The best of the crypto debit card is here in APAC, Europe, Canada and the US and with lots of benefits like free Spotify/Netflix/Lounge

Royal Indigo 500 MCO (10K CRO) Card

Royal Indigo 500 MCO (10K CRO) Card

Table of Contents?

- MCO Visa Card Introduction? MCO Token Ecosystem? Types of MCO Visa Card? ? Analyzing MCO Visa Card (outdated due to the CRO changes)

- ? Things You Should Know Before Using the Card

- Start Shopping and Withdrawals

- ? Conclusion (Pros and Cons)

- ? Hedging Strategies (To my telegram channel) It?s an outdated strategy. There?s no good way to hedge it but you still can reference.

? Please search the above keyword to jump to the section (? = most read)

- 2020/8/8 updates: MCO will be replaced by CRO in the next months. Maybe soon we?ll need to call it CRO Visa Card

? Chinese Version

I believe that every crypto fan knows about the current situation of blockchain/cryptocurrency. Liquidity is one of the difficulties caused by regulations, high volatility, adoption, etc. This problem leads to only a few merchants accepting cryptocurrency as a payment method. When ICO exploded in 2017, there were some companies that want to cooperate with the international transaction facility like VISA/MasterCard. The most notable ones were Crypto.com and TenX. Almost two years have passed and regulations gradually became clearer, giving those companies the ability to issue their cards. Finally, a lot of crypto fans, like me, can now have the chance to spend cryptos in our daily lives!

? TL;DR Click me to know the conclusion and apply for the card!

Now supported countries are Europe, Canada, the US and APAC regions: Singapore ????? ???Hong Kong ??????? ?????? ???Philippines ???Vietnam ?? (The card put on hold right now)?Australia ???New Zealand ???

The below content is based on the experience of the APAC card. It may have a slightly different from the US and Europe card.

MCO Visa Card Introduction

MCO Visa Card is a card service that belongs to Crypto.com. Crypto.com (formerly Monaco) raised cryptocurrency equivalent to 2.67M dollars in min-2017. In the same period of time, there was also a project about to do the same business, TenX. They also raised cryptocurrency equivalent to 8M dollars. After some fierce competition, as we can confirm, the TenX?s community and its card issue rate both lost to Crypto.com?s. In the early days, I applied for TenX?s card, but now? Nothing. This post mainly analyzes the MCO Visa Card but first, I?ll quickly go through the MCO cryptocurrency then dive into the card details.

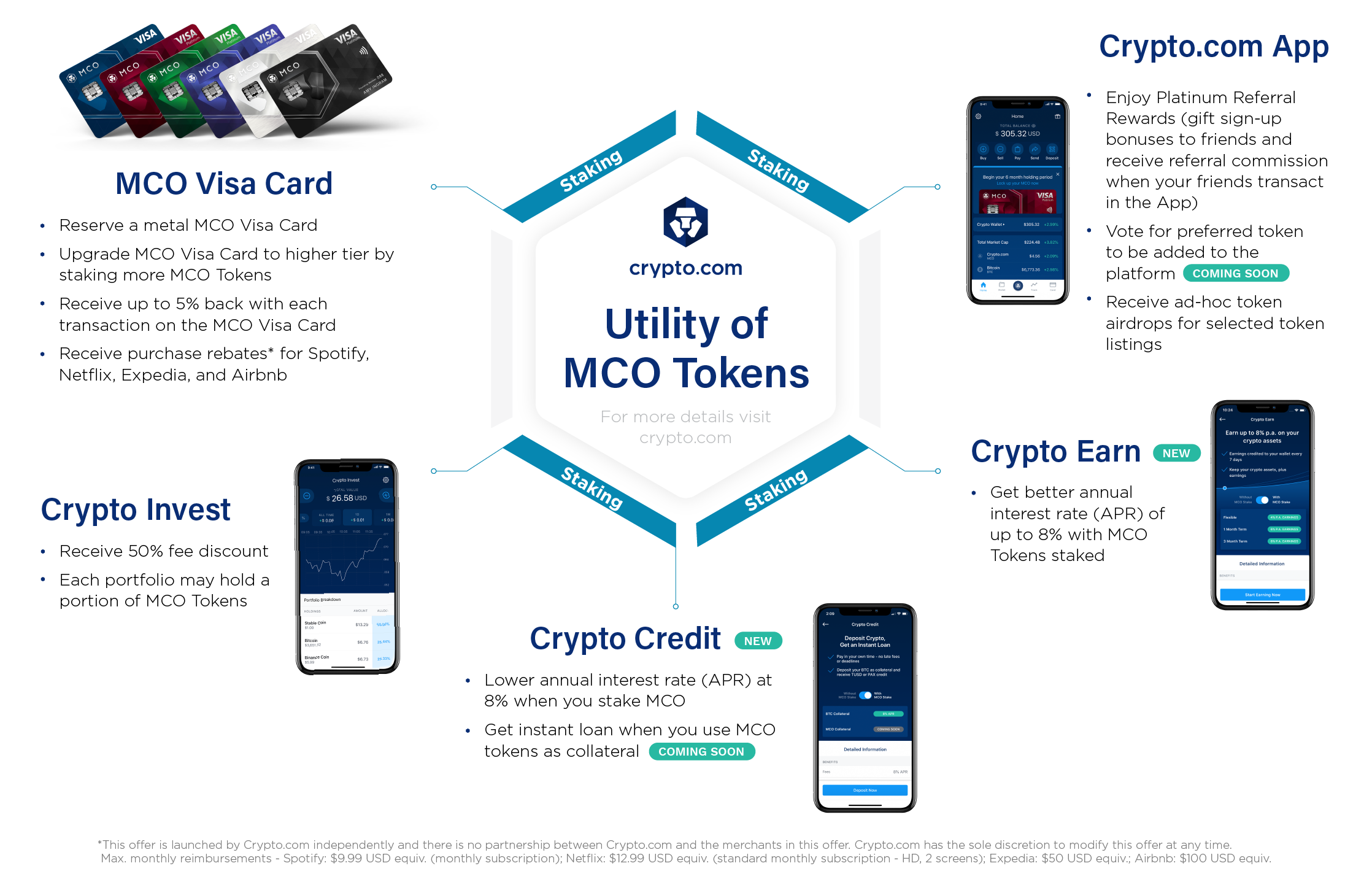

MCO Token Ecosystem (Now becomes CRO utility)

The utility of MCO token is now part of the CRO utility

The utility of MCO token is now part of the CRO utility

As the above image shows, the current benefits of stacking MCO are all related to Crypto.com services like:

- Earn service (like lending): Higher lending interest rate.

- Credit service (like loan): Lower loan interest rate.

- Invest service (like financial management): Half of the fee from profit.

I?ll go through these real quick because I don?t use any of them personally. You can go check them out if you are interested. The Earn service provides 8% APR with a flexible period (which can let you withdraw anytime) or 12% APR with 3 months of being locked. It is still a bit like the Celsius platform so there is no obvious difference. I would rather put money in a low-risk platform, like Celsius, or the high-risk one, like Bitfinex (both contained referral code, please remove it if you mind). All in all, those services are more elastic and I don?t really want to put all my eggs in one basket. If you use the above Crypto.com services, you should count this kind of risk in the below evaluation.

From the point of security, Crypto.com does a pretty good job at it. They have a page describing their securities including the multi-sig wallet from Ledger Vault, code auditing, penetration testing, the security bounty program at HackerOne, and many others.

