of deals.

People have a mentality that makes them feel they need to keep up with their neighbors and friends. You might feel inferior if you don?t have a new car like Bob from down the street. Social pressure pulls at you to keep up with everyone ? to constantly go out and buy a new boat or a new car or the latest gadget.

Imagine running into your neighbor who shows you his new boat and tells you how great it is. But a few seconds later, he complains about how expensive daily upkeep is.

You smile as you think about how living frugally saved you from being like your neighbor. The flashiness of the new boat is short lived but the six or seven digits in your bank account are not.

You now have the tools to start living frugally. Don?t feel overwhelmed and think you have to accomplish all of these at once. Instead, start small with one step today.

Choose one frugal living idea and make it a habit. If you do nothing else all day make sure you apply your idea every day. After a couple of weeks, you will notice it will be automatic and you will not have to think about it.

Next, choose another and go through the same process until that too becomes a habit. You will see big changes almost immediately.

You will be well on your way to living a more full, enjoyable life.

Trust me. If I can do this, you can do it too!

And there?s no better time to start than right now.

This article is for informational purposes only, it should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions