The Weighted Average Cost of Capital (WACC) shows a firm?s blended cost of capital across all sources, including both debt and equity. We weigh each type of financing source by its proportion of total capital and then add them together. Financial analysts use WACC widely in financial modeling as the discount rate when calculating the present value of a project or business.

Join me in exploring the concept of WACC, how to calculate it and where to use it, with a practical example at the end.

What is the Weighted Average Cost of Capital (WACC)

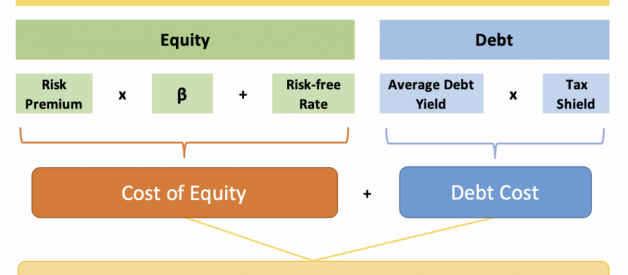

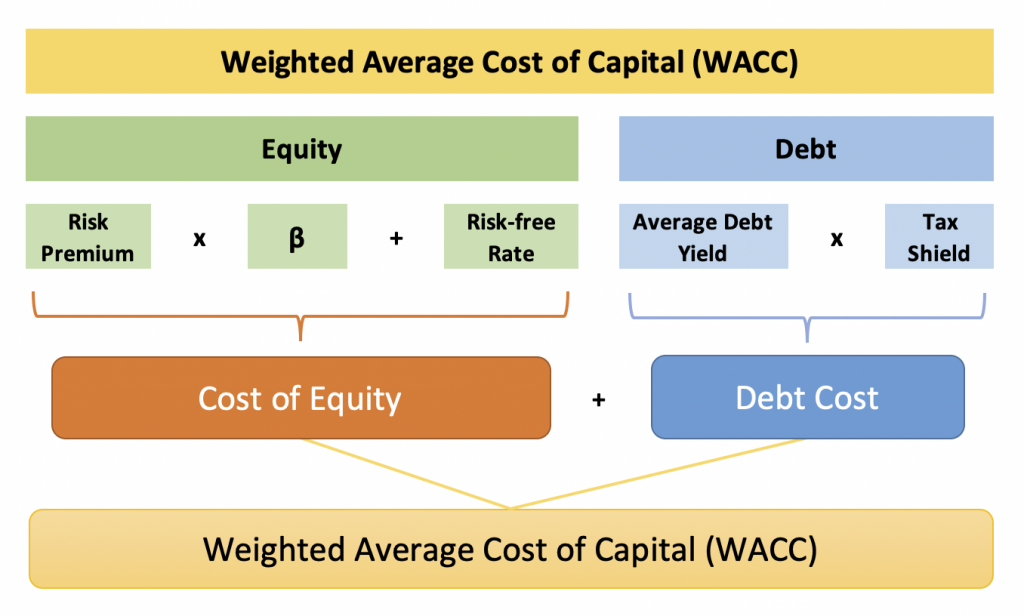

The Weighted Average Cost of Capital shows us the relationship between the components of capital, commonly Equity and Debt.

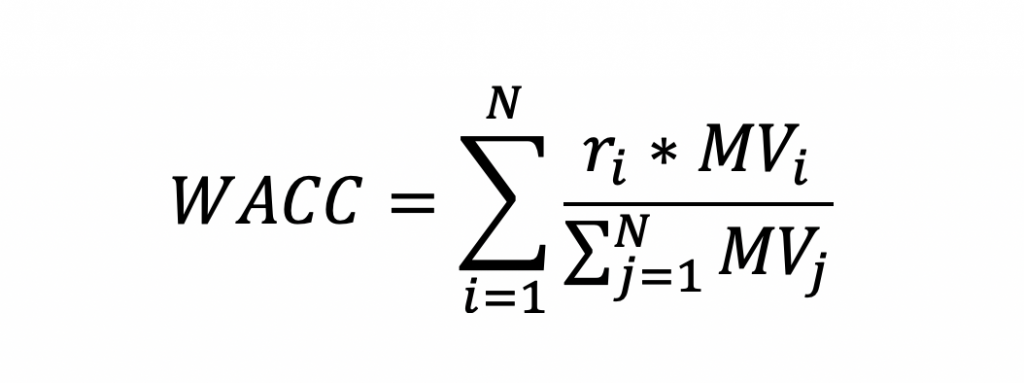

We can calculate the WACC via the following formula, regardless of the number of components we deem as part of the equation:

Where:

- ri is the rate of return for each component;

- MVi & MVj is the market value of the component;

- N is the number of capital components.