Types of MCO Visa Card

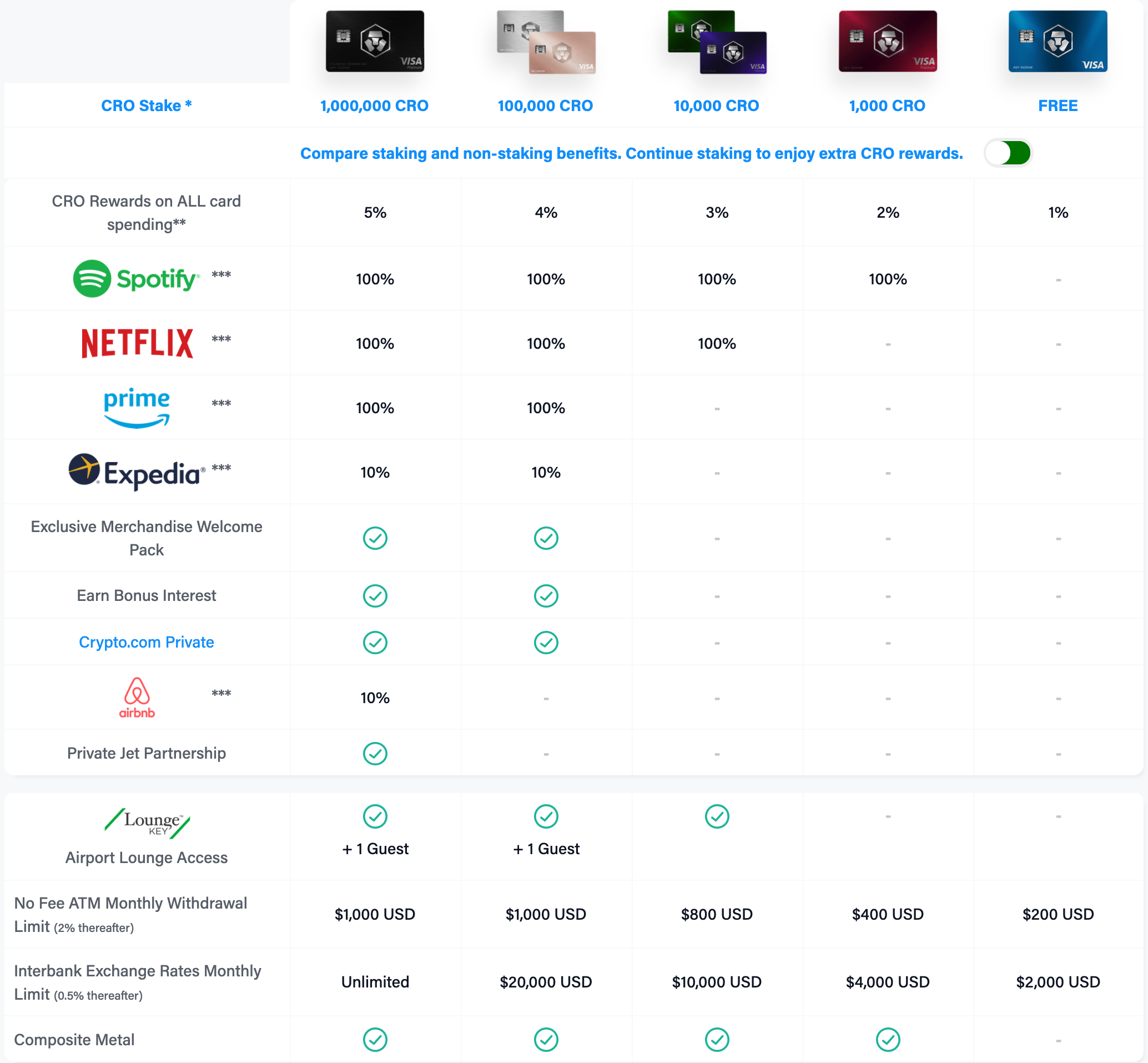

benefits table from official site ? https://crypto.com/cn/cards.html

benefits table from official site ? https://crypto.com/cn/cards.html

Note: the unit in the lower part of the image is SGD, not USD if the card issued from APAC

Above is a benefit table with respect to the card types screenshotted from the official sites. The following are some extracted information we need to keep in mind for the risk evaluation:

- Midnight Blue = Free to sign up for with no registration fee

Below are the types for the metal card (current ratio: 1 CRO = 0.16 USD)

- Ruby Steel = Low entry-level for staking 1K CRO (? 160 USD)

- Royal Indigo/Jade Green = Staking 10K CRO (? 1.6K USD)

- Icy White/Frosted Rose Gold = High-end for stacking 100K CRO (? 16K USD)

- Obsidian Black = High-end for stacking 1M CRO (? 160K USD)

Monthly rebate (crypto.com has the right to modify rates at any time):

- Spotify: USD 9.99

- Netflix: USD 12.99

- Expedia 10%: USD 50

- Airbnb 10%: USD 100

The missing part from the image (additional benefits)?

