Which Cryptocurrency Will Win?

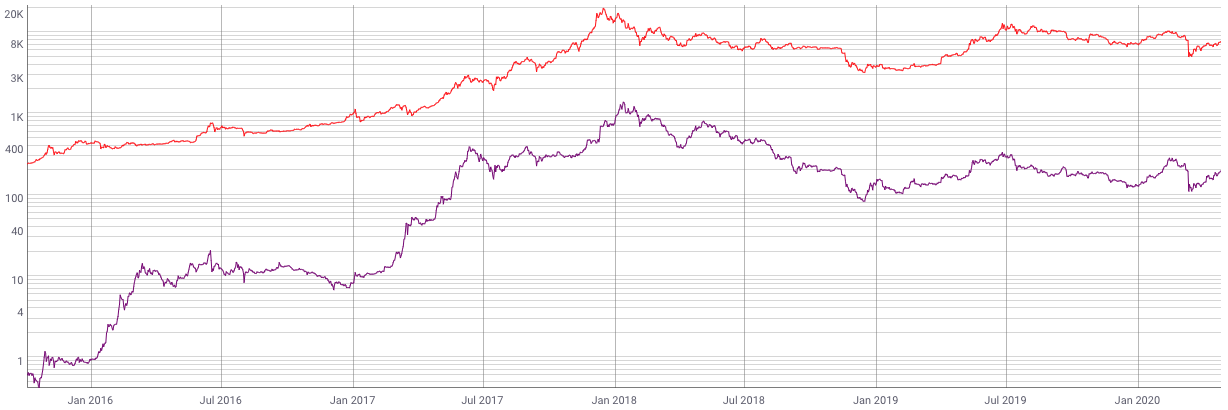

BTC vs ETH ? Price in USD (source: Coinmetrics.io)

BTC vs ETH ? Price in USD (source: Coinmetrics.io)

Disclaimer: I am not a financial advisor and I?m not telling you where to put your money. Either or both BTC and ETH values could drop to zero.

This is a bait and switch title, but only because a lot of people are asking a question that doesn?t make sense.

The question, ?which will win, Bitcoin or Ethereum?? implies some misconceptions which do not reflect reality.

- Misconception: Bitcoin and Ethereum are Currencies, and should be judged by how good they are at being money. Reality: Bitcoin and Ethereum are cryptonetworks, and should be judged by the value each network is capable of producing. (BTC and ETH are currencies which are used to reward participation in the respective networks).

- Misconception: BTC vs ETH is a zero-sum game. Reality: BTC and ETH could complement each other, and asset diversification reduces risk.

Misconception: Bitcoin and Ethereum are currencies, and should be judged against each other by how good they are at being money.

The reality is that Bitcoin and Ethereum are both decentralized computation networks. They have each made engineering trade-offs that make them good for some use-cases and bad for others.

The Bitcoin Network Isn?t Money ? It?s Security

Bitcoin is the most secure decentralized, immutable ledger in the history of computing. It features Turing-incomplete smart contracts that limit the features that bad actors could potentially exploit to steal assets on the network, and its security is backed by mind-boggling amounts of hash-power which has increased exponentially over the past decade.

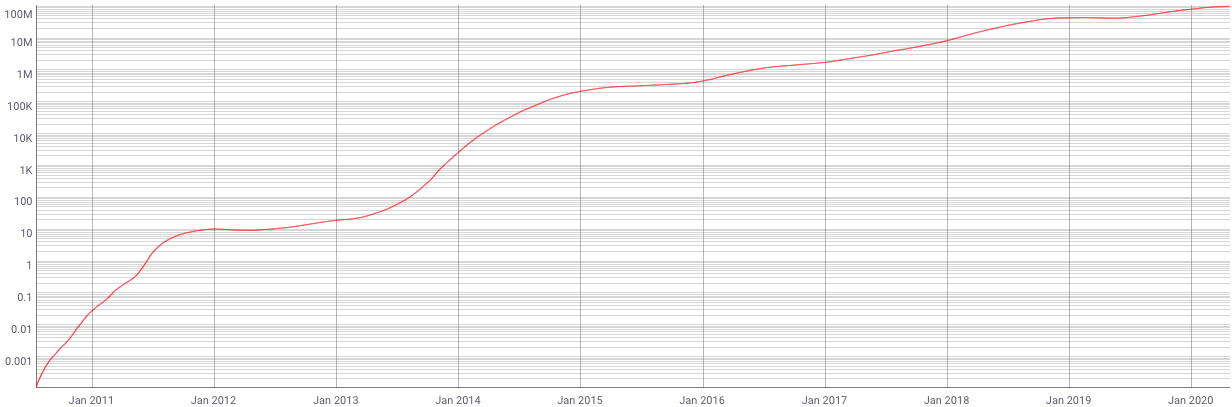

Bitcoin Network Hash Rate, log ? each increasing number on the left side is 10x larger than the previous. (source: Coinmetrics.io)

Bitcoin Network Hash Rate, log ? each increasing number on the left side is 10x larger than the previous. (source: Coinmetrics.io)

It would be incredibly expensive to try to double-spend assets on the Bitcoin network ? expensive enough that it?s probably physically impossible to purchase enough computing resources and electricity to successfully 51% attack the Bitcoin network without making a multi-year commitment and investing over $100 billion in the process.

If you?re going to go to all that trouble, you?re a lot better off financially if you just mine bitcoin and take the legitimate profits from that.

In order to double spend money on the Bitcoin network, you need a few things:

1 ? Access to a Bitcoin wallet with enough Bitcoin in it to make a double-spend attack worthwhile. As you?ll soon see, you?d need to buy a LOT of Bitcoin (> $100 billion dollar?s worth) to make such at attack viable, and doing so quickly would drive up the price of Bitcoin further. The more you buy, the harder it is to buy more, because you have to find more sellers willing to sell to you at the offer price. In the process of buying enough Bitcoin to make a double-spend attack viable, you?ll likely drive up the price of Bitcoin by 10x or so, pushing your goal further and further out of reach.

2 ? You?d need to find enough things to buy with that Bitcoin that you end up with something of value after the fact. If successful, the attack would prove that the Bitcoin network is not as secure as everybody thinks, so the value of your ill-got gains would quickly plummet. You?d need to buy and take delivery of enough other assets to make the attack worthwhile. As of this writing, it?s somewhat difficult to find people willing to sell you a pizza for Bitcoin, let alone $100 billion+ worth of assets.

3 ? You?d need to purchase or take control of enough Bitcoin mining equipment to outpace 50% of the existing network. In the last 24 hours, the Bitcoin network performed and estimated 110 million terahashes per second. A terahash is 1,000,000,000,000?1 trillion hashes. 110 of those is such a huge number that it?s best expressed in scientific notation: 1.1×10?.

The fastest miner on the market (not shipping yet, as of this writing, shipping date TBD) is currently the Bitmain Antminer S19 Pro (110TH/Sec). You?d need to buy 55 million of them at a cost of about $150 billion to 51% attack the Bitcoin network, but it?s unlikely that the manufacturer can produce anywhere near that quantity fast enough for you to mount a 51% attack with them. In fact, as I write this, they?re already sold out.

Even if you could find enough hardware to mount an attack, the typical total daily volume for Bitcoin transactions is less than 1/5th the amount you?d need to double spend to pay back your investment in the attack. Finding enough double-spend victims to make the attack worth your while is going to be a major struggle.

Your only real option is to attack the mining pools. There are currently 3 large Bitcoin mining pools that collectively control more than 51% of Bitcoin?s hash power. If you managed to gain control of all 3, you might be able to double spend, but mining pools aren?t just magic hash power controllers ? they?re made up of hundreds of thousands of individual miners who could each individually detect a double-spend and quickly switch their hash power to an alternative pool.

In fact, that process can be automated, so that as soon as an attack is detected, the pool participants can quickly decentralize, meaning you would need to concentrate your double-spends on a small enough number of transactions to slip them through before the mining pool participants can react.

If you can manage to get past all those obstacles and get away with your double spend attacks, everyone will know, and everyone will know the wallets you used to do it. Those wallets can and will be quickly blacklisted on every major exchange.

Breaking into a gold vault is only half the battle. You also need to be able to get away with the gold. Recently, a DeFi hacker on Ethereum returned the stolen funds to avoid punishment because his identity was detected. You?ll run into the same problem if you try to mount a double spend attack on a network as big as Bitcoin.

I know there have been successful double spend attacks on smaller networks. But the difference between double spending on a small network vs double spending on Bitcoin is like the difference between drinking a glass of water and drinking an ocean.

All of this security exists to protect money, but it?s hyper-overkill to protect your latte purchase. The Bitcoin network is particularly good at protecting transactions with values in the range of $10k+. In other words, it?s great for settling large batches of smaller value transactions.

Bitcoin?s immutable ledger can also protect data, with no financial transaction involved. The OP_RETURN operation can record a short piece of data immutably on the Bitcoin ledger, forever. That data can be the unique fingerprint that identifies a much larger chunk of data, including the transaction history of an off-chain ledger, a real-estate deed, or the hash of a creative work (akin to securing copyright, trademark, or patent protection). Those fingerprints can be used as evidence of ownership which do not rely on any country?s system of laws.

Using the Bitcoin network, a writer can prove with the laws of math that they had a document at a given point in time, supplying evidence that could support a claim of ownership. That proof is a valid attestation of fact in every jurisdiction, and international courts are likely to recognize that.

You could do the same to record receipts for the purchase of valuable items, such as real-estate, cars, boats, or stocks.

The Ethereum Network Isn?t Money ? It?s Programmable Value

Ethereum is great at creating tokens which can represent fractional ownership shares, vested interests, controlling votes, access and permissions, the ability to share control over assets with people you may not trust, etc.

Ethereum has so far spawned multiple killer apps:

- Fundraising (see the 2017 ICO boom).

- Decentralized Finance (DeFi).

- Non-Fungible Tokens (NFTs) including digital collectibles of many different varieties.

Potentially, Ethereum could replace the stock system, reinvent insurance, and break your dependence on banks for things like checking accounts, savings accounts, and loans. Because Bitcoin chose security over flexibility, Bitcoin can?t do those things without building separate, more flexible networks alongside the main Bitcoin network (e.g., Blockstack and friends).

But Ethereum?s security is far more questionable than Bitcoin?s. With all of that additional flexibility, there is also a far larger attack surface for hackers to exploit. But what if you could conduct your transactions on Ethereum, and then immutably record their state on the Bitcoin network periodically, for additional protection?

A large number of Bitcoin network transactions don?t actually send Bitcoin. Instead, they secure data with hashes (data anchors) using protocols like Proof of Proof and Proof of Existence. Bitcoin is currently the most secure decentralized ledger in the world, and the best way I?m aware of to secure such valuable data.

In other words, Ethereum apps could really use the Bitcoin network?s help.

The Right Question

The right question is not which currency will win. That?s irrelevant. The value of each currency comes from the value of each network, so if you really want to compare the assets, you have to compare the networks.

Bitcoin is a bit like a bank vault. You can store and transfer ownership of anything in the vault (including information), but you can?t really do much else with it.

Ethereum is more like a data center that you can pack any kind of computer into to perform any kind of calculation, with some limits. Each computer has to follow some specific rules. You can pack it with many different kinds of computers calculating different things. But the cost of running those computers in that data center is quite high. For most computing needs, you?ll be better off renting computers from centralized providers like Amazon or Microsoft. Ethereum is best when lots of people who don?t trust each other need consensus on the state of computations, e.g. financial transactions.

I?ve seen tweets suggesting that one day the Ethereum network could replace the Bitcoin network, and BTC could continue to exist, complete with all its great financial policies, on top of the Ethereum network.

That is theoretically true, but since hackers can explore that data center and there are lots of interesting ways to make those computers attack each other, that doesn?t strike me as a good idea. It seems to me that the Bitcoin network?s enhanced security will always be capable of making security guarantees that Ethereum may never be able to match.

Likewise, Ethereum is capable of doing things that the Bitcoin network simply can?t do ? by design.

Bitcoin trades flexibility for security, while Ethereum trades security for flexibility.

Both are valuable and worth paying for, and both tradeoffs are worth making based on the respective rewards.

Both are great, complementary networks. You can use Bitcoin to secure assets that are tokenized and traded on Ethereum. And BTC can be more useful to holders if you can take loans against it using Ethereum?s DeFi protocols.

As for the assets themselves, BTC vs ETH: Money has different properties worth considering:

- Medium of exchange

- Store of value

- Unit of account

Medium of exchange. Both are good mediums of exchange, but BTC has far more opportunities for exchange right now (a lot more people paying and accepting in BTC than ETH).

Store of value. Both could be great long-term stores of value. Which is better remains to be seen. Time will decide.

Unit of account. Both are currently too volatile to be a good unit of account (hence stablecoins).

BTC is capped at 21 million. Eventually (note to ETH maximalists, this event is more than 100 years from now), there will be no more Bitcoin to mine ? unless a majority of the Bitcoin network agrees to a change in the policy. If or when the BTC cap is reached, the Bitcoin network will transition to transaction fee incentives (which it has always had). Fees for transactions will go up over time, along with the relative security of the network. As fees rise, lower value transactions will move to other networks, while higher-value transactions will likely stay on the Bitcoin network for enhanced security.

As a security and settlement layer of the internet of value, that is not a problem, because transactions are generally quite valuable. The average value of a BTC transaction today is about $5,700. People transacting thousands in value don?t mind paying a small fee. There is a thriving fee market for Bitcoin today. I see no reason for that it would do anything but grow in the future.

For those who don?t need that much security, there are already low-fee and no-fee alternatives for your morning latte purchase, including side-chains and the lightning network. You could even spend BTC via Ethereum side-chains for near zero fees, if you could find somebody who?d take the payment.

Satoshi talked about state channels for low-fee transactions all the way back in 2011. This has always been part of the plan for Bitcoin, and it?s worked great for 10 years. There?s no reason to think anything different today.

Bitcoin vs Ethereum?

The question hardly makes sense.

Imagine both Bitcoin and Ethereum operating as complementary protocols underlying a multi-trillion dollar internet of value.

Both can win.

Eric Elliott is the author of the books, ?Composing Software? and ?Programming JavaScript Applications?. As co-founder of EricElliottJS.com and DevAnywhere.io, he teaches developers essential software development skills. He builds and advises development teams for crypto projects, and has contributed to software experiences for Adobe Systems, Zumba Fitness, The Wall Street Journal, ESPN, BBC, and top recording artists including Usher, Frank Ocean, Metallica, and many more.

He enjoys a remote lifestyle with the most beautiful woman in the world.

![Putlockers!! The Flash [S6E2] A Flash of the Lightning | The CW](https://911weknow.com/wp-content/themes/mts_myblog/images/nothumb-myblog-related.png)