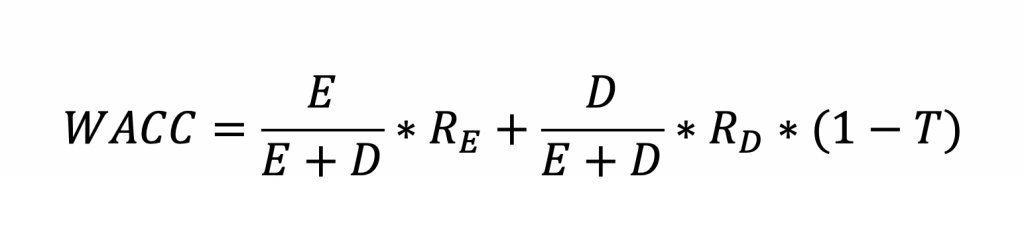

As we mentioned above, most of the time, we only have equity and debt financing. Therefore, we can simplify the formula to the more understandable:

Where:

- E is the market value of Equity;

- D is the market value of Debt;

- RE is the required rate of return on equity;

- RD is the cost of debt, or the yield to maturity on existing debt;

- T is the applicable tax rate.

Why is the Weighted Average Cost of Capital (WACC) important

WACC has the purpose of determining the cost of each component of the structure of capital. Each element has its associated cost:

- Ordinary shares pay out dividends;

- The firm pays interest on its debt;

- Preferred stock has a fixed rate payment.

The WACC is an essential part of the Discounted Cash Flow (DCF) model, which makes it a vital concept, especially for finance professionals in business development and investment banking.

WACC is dictated by the external market and not by the management of the company. It represents the minimum return a company must earn on its asset base to satisfy its owners, creditors, and other capital providers, or they will invest elsewhere.

A company can have multiple sources of capital, like common stock, preferred stock, regular debt, convertible debt, options, pension liabilities, government subsidies, and others. Different securities represent different sources of financing and are expected to generate separate returns. Therefore the Weighted Average Cost of Capital considers the weights of all sources of financing. However, the more complex the capital structure of a company is, the harder it gets to calculate its WACC.

Calculating WACC

Cost of Equity

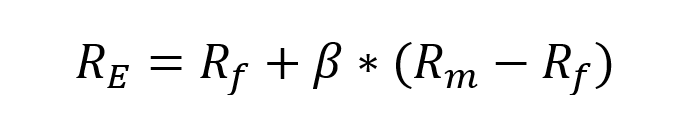

We calculate the Cost of Equity (RE) via the Capital Asset Pricing Model (CAPM). It corresponds to risk versus reward and determines the return of equity that shareholders expect on their investments.

Other ways to calculate the cost of capital can be the Dividend Discount method, the Bond Yield Plus Risk Premium approach, and others.

Cost of Debt

The Cost of Debt is the more accessible part of the WACC calculation. It is the yield to maturity on the firm?s debt, which is the return expected on the company?s debt if it?s held to maturity.

As interest payments are tax-deductible, we multiply by (1-tax), which is known as a tax shield.

WACC Usage

We most commonly use WACC as a discount rate for calculating the net present value (NPV) of a business. WACC is used to evaluate investments, as it is considered the opportunity cost of the company.

We commonly use WACC as a hurdle rate, or the minimum rate of return, acceptable for a project.

The Weighted Average Cost of Capital is also helpful when evaluating mergers and acquisitions, as well as preparing financial models of investment projects. If an investment?s IRR (Internal Rate of Return) is below WACC, we should not invest in it.

The reason we use a weighted metric is that usually, the company would receive different amounts from different capital sources.

A company that wants to lower its WACC may first look into cheaper financing options. It can issue more bonds instead of stock because it?s a more affordable financing option. This will increase the debt to equity ratio, and because debt is cheaper than equity, WACC will decrease.

Example

Let us look at a newly formed company as an example.

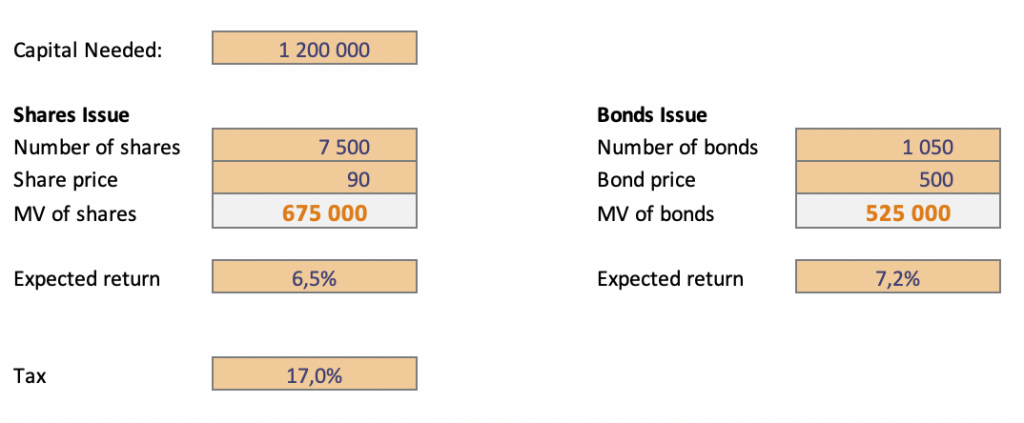

Assume this company has to raise 1.2 mil euros in the capital so it can acquire office space and the needed equipment for the company to operate.