- 10K CRO tier has the CRO reward for 16% APR paid weekly.

- 100K/1M CRO tier has the CRO reward for 18% APR paid weekly.

Note:

- The above benefits are not a result of the partnership between Crypto.com and those companies. Crypto.com identifies the rebate by the merchant name or transaction ID.

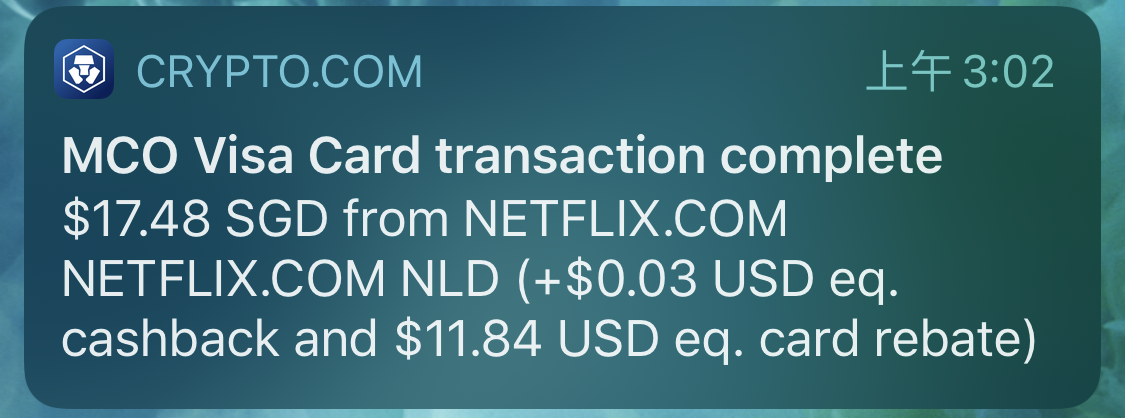

Netflix Family Taiwan 390 NTD ? 17.48 SGD ? 12.9 USD < 12.99 USD

Netflix Family Taiwan 390 NTD ? 17.48 SGD ? 12.9 USD < 12.99 USD

- Spotify and Netflix can both use the plan you desire, for example, a family plan, but the limitations are shown above. If you exceed the limitation, you need to pay the rest of the amount. Except for the rebates, you are entitled to a certain amount of cashback with the payment you make. As shown in the image, the Netflix family plan in Taiwan is 390 NTD ? 17.48 SGD ? 12.9 USD. It?s within the rebate amount, 12.99 USD. Although, it was one dollar short, but still acceptable.

- The Spotify account needs to change the country setting to Singapore. If you don?t want to change it, you can use PayPal to bypass it (use card issuer?s exchange rate). This is because Spotify binds the country setting and the card issuer?s country for the availability of charge.

- LoungeKey is the service for free access to business lounges. Remember to register it before using it. There are some differences between 10K CRO and 100K+ CRO tier card. You can notice that the 10K CRO tier is 100 lounges lesser on the official site. I?m not sure which airports are excluded. I will leave it for you to figure out. Before using the lounge, the counter will put 3.25 USD on hold for a while. Click me to check out the details.

- Every card type should stack a corresponding amount of CRO for 6 months. In this period, the CRO can?t be unlocked. After that, you can unlock it anytime you want. However, if you unlock the CRO, you will be losing lots of benefits that come with staking (like cashback, Spotify and etc.). So, the best hedging strategy is to use the below methods: downgrade and stop-loss (i.e. sell the CRO near the cost price).

- After the CRO locking period, you can downgrade the tier. You will still have the benefits of 0 fee ATM withdrawal, interbank exchange rates, LoungeKey and a physical card. However, the remaining benefits will be downgraded to the corresponding tier (Like Spotify and Netflix). For example, 10K CRO tier downgrades to 1K CRO tier, you will be losing the Netflix rebate and dropping the cashback rate from 3% to 2%.

- You can upgrade your card tier anytime, including the locking period, for a charge of 50 USD (Singapore issued card is 50 SGD). The benefits and the physical card will be replaced.

- The Visa card is valid for 4 years.

Analyzing MCO Visa Card (Old MCO version)

(for current ratio 1 MCO ? 4 USD)

Assuming that we spend 6,666 USD annually. The actual spending varies from person to person. You should change the number in the following evaluation.

? Plastic Blue Card

0 risk with 1% cashback. You can save 66.66 USD annually.

? Ruby teel (50 MCO ? 200 USD) ? The best deal

You?ll breakeven starting from the 8th month, and save 103.2 USD in the first year. After that, you?ll save 253.2 USD annually.

(Spotify * 8 months + 8 months of cashback) ? (value of staking the MCO ? 50 USD bonus from referral code)

= (9.99*8+6666/12*8*0.02)-(200?50) = 18.8 USD (break even)

(Spotify*12 months + a year of cashback)

= 9.99*12+6666*0.02 = 253.2 USD

The best deal lies in the metal cards. After staking 8 months of 50 MCO, you won?t need to worry about the MCO price anymore and instead enjoy your 2% cashback with free Spotify.

? Royal Indigo/Jade Gree (500 MCO ? 2,000 USD) ? Sweatspot

By using the downgrade strategy, you can break-even in the 6th month, if the MCO price isn?t lower than 3.51 USD. You save 665.74 USD annually.

Assume:

- Travel once a year and use this service twice. The value of LoungeKey is hard to be evaluated. We counted it as 35 USD because it?s close to the price when you bring a guest.

- The MCO price is stable at around 4 USD

Method 1: Break-even in the 3rd year and save 47.2 USD. Save 665.74 USD annually afterward.

(Spotify + Netflix) * 36 months + Use LoungeKey 3 * 2 times + 3 years of interest + 3 years of cashback ? (Value of staking the MCO ? 50 USD bonus from referral code)

= ((9.99+12.99)*36+35*6+(500*0.06*4*3)+(6666*0.03*3)-(2000?50)? 47.2 USD

(Spotify + Netflix) * 12 months + LoungeKey * 2 times + a year of interest + a year of cashback

= ((9.99+12.99)*12+35*2+(500*0.06*4)+(6666*0.03) = 665.74 USD

This period is too long, we can?t assure that the benefits remain unchanged in the future and it?s too risky ? so we use another way to evaluate. Downgrade to 50 MCO tier after an unlocked period (6 months). Only Netflix, interest and cashback change, other benefits are retained(LoungeKey, ATM, and etc.).

Method 2: Downgrade Strategy. Break-even in the 6th month, only when MCO price above 3.51 USD.

(Spotify + Netflix) * 6 months + Use LoungeKey 2 times + 6 months of interest + 6 months of cashback ? (Value of staking the MCO ? 50 USD bonus from referral code)

= ((9.99+12.99)*6+35*2+(500*0.06*4*0.5)+(6666*0.03*0.5)-(2000?50)? -1582.13 USD

In the 6th month, you lose 1,582.13 USD. At that moment, you downgrade to 50 MCO tier and sell the rest 450 MCO. To cover the loss, price of 1 MCO most above

= 1582.13/(500?50) = 3.5158 USD

Break-even in the 6th month, only when MCO price stays above 3.51 USD.

What if the price drops below 3 USD in the 6th month? At that moment, you downgrade to 50 MCO tier and sell the MCO at 3 USD each. Break-even in the 18th month (1.5 years) and save 21.07 USD.