They start by issuing and selling 7,500 shares at 90 euro each share. We can calculate the market value of equity at 675 thousand euros. As investors expect a 6.5% return on their investment, we consider this to be the cost of equity.

The rest of the capital is raised by selling 1,050 bonds for 500 euro each. The market value of the bonds is 525 thousand euros. The bonds carry a return rate of 7.2%, so we consider this the cost of debt.

The applicable tax rate for the company is 17%, based on their annual financial statements:

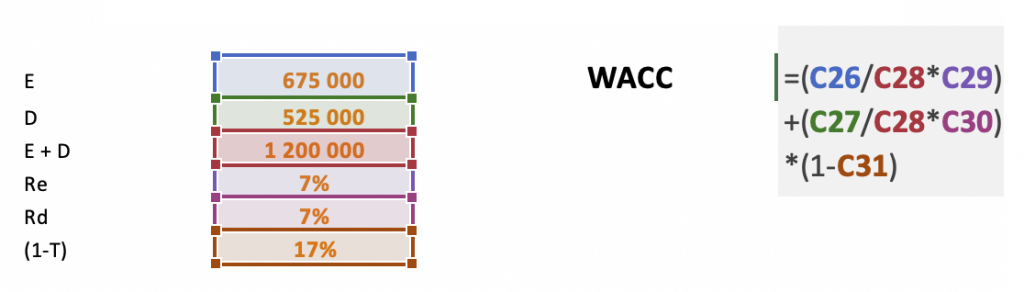

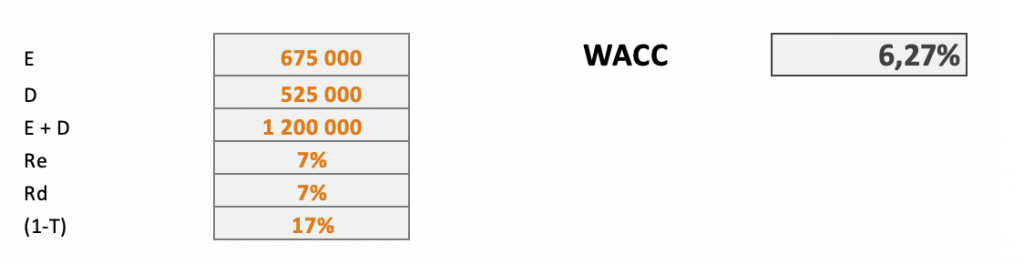

Now that we have all this information on the sources of financing the company has utilized, we can calculate the WACC as follows:

That way we calculate a Weighted Average Cost of Capital of about 6,27%.

You can download the example as an Excel file in the original article.

Advantages and Disadvantages

Let us look at some advantages and disadvantages of the most common components of a firm?s capital structure.

Equity

(+) Usually, there is no legal obligation to pay dividends;

(+) No maturity where the investment has to be returned;

(+) Carries lower financial risk;

(+) With good profitability prospects, equity could be cheaper than debt;

(-) New equity dilutes ownership share of profit and control;

(-) It?s costlier to underwrite equity than debt;

(-) Too much equity can make the company a target for a Leveraged Buy-Out (LBO) from another company;

(-) No tax shield, not tax-deductible and may lead to double taxation.

Debt

(+) No loss of control, as there are no voting rights;

(+) The upper limit placed on the share of profits;

(+) Flotation costs are usually lower than equity;

(+) Interest payments are tax-deductible;

(-) There?s a legal obligation to make payments even if the company is in an inadequate cash position;

(-) In the case of bonds, upon maturity, the full face value is due at once;

(-) As debt increases, this reflects on the systematic (financial) risk and leads to higher cash flows being required, to support the increased debt.

Conclusion

Companies need to know their WACC as a way to gauge expenses and analyze new projects. It is also a way to explain the capital structure of the company and determine the best proportions between various financing sources. The lower the WACC, the cheaper it is for the company to fund further investment initiatives. It is also important to remember that the more complex the capital structure of the company is, the harder it gets to calculate the Weighted Average Cost of Capital.

Disclaimer: The information in this article is for educational purposes only and should not be treated as professional advice.

Originally posted on https://magnimetrics.com/ on 25 September 2019.