= (450*3)+(9.99*12+6666*0.02)-1582.13 = 21.07 USD

It?s a middle-risk tier because you may have a little chance to lose money. The attached image below is the price relative chart so far. (K line for MCO/USD, Orange line for BTC/USD, Yellow line for the index of altcoin)

compare MCO/USD, BTC/USD and TOTAL2(index for ALTCOINS)

compare MCO/USD, BTC/USD and TOTAL2(index for ALTCOINS)

As you can see, MCO price is the same as other altocins, they all follow the BTC price. However, it?s good to see that the MCO price deviates a bit from the index of altcoin now. May be caused by the fact that Crypto.com has a high issuing rate in APAC and the US recently. Also, they are going to issue the card to EU users in Q1 2020 and then in Canada. Therefore, you can evaluate your own risk. If you think the following six months is a bull market, I suggest you apply for the 500 MCO tier. Instead, if you think it will be a bear market or you don?t want to let the price bother you, the best choice is 50 MCO tier.

? Icy White/Frosted Rose Gold/Obsidian Black (? 5K MCO) ? Extreme Risky

It?s highly risky. You probably know that even I don?t evaluate it. Crypto.com still hasn?t announced the service of MCO Private or any reliable benefits.

Things You Should Know Before Using the Card

You may think that MCO Visa Card can automatically exchange your crypto to fiat while paying the bill, but not really, you need to manually sell your crypto before spending it. I guess this is kind of a weird design because of crypto?s high volatility. This design allows the users to pick the right timing to exchange the crypto to fiat. Compared to TenX, I like their flow more. Check this demo video: https://youtu.be/eDq38ORoOjA. Maybe the flow of the MCO Visa Card is the better choice when there?s no option for stable coins.

Wallet types from Crypto.com:

- (Crypto) Wallet: Crypto stays here

- Fiat Wallet: Support lots of fiat currency

- Card (Wallet): Support a few fiat currencies for the card only

Functionality:

Fiat Wallet?

- Wire transfer to deposit and withdraw the fiat (Now support 21 currencies)

- Currency exchange in Fiat Wallet only

- Buy the crypto and store it in Crypto Wallet

Card Wallet?

- Spend the fiat in the Card Wallet through the MCO Visa Card

- Currency exchange in Card Wallet only (APAC: SGD, EUR, AUD, HKD, JPY, and GBP)

- Despoit can only be done through Crypto Wallet or Credit/Debit Card (Fee: for the Credit card is 1%, for the debit card is 0%. In Taiwan, we have another cross border fee which is 1.5%)

- The only fiat currency you can deposit in Card Wallet is SGD. For other fiat currencies, you can exchange by SGD. Like if you plan to travel to Japan in the future. You can exchange SGD to JPY when the rate is good.

- Withdrawal needs an ATM machine that supports Visa.

Crypto Wallet?

- The place to store your crypto

- Buy the crypto through other cryptos, Fiat Wallet or credit/debit card (both fees are 3.5%. Also, the bank cross-border transaction fee in Taiwan is about 1.5%) is valid.

- Sell the crypto to exchange for other cryptos, Fiat Wallet and Card Wallet are available.

- There?s only an internal transfer function for the Pay service so it?s on-chain action (with fee) if you withdraw the crypto.

The important part:

- People always confuse Fiat Wallet with Card Wallet because they both store fiat currency. However, they are not interchangeable.

- In App, the fiat from the Card Wallet can?t be transferred to other in-App wallets. You can only spend it via the card or withdraw it from the ATM.

To sum it up, before you use the MCO Visa Card, you should deposit money into your Card Wallet first.

There are two options:

- Sell the crypto from the Crypto Wallet to Card Wallet. Currently only support BTC, ETH, LTC, XRP. For APAC region, there?s no option for stable coins but the US card has this option. Every crypto has its minimal deposit amount.

- (It?s suitable for people who are not quite familiar with the crypto world) By using credit/debit cards to make deposits in the Card Wallet. Fee for debit card is 0 but credit card is 1%. Also, mind the bank cross-border transaction fee. In Taiwan, it is about 1.5%.

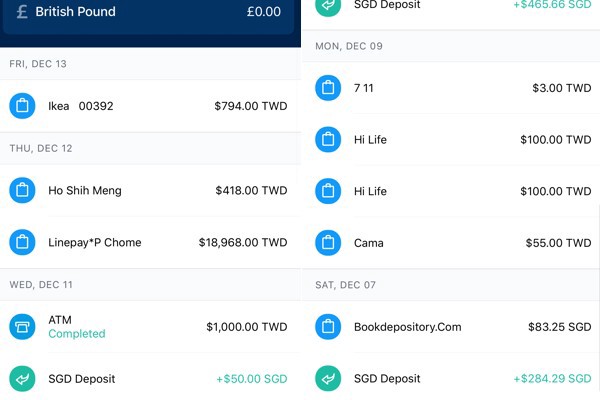

Start Shopping and Withdrawals!

Supports most of the POS machines in Taiwan

Supports most of the POS machines in Taiwan ? withdrew 1000 NTD from ATM

? withdrew 1000 NTD from ATM same as the exchange rate from Visa?2019/12/11, 1000 NTD = 44.6910574 SGD?

same as the exchange rate from Visa?2019/12/11, 1000 NTD = 44.6910574 SGD?

Shopping:

Remember to toggle the international usage button in the card page before using it.

For physical shopping, the POS machine needs to support the cross-border transactions.

For online shopping, if the site needs the 3DS verification, the transaction will not be successful. Crypto.com?s blog has announced that they already support 3DS verification, but outside Singapore, it?s still not functional. However, you can use third-party payment services like PayPal or Line Pay to bypass this verification step.

Withdrawal?

The ATM needs to support cross-border withdrawal. Be aware that some banks will add a fee on this kind of transaction. As the image shows, I withdrew 1000 NTD from the card and my Card Wallet reduced 44.69 SGD which is the same as the exchange rate from Visa. After that day, my balance reduced a weird amount of ATM fee, 0.01 SGD. It?s still acceptable. This free-fee benefit is awesome. People can bring less money when traveling around the world. Although the free quota is not that much, it is still helpful when you run out of money in a foreign country. If the free quota is exceeded, the fee is about 2% which is more expensive than the bank card(for Taiwan users).

Conclusion (Pros and Cons)

Pros?

- ? High cashback rate: Without spending a penny to apply for the card, you still have a 1% cashback benefit. It beats all the multi-currency cards in the world. Like the black card from Revolut which has this kind of benefit, but you need to pay 12.99 EUR (around 14.3 USD) monthly membership fee.

- ?? Travel buddy: 0 cross-border transaction and withdrawal fee + support multiple fiat currencies (APAC card supports: SGD, EUR, AUD, HKD, JPY, GBP). Compare to Revolut?s 30 fiat currencies and TransferWise?s 50 fiat currencies, it totally loses. After you applied for the card, you can give up the use of crypto but only deposit the Card Wallet via credit/debit card to prevent the price slippage or the exchange fluctuation.

- ? Fee quota for ATM withdrawal is quite much: For ruby steel card, you have 400 SGD free quote (around 294 USD or 265.9 EUR). If the stacking CRO has already reached break-even, it?s better than Revolut?s standard account, 200 EUR.

- Lots of benefits (Like free Spotify, Netflix, interest, free lounges, and etc.)

- It?s suitable for newbies who are willing to try the crypto world

- Low eligibility required for the metal card

- Crypto spendable card

Cons:

- Stake: People should lock the CRO for 6 months when applying for the metal card. After 6 months, you can unlock anytime. After unlocking the CRO you will be losing lots of benefits coming with staking. The best hedge strategies are downgrade and stop-loss when near the cost price.

- Not an automatic exchange: It doesn?t directly exchange your crypto to fiat currency when purchasing. The user needs to exchange it beforehand.

- Price slippage or exchange fluctuation: There?s a price slippage when depositing into the Card Wallet from Crypto Wallet. People may use their non-native currency so sometimes they may lose some pennies when exchanging to fiat currency. I think this is not a major problem because the cashback can cover it.

- POS machine and third-party payment service may not work if they don?t support the cross-border transactions (By using supported service, like PayPal or Line Pay, to bypass this obstacle)

- E-commerce platform which needs the 3DS verification may fail. However, by using the aforementioned supported third-party payment services the user can bypass it

- If you don?t use services from Crypto.com, any benefits from the card or your traditional bank?s credit/debit card already have a high cashback rate, this card may not be appealing to you. It just another way to let you transform the crypto to fiat to let you spend.

- The company?s overall cash flow is unclear: They spend lots of ADs and provided lots of benefits such as referral program, MCO and CRO stacking reward, Card and Earn services. However, how did the money come from? They couldn?t earn that much money just from in-App crypto purchasing fee. This might let people suspect that they are a Ponzi scheme. I also found a weird trading activity after the huge crash in 03/2020. MCO pairs volume is twice then before but the price still the same. In CRO pairs, price up and volume up. However, the participants of their CRO campaigns seems not that much. This might let me think of it they are manipulating the market. On Reddit, somebody mention the manipulation too.

To sum it up, the best card is the low-risk ruby steel card (1K CRO). People can break even really quick. It?s another better deal for applying for the 10K CRO tier?s card if you are expecting a bull market in the near future.

? Click me to register and download the Crypto.com app

Referral Code: 4hkcdecgk8 (You can get 50 USD in CRO equivalent. If you missed it at the registration step, you can fill it in the settings page afterward)

For the tutorial, check the details here. If there?s any problem, you can pm me at telegram (@oof00foof).

Conclusion:

After some trial and experiencing lots of problems, I really recommend people who have spare cash to apply for the ruby steel card. You only need around 160 USD to get the METAL CARD with lots of benefits. It?s impossible to see this deal in the market right now. If you don?t apply for it, could you live with that on your conscience?

Ok, I have said a lot about the benefits of the card, and in the end, I would like to list some of my concerns and expectations.

This card uses Visa to handle the cross-border transaction. It actually violates the spirit of crypto after all. Lots of companies and Crypto.com have already proposed solutions to removing the middleman. No matter it is a direct crypto transaction or hybrid solutions, the obstacle still points to regulations and popularity. I think those problems will be solved in the near future. Sooner or later, crypto will be used widely. At least, that is what I think.

Crypto.com has lots of expenditures from campaigns and services but it still provides lots of benefits to users. I guess they make some profit from the price slippage when users exchange cryptos in the App, or maybe when the quantitative trading team does some behind-the-scenes work, or maybe like how Ethereum Foundation sells crypto during all-time highs. Even worse, they could be like other start-up companies that keep burning through money. So again, don?t put all your eggs in one basket. As an engineer and investor, some problems really make me feel a bit suspicious when using Crypto.com. Like:

- The official site has two domains, getmco.com and crypto.com. This makes people confused and even worse, these two sites have different content. Like the information of card currency between the SGD and USD card. The site uses Bootstrap and it is very obvious that the team didn?t customize the design, because it is stale-looking and almost 20% of sites on the internet use this kind of CSS framework(same style).

- In the App, the loading speed from API may sometimes be a bit slow and there are some function disappearing bugs that people may bump into, but I have to say, their customer support team is extremely incredible. Very responsive in helping customers solve their problems.

- They issue two kinds of crypto (MCO and CRO). I know they have clearly separated two coins? utility from each other but this gives me a feeling of COBINHOOD dj vu.

Crypto.com, as a start-up company, is fine to have some minor issues such as wording, design, engineering, and performance problems. The important functions are all working without any serious issues, so it is still tolerable. We can wait for them to gradually improve every detail. All in all, this is the only awesome card that allows me to spend cryptos. For now, I?ll be using this card as my default card for overseas traveling because it?s way better than typical bank cards.

I have created a telegram channel to blog about my life in the crypto world, come follow me here ? https://t.me/oof_this_is_my_crypto_life